9 Common Health Conditions That Are Typically Excluded from Health Insurance Coverage

Health insurance policies are designed to provide coverage for a wide range of medical conditions and treatments. However, there are certain health conditions that are generally not covered under these policies. It is important for individuals to be aware of these conditions in order to make informed decisions about their healthcare.

One of the conditions that is often not covered under health insurance policies is cosmetic surgery. While there may be exceptions for reconstructive surgery due to accidents or birth defects, most policies do not cover procedures that are performed solely for cosmetic purposes.

Another condition that is typically not covered is infertility treatment. Many health insurance policies do not provide coverage for fertility treatments such as in vitro fertilization (IVF) or other assisted reproductive technologies.

Mental health conditions are also often not covered under health insurance policies. While some policies may provide limited coverage for mental health services, many do not cover conditions such as depression, anxiety, or bipolar disorder.

Chronic conditions such as diabetes or hypertension may also not be covered under health insurance policies. These conditions require ongoing treatment and management, which can be expensive. As a result, some policies may exclude coverage for these conditions or impose limitations on coverage.

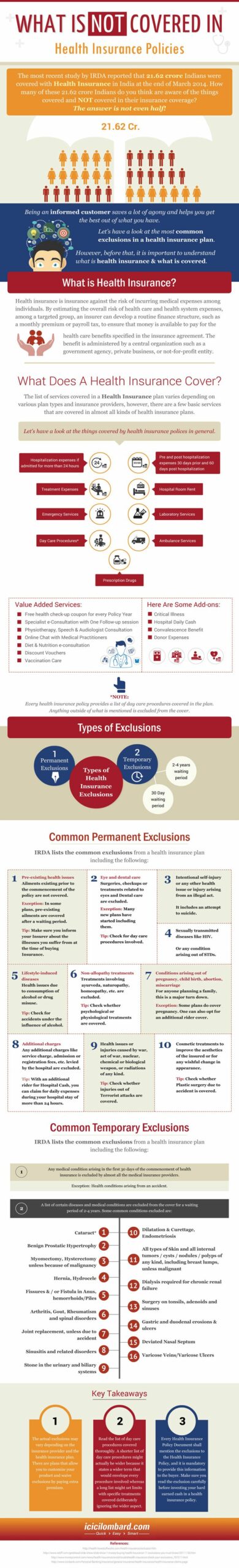

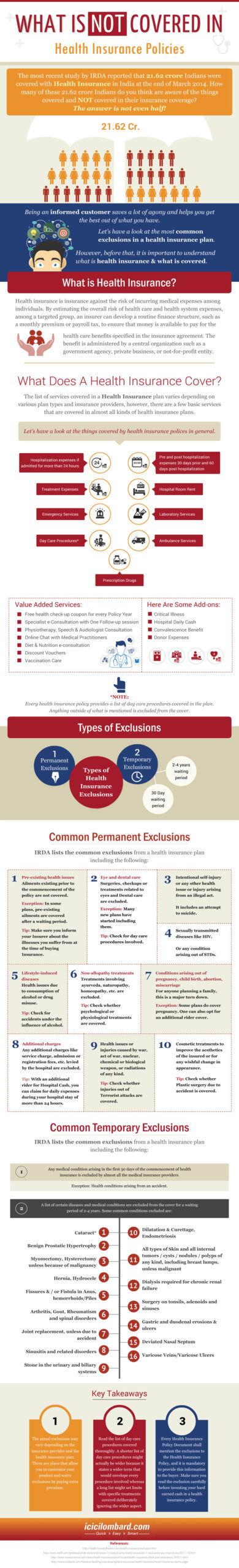

Pre-existing conditions are another category of health conditions that are generally not covered under health insurance policies. Pre-existing conditions are medical conditions that individuals have prior to obtaining health insurance coverage. In many cases, insurance companies may deny coverage for these conditions or charge higher premiums.

Other health conditions that are often not covered under health insurance policies include weight loss surgery, alternative therapies such as acupuncture or chiropractic care, and experimental or investigational treatments.

It is important for individuals to carefully review their health insurance policies to understand what conditions and treatments are covered. In some cases, individuals may need to purchase additional coverage or seek alternative options for these conditions.

In conclusion, while health insurance policies provide coverage for a wide range of medical conditions, there are certain conditions that are generally not covered. It is important for individuals to be aware of these conditions and seek alternative options for treatment if necessary.

Pre-existing health conditions

Pre-existing health conditions refer to any health conditions that an individual has prior to obtaining health insurance coverage. These conditions can range from chronic illnesses such as diabetes or asthma to previous injuries or surgeries. In most cases, health insurance policies do not provide coverage for pre-existing conditions, or they may impose waiting periods or exclusions for these conditions.

Not all pre-existing health conditions are treated the same by health insurance providers. Some insurers may provide coverage for certain conditions after a waiting period, while others may exclude coverage altogether. It is important for individuals with pre-existing conditions to carefully review their insurance policy to understand what is covered and what is not.

There are several reasons why health insurance policies do not generally cover pre-existing conditions. First, these conditions often require ongoing and expensive medical treatment, which can increase the cost of insurance for the entire pool of policyholders. Second, insurers may view pre-existing conditions as a risk factor, as individuals with these conditions are more likely to require medical care in the future.

If you have a pre-existing health condition, it is important to explore other options for obtaining coverage. This may include seeking coverage through an employer-sponsored group health insurance plan, applying for government-sponsored programs such as Medicaid or Medicare, or purchasing a separate health insurance policy that specifically covers pre-existing conditions.

In conclusion, pre-existing health conditions are generally not covered under health insurance policies. It is important for individuals with these conditions to carefully review their policy and explore other options for obtaining coverage.

Cosmetic surgery

Cosmetic surgery refers to a range of procedures that aim to enhance a person’s appearance or improve their self-esteem. These procedures are typically not covered under health insurance policies, as they are considered elective and not medically necessary.

While cosmetic surgery can have numerous benefits for individuals, such as improved confidence and self-image, it is generally not covered by health insurance. This means that individuals who wish to undergo cosmetic surgery will need to pay for the procedures out of pocket.

There are several reasons why cosmetic surgery is not covered under health insurance policies. Firstly, health insurance is designed to cover medical conditions and treatments that are necessary for maintaining or improving a person’s health. Cosmetic surgery, on the other hand, is considered to be a personal choice and not essential for health.

Additionally, cosmetic surgery can be quite expensive, and health insurance policies are typically designed to cover the costs of necessary medical treatments rather than elective procedures. Insurance companies prioritize coverage for conditions that pose a direct threat to a person’s health and well-being.

It is important for individuals considering cosmetic surgery to carefully research the costs and potential risks associated with the procedures. They should also consult with their health insurance provider to understand what, if any, expenses may be covered under their policy.

In conclusion, cosmetic surgery is generally not covered under health insurance policies. While it can have numerous benefits for individuals, it is considered elective and not medically necessary. Individuals who wish to undergo cosmetic surgery will need to pay for the procedures out of pocket.

Weight loss programs

Weight loss programs are generally not covered under health insurance policies. These programs are designed to help individuals lose weight and improve their overall health, but they are often considered to be elective or cosmetic treatments rather than necessary medical interventions.

There are several reasons why weight loss programs are not covered by health insurance. Firstly, insurance companies typically only cover treatments that are deemed medically necessary, and weight loss is often seen as a personal choice rather than a medical condition. Additionally, weight loss programs can vary widely in their effectiveness and may not have consistent results for all individuals.

While weight loss programs may not be covered by health insurance, there are other options available for individuals who are looking to lose weight. Many communities offer free or low-cost weight loss support groups, which can provide guidance and accountability for individuals on their weight loss journey.

Some employers also offer wellness programs that include weight loss support and resources. These programs may include access to nutritionists, exercise classes, and other resources to help employees achieve their weight loss goals.

It’s important to note that while weight loss programs may not be covered by health insurance, there may be exceptions for individuals with certain medical conditions. For example, individuals with obesity-related health conditions such as diabetes or high blood pressure may be eligible for coverage of weight loss programs as part of their medical treatment.

In conclusion, weight loss programs are generally not covered under health insurance policies. However, there are alternative options available for individuals who are looking to lose weight, such as community support groups and employer wellness programs. It’s important to explore these options and consult with a healthcare professional to determine the best approach for achieving weight loss goals.

Alternative medicine

Alternative medicine refers to a range of healthcare practices that are not considered part of conventional or Western medicine. These practices are often used as an alternative or complement to traditional medical treatments. While some alternative medicine treatments have been shown to be effective for certain health conditions, they are generally not covered under health insurance policies.

There are various alternative medicine practices that fall under the category of 9 health conditions generally not covered under health insurance policy. These include acupuncture, chiropractic care, herbal medicine, homeopathy, naturopathy, Ayurveda, traditional Chinese medicine, energy healing, and massage therapy.

Acupuncture involves the insertion of thin needles into specific points on the body to stimulate healing and relieve pain. Chiropractic care focuses on the alignment of the spine and musculoskeletal system to promote overall health. Herbal medicine uses plants and plant extracts to treat various health conditions. Homeopathy involves using highly diluted substances to trigger the body’s natural healing response.

Naturopathy is a holistic approach to healthcare that emphasizes the use of natural remedies and therapies. Ayurveda is an ancient Indian system of medicine that aims to balance the body, mind, and spirit. Traditional Chinese medicine includes practices such as acupuncture, herbal medicine, and dietary therapy. Energy healing involves the manipulation of energy fields to promote healing. Massage therapy uses manual techniques to manipulate the body’s soft tissues for therapeutic purposes.

While alternative medicine practices can be beneficial for certain individuals, they are generally not covered under health insurance policies. This is because their effectiveness and safety may not be supported by sufficient scientific evidence. Additionally, the cost of these treatments can vary widely, making it difficult for insurance companies to establish standardized coverage policies.

If you are interested in pursuing alternative medicine treatments, it is important to consult with a healthcare professional and carefully consider the potential risks and benefits. It may be necessary to seek alternative means of financing these treatments, such as out-of-pocket payment or specialized health savings accounts.

Infertility treatments

Infertility treatments are generally not covered under health insurance policies. Infertility is a medical condition that affects the reproductive system and can make it difficult for couples to conceive a child. However, most insurance companies do not consider infertility treatments to be medically necessary and therefore do not provide coverage for them.

There are various types of infertility treatments available, such as in vitro fertilization (IVF), intrauterine insemination (IUI), and fertility medications. These treatments can be expensive, and without insurance coverage, the cost can be a significant burden for couples seeking to conceive.

Some insurance policies may offer limited coverage for infertility treatments, but it is important to carefully review the policy details and understand what is covered and what is not. In many cases, even if some infertility treatments are covered, there may be restrictions or limitations on the coverage, such as a maximum number of treatment cycles or a requirement for pre-authorization.

It is advisable for individuals and couples who are seeking infertility treatments to explore other options for financial assistance, such as fertility grants or loans, or to consider saving up for the treatments themselves. Additionally, there are organizations and support groups that can provide information and resources on affordable infertility treatments.

Overall, it is important for individuals and couples dealing with infertility to be aware that infertility treatments are generally not covered under health insurance policies. It is crucial to carefully review insurance policies and explore other financial options to make informed decisions about pursuing infertility treatments.

Mental health services

Mental health services are an essential part of overall healthcare, but they are generally not covered under health insurance policies. This means that individuals seeking treatment for mental health conditions may have to pay out of pocket for these services.

There are various reasons why mental health services are not covered under health insurance. One reason is that mental health conditions are often considered pre-existing conditions, which means that insurance companies may exclude coverage for them. Additionally, mental health services can be expensive, and insurance companies may not want to bear the cost of providing coverage for these services.

This lack of coverage for mental health services can have significant implications for individuals with mental health conditions. Without insurance coverage, many people may be unable to afford the necessary treatments and therapies. This can lead to a worsening of their condition and a decrease in their overall quality of life.

However, it is important to note that there are some insurance plans that do offer coverage for mental health services. These plans may have higher premiums or require individuals to meet certain criteria, but they can provide much-needed financial assistance for those seeking mental health treatment.

In conclusion, mental health services are generally not covered under health insurance policies. This lack of coverage can create barriers to accessing necessary treatments and therapies for individuals with mental health conditions. It is crucial for policymakers, insurance companies, and healthcare providers to work together to ensure that mental health services are more widely covered and accessible to all individuals.

Long-term care

Long-term care refers to the ongoing assistance and support provided to individuals who are unable to perform basic activities of daily living, such as bathing, dressing, eating, and using the bathroom, due to chronic illness, disability, or cognitive impairment. This type of care is typically not covered under health insurance policies.

Long-term care can be provided in various settings, including nursing homes, assisted living facilities, and the individual’s own home. The cost of long-term care can be significant, and many people are not financially prepared to cover these expenses on their own.

While health insurance policies generally cover acute medical conditions and hospitalization, they do not typically cover the ongoing care and support needed for long-term conditions. This can leave individuals and their families facing high out-of-pocket costs for long-term care services.

Some individuals may choose to purchase long-term care insurance to help cover the costs of future care. However, it’s important to note that long-term care insurance policies vary in terms of coverage and eligibility requirements. Additionally, these policies can be expensive, especially if purchased later in life.

Without insurance coverage for long-term care, individuals and their families may need to rely on personal savings, Medicaid, or other government assistance programs to help cover the costs. Planning ahead and considering long-term care options can be crucial for financial security and peace of mind.

In conclusion, long-term care is a health condition that is generally not covered under health insurance policies. It is important for individuals to understand their options and plan ahead to ensure they have the necessary support and resources in place for potential long-term care needs.

Experimental treatments

Experimental treatments are health conditions that are generally not covered under a health insurance policy. These treatments refer to medical procedures, therapies, or medications that are still in the experimental stage and have not yet been proven to be safe and effective for the general population.

Insurance companies typically do not cover experimental treatments because they are considered high-risk and may not provide the desired health outcomes. Additionally, the cost of these treatments can be exorbitant, making it financially impractical for insurance companies to include them in their coverage.

Examples of experimental treatments include stem cell therapy, gene therapy, and experimental drugs for rare diseases. These treatments often involve cutting-edge technology and innovative approaches to healthcare, but their effectiveness and safety are still being studied.

While experimental treatments may hold promise for individuals with severe or life-threatening conditions, the decision to pursue them is often a personal one. Patients and their families must carefully consider the potential risks and benefits, as well as the financial implications, before deciding to proceed.

In some cases, individuals may be able to participate in clinical trials for experimental treatments, where the costs may be covered by the research study. However, it’s important to note that participation in clinical trials is not guaranteed and eligibility criteria may apply.

Elective procedures

Elective procedures refer to medical treatments or surgeries that are chosen by the patient and are not considered medically necessary. These conditions generally are not covered under health insurance policies, as they are not deemed essential for the patient’s health or well-being.

Examples of elective procedures include cosmetic surgeries, such as breast augmentation or facelifts, and weight loss surgeries, such as gastric bypass or lap band procedures. These procedures are typically done for aesthetic or personal reasons rather than for medical necessity.

While elective procedures may provide psychological or emotional benefits for some individuals, health insurance companies generally do not cover the costs associated with these treatments. This means that patients will be responsible for paying for these procedures out of pocket.

It’s important for individuals considering elective procedures to carefully review their health insurance policies and understand what is covered and what is not. In some cases, health insurance may cover a portion of the costs if the procedure is deemed medically necessary for certain conditions, such as reconstructive surgery after a mastectomy.

Additionally, some health insurance plans offer optional coverage for certain elective procedures, but this often comes with its own set of limitations and higher premiums. It’s crucial for individuals to thoroughly research and understand their health insurance coverage before undergoing any elective procedures to avoid unexpected costs.

In conclusion, elective procedures are conditions generally not covered under health insurance policies. It is important for individuals to carefully review their policies and consider the potential costs before deciding to undergo any elective procedures.

Dental procedures

When it comes to health insurance, dental procedures are generally not covered under the policy. This means that individuals will need to pay for any dental treatments out of pocket, unless they have a separate dental insurance plan.

There are several reasons why dental procedures are not covered under health insurance. One reason is that dental care is often considered to be a separate branch of healthcare, with its own specialized providers and treatments. Additionally, dental procedures are typically elective in nature, meaning they are not necessary for the overall health and well-being of an individual.

Some of the dental conditions that are generally not covered under health insurance include cosmetic dentistry procedures such as teeth whitening or veneers. These procedures are considered to be aesthetic in nature and are not deemed medically necessary.

Other dental conditions that may not be covered include orthodontic treatments like braces or Invisalign. While these treatments can improve the alignment of the teeth and bite, they are often seen as cosmetic rather than essential for overall health.

However, there are some exceptions to the rule. For example, health insurance policies may cover dental procedures that are deemed medically necessary, such as oral surgery or treatment for gum disease. Additionally, some health insurance plans may offer limited coverage for preventive dental care, such as regular cleanings and exams.

In conclusion, dental procedures are generally not covered under health insurance policies. Individuals may need to seek separate dental insurance or pay for dental treatments out of pocket. It is important to carefully review the terms of a health insurance policy to understand what dental services are covered and what are not.

Vision care

Vision care is one of the 9 health conditions that are generally not covered under a health insurance policy. While health insurance typically covers a range of medical conditions and treatments, vision care is often considered a separate category that requires its own coverage.

Many health insurance policies do not provide coverage for routine vision care, such as eye exams and prescription glasses or contact lenses. These services are often considered elective or cosmetic in nature, rather than essential for overall health and well-being.

However, it’s important to note that some health insurance policies may offer limited coverage for vision care in certain circumstances. For example, they may cover vision care related to a specific medical condition or injury. It’s always best to review the specific terms and conditions of your health insurance policy to understand what is covered and what is not.

If you require routine vision care and it is not covered under your health insurance policy, you may need to consider purchasing separate vision insurance or paying out-of-pocket for these services. Vision insurance plans typically provide coverage for routine eye exams, prescription eyewear, and sometimes even surgical procedures.

In conclusion, vision care is an important aspect of overall health and well-being, but it is often not covered under a standard health insurance policy. It’s important to review your policy and consider additional coverage options if you require routine vision care.

Hearing aids

Hearing aids are not generally covered under health insurance policies. These devices are used to amplify sound for individuals with hearing impairments. While hearing loss is a common condition, insurance companies often consider hearing aids to be elective or cosmetic rather than necessary medical devices.

There are approximately 9 health conditions that are generally not covered under a health insurance policy, and hearing aids are one of them. Other conditions that fall into this category include cosmetic surgery, weight loss procedures, and fertility treatments.

Even though hearing aids are not covered under most health insurance policies, there may be alternative options for financial assistance. Some employers offer supplemental insurance plans or hearing aid reimbursement programs. Additionally, there are organizations and charities that provide grants or low-cost hearing aids for individuals in need.

If you require a hearing aid and it is not covered by your health insurance policy, it is important to explore other avenues for obtaining one. Speak with your healthcare provider, research potential financial assistance programs, and consider the various options available to you.

Over-the-counter drugs

Over-the-counter drugs are medications that can be purchased without a prescription from a healthcare professional. These drugs are commonly used to treat minor health conditions such as headaches, colds, allergies, and indigestion. While they are easily accessible and widely used, over-the-counter drugs are generally not covered under health insurance policies.

Health insurance policies typically cover prescription medications that require a doctor’s authorization. This is because prescription drugs are often used to treat more serious or chronic health conditions, and their cost can be significantly higher than over-the-counter drugs. Insurance companies prioritize coverage for prescription medications to ensure that individuals have access to necessary treatments.

However, it is important to note that there may be exceptions to this general rule. Some health insurance policies may provide limited coverage for certain over-the-counter drugs if they are deemed medically necessary and prescribed by a healthcare professional. This is typically determined on a case-by-case basis, and individuals should consult their insurance provider for specific details regarding coverage.

When it comes to over-the-counter drugs, individuals are generally responsible for purchasing them out of pocket. This means that the cost of these medications is not covered by health insurance and individuals need to pay for them directly. It is important for individuals to budget for these expenses and consider the potential costs of over-the-counter drugs when planning for their healthcare needs.

Cosmetic dentistry

Cosmetic dentistry is a branch of dentistry that focuses on improving the appearance of a person’s teeth, gums, and smile. While it may have aesthetic benefits, it is generally not covered under health insurance policies as it is considered elective or cosmetic in nature.

Some of the cosmetic dentistry procedures that are not covered by health insurance include teeth whitening, porcelain veneers, dental implants for cosmetic purposes, and orthodontic treatments for purely cosmetic reasons.

Teeth whitening is a popular cosmetic dentistry procedure that aims to remove stains and discoloration from the teeth, resulting in a brighter and more youthful smile. However, since it is not considered medically necessary, it is typically not covered by health insurance.

Porcelain veneers are thin shells that are bonded to the front of the teeth to improve their appearance. They can be used to correct various dental imperfections such as chips, cracks, and gaps. While they can enhance the smile, they are generally not covered by health insurance as they are considered elective.

Dental implants are commonly used to replace missing teeth. However, if the purpose of the dental implant is purely cosmetic, such as replacing a tooth that is not causing any functional issues, it may not be covered by health insurance.

Orthodontic treatments, such as braces or clear aligners, are often used to correct misaligned teeth or bite issues. While these treatments can have both aesthetic and functional benefits, if the primary purpose is cosmetic in nature, they may not be covered by health insurance.

It is important to note that the coverage for cosmetic dentistry procedures may vary depending on the specific health insurance policy. Some policies may provide limited coverage for certain procedures if they are deemed medically necessary. It is always advisable to check with the insurance provider to understand the coverage and benefits available for cosmetic dentistry.

Non-emergency ambulance services

Non-emergency ambulance services are generally not covered under health insurance policies. While emergency ambulance services are usually covered, non-emergency transportation services are often considered to be outside the scope of health insurance coverage.

Non-emergency ambulance services refer to transportation for patients who do not require immediate medical attention or are not in a life-threatening situation. These services are typically used for scheduled medical appointments, transfers between healthcare facilities, or transportation for patients with mobility issues.

Since non-emergency ambulance services are not considered medically necessary, health insurance companies do not typically provide coverage for them. Patients who require non-emergency transportation may need to explore alternative options, such as private pay services or government-funded transportation programs.

It is important for individuals to carefully review their health insurance policy to understand what services are covered and what services are not. While emergency ambulance services are generally covered, non-emergency transportation services may require additional out-of-pocket expenses.

If a person requires non-emergency ambulance services on a regular basis, they may want to consider supplemental insurance plans that specifically cover transportation services. These plans can help offset the cost of non-emergency transportation and provide peace of mind for individuals who rely on these services.

Question-answer:

What are some health conditions that are generally not covered by health insurance policies?

Some health conditions that are generally not covered by health insurance policies include cosmetic surgery, infertility treatment, weight loss surgery, experimental treatments, and self-inflicted injuries.

Why are these health conditions not covered by health insurance policies?

These health conditions are not covered by health insurance policies because they are often considered elective or not medically necessary. Insurance companies typically only cover treatments and procedures that are deemed essential for a person’s health and well-being.

What can individuals do if they need treatment for a health condition that is not covered by their health insurance policy?

If individuals need treatment for a health condition that is not covered by their health insurance policy, they may have to pay for the treatment out of pocket. They can also explore other options such as applying for financial assistance programs, seeking alternative treatments, or negotiating with healthcare providers for discounted rates.