What is TPA in Health Insurance?

In the world of health insurance, the term TPA is frequently used, but many people may not fully understand what it means. TPA stands for Third Party Administrator, and it plays a crucial role in the functioning of health insurance. In simple terms, a TPA is an independent organization that is responsible for managing various aspects of a health insurance policy.

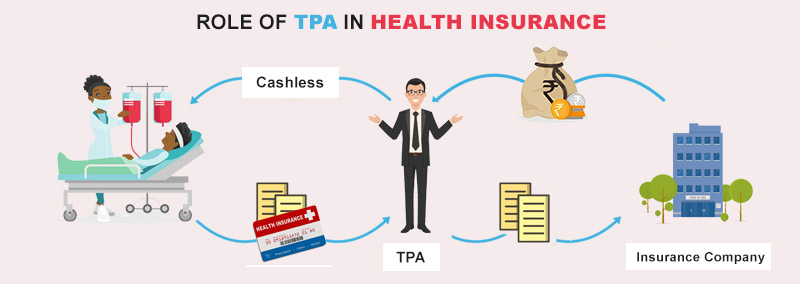

When it comes to health insurance, TPA acts as a mediator between the insurance company, the policyholder, and the healthcare provider. It is responsible for processing claims, managing policyholder information, and coordinating with healthcare providers to ensure smooth and efficient healthcare services. Essentially, TPA is the backbone of the health insurance industry, ensuring that all parties involved are well taken care of.

One of the primary functions of a TPA is claim processing. When a policyholder seeks medical treatment, they submit a claim to the TPA, who then verifies the authenticity of the claim, checks for coverage eligibility, and processes the payment to the healthcare provider. This process involves a thorough examination of medical records, bills, and other relevant documents to ensure that the claim is legitimate and falls within the policy’s terms and conditions.

In addition to claim processing, TPAs also handle other important tasks such as policyholder enrollment, providing customer support, and maintaining a comprehensive database of policyholder information. They act as a bridge between the insurance company and the policyholder, ensuring that all communication and transactions are carried out smoothly and efficiently.

In conclusion, understanding the role of a TPA in health insurance is crucial for policyholders to navigate the complex world of healthcare. From claim processing to policyholder management, TPAs play a vital role in ensuring that health insurance policies are effectively administered. By acting as intermediaries, TPAs streamline the entire process, allowing policyholders to focus on their health while ensuring that their insurance benefits are utilized efficiently.

Understanding TPA in Health Insurance

A Third Party Administrator (TPA) is an entity that processes and manages health insurance claims on behalf of insurance companies. TPAs play a crucial role in the healthcare industry by ensuring smooth operations and efficient handling of claims.

TPAs act as intermediaries between the insurance company, the insured individuals, and the healthcare providers. They are responsible for verifying the eligibility of the insured, processing claims, and coordinating with healthcare providers to ensure timely and accurate payments.

Health insurance is a type of coverage that provides financial protection for medical expenses incurred by individuals. It helps individuals and families afford the cost of healthcare services, including doctor visits, hospital stays, medications, and surgeries.

TPAs are essential in health insurance as they help streamline the claims process, reduce administrative burden for insurance companies, and ensure that insured individuals receive the benefits they are entitled to. They also help in fraud detection and prevention by thoroughly reviewing claims for accuracy and legitimacy.

In summary, TPA in health insurance is an entity that handles the processing and management of insurance claims. They play a crucial role in ensuring the smooth functioning of the healthcare industry and help individuals receive the benefits they are entitled to under their health insurance policies.

What is TPA in Health Insurance?

In the world of health insurance, TPA stands for Third Party Administrator. A TPA is an organization that is contracted by insurance companies to handle various administrative tasks related to health insurance policies. These tasks can include claims processing, policy enrollment and management, customer service, and provider network management.

TPAs act as intermediaries between the insurance company, the policyholder, and the healthcare providers. They play a crucial role in ensuring the smooth operation of health insurance policies and processes. By outsourcing these administrative tasks to TPAs, insurance companies can focus on their core competencies, such as underwriting and risk management.

TPAs are responsible for processing and adjudicating claims submitted by policyholders and healthcare providers. This involves verifying the eligibility of the policyholder, reviewing the medical records and bills, and determining the amount that the insurance company will reimburse. TPAs also handle customer inquiries and provide assistance in understanding policy benefits and coverage.

Additionally, TPAs play a role in managing the provider network for the insurance company. They negotiate contracts with healthcare providers, ensuring that policyholders have access to a wide range of medical services. TPAs also monitor the quality of care provided by these providers and handle any disputes or grievances that may arise.

In summary, TPA is an integral part of the health insurance ecosystem. They handle the administrative tasks related to health insurance policies, including claims processing, policy enrollment, customer service, and provider network management. By outsourcing these tasks to TPAs, insurance companies can streamline their operations and provide better service to their policyholders.

How does TPA work in Health Insurance?

Health Insurance is an essential aspect of our lives, providing financial coverage for medical expenses. In the context of health insurance, TPA stands for Third Party Administrator. But what exactly is TPA and how does it work in health insurance?

TPA is an intermediary organization that acts as a bridge between the policyholder and the insurance company. It is responsible for managing various administrative tasks related to health insurance claims. Their primary role is to process and settle claims on behalf of the insurance company.

So, what does this mean for policyholders? When an individual seeks medical treatment, they submit their health insurance claim to the TPA. The TPA then reviews the claim, verifies the details, and assesses its eligibility for coverage. They ensure that the claim is filed correctly and all necessary documents are provided.

Once the claim is approved, the TPA coordinates with the healthcare provider to process the payment. They handle the financial aspects of the claim, ensuring that the policyholder receives the reimbursement or direct payment from the insurance company.

In addition to claim processing, TPAs also offer other services such as network management, customer support, and grievance redressal. They maintain a network of healthcare providers, negotiate rates, and ensure that policyholders have access to quality healthcare services.

Overall, TPA plays a crucial role in the smooth functioning of health insurance. They act as a link between the policyholder and the insurance company, ensuring that claims are processed efficiently and policyholders receive the necessary financial support for their health expenses.

Why is TPA important in Health Insurance?

TPA, or Third Party Administrator, plays a crucial role in the health insurance industry. It acts as an intermediary between the insurance provider and the insured individual or organization. TPA is responsible for various administrative tasks, including claims processing, policy management, and customer service.

One of the main reasons why TPA is important in health insurance is its expertise in handling complex administrative tasks. Health insurance involves a wide range of processes, such as verifying policy details, assessing claims, and coordinating with healthcare providers. TPA professionals are trained to navigate these processes efficiently, ensuring smooth operations and timely resolution of issues.

TPA also plays a vital role in ensuring transparency and accountability in health insurance. As a third-party entity, it acts as a neutral party that can objectively assess claims and policy compliance. This helps prevent fraudulent activities and ensures that the insurance provider and the insured individual are both treated fairly.

Moreover, TPA brings convenience to the insured individuals by providing a single point of contact for all their health insurance needs. Instead of dealing directly with the insurance provider, individuals can reach out to the TPA for policy-related queries, claims assistance, and other administrative support. This simplifies the process for the insured and saves them time and effort.

In summary, TPA is an integral part of the health insurance ecosystem. Its role in handling administrative tasks, ensuring transparency, and providing convenience to the insured makes it an important player in the industry. Without TPA, the complexities of health insurance would be much harder to navigate for both the insurance provider and the insured individuals or organizations.

Benefits of TPA in Health Insurance

TPA (Third Party Administrator) plays a crucial role in the health insurance industry. It acts as a mediator between the insurance company and the insured individuals. Here are some of the benefits of having a TPA in health insurance:

- Efficient Claims Processing: TPA streamlines the claims process by handling all the paperwork, documentation, and verification on behalf of the insured individuals. This ensures quick and efficient settlement of claims, reducing the hassle for policyholders.

- Expertise and Knowledge: TPAs are experts in the field of health insurance. They possess in-depth knowledge about insurance policies, medical procedures, and healthcare providers. This expertise helps in providing accurate information and guidance to insured individuals, ensuring they make informed decisions about their health.

- Network of Healthcare Providers: TPAs have tie-ups with a wide network of healthcare providers, including hospitals, clinics, and diagnostic centers. This enables insured individuals to access quality healthcare services at discounted rates, maximizing the benefits of their health insurance policy.

- 24/7 Customer Support: TPAs provide round-the-clock customer support to insured individuals. They are available to answer queries, provide assistance, and resolve any issues related to health insurance. This ensures that policyholders have access to prompt support whenever they need it.

- Transparency and Accountability: TPAs maintain transparent records of all transactions and interactions with insured individuals. This promotes accountability and ensures that the insurance company and the insured individuals have a clear understanding of the services provided and the costs involved.

In conclusion, having a TPA in health insurance brings numerous benefits, including efficient claims processing, expertise and knowledge, access to a network of healthcare providers, 24/7 customer support, and transparency and accountability. It plays a crucial role in simplifying the insurance process and ensuring that insured individuals receive the best possible healthcare services.

Key features of TPA in Health Insurance

Health insurance is a vital aspect of our lives, providing financial protection in case of medical emergencies. However, navigating through the complexities of insurance claims and reimbursements can be overwhelming. This is where Third Party Administrators (TPAs) play a crucial role in streamlining the process.

TPA, in the context of health insurance, refers to an entity that acts as an intermediary between the insurance company and the insured individual. They handle various administrative tasks related to insurance claims, policy management, and customer service.

One of the key features of TPA in health insurance is their expertise in claim processing. TPAs have a deep understanding of the insurance industry and the complex procedures involved in claim settlements. They ensure that the claims are thoroughly reviewed, processed efficiently, and settled in a timely manner.

TPAs also provide customer support services, assisting insured individuals in understanding their policy benefits, coverage details, and claim procedures. They act as a point of contact for policyholders, addressing their queries and concerns related to health insurance.

Another important aspect of TPA in health insurance is their network of healthcare providers. TPAs maintain a wide network of hospitals, clinics, and doctors, ensuring that insured individuals have access to quality healthcare services. They negotiate with healthcare providers to secure discounted rates and cashless treatment facilities for policyholders.

In addition, TPAs play a crucial role in managing policy renewals and updates. They send timely reminders to policyholders regarding premium payments and policy expiry dates. TPAs also help in updating policy details, such as adding or removing family members from the coverage.

In summary, TPAs in health insurance serve as a bridge between the insurance company and the insured individual, providing efficient claim processing, customer support, network management, and policy management services. Their expertise and services contribute to a hassle-free and smooth insurance experience for policyholders.

Choosing the right TPA for Health Insurance

When it comes to insurance, health is a top priority. That’s why choosing the right Third Party Administrator (TPA) for your health insurance is crucial. A TPA is responsible for managing the claims and administration process on behalf of the insurance company. They play a vital role in ensuring a smooth and efficient experience for policyholders.

One of the key factors to consider when selecting a TPA is their expertise in the health insurance industry. It is important to choose a TPA that specializes in health insurance, as they will have a deeper understanding of the specific requirements and challenges involved in this field. Look for a TPA that has a proven track record and extensive experience in handling health insurance claims.

Another important aspect to consider is the TPA’s network of healthcare providers. A strong network of hospitals, doctors, and specialists is essential for ensuring that policyholders have access to quality healthcare services. Make sure that the TPA you choose has a wide network of healthcare providers in your area, so that you can receive the care you need without any hassle.

Additionally, it is important to evaluate the TPA’s customer service and support. A good TPA should be responsive, efficient, and proactive in addressing any queries or concerns that policyholders may have. Look for a TPA that offers multiple channels of communication, such as phone, email, and online chat, so that you can easily reach out to them whenever you need assistance.

In conclusion, choosing the right TPA for your health insurance is a decision that should not be taken lightly. Consider factors such as expertise in the health insurance industry, network of healthcare providers, and customer service when making your choice. By selecting the right TPA, you can ensure a seamless and hassle-free experience when it comes to managing your health insurance claims.

Common challenges with TPA in Health Insurance

When it comes to health insurance, understanding what a Third Party Administrator (TPA) is and how it functions is crucial. TPAs play a vital role in managing and processing health insurance claims on behalf of insurance companies. However, there are several common challenges that can arise in the TPA process.

1. Delayed claim processing: One of the major challenges with TPAs in health insurance is the potential for delayed claim processing. Due to the high volume of claims that TPAs handle, there may be delays in processing and approving claims. This can cause frustration for policyholders who are in need of timely reimbursement for medical expenses.

2. Lack of transparency: Another challenge is the lack of transparency in the TPA process. Policyholders may not have full visibility into the status of their claims or the reasons for claim denials. This can lead to confusion and dissatisfaction with the insurance provider.

3. Inadequate customer support: Many TPAs struggle to provide adequate customer support to policyholders. This can result in difficulties in reaching out to the TPA for claim-related queries or concerns. Poor customer support can further exacerbate the challenges faced by policyholders and impact their overall experience with the insurance provider.

4. Coordination issues: Coordinating between the insurance company, policyholders, and healthcare providers can be a challenge for TPAs. This can lead to miscommunication, errors in claim processing, and delays in resolving issues. Effective coordination is crucial for a smooth and efficient TPA process.

5. Data security risks: With the increasing use of technology in the TPA process, data security risks have become a significant concern. TPAs handle sensitive personal and medical information, and any breach in data security can have serious consequences. It is essential for TPAs to prioritize data protection and implement robust security measures.

Overall, while TPAs play a vital role in health insurance, there are several challenges that need to be addressed to ensure a seamless and efficient process for policyholders. Improving claim processing times, enhancing transparency, providing better customer support, strengthening coordination, and prioritizing data security are key areas that TPAs should focus on to overcome these challenges.

How to file a claim through TPA in Health Insurance?

If you have health insurance, you may need to file a claim through a Third Party Administrator (TPA) in order to receive reimbursement for medical expenses. Here’s what you need to know about the process:

1. Understand what TPA is: TPA stands for Third Party Administrator, and it is a company that processes and manages claims on behalf of an insurance provider. They act as a middleman between the insured individual and the insurance company.

2. Gather necessary documents: Before filing a claim through TPA, make sure you have all the required documents. This may include medical bills, prescriptions, diagnostic reports, and any other relevant paperwork.

3. Contact your TPA: Reach out to your TPA to initiate the claim process. They will provide you with the necessary forms and guide you through the steps you need to take.

4. Fill out the claim form: Complete the claim form provided by the TPA. Be sure to provide accurate and detailed information about your medical treatment, expenses, and any other relevant details.

5. Submit the claim: Once you have filled out the claim form and gathered all the necessary documents, submit them to your TPA. Make sure to keep copies of everything for your records.

6. Follow up: After submitting the claim, stay in touch with your TPA to track the progress of your claim. They will keep you informed about any additional information or documentation that may be required.

7. Receive reimbursement: If your claim is approved, the TPA will process the reimbursement and you will receive the payment for your medical expenses.

By following these steps, you can file a claim through TPA in your health insurance and ensure that you receive the reimbursement you are entitled to.

Understanding TPA network in Health Insurance

In the world of health insurance, a TPA (Third Party Administrator) plays a crucial role. But what exactly is a TPA and how does it fit into the insurance landscape?

A TPA is a company that is contracted by an insurance provider to manage certain aspects of their health insurance policies. This can include claims processing, customer service, and provider network management. Essentially, a TPA acts as a middleman between the insurance company, the insured individuals, and the healthcare providers.

One of the key functions of a TPA is to maintain a network of healthcare providers. This network consists of hospitals, clinics, doctors, and other medical professionals who have agreed to provide services to the insured individuals at negotiated rates. By creating and managing this network, the TPA ensures that the insured individuals have access to quality healthcare services at affordable prices.

When an insured individual needs medical treatment, they can visit any healthcare provider within the TPA network. The TPA then processes the claims on behalf of the insurance company, ensuring that the provider is paid for the services rendered. This streamlined process helps to simplify the claims process and ensure timely reimbursement for both the insured individuals and the healthcare providers.

In summary, a TPA is an integral part of the health insurance industry. They work behind the scenes to manage the network of healthcare providers, process claims, and provide customer service to insured individuals. By understanding the role of a TPA, individuals can better navigate the complexities of their health insurance policies and ensure they receive the care they need.

TPA vs Insurance Company: What’s the difference?

When it comes to health insurance, it’s important to understand the difference between a Third Party Administrator (TPA) and an insurance company. While both play a role in managing healthcare claims and providing coverage, there are some key distinctions that set them apart.

A TPA is a company that is contracted by an insurance company to handle the administrative tasks related to health insurance claims. They act as a middleman between the insurance company and the insured individual or healthcare provider. TPAs are responsible for processing claims, verifying eligibility, managing provider networks, and handling customer service inquiries.

On the other hand, an insurance company is the entity that provides the actual insurance coverage. They collect premiums from policyholders and are responsible for paying out claims based on the terms of the policy. Insurance companies also handle underwriting, which involves assessing risk and determining premium rates.

So, in summary, TPAs are responsible for the day-to-day administrative tasks of managing health insurance claims, while insurance companies provide the actual insurance coverage and handle the financial aspects of the policy. Understanding the roles of both entities is crucial in navigating the complex world of health insurance.

TPA regulations and guidelines in Health Insurance

TPA, or Third Party Administrator, is an important component in the health insurance industry. It is responsible for managing and processing claims on behalf of insurance companies and policyholders. As such, there are regulations and guidelines in place to ensure that TPAs operate in a fair and transparent manner.

One of the key regulations is that TPAs must be licensed by the relevant regulatory authorities. This ensures that they meet certain standards and have the necessary expertise to handle health insurance claims. Additionally, TPAs are required to maintain records of all transactions and provide regular reports to the insurance companies they work with.

TPAs are also subject to guidelines regarding the processing of claims. They must adhere to specific timelines for claim settlement and provide clear communication to policyholders regarding the status of their claims. This helps to ensure that policyholders receive timely and accurate information about their insurance coverage.

Furthermore, TPAs are required to maintain confidentiality and data security when handling sensitive information. This includes protecting the personal and medical information of policyholders, as well as ensuring the security of electronic systems and databases.

In addition to these regulations, TPAs are also expected to follow ethical guidelines in their interactions with policyholders and insurance companies. This includes treating all parties with respect and professionalism, providing accurate and unbiased information, and resolving any disputes or complaints in a fair and timely manner.

Overall, the regulations and guidelines in place for TPAs in the health insurance industry are designed to protect the interests of policyholders and ensure the smooth and efficient processing of claims. By adhering to these regulations, TPAs can help to maintain trust and confidence in the health insurance system.

TPA services for policyholders in Health Insurance

TPA, which stands for Third Party Administrator, provides essential services for policyholders in health insurance. These services include claims processing, policy management, and customer support.

One of the main functions of a TPA is to process insurance claims. When policyholders submit their medical bills and other relevant documents, the TPA reviews and verifies the information to determine the coverage and eligibility. They ensure that the claims are processed accurately and efficiently, reducing the burden on the policyholders.

TPAs also play a crucial role in policy management. They assist policyholders in understanding their insurance coverage, including the benefits, limitations, and terms and conditions. They help policyholders navigate through the complexities of the insurance policy, ensuring that they make informed decisions about their healthcare.

Furthermore, TPAs provide customer support services to policyholders. They address queries and concerns related to insurance coverage, claims, and policy details. Policyholders can reach out to the TPA for assistance and guidance, ensuring a smooth and hassle-free experience with their health insurance.

In summary, TPA services are an integral part of health insurance, helping policyholders with claims processing, policy management, and customer support. They ensure that policyholders have a clear understanding of their insurance coverage and provide assistance throughout their healthcare journey.

How to check the credibility of a TPA in Health Insurance?

When it comes to choosing a Third Party Administrator (TPA) for your health insurance, it is important to ensure their credibility. A TPA plays a crucial role in managing your health insurance claims and providing assistance throughout the insurance process. Here are some steps you can take to check the credibility of a TPA:

- Research their reputation: Start by researching the reputation of the TPA. Look for reviews and ratings from other policyholders to get an idea of their performance and customer satisfaction.

- Check their license: Verify if the TPA is licensed by the relevant regulatory authority. This ensures that they meet the required standards and regulations set by the governing body.

- Review their network: Evaluate the TPA’s network of healthcare providers. A wide and reliable network ensures that you have access to quality healthcare services when needed.

- Assess their technology: A good TPA should have a robust and user-friendly technology platform. This allows for smooth communication, easy access to information, and efficient claim processing.

- Consider their experience: Look for a TPA that has a proven track record and experience in the health insurance industry. An experienced TPA is more likely to have the expertise and knowledge to handle your claims effectively.

- Check their financial stability: It is important to ensure that the TPA is financially stable. This ensures that they have the necessary resources to handle claims and provide timely reimbursements.

By following these steps, you can assess the credibility of a TPA in health insurance and make an informed decision when choosing one for your insurance needs.

What to do if you are not satisfied with TPA services in Health Insurance?

If you are not satisfied with the TPA (Third Party Administrator) services provided in your health insurance, there are several steps you can take to address your concerns and seek resolution.

1. Understand the issue: Start by identifying the specific areas where you are dissatisfied with the TPA services. Is it the delay in claim processing, lack of communication, or unhelpful customer support? Understanding the issue will help you articulate your concerns effectively.

2. Contact the TPA: Reach out to the TPA directly to discuss your concerns. Provide them with the details of your policy, the specific issue you are facing, and any supporting documents. Request a resolution and ask for a timeline within which they will address your complaint.

3. Escalate the complaint: If you do not receive a satisfactory response from the TPA or if they fail to address your complaint within the agreed timeline, escalate the issue to the insurance company. Contact their customer support or grievance redressal department and explain the situation. Provide them with the details of your previous communication with the TPA.

4. Seek assistance from regulatory authorities: If the insurance company also fails to resolve your complaint, you can approach the regulatory authorities in your country. They have oversight over the insurance industry and can intervene on your behalf. Provide them with all the relevant details and documentation to support your case.

5. Consider switching insurance providers: If your complaints remain unresolved and you continue to be unsatisfied with the TPA services, you may consider switching to a different health insurance provider. Research other insurance companies, compare their TPA services, and choose one that meets your expectations.

Remember, it is important to document all your interactions, maintain a record of correspondence, and keep copies of any supporting documents. This will help you present a stronger case and increase the chances of a positive resolution to your complaint.

TPA role in managing cashless hospitalization in Health Insurance

When it comes to health insurance, one of the most important aspects is the ability to receive cashless hospitalization. This means that policyholders can avail medical treatment without having to pay for it upfront and later claim reimbursement. To facilitate this process, Third Party Administrators (TPAs) play a crucial role.

So, what exactly is a TPA in the context of health insurance? A TPA is a specialized organization that acts as an intermediary between the policyholder, the insurance company, and the healthcare provider. Their primary responsibility is to manage and coordinate cashless hospitalization for policyholders.

Insurance companies partner with TPAs to streamline the cashless hospitalization process. When a policyholder requires medical treatment, they can approach a network hospital that has a tie-up with the TPA. The TPA then verifies the policyholder’s eligibility, checks the coverage limits, and approves the cashless claim. This allows the policyholder to receive the required treatment without any financial burden.

To effectively manage cashless hospitalization, TPAs maintain a database of network hospitals and medical practitioners. They negotiate rates with these providers to ensure that policyholders receive quality healthcare at affordable prices. TPAs also handle the paperwork and documentation required for the claim process, reducing the administrative burden on policyholders.

In addition