What Is Health Insurance Card? How It Works, Benefits

Health insurance is a vital component of healthcare, providing individuals and families with financial protection against the costs of medical care. A health insurance card is a tangible representation of this coverage, serving as proof of insurance and providing access to healthcare services.

So, how does a health insurance card work? When an individual enrolls in a health insurance plan, they receive a card from their insurance provider. This card typically includes important information such as the individual’s name, policy number, and the contact information for the insurance company. It is important to keep this card on hand at all times, as it is often required when seeking medical care.

Health insurance cards serve several functions. Firstly, they provide proof of insurance coverage, which is necessary when visiting healthcare providers. This helps to ensure that individuals receive the appropriate care without facing unexpected out-of-pocket costs. Additionally, health insurance cards often include important details about the individual’s coverage, such as copayment amounts and deductibles.

Furthermore, health insurance cards can provide access to various benefits and services. Many insurance plans offer additional perks, such as discounted gym memberships or access to telemedicine services. These benefits are often linked to the insurance card, allowing individuals to take advantage of them easily.

In conclusion, health insurance cards play a crucial role in the healthcare system. They provide proof of insurance coverage, important details about the individual’s policy, and access to various benefits and services. Understanding how health insurance cards work is essential for navigating the complex world of healthcare and ensuring that individuals can receive the care they need.

Understanding Health Insurance Cards

Health insurance cards play a crucial role in the healthcare system. They are issued by insurance companies to their policyholders and serve as proof of insurance coverage. These cards provide important information about the policyholder, including their name, policy number, and contact information.

Health insurance cards work by allowing policyholders to access the benefits and services provided by their insurance plan. When visiting a healthcare provider, policyholders present their insurance card, which the provider uses to verify coverage and billing information. This helps ensure that the policyholder receives the appropriate medical services without incurring significant out-of-pocket expenses.

Having health insurance offers a wide range of benefits. First and foremost, it provides financial protection by covering a portion or all of the costs associated with medical care. This includes doctor visits, hospital stays, prescription medications, and preventive services. Health insurance also offers access to a network of healthcare providers, ensuring that policyholders can receive quality care from professionals in their area.

Another important benefit of health insurance cards is the ability to easily manage healthcare expenses. The card typically includes information about deductibles, copayments, and coinsurance, which are important factors in determining the policyholder’s financial responsibility. Policyholders can refer to their insurance card to understand what costs they may be responsible for and plan accordingly.

Overall, health insurance cards are essential tools for individuals to navigate the complex world of healthcare. They provide proof of insurance coverage, facilitate access to medical services, offer financial protection, and help policyholders manage their healthcare expenses. Understanding how these cards work and the benefits they provide is crucial for making informed decisions about healthcare and ensuring that individuals receive the care they need.

How Health Insurance Cards Work

A health insurance card is a crucial component of any health insurance plan. It serves as proof of insurance coverage and allows individuals to access the benefits provided by their insurance plan.

When an individual receives their health insurance card, they should keep it with them at all times. The card typically includes important information such as the insured person’s name, policy number, and the contact information for the insurance company.

When seeking medical care, individuals present their health insurance card to the healthcare provider. The provider will then use the information on the card to verify the individual’s coverage and to bill the insurance company for the services provided.

The health insurance card works as a communication tool between the insured person, the healthcare provider, and the insurance company. It ensures that the provider knows the individual’s coverage details and can bill the insurance company directly for the services rendered.

Having a health insurance card offers numerous benefits. It allows individuals to access medical services without having to pay the full cost out of pocket. Instead, the insurance company will cover a portion of the expenses, depending on the terms of the insurance plan.

Additionally, the health insurance card provides peace of mind, knowing that there is financial protection in case of unexpected medical expenses. It also allows for easier record-keeping, as the card can be used to track and monitor healthcare expenses.

In summary, a health insurance card is a vital tool that works to facilitate communication between the insured person, healthcare providers, and insurance companies. It provides proof of coverage and allows individuals to access the benefits of their insurance plan, reducing out-of-pocket expenses and providing financial protection in case of medical emergencies.

The Importance of Health Insurance Cards

Health insurance cards play a crucial role in ensuring that individuals have access to the benefits and services provided by their insurance plans. These cards serve as a form of identification and contain important information about the individual’s coverage.

One of the key benefits of having a health insurance card is that it allows individuals to easily access medical services and treatments. When visiting a healthcare provider, individuals can present their insurance card, which helps the provider verify their coverage and streamline the billing process. This not only saves time but also ensures that individuals receive the necessary care without any delays or complications.

Health insurance cards also provide individuals with a sense of security and peace of mind. Knowing that they have insurance coverage and having a physical card to present when needed can alleviate the financial burden associated with medical expenses. This can be especially important in emergency situations or when individuals require costly treatments or surgeries.

Another important aspect of health insurance cards is that they help individuals keep track of their healthcare expenses. The card often contains information about deductibles, copayments, and out-of-pocket maximums, allowing individuals to understand their financial responsibility and plan accordingly. This transparency promotes informed decision-making and empowers individuals to make the best choices for their health and financial well-being.

In summary, health insurance cards are essential tools that facilitate access to healthcare services, provide financial security, and promote informed decision-making. Having a health insurance card ensures that individuals can receive the necessary care and benefits, ultimately contributing to their overall health and well-being.

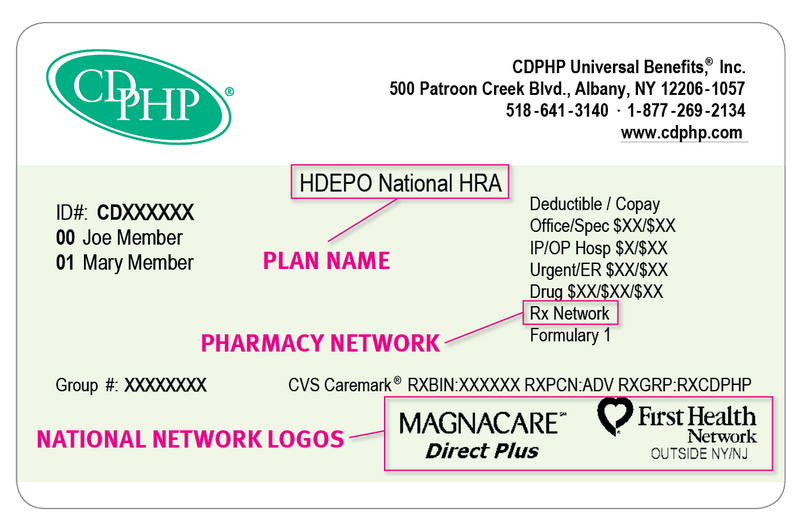

What Information is on a Health Insurance Card

A health insurance card contains important information that is necessary for accessing healthcare services and benefits. It serves as a form of identification and proof of insurance coverage. The card typically includes the following information:

- Insurance company name: This is the name of the health insurance company that provides the coverage.

- Policyholder’s name: The card will display the name of the person who holds the health insurance policy.

- Policy number: This is a unique identifier assigned to the policyholder’s insurance policy.

- Group number: Some health insurance plans may assign a group number to identify a specific group or organization that the policyholder belongs to.

- Effective date: The card will indicate the date when the health insurance coverage became active.

- Expiration date: This is the date when the health insurance coverage will end, unless the policy is renewed.

- Contact information: The card may provide contact details for the insurance company, such as a customer service phone number or website.

Having this information readily available on the health insurance card is important for both the policyholder and healthcare providers. It allows healthcare professionals to verify insurance coverage and bill the insurance company directly for services provided. For policyholders, the card serves as a convenient reference for their insurance information and can be presented when seeking medical care.

How to Use Your Health Insurance Card

Understanding how to use your health insurance card is essential for accessing the benefits provided by your insurance plan. Your health insurance card serves as proof of your coverage and allows you to receive medical services and prescriptions at discounted rates or with no out-of-pocket costs.

When you visit a healthcare provider, you will need to present your health insurance card. The provider will then use the information on your card to verify your coverage and bill the insurance company directly. It’s important to keep your card with you at all times, as you may need it in emergencies or unexpected medical situations.

When using your health insurance card, it’s crucial to understand the benefits and limitations of your plan. Your card will typically have information such as your policy number, group number, and the name of your insurance company. It may also include a list of covered services and any copayments or deductibles you are responsible for.

Before seeking medical services, it’s a good idea to familiarize yourself with the details on your health insurance card. This includes understanding which healthcare providers are in-network and which are out-of-network. In-network providers have negotiated rates with your insurance company, resulting in lower costs for you. Out-of-network providers may not be covered or may require higher out-of-pocket expenses.

In addition to presenting your health insurance card at healthcare facilities, you may also need to provide it when filling prescriptions at a pharmacy. The card will contain information that allows the pharmacy to bill your insurance for the cost of the medication. This can help you save money on prescription drugs.

It’s important to keep your health insurance card updated with any changes in your personal information or coverage. If you receive a new card, be sure to destroy the old one to prevent any potential misuse of your insurance information. If you lose your card, contact your insurance company immediately to request a replacement.

Understanding Health Insurance Networks

Health insurance networks are an important aspect of understanding how health insurance works. A network is a group of healthcare providers, such as doctors, hospitals, and clinics, that have agreed to provide services to members of a specific health insurance plan. These networks can vary in size and scope, and they can have a significant impact on the benefits and costs associated with your health insurance.

When you have health insurance, you typically have the option to choose between different types of networks. The most common types are preferred provider organizations (PPOs) and health maintenance organizations (HMOs). PPOs offer a greater degree of flexibility, allowing you to see any healthcare provider within the network or outside of it, although you may have to pay higher out-of-pocket costs for out-of-network care. HMOs, on the other hand, require you to choose a primary care physician who will coordinate your care and refer you to specialists within the network.

There are several benefits to being part of a health insurance network. First and foremost, being in-network can help you save money. Healthcare providers within the network have agreed to accept negotiated rates from the insurance company, which are often lower than the rates charged to uninsured individuals. This can result in significant savings on medical expenses, such as doctor visits, hospital stays, and prescription medications.

Another benefit of being part of a health insurance network is the ease of accessing care. When you are part of a network, you can typically find healthcare providers who are conveniently located near your home or workplace. This can make it easier to schedule appointments and receive timely care when you need it. Additionally, being part of a network often means that your insurance company will handle the administrative tasks, such as billing and claims processing, on your behalf.

In conclusion, understanding health insurance networks is crucial for navigating the complex world of health insurance. By choosing a plan with a network that meets your needs and preferences, you can take advantage of the benefits, such as cost savings and easy access to care, that come with being part of a network.

Choosing the Right Health Insurance Card

When it comes to selecting a health insurance card, it’s important to consider the benefits it offers and how it works. A health insurance card is a crucial tool that provides access to various healthcare services and helps cover the costs associated with medical treatments. It is essential to choose the right card that suits your specific health needs.

One of the key factors to consider when selecting a health insurance card is the range of benefits it provides. Different cards offer different coverage options, such as hospitalization, doctor visits, prescription medications, and preventive care. It’s important to assess your individual healthcare requirements and choose a card that offers the necessary benefits to meet those needs.

Understanding how the health insurance card works is also essential. Typically, the card acts as proof of insurance and contains important information, such as the policyholder’s name, policy number, and coverage details. It is presented at the time of receiving healthcare services to ensure that the provider is aware of the insurance coverage and can bill the insurance company accordingly.

Furthermore, it’s important to consider the network of healthcare providers associated with the health insurance card. Some cards may have a specific network of doctors, hospitals, and clinics that offer services at reduced rates, while others may provide more flexibility in choosing healthcare providers. Evaluating the network options and ensuring that your preferred healthcare providers are included can help ensure you receive the best care.

In conclusion, choosing the right health insurance card involves considering the benefits it offers, understanding how it works, and evaluating the network of healthcare providers. By carefully assessing your healthcare needs and comparing different card options, you can select a card that provides the necessary coverage and ensures access to quality healthcare services.

Common Misconceptions about Health Insurance Cards

Health insurance cards can be confusing, and there are several misconceptions about how they work and the benefits they provide. One common misconception is that having a health insurance card means you have unlimited coverage for all medical expenses. While health insurance cards do provide coverage for certain medical services, they often come with limitations and exclusions.

Another misconception is that health insurance cards are the same as a form of payment. While health insurance cards can be used to pay for medical services, they are not the same as a credit or debit card. Instead, they serve as a way to identify you as a member of a specific health insurance plan and provide information to healthcare providers about your coverage.

Some people also mistakenly believe that health insurance cards are only necessary for major medical procedures or emergencies. However, health insurance cards are important for all types of medical care, including routine check-ups, prescription medications, and preventive services. Having a health insurance card ensures that you can access the benefits and discounts provided by your insurance plan for all of your healthcare needs.

Additionally, there is a misconception that health insurance cards are only for individuals who are sick or have pre-existing conditions. In reality, health insurance cards are available to everyone, regardless of their health status. Having health insurance coverage can help individuals and families save money on medical expenses and ensure access to necessary healthcare services.

It’s important to understand the true benefits and limitations of your health insurance card. Take the time to review your insurance plan and familiarize yourself with the coverage it provides. By understanding how your health insurance card works, you can make informed decisions about your healthcare and ensure that you are maximizing the benefits of your insurance coverage.

Benefits of Having a Health Insurance Card

A health insurance card provides numerous benefits to individuals and families. It serves as a proof of coverage and allows individuals to access healthcare services and receive the necessary medical treatment. The card contains important information about the policyholder, such as their name, policy number, and contact information, which makes it easier for healthcare providers to verify coverage and bill the insurance company.

One of the major benefits of having a health insurance card is the financial protection it offers. With a card, individuals can receive medical care without worrying about the high costs associated with healthcare services. The insurance company will cover a portion or all of the costs, depending on the policy terms and conditions. This helps individuals and families save money and avoid financial hardship in case of unexpected medical expenses.

In addition, a health insurance card provides access to a wide network of healthcare providers. Insurance companies typically have agreements with various hospitals, clinics, and doctors, allowing policyholders to receive care from these providers at discounted rates. This ensures that individuals can receive quality healthcare services without having to pay the full price. The card also often includes a list of in-network providers, making it easier for individuals to find a healthcare provider that accepts their insurance.

Moreover, a health insurance card promotes preventive care and encourages individuals to prioritize their health. Many insurance plans cover preventive services, such as vaccinations, screenings, and annual check-ups, at no additional cost. By having a health insurance card, individuals are more likely to take advantage of these services, which can help detect and prevent health issues before they become more serious and costly to treat.

Finally, a health insurance card provides peace of mind. Knowing that you have access to healthcare services and financial protection in case of medical emergencies or illnesses can alleviate stress and anxiety. It allows individuals to focus on their health and well-being without the added worry of how to pay for medical expenses.

How Health Insurance Cards Help with Medical Expenses

Health insurance cards provide a range of benefits to individuals seeking medical care. These cards serve as proof of insurance coverage and enable individuals to access a variety of healthcare services. With health insurance, individuals can receive necessary medical treatments and services without having to pay the full cost out of pocket.

One of the main benefits of health insurance cards is that they help to reduce the financial burden of medical expenses. When individuals have insurance, they typically only need to pay a portion of the total cost for healthcare services, known as a copayment or coinsurance. This can significantly lower the overall cost of medical treatments, making them more affordable and accessible.

Additionally, health insurance cards often provide coverage for preventive care services, such as vaccinations, screenings, and wellness visits. These services are important for maintaining good health and preventing the onset of serious medical conditions. By having insurance, individuals can receive these preventive services at little to no cost, promoting overall well-being and early detection of potential health issues.

Health insurance cards also help individuals to navigate the complex healthcare system. Insurance companies typically have networks of healthcare providers that have agreed to provide services at discounted rates. By presenting their insurance card, individuals can easily find and access in-network providers, ensuring that they receive the benefits of their insurance coverage and minimizing the chance of unexpected out-of-pocket expenses.

In summary, health insurance cards provide numerous benefits to individuals seeking medical care. They help to reduce the financial burden of medical expenses, cover preventive care services, and facilitate access to in-network healthcare providers. By understanding how health insurance works and utilizing their insurance cards, individuals can better manage their healthcare costs and receive the necessary treatments and services for their well-being.

How Health Insurance Cards Simplify the Billing Process

Health insurance cards play a crucial role in simplifying the billing process for individuals and healthcare providers. These cards, issued by health insurance companies, contain important information about the individual’s coverage and benefits.

When a person visits a healthcare provider, they can present their health insurance card to ensure that their medical expenses are covered. The card typically includes the individual’s name, policy number, and the name of the insurance company. This information allows the healthcare provider to verify the individual’s coverage and bill the insurance company directly.

By presenting their health insurance card, individuals can avoid the hassle of paying out-of-pocket for their medical expenses and then seeking reimbursement from the insurance company. The card streamlines the billing process, making it more efficient and convenient for both the patient and the healthcare provider.

In addition to simplifying the billing process, health insurance cards also provide individuals with a clear understanding of their benefits. The card often includes information about the individual’s co-pays, deductibles, and coverage limits. This allows individuals to make informed decisions about their healthcare and understand their financial responsibilities.

Furthermore, health insurance cards can be used as a form of identification at healthcare facilities. The card may include a photo of the individual, further ensuring that their identity is verified and their medical records are accurately linked to their insurance coverage.

Overall, health insurance cards play a vital role in simplifying the billing process and providing individuals with a clear understanding of their coverage and benefits. By presenting their card, individuals can ensure that their medical expenses are covered and avoid the inconvenience of seeking reimbursement. These cards are a valuable tool in navigating the complex world of healthcare insurance.

Health Insurance Cards and Preventive Care

Health insurance cards play a crucial role in providing access to preventive care. These cards contain important information about the policyholder’s insurance coverage and can be presented at healthcare facilities to receive the necessary services.

Preventive care refers to healthcare services and screenings that are aimed at preventing illnesses or detecting them at an early stage. With a health insurance card, individuals can access a range of preventive care services, such as vaccinations, annual check-ups, and screenings for conditions like cancer and diabetes.

Having a health insurance card ensures that individuals can receive these preventive services without having to worry about the financial burden. Insurance plans often cover the cost of preventive care, making it more accessible to policyholders. This encourages individuals to prioritize their health and take proactive measures to prevent potential health issues.

In addition to covering the cost of preventive care, health insurance cards also provide policyholders with access to a network of healthcare providers. These providers have agreements with the insurance company, which means that policyholders can receive care at discounted rates. This can be particularly beneficial for individuals who require ongoing preventive care or have a chronic condition that requires regular monitoring.

By using their health insurance card, policyholders can not only save money on preventive care but also have greater peace of mind knowing that they have access to necessary healthcare services. It is important for individuals to familiarize themselves with the coverage and benefits provided by their insurance card to make the most of their preventive care options.

Health Insurance Cards and Prescription Medications

Health insurance cards play a crucial role in providing access to prescription medications. Prescription medications are an essential part of maintaining good health and managing chronic conditions. With the help of health insurance, individuals can receive the necessary medications without facing excessive financial burdens.

When it comes to prescription medications, health insurance works by covering a portion of the cost. The specific coverage details vary depending on the insurance plan, but most plans require individuals to pay a copayment or coinsurance for their medications. This means that individuals pay a predetermined amount out of pocket, while the insurance company covers the remaining cost.

The benefits of using a health insurance card for prescription medications are numerous. Firstly, it provides access to a wide range of medications that may otherwise be unaffordable. Insurance coverage allows individuals to receive the medications they need to manage their health conditions without breaking the bank.

Additionally, health insurance cards often provide access to preferred pharmacies or mail-order prescription services. These options can offer convenience and cost savings, making it easier for individuals to obtain their medications. Some insurance plans may also offer discounts or special pricing agreements with certain pharmacies, further reducing the cost of prescription medications.

Moreover, health insurance cards may include coverage for both generic and brand-name medications. Generic medications are typically more affordable, while brand-name medications may be necessary for specific health conditions. With insurance coverage, individuals have the flexibility to choose the most appropriate medication for their needs without worrying about the financial implications.

In conclusion, health insurance cards play a vital role in ensuring access to prescription medications. They work by providing coverage for a portion of the cost, allowing individuals to receive the medications they need without excessive financial burdens. The benefits of using a health insurance card for prescription medications include affordability, access to preferred pharmacies, and coverage for both generic and brand-name medications.

Health Insurance Cards and Emergency Medical Services

Health insurance cards play a crucial role in ensuring access to emergency medical services. When an individual experiences a medical emergency, having a health insurance card can provide numerous benefits and expedite the process of receiving necessary care.

One of the primary benefits of health insurance cards in emergency situations is that they serve as proof of insurance coverage. Emergency medical services providers can quickly verify the individual’s insurance information and determine the extent of their coverage. This ensures that the individual receives the appropriate care without delays or complications.

In addition to serving as proof of insurance, health insurance cards also contain important contact information. This information includes the insurance provider’s customer service hotline, which can be crucial in emergency situations. Individuals can call the hotline to receive guidance on the nearest in-network healthcare facilities or to get assistance with any insurance-related queries.

Moreover, health insurance cards often include details about emergency medical services coverage. This can include information about copayments, deductibles, and out-of-pocket maximums. Understanding these details can help individuals make informed decisions about seeking emergency care and managing their healthcare expenses.

Furthermore, health insurance cards may contain instructions on how to handle emergency situations. These instructions can include steps to take in case of accidents, sudden illnesses, or other medical emergencies. This information can be invaluable, especially for individuals who may be in a state of panic or distress during such situations.

In summary, health insurance cards are essential for accessing emergency medical services. They provide proof of insurance coverage, contain important contact information, offer details about coverage, and provide instructions on handling emergency situations. Having a health insurance card can help individuals receive timely and appropriate care, ensuring their well-being in times of crisis.

Health Insurance Cards and Specialist Care

Health insurance cards play a crucial role in accessing specialist care. These cards are provided by insurance companies and serve as proof of coverage for medical services. They contain important information such as the policyholder’s name, policy number, and the insurance company’s contact details.

When seeking specialist care, having a health insurance card is essential. It allows patients to easily identify themselves as insured individuals and ensures that the insurance company will cover the cost of the visit. Specialists, such as dermatologists or cardiologists, often require a referral from a primary care physician, and presenting the insurance card can streamline this process.

The way health insurance cards work with specialist care is by providing access to a network of healthcare providers. Insurance companies usually have a network of preferred specialists who have agreed to accept negotiated rates for their services. When using the health insurance card to seek specialist care, patients can enjoy the benefits of these negotiated rates, which can result in significant cost savings.

Moreover, health insurance cards often include additional benefits specifically for specialist care. These benefits may include coverage for diagnostic tests, surgical procedures, or medications prescribed by the specialist. By presenting their health insurance card, patients can take advantage of these additional benefits and ensure that they receive the necessary care without incurring excessive out-of-pocket expenses.

In summary, health insurance cards are essential for accessing speci