Deductible In Health Insurance

When it comes to health insurance, understanding the basics of deductibles is crucial. A deductible is the amount of money that you must pay out-of-pocket before your insurance coverage kicks in.

Health insurance premiums can be expensive, and having a deductible is one way to help lower your monthly premium. However, it’s important to understand how deductibles work and what they mean for your healthcare costs.

When you visit a healthcare provider, you may be required to pay a copayment or coinsurance, which is a small fee that you must pay at the time of your visit. This fee is separate from your deductible and is typically a fixed amount.

Once you have met your deductible, your insurance coverage will begin to pay for a portion of your healthcare costs. However, it’s important to note that not all healthcare services may be covered by your insurance. It is important to review your policy to understand what services are covered and which providers are in-network.

In-network providers have agreed to provide services at a discounted rate to insurance members. If you choose to see an out-of-network provider, you may be responsible for a larger portion of the cost.

Understanding your health insurance coverage, including your deductible, can help you make informed decisions about your healthcare and manage your out-of-pocket costs. Take the time to review your policy and speak with your insurance provider to ensure you have the coverage you need.

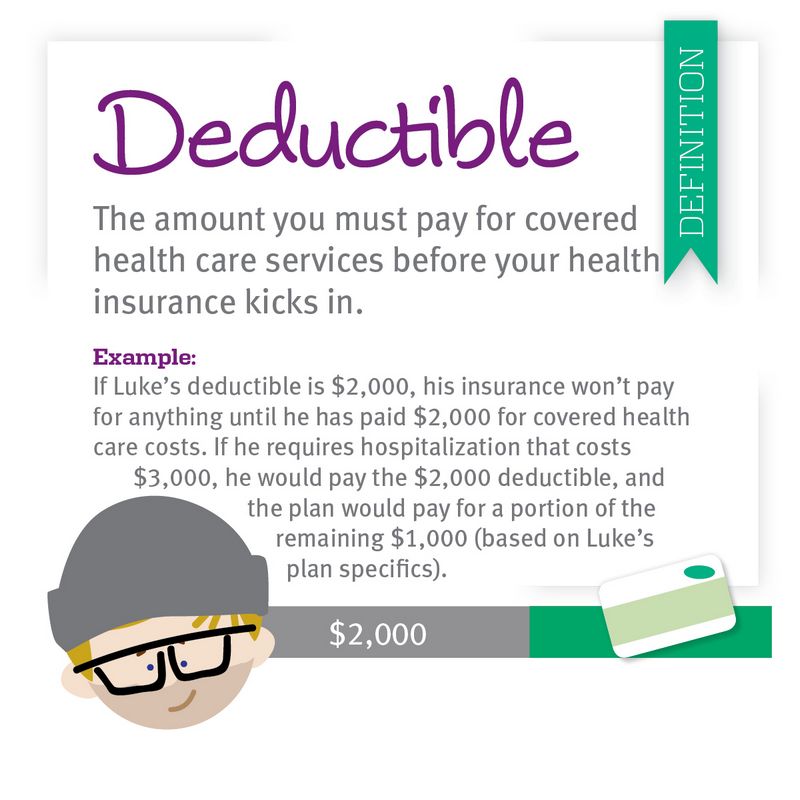

What is a Deductible?

A deductible is the amount of money that you must pay out-of-pocket before your health insurance coverage kicks in. It is a fixed amount that you are responsible for paying before the insurance company starts to cover your medical expenses.

When you have a deductible, it means that you have to pay for a certain amount of your healthcare costs before your insurance will start to pay. For example, if you have a $1,000 deductible, you will have to pay the first $1,000 of your medical expenses before your insurance starts to cover the rest.

It’s important to understand that a deductible is different from a copayment or coinsurance. While a deductible is a fixed amount that you must pay before your insurance coverage begins, a copayment is a set amount that you must pay for each visit or service, and coinsurance is a percentage of the cost that you are responsible for paying.

Having a deductible can help keep your health insurance premiums lower. Insurance companies often offer plans with higher deductibles at a lower premium cost. This means that you may have to pay more out-of-pocket when you need medical care, but your monthly premium will be more affordable.

Before choosing a health insurance plan, it’s important to consider your healthcare needs and budget. If you rarely visit the doctor and are generally healthy, a plan with a higher deductible and lower premium may be a good option for you. However, if you have ongoing health issues or anticipate needing frequent medical care, a plan with a lower deductible and higher premium may provide better coverage.

How Does a Deductible Work in Health Insurance?

Health insurance is a crucial aspect of financial planning, providing coverage for medical expenses. Understanding how a deductible works is essential for making informed decisions about your health insurance policy.

A deductible is the amount of money that you must pay out of pocket before your insurance coverage kicks in. It is a fixed amount that you are responsible for paying before your insurance company starts covering your medical expenses.

When you have a health insurance policy with a deductible, you are required to pay for certain medical services and treatments until you reach your deductible amount. This means that you will have to pay for doctor visits, prescriptions, and other healthcare services until you have met your deductible.

Once you have met your deductible, your insurance coverage will begin to pay for a portion or all of your medical expenses, depending on your policy. It is important to note that even after you have met your deductible, you may still be responsible for paying copayments or coinsurance for certain services.

Choosing a health insurance policy with a higher deductible often means that you will have a lower monthly premium. However, it also means that you will have to pay more out of pocket before your insurance coverage starts. On the other hand, a policy with a lower deductible will typically have a higher monthly premium but may require less out-of-pocket expenses.

It is also important to consider the network of providers when choosing a health insurance policy. In-network providers have negotiated rates with your insurance company, which can help you save money on medical expenses. If you choose an out-of-network provider, you may have to pay a higher deductible or a larger portion of the cost.

In conclusion, understanding how a deductible works in health insurance is essential for managing your healthcare expenses. It is important to carefully review your policy and consider factors such as deductible amount, monthly premium, network of providers, and out-of-pocket expenses before making a decision.

Types of Deductibles in Health Insurance

When it comes to health insurance, understanding the different types of deductibles is crucial. A deductible is the amount of money you must pay out-of-pocket before your insurance coverage kicks in. Here are some common types of deductibles you may encounter:

- Individual Deductible: This is the amount of money that each individual covered by the policy must pay before the insurance provider starts covering their healthcare expenses.

- Family Deductible: If you have a family health insurance plan, the family deductible is the total amount that the entire family must pay before the insurance coverage applies to any individual’s medical expenses.

- Embedded Deductible: In some plans, there may be separate deductibles for different types of services, such as prescription drugs or hospital stays. An embedded deductible means that each individual’s expenses will count towards both the individual deductible and the overall family deductible.

- Out-of-Network Deductible: If your health insurance plan has a network of preferred providers, seeking care outside of this network may come with its own deductible. This means that you will have to pay a certain amount out-of-pocket before your insurance starts covering services from out-of-network providers.

- High Deductible Health Plan (HDHP): This type of plan typically has a higher deductible compared to traditional health insurance plans. HDHPs are often paired with a Health Savings Account (HSA), which allows you to save pre-tax dollars to pay for medical expenses.

Understanding the different types of deductibles in health insurance can help you choose the right plan for your needs. Consider factors such as your health, budget, and preferred providers before selecting a plan with the appropriate deductible.

Choosing the Right Deductible for You

When it comes to health insurance, one of the most important factors to consider is the deductible. The deductible is the amount of money that you have to pay out of pocket before your insurance coverage kicks in. It is important to choose the right deductible for you, as it can greatly impact your premium and out-of-pocket costs.

There are different deductible options available, ranging from low to high. A low deductible means that you will have a higher premium, but you will pay less out of pocket when you need medical services. On the other hand, a high deductible means that you will have a lower premium, but you will have to pay more out of pocket before your insurance coverage starts.

When choosing a deductible, it is important to consider your own healthcare needs and financial situation. If you frequently visit doctors or specialists, a low deductible may be a better option for you. However, if you rarely need medical services and are looking to save on your premium, a high deductible may be more suitable.

It is also important to consider the network of providers that are covered under your insurance plan. Some plans have a network of preferred providers, and if you choose to see an out-of-network provider, you may have to pay a higher deductible. Make sure to review the network coverage before making a decision.

In addition to the deductible, it is also important to consider other out-of-pocket costs such as copayments and coinsurance. These are the amounts that you have to pay each time you receive medical services. It is important to factor in these costs when choosing a deductible.

In summary, choosing the right deductible for your health insurance is a decision that should be based on your individual healthcare needs and financial situation. Consider factors such as your frequency of medical services, your budget, and the network of providers covered under your plan. By carefully evaluating these factors, you can make an informed decision and ensure that you have the right coverage for your needs.

Factors to Consider When Choosing a Deductible

When selecting a health insurance plan, one of the most important factors to consider is the deductible. The deductible is the amount of money that you must pay out-of-pocket before your insurance coverage kicks in. It is essential to choose a deductible that fits your budget and healthcare needs.

One factor to consider is your monthly premium. A higher deductible typically means a lower monthly premium, while a lower deductible usually results in a higher premium. If you are generally healthy and rarely visit the doctor, a higher deductible may be a good option to save on monthly costs.

Another factor to consider is your expected healthcare expenses. If you have ongoing medical conditions or anticipate the need for regular medical care, a lower deductible may be beneficial. This way, you can reach your deductible sooner and have your insurance coverage start paying for your healthcare expenses.

You should also take into account your access to healthcare providers. Some insurance plans have a network of preferred providers, and visiting an out-of-network provider may result in higher out-of-pocket costs. If you have a specific provider you prefer, it’s important to check if they are in-network with the insurance plan you are considering.

Copayments are another factor to consider. A copayment is a fixed amount that you pay for certain services, such as doctor visits or prescription medications. Some insurance plans waive copayments once the deductible is met, while others require copayments regardless of the deductible. Understanding how copayments work can help you make an informed decision about your deductible.

In summary, when choosing a deductible for your health insurance, it is crucial to consider factors such as your monthly premium, expected healthcare expenses, access to providers, and copayments. By carefully evaluating these factors, you can select a deductible that provides the right balance between out-of-pocket costs and insurance coverage.

Pros and Cons of High Deductible Health Plans

High Deductible Health Plans (HDHPs) have become increasingly popular in recent years. These plans offer lower premiums, which can be appealing to individuals and families looking to save on their monthly healthcare costs. However, it’s important to understand the pros and cons before choosing this type of plan.

One of the main advantages of HDHPs is the ability to access a larger network of providers. With lower premiums, insurance companies can negotiate contracts with a wider range of doctors, specialists, and hospitals. This means that individuals with an HDHP have more options when it comes to choosing a healthcare provider, ensuring that they receive the best possible care.

Another benefit of HDHPs is the opportunity to save on out-of-pocket expenses. While the deductible may be higher compared to other health insurance plans, once the deductible is met, the insurance coverage kicks in and the individual is only responsible for a portion of the costs. This can result in significant savings, especially for those who rarely visit the doctor or require minimal medical care.

On the flip side, one of the downsides of HDHPs is the high deductible itself. Individuals with high deductible plans are responsible for paying a larger portion of their medical expenses out-of-pocket before the insurance coverage begins. This can be a financial burden for those who require regular medical care or have chronic health conditions.

Additionally, HDHPs may not provide the same level of coverage for certain services or treatments. Some plans may have limitations or exclusions on certain procedures, medications, or therapies. It’s important to carefully review the plan’s coverage details to ensure that it meets your specific healthcare needs.

In conclusion, high deductible health plans offer lower premiums and access to a larger network of providers, which can be advantageous for some individuals and families. However, the high deductible and potential limitations on coverage should also be taken into consideration. It’s important to weigh the pros and cons and carefully evaluate your healthcare needs before choosing an HDHP.

How to Meet Your Deductible

Understanding your health insurance coverage can be a complex task, especially when it comes to deductibles. A deductible is the amount of money you must pay out-of-pocket before your insurance starts to cover your healthcare expenses. Meeting your deductible can be a challenge, but with some careful planning and smart choices, you can minimize your out-of-pocket costs.

1. Know your deductible: Familiarize yourself with the details of your health insurance plan, including your deductible amount and any copayments or premiums you may have. This will give you a clear understanding of what you need to pay before your insurance kicks in.

2. Budget for healthcare expenses: Set aside a portion of your monthly budget to cover your deductible and any other out-of-pocket costs. This will help you plan ahead and avoid any financial surprises when it comes time to pay for medical services.

3. Choose in-network providers: When seeking medical care, try to choose providers that are in your insurance network. In-network providers have negotiated rates with your insurance company, which can help lower your overall healthcare costs and help you meet your deductible more quickly.

4. Consider generic medications: If you require prescription medications, ask your doctor if there are generic alternatives available. Generic medications are often less expensive than brand-name drugs and can help you save money towards meeting your deductible.

5. Take advantage of preventive care: Many health insurance plans offer free or low-cost preventive services, such as vaccinations and screenings. By taking advantage of these services, you can stay healthy and avoid more costly healthcare expenses that could contribute to your deductible.

6. Keep track of your expenses: Keep a record of all your healthcare expenses, including doctor visits, prescriptions, and medical tests. This will help you monitor your progress towards meeting your deductible and provide documentation for any potential insurance claims.

7. Explore health savings accounts: If your insurance plan offers a health savings account (HSA), consider contributing to it. HSAs allow you to set aside pre-tax money to pay for qualified medical expenses, which can help you meet your deductible more efficiently.

By following these tips, you can navigate the complexities of your health insurance deductible and work towards meeting it in a cost-effective manner. Remember to stay informed about your coverage, make smart healthcare choices, and take advantage of any resources available to you through your insurance network.

What Happens After You Meet Your Deductible?

After you meet your deductible in your health insurance coverage, you may be wondering what happens next. Once your deductible is met, your insurance plan will start to cover a larger portion of your medical expenses, allowing you to save money on healthcare costs.

When you meet your deductible, you will typically enter a new phase of your insurance coverage called the “coinsurance” period. During this time, you will be responsible for paying a percentage of your medical costs, while your insurance provider will cover the rest. This percentage is usually outlined in your insurance policy and can vary depending on the plan you have chosen.

It’s important to note that even after you meet your deductible, you may still have to pay copayments or coinsurance for certain services. These additional costs are typically a fixed amount or a percentage of the total cost of the service, and they help to share the cost of healthcare between you and your insurance provider.

Another important factor to consider after meeting your deductible is your network of healthcare providers. Your insurance plan may have a network of preferred providers, and if you choose to receive care from a provider outside of this network, you may be responsible for a higher percentage of the cost. It’s always a good idea to check with your insurance provider or review your policy to understand which providers are in-network and how much you may be responsible for paying if you choose an out-of-network provider.

Meeting your deductible can also have an impact on your out-of-pocket maximum. The out-of-pocket maximum is the maximum amount of money that you will have to pay for covered services in a given year. Once you meet your deductible, any additional payments you make, such as copayments or coinsurance, will count towards your out-of-pocket maximum. Once you reach this maximum, your insurance provider will cover 100% of the cost of covered services, giving you peace of mind that your healthcare costs are fully covered.

Common Misconceptions about Deductibles

When it comes to health insurance, there are several common misconceptions about deductibles that can lead to confusion and misunderstandings. One of the most common misconceptions is that a deductible is the same as a copayment. However, this is not true. While a copayment is a fixed amount that you pay for certain services, a deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in.

Another misconception is that once you meet your deductible, you no longer have to pay anything for your healthcare services. This is not entirely accurate. While meeting your deductible means that your insurance will start covering a portion of the costs, you may still be responsible for a percentage of the expenses, known as coinsurance. It’s important to understand the details of your insurance plan and how much you will be responsible for even after meeting your deductible.

Some people also believe that they must pay their deductible before they can see any healthcare providers. While it’s true that some insurance plans require you to pay your deductible upfront, many plans allow you to see providers within their network and only pay a copayment or coinsurance, even if you haven’t met your deductible yet. It’s important to check with your insurance provider to understand their specific rules and requirements.

Lastly, some individuals think that a higher deductible means better coverage. While it’s true that plans with higher deductibles often have lower monthly premiums, it’s important to consider your individual healthcare needs and financial situation. A high deductible may be more affordable on a monthly basis, but it also means that you will have to pay more out-of-pocket before your insurance coverage begins.

In conclusion, understanding the basics of deductibles in health insurance is crucial to making informed decisions about your coverage. By debunking these common misconceptions, you can better navigate your insurance plan and ensure that you are getting the most out of your coverage.

How Deductibles Affect Premiums

When it comes to health insurance, understanding how deductibles affect premiums is crucial. A deductible is the amount of money that you have to pay out-of-pocket for your healthcare before your insurance kicks in. This means that if you have a higher deductible, you will have to pay more before your insurance starts covering your expenses.

One way that deductibles can affect premiums is through the type of health insurance plan you choose. Some plans have higher deductibles but lower premiums, while others have lower deductibles but higher premiums. It’s important to consider your own healthcare needs and budget when deciding which plan is right for you.

In addition, the network of healthcare providers that your insurance company works with can also impact your deductible and premium. If you choose a plan that has a larger network of providers, you may have a higher premium but a lower deductible. On the other hand, if you choose a plan with a smaller network, you may have a lower premium but a higher deductible.

Copayments are another factor to consider when understanding how deductibles affect premiums. A copayment is a fixed amount that you have to pay for certain services, such as a doctor’s visit or a prescription medication. Depending on your insurance plan, copayments may be required even after you’ve met your deductible. These copayments can add up and affect your overall healthcare costs.

In conclusion, it’s important to carefully consider how deductibles affect premiums when choosing a health insurance plan. Understanding the trade-offs between deductibles, premiums, networks, and copayments can help you make an informed decision that meets your healthcare needs and budget.

Tips for Saving Money on Deductibles

When it comes to health insurance, understanding how deductibles work can help you save money. A deductible is the amount of money you have to pay out-of-pocket before your insurance coverage kicks in. Here are some tips to help you save money on deductibles:

- Choose a high deductible plan: Opting for a plan with a higher deductible can lower your monthly premium. If you are generally healthy and don’t anticipate needing many medical services, this could be a cost-effective option.

- Stay in-network: Using healthcare providers that are in your insurance network can help you save on out-of-pocket costs. Providers in-network have negotiated rates with your insurance company, which can result in lower deductible amounts.

- Utilize preventive care: Taking advantage of preventive care services, such as annual check-ups and vaccinations, can help you catch potential health issues early on. Many insurance plans cover preventive care at no cost to you, even before meeting your deductible.

- Consider a health savings account (HSA): An HSA is a tax-advantaged savings account that can be used to pay for qualified medical expenses. Contributions to an HSA are tax-deductible, and the funds can be used to cover deductibles, copayments, and other out-of-pocket costs.

- Shop around for services: Before undergoing any medical procedures or tests, it’s a good idea to compare prices from different providers. You may find that certain providers offer the same quality of care at a lower cost, helping you save on your deductible.

By following these tips, you can take steps to save money on deductibles and make the most out of your health insurance coverage.

Understanding Out-of-Pocket Maximums

When it comes to health insurance, it’s important to understand the concept of out-of-pocket maximums. An out-of-pocket maximum is the highest amount of money you will have to pay for covered healthcare services in a given year. This includes deductibles, copayments, and coinsurance.

Deductibles are the amount of money you have to pay out of your own pocket before your insurance coverage kicks in. Once you have met your deductible, you may still have to pay a copayment or coinsurance for certain services. Copayments are fixed amounts you pay for specific services, while coinsurance is a percentage of the cost of a service that you are responsible for.

It’s important to note that out-of-pocket maximums only apply to covered services. If you receive care from a provider who is not in your insurance network, you may be responsible for the full cost of the services. That’s why it’s important to choose a health insurance plan that has a provider network that meets your needs.

Premiums are the monthly payments you make to your insurance company in exchange for coverage. Premiums are separate from out-of-pocket costs and are not included in the out-of-pocket maximum. It’s important to budget for both your premiums and your potential out-of-pocket costs when choosing a health insurance plan.

Understanding out-of-pocket maximums is crucial for managing your healthcare expenses. By knowing the maximum amount you will have to pay in a given year, you can better plan for potential healthcare costs and make informed decisions about your health insurance coverage.

How Deductibles Differ from Copayments and Coinsurance

When it comes to health insurance, understanding the basics of deductibles, copayments, and coinsurance is crucial. While all three terms relate to the out-of-pocket costs you may have to pay for medical services, they differ in important ways.

A deductible is the amount of money you must pay out of your own pocket before your insurance coverage kicks in. For example, if you have a $1,000 deductible, you will have to pay the first $1,000 of your medical expenses before your insurance starts paying. Deductibles can vary depending on your insurance plan and can be higher or lower depending on the level of coverage you choose.

On the other hand, copayments are fixed amounts you pay for specific medical services, such as a doctor’s visit or a prescription. These are typically small amounts, like $20 or $30, and are paid at the time of service. Copayments are separate from your deductible and do not count towards meeting your deductible.

Coinsurance, meanwhile, is a percentage of the cost of a medical service that you are responsible for paying. For example, if you have a 20% coinsurance rate and the cost of a procedure is $1,000, you would be responsible for paying $200, while your insurance would cover the remaining $800. Coinsurance usually kicks in after you have met your deductible.

Understanding the differences between deductibles, copayments, and coinsurance is important for making informed decisions about your health insurance coverage. It’s essential to review your insurance plan’s details, including the network of doctors and providers, to ensure you have a clear understanding of how these costs will affect your out-of-pocket expenses.

Can You Deduct Health Insurance Deductibles on Your Taxes?

When it comes to managing your health expenses, understanding the tax implications of your health insurance deductibles is crucial. A deductible is the amount of money you must pay out-of-pocket before your insurance coverage kicks in. But can you deduct these deductibles on your taxes?

The answer depends on a few factors. Generally, you cannot deduct health insurance deductibles on your taxes. However, there are certain situations where you may be able to deduct them. For example, if your total medical expenses for the year exceed a certain percentage of your adjusted gross income, you may be able to deduct some of your health insurance deductibles.

To determine if you qualify for a deduction, you’ll need to calculate your total medical expenses, including deductibles, copayments, and other out-of-pocket costs. It’s also important to note that the deductible must be paid for medical services that are considered eligible expenses by your insurance provider.

Additionally, if you have a health insurance plan that allows you to contribute to a health savings account (HSA), you may be able to deduct your deductible expenses through your HSA contributions. This can provide you with a tax advantage, as contributions to an HSA are typically tax-deductible.

It’s important to consult with a tax professional or financial advisor to determine if you qualify for any deductions related to your health insurance deductibles. They can help you navigate the complexities of the tax code and ensure you’re maximizing your deductions while staying compliant with the law.

What to Do If You Can’t Afford Your Deductible

If you find yourself unable to afford your health insurance deductible, there are several options you can consider to help alleviate the financial burden. Firstly, reach out to your insurance provider and explain your situation. They may be able to offer alternative payment plans or assistance programs to help you cover the deductible.

Another option is to explore copayment options. Copayments are a fixed amount that you pay for certain services, such as doctor visits or prescription medications. By focusing on copayments rather than the deductible, you can spread out the cost of your healthcare expenses over time.

You can also consider adjusting your premium. Premiums are the monthly payments you make for your health insurance coverage. By opting for a plan with a higher premium, you may be able to lower your deductible and reduce your out-of-pocket expenses.

Additionally, it’s important to review your health insurance network. In-network providers typically have negotiated rates with your insurance company, which can result in lower costs for you. By choosing healthcare providers within your network, you can potentially save money on your deductible.

If all else fails, you may want to explore other health insurance options that better fit your budget. Compare different plans and providers to find one that offers a more affordable deductible and premium. Remember to carefully review the coverage and benefits provided by each plan to ensure it meets your healthcare needs.

Question-answer:

What is a deductible in health insurance?

A deductible in health insurance is the amount of money that you have to pay out of pocket before your insurance coverage kicks in. It is a fixed amount that you must pay each year for covered medical services before your insurance company starts to pay.

How does a deductible work in health insurance?

A deductible works by setting a specific amount of money that you must pay before your insurance coverage begins. For example, if you have a $1,000 deductible and you receive a medical bill for $2,000, you will have to pay the first $1,000 out of pocket, and then your insurance will cover the remaining $1,000. Once you meet your deductible, your insurance will start to pay a portion or all of the costs for covered services.