Things to Know About Health Insurance for Pre-existing Medical Conditions

When it comes to health insurance, understanding the coverage and costs associated with pre-existing medical conditions is crucial. Pre-existing medical conditions refer to any health conditions or illnesses that you had before obtaining health insurance coverage. These conditions can range from chronic illnesses, such as diabetes or heart disease, to past surgeries or injuries.

One important aspect to consider when it comes to health insurance for pre-existing medical conditions is the premiums. Premiums are the monthly payments you make to maintain your health insurance coverage. For individuals with pre-existing conditions, insurance companies may charge higher premiums to account for the increased risk of medical expenses.

Another important factor to consider is the network of healthcare providers. Health insurance plans often have a network of doctors, hospitals, and other healthcare providers that they work with. It is important to check if your preferred healthcare providers are in-network, as out-of-network care may not be covered or may have higher out-of-pocket costs.

Additionally, health insurance plans for pre-existing medical conditions may have a deductible. A deductible is the amount of money you must pay out of pocket before your insurance coverage kicks in. It is important to understand the deductible amount and how it applies to your pre-existing conditions, as it can significantly impact your out-of-pocket costs.

In conclusion, when considering health insurance for pre-existing medical conditions, it is crucial to understand the premiums, coverage, network, and deductible associated with the plan. Being aware of these factors can help you make an informed decision and ensure that you have the necessary coverage for your healthcare needs.

Understanding Health Insurance Coverage for Pre-existing Medical Conditions

Health insurance coverage for pre-existing medical conditions is an important aspect of any insurance policy. It is crucial to understand how your insurance plan covers these conditions, as it can greatly impact your premiums and out-of-pocket costs.

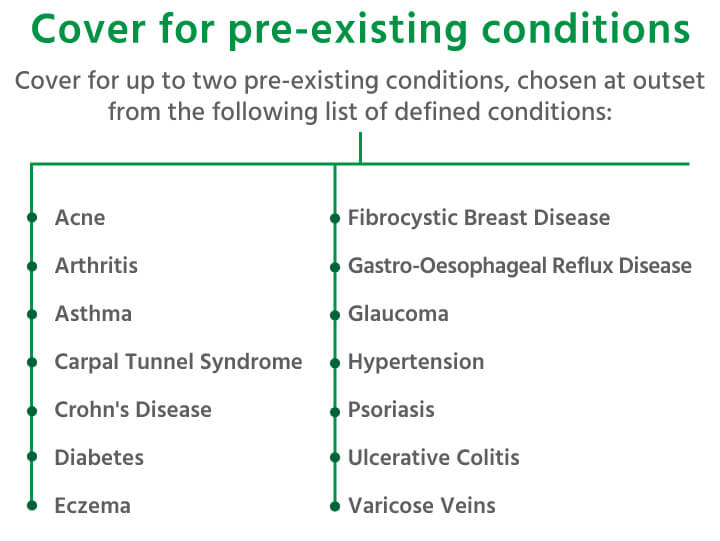

When you have a pre-existing medical condition, it means that you had the condition before you enrolled in the insurance plan. Examples of pre-existing conditions can include diabetes, asthma, or heart disease. Insurance companies may have different definitions of what qualifies as a pre-existing condition, so it is important to review your policy carefully.

One key aspect to consider is whether your insurance plan covers your pre-existing condition. Some plans may exclude coverage for pre-existing conditions for a certain period of time, known as a waiting period. During this time, you may have to pay for any medical expenses related to your pre-existing condition out-of-pocket.

Another important factor to understand is the network of providers that are covered by your insurance plan. It’s essential to know which doctors, hospitals, and specialists are in-network, as using out-of-network providers can result in higher costs or limited coverage for your pre-existing condition.

Additionally, it’s important to understand the deductible and out-of-pocket costs associated with your insurance plan. The deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. For pre-existing conditions, you may have separate deductibles or limits on coverage, so it’s important to review your policy to understand these details.

In conclusion, understanding your health insurance coverage for pre-existing medical conditions is crucial for managing your healthcare costs. Reviewing your policy, understanding the conditions covered, and knowing the network of providers can help you make informed decisions about your healthcare and ensure that you receive the coverage you need.

What are Pre-existing Medical Conditions?

A pre-existing medical condition refers to any health condition or illness that an individual has before obtaining health insurance coverage. These conditions can include chronic illnesses, such as diabetes or heart disease, as well as previous injuries or surgeries. Insurance companies typically consider pre-existing conditions when determining premiums and coverage options.

When it comes to health insurance, pre-existing medical conditions can have a significant impact on the cost and coverage of the policy. Insurance companies may charge higher premiums or impose waiting periods for coverage related to pre-existing conditions. Some policies may even exclude coverage for certain conditions altogether.

It’s important to note that the definition of pre-existing conditions can vary between insurance providers. While some insurers may consider any condition that was diagnosed or treated before the insurance policy was issued as pre-existing, others may have specific criteria or timeframes in place.

Furthermore, insurance companies typically have networks of healthcare providers that policyholders must use in order to receive full coverage. It’s important for individuals with pre-existing conditions to ensure that their preferred doctors and specialists are part of the insurance network to avoid additional out-of-pocket expenses.

In conclusion, pre-existing medical conditions can have a significant impact on health insurance coverage and costs. It’s crucial for individuals with such conditions to carefully review policy terms, including premiums, deductibles, and coverage options. Additionally, understanding the insurance network and ensuring that preferred healthcare providers are included can help individuals manage their medical expenses effectively.

The Importance of Health Insurance

Having medical insurance is crucial for individuals with pre-existing medical conditions. Health insurance provides coverage for medical expenses, including doctor visits, hospital stays, and medications. Without insurance, these costs can quickly add up and become unaffordable for many people.

One of the main benefits of health insurance is that it helps to lower the financial burden of medical treatments. With insurance, individuals only need to pay a portion of the total cost, known as the deductible, while the insurance company covers the rest. This can save individuals from having to pay large sums of money out of pocket.

Another important aspect of health insurance is the network of healthcare providers. Insurance companies have agreements with specific doctors, hospitals, and clinics, allowing individuals to receive care from these providers at a reduced cost. This network ensures that individuals can access the medical services they need without having to worry about finding a provider who accepts their insurance.

Furthermore, health insurance can help individuals with pre-existing conditions to manage their conditions more effectively. Insurance often covers preventive care, such as regular check-ups and screenings, which can help detect and manage conditions before they become more serious. This proactive approach to healthcare can lead to better overall health outcomes.

Finally, health insurance can help individuals save money in the long run. While insurance premiums may seem like an additional expense, they are often much lower than the cost of medical treatments without insurance. By paying a monthly premium, individuals can have peace of mind knowing that they are financially protected in case of any unexpected medical issues.

Types of Health Insurance Coverage

When it comes to health insurance, there are several types of coverage available to individuals with pre-existing medical conditions. These types of coverage include:

- Traditional Health Insurance: This type of coverage typically requires individuals to pay a deductible before the insurance company begins to cover medical expenses. Once the deductible is met, the insurance company will pay a percentage of the costs for covered services.

- Managed Care Plans: These plans often have a network of healthcare providers that individuals must use in order to receive coverage. Managed care plans may include health maintenance organizations (HMOs) and preferred provider organizations (PPOs).

- High-Deductible Health Plans (HDHPs): HDHPs have higher deductibles than traditional health insurance plans. However, they often have lower premiums. These plans are often paired with a health savings account (HSA), which allows individuals to save money tax-free for medical expenses.

- Short-term Health Insurance: This type of coverage is designed to provide temporary insurance for individuals who are between jobs or in need of coverage for a specific period of time. Short-term health insurance plans may have limitations on coverage for pre-existing conditions.

It’s important to carefully review the details of each type of health insurance coverage to determine which option is best for your specific needs and pre-existing conditions. Consider factors such as the cost of premiums, the level of coverage provided, and the network of healthcare providers available to you. Consulting with a healthcare insurance professional can also help you navigate the options and make an informed decision.

Limitations and Exclusions for Pre-existing Conditions

When it comes to health insurance coverage for pre-existing medical conditions, there are certain limitations and exclusions that you should be aware of. These limitations and exclusions can affect the premiums, deductibles, and overall coverage that you receive.

Firstly, it’s important to note that not all health insurance plans cover pre-existing conditions. Some plans may exclude coverage for certain pre-existing conditions altogether, while others may impose waiting periods before coverage kicks in. It’s crucial to carefully review the terms and conditions of your insurance policy to understand what is covered and what is not.

Secondly, if your health insurance plan does cover pre-existing conditions, it’s likely that you will need to seek medical care within the insurance company’s network of providers. Going out-of-network for treatment related to your pre-existing condition may result in higher out-of-pocket costs or even no coverage at all.

Additionally, many health insurance plans have a separate deductible for pre-existing conditions. This means that you may have to pay a certain amount out of pocket before your insurance coverage begins for any expenses related to your pre-existing condition. It’s important to understand the specific deductible requirements of your plan to plan your budget accordingly.

In conclusion, while health insurance plans may offer coverage for pre-existing conditions, there are limitations and exclusions that can impact your overall coverage and out-of-pocket costs. It’s crucial to carefully review your policy, understand the network of providers, and be aware of any separate deductibles that may apply to your pre-existing condition.

Waiting Periods for Pre-existing Conditions

When it comes to health insurance, one important aspect to consider is the waiting period for pre-existing conditions. A pre-existing condition is a health issue that you had before obtaining insurance coverage. It could be anything from diabetes to asthma or even a previous surgery. Insurance companies often impose waiting periods to ensure that they are not providing coverage for conditions that were already present before the policy was purchased.

During the waiting period, which can vary depending on the insurance company and policy, you may not be eligible for coverage related to your pre-existing condition. However, it’s important to note that this waiting period only applies to the specific condition and not to other aspects of your health. You can still receive coverage for other health issues or seek medical care within the insurance network.

While waiting for the waiting period to end, it’s crucial to continue paying your insurance premiums and maintaining your coverage. This ensures that you have access to healthcare services and coverage for any new health issues that may arise during this period.

In addition to the waiting period, you may also have a deductible to meet before your insurance coverage kicks in. The deductible is the amount of money you must pay out of pocket before your insurance company starts covering your medical expenses. It’s important to understand your policy’s deductible and how it applies to pre-existing conditions.

Overall, understanding waiting periods for pre-existing conditions is essential when choosing a health insurance policy. It’s important to carefully review the terms and conditions of the insurance plan to ensure that it aligns with your healthcare needs and financial situation. By doing so, you can make informed decisions about your coverage and ensure that you receive the necessary care for both pre-existing and new health conditions.

How to Obtain Health Insurance with Pre-existing Conditions

If you have pre-existing medical conditions, obtaining health insurance can be a challenging process. However, it is not impossible. Here are some steps you can take to secure health insurance coverage:

- Research different insurance options: Start by exploring different insurance providers and plans that offer coverage for pre-existing conditions. Look for plans that have a wide network of medical providers and hospitals.

- Compare premiums and deductibles: When evaluating insurance plans, compare the premiums and deductibles. Premiums are the monthly payments you make for the insurance, while deductibles are the amount you have to pay out of pocket before the insurance starts covering your medical expenses.

- Check if your employer offers coverage: If you are employed, check if your employer offers health insurance coverage. Many employers provide group health insurance plans that cover pre-existing conditions.

- Consider government programs: In some countries, there are government programs that offer health insurance coverage for individuals with pre-existing conditions. Research if you qualify for any of these programs and what their coverage entails.

- Review the coverage: Carefully review the coverage offered by different insurance plans. Make sure they provide adequate coverage for your pre-existing conditions, including medications, treatments, and specialist visits.

- Seek assistance from an insurance broker: If you are having difficulty finding insurance coverage on your own, consider seeking assistance from an insurance broker. They can help you navigate the complex insurance market and find a plan that suits your needs.

Remember, it is important to disclose all your pre-existing conditions when applying for health insurance. Failure to do so may result in denial of coverage or claims being rejected in the future. Be honest and thorough when providing your medical history to ensure you receive the appropriate coverage for your needs.

Understanding the Affordable Care Act and Pre-existing Conditions

Under the Affordable Care Act (ACA), individuals with pre-existing medical conditions have access to health insurance coverage. This means that insurance companies cannot deny coverage or charge higher premiums based on a person’s pre-existing conditions.

Health insurance plans under the ACA are required to cover essential health benefits, including medical services and treatments for pre-existing conditions. This ensures that individuals with pre-existing conditions can receive the necessary medical care without facing significant financial burdens.

When choosing a health insurance plan, it’s important to understand the terms and conditions, such as deductibles and networks. A deductible is the amount of money that individuals must pay out of pocket before their insurance coverage kicks in. It’s important to consider the deductible amount when budgeting for healthcare expenses.

Insurance networks refer to the group of doctors, hospitals, and other healthcare providers that have agreed to provide services to individuals with a specific insurance plan. It’s important to check if your preferred healthcare providers are in-network to ensure that you can receive the care you need without incurring additional out-of-pocket costs.

If you have a pre-existing condition and are seeking health insurance coverage, it’s important to compare different plans and understand the coverage options available to you. The ACA provides protections for individuals with pre-existing conditions, ensuring that they have access to the medical care they need without facing discrimination or exorbitant costs.

Tips for Choosing the Right Health Insurance Plan

When selecting a health insurance plan, it’s important to consider your specific medical conditions and needs. Here are some tips to help you choose the right plan:

- Check the coverage: Look for a plan that provides coverage for your pre-existing medical conditions. Some insurance plans may have exclusions or waiting periods for certain conditions, so make sure to review the policy carefully.

- Compare premiums: Consider the monthly premiums you’ll have to pay for the insurance plan. While lower premiums may seem appealing, make sure to also consider the coverage and benefits provided.

- Review the network: Check if the plan has a network of doctors, hospitals, and specialists that you prefer or need. Having access to a wide network can ensure that you receive the medical care you require.

- Understand the deductible: The deductible is the amount you have to pay out of pocket before the insurance coverage kicks in. Consider your medical expenses and choose a plan with a deductible that you can comfortably afford.

- Consider additional benefits: Some insurance plans offer additional benefits such as prescription drug coverage, preventive care services, or wellness programs. These benefits can be valuable in managing your medical conditions.

Remember to carefully review the terms and conditions of each health insurance plan before making a decision. It’s important to find a plan that provides the right coverage and benefits for your specific medical needs.

How to Make a Claim for Pre-existing Conditions

If you have pre-existing medical conditions and are covered by health insurance, it is important to understand the process of making a claim. Making a claim for pre-existing conditions involves several steps to ensure that you receive the coverage and benefits you are entitled to.

1. Understand your insurance policy: Familiarize yourself with the details of your insurance policy, including the coverage for pre-existing conditions. This will help you understand what conditions are covered, what the premiums and deductibles are, and whether there are any restrictions on accessing certain medical services or treatments.

2. Check the network: Determine if your insurance plan has a network of healthcare providers. If so, it is important to receive medical treatment from providers within the network to ensure that your claims are processed smoothly. If you need to see a specialist or receive certain treatments, check if they are covered under your policy and within the network.

3. Keep track of medical expenses: Maintain a record of all medical expenses related to your pre-existing conditions. This includes bills, receipts, and any other documentation that proves the expenses incurred. This will help you when filing a claim and ensure that you are reimbursed for the eligible expenses.

4. Submit the claim: When you receive medical treatment for your pre-existing conditions, make sure to submit the claim to your insurance provider in a timely manner. Follow the instructions provided by your insurance company to ensure that all necessary information is included. This may include the medical diagnosis, treatment details, and any supporting documentation.

5. Follow up on the claim: After submitting the claim, it is important to follow up with your insurance provider to ensure that it is being processed. Keep track of the claim number and contact information for any inquiries or updates. If there are any issues or delays, reach out to your insurance provider for clarification.

By following these steps, you can navigate the process of making a claim for pre-existing conditions and ensure that you receive the coverage and benefits you are entitled to under your health insurance policy.

The Role of Health Insurance Agents and Brokers

Health insurance agents and brokers play a crucial role in helping individuals and businesses navigate the complex world of health insurance. They serve as intermediaries between insurance companies and consumers, providing expert advice and guidance on selecting the right insurance plan.

One of the main responsibilities of health insurance agents and brokers is to help individuals and businesses understand the different types of coverage available. They provide detailed information on the premiums, deductibles, and out-of-pocket costs associated with each plan, helping consumers make informed decisions.

Additionally, health insurance agents and brokers assist individuals with pre-existing medical conditions in finding suitable insurance options. They have a deep understanding of the various insurance companies and their networks, and can help individuals find a plan that covers their specific medical needs.

Agents and brokers also play a vital role in helping individuals and businesses navigate the claims process. They can provide guidance on how to file claims, understand coverage limits, and ensure that individuals receive the maximum benefits from their insurance plans.

Overall, health insurance agents and brokers are essential in helping individuals and businesses find the right health insurance coverage for their specific needs. They provide valuable expertise and support throughout the entire insurance process, ensuring that individuals have access to the medical care they need.

The Importance of Regular Health Check-ups

Regular health check-ups are essential for maintaining good health and preventing the onset of serious medical conditions. These check-ups allow healthcare professionals to monitor your overall health and detect any early signs of potential health issues. By identifying and addressing these issues early on, you can prevent them from developing into more serious problems.

For individuals with pre-existing medical conditions, regular health check-ups are even more important. These check-ups can help ensure that your condition is being properly managed and that any necessary adjustments to your treatment plan are made. They also provide an opportunity to discuss any concerns or symptoms you may be experiencing with your healthcare provider.

Insurance coverage for regular health check-ups is crucial, as it helps to offset the cost of these appointments. Many insurance plans cover preventive services, including routine check-ups, without requiring a copayment or deductible. This means that you can receive the necessary care without worrying about the financial burden.

When choosing an insurance plan, it’s important to consider the network of healthcare providers available to you. Make sure that the plan you select includes the doctors and specialists you prefer to see for your regular check-ups. This will ensure that you receive the highest quality care from professionals who are familiar with your medical history and condition.

Regular health check-ups are an investment in your overall well-being. They provide an opportunity to catch and address potential health issues early on, improving your chances of successful treatment and recovery. By prioritizing regular check-ups and ensuring proper insurance coverage, you can take proactive steps towards maintaining your health and managing any pre-existing medical conditions.

How to Manage and Improve Pre-existing Conditions

Managing and improving pre-existing conditions is crucial for maintaining good health and getting the most out of your health insurance coverage. Here are some tips to help you navigate the complexities of dealing with pre-existing conditions:

- Stay informed: Educate yourself about your specific pre-existing condition and its treatment options. Understanding your condition will help you make informed decisions about your health and insurance coverage.

- Follow a healthy lifestyle: Adopting a healthy lifestyle can help improve your pre-existing condition and reduce the need for medical intervention. This includes eating a balanced diet, exercising regularly, getting enough sleep, and managing stress.

- Take prescribed medications: If your pre-existing condition requires medication, make sure to take it as prescribed by your healthcare provider. Skipping doses or not following the recommended dosage can worsen your condition.

- Keep track of your health: Regularly monitor your health and keep a record of any changes or symptoms. This information can help you and your healthcare provider make informed decisions about your treatment plan.

- Utilize your insurance benefits: Understand your health insurance coverage, including the deductible, premiums, and network of healthcare providers. Use the benefits available to you to manage and improve your pre-existing condition.

- Communicate with your healthcare provider: Maintain open and honest communication with your healthcare provider. Discuss any concerns or questions you may have about managing your pre-existing condition and work together to develop a comprehensive treatment plan.

- Join support groups: Connecting with others who have similar pre-existing conditions can provide valuable support and information. Consider joining support groups or online communities to share experiences and learn from others.

- Stay positive: Managing a pre-existing condition can be challenging, but maintaining a positive mindset can have a significant impact on your overall well-being. Surround yourself with a supportive network and focus on the things you can control.

Remember, managing and improving pre-existing conditions requires a proactive approach and a partnership between you, your healthcare provider, and your health insurance company. By taking control of your health and utilizing the resources available to you, you can effectively manage your pre-existing condition and lead a healthier life.

Resources for Finding Affordable Health Insurance

When it comes to finding affordable health insurance coverage, there are several resources available to help you navigate the complex world of insurance plans and options. Here are a few resources that can assist you in finding the right health insurance plan for your needs:

- Health Insurance Marketplace: The Health Insurance Marketplace is a website where you can compare and purchase health insurance plans. It offers a variety of options, including plans with lower premiums and higher deductibles, which may be more affordable for individuals with pre-existing conditions.

- Insurance Brokers: Insurance brokers are professionals who can help you navigate the different health insurance options available to you. They can provide personalized guidance and help you find a plan that fits your budget and coverage needs.

- Nonprofit Organizations: There are several nonprofit organizations that provide assistance and resources for individuals seeking affordable health insurance. These organizations can offer guidance on finding low-cost options and may even provide financial assistance for premiums or deductibles.

- Government Programs: Depending on your income and eligibility, you may qualify for government programs that provide affordable health insurance options. Programs such as Medicaid and the Children’s Health Insurance Program (CHIP) can provide coverage for individuals and families with limited financial resources.

- Employer-Sponsored Plans: If you are employed, your employer may offer health insurance coverage as part of your benefits package. These plans often have lower premiums and may provide coverage for pre-existing conditions. It’s important to review the details of the plan and understand any limitations or network restrictions.

Remember, when searching for affordable health insurance, it’s important to consider not only the cost of premiums but also the coverage and benefits provided. Take the time to compare different plans and consult with experts who can help guide you in making the best decision for your health and financial needs.

The Impact of Pre-existing Conditions on Health Insurance Premiums

When it comes to health insurance, pre-existing conditions can have a significant impact on the premiums you pay. Insurance companies take into account your medical history and any pre-existing conditions when determining the cost of your coverage.

Pre-existing conditions are medical conditions that you have been diagnosed with or received treatment for before obtaining health insurance. These conditions can range from chronic illnesses such as diabetes or heart disease to more minor conditions like allergies or asthma.

Insurance companies view pre-existing conditions as a risk factor because they may require ongoing medical treatment or increase the likelihood of future medical expenses. As a result, individuals with pre-existing conditions may be charged higher premiums compared to those without any pre-existing conditions.

In addition to higher premiums, individuals with pre-existing conditions may also face higher deductibles. A deductible is the amount of money you must pay out of pocket before your insurance coverage kicks in. Insurance companies may set higher deductibles for individuals with pre-existing conditions to help offset the potential costs associated with their medical care.

It is important to note that the impact of pre-existing conditions on health insurance premiums and coverage varies depending on the insurance provider and the specific condition. Some insurance companies may offer coverage for pre-existing conditions but at a higher cost, while others may exclude coverage altogether. It is crucial to carefully review the terms and conditions of any health insurance policy to understand how pre-existing conditions will be treated.

In conclusion, pre-existing conditions can have a significant impact on health insurance premiums. It is important to be aware of how your medical history and any pre-existing conditions may affect the cost of your coverage and the level of protection you receive. Understanding the impact of pre-existing conditions can help you make informed decisions when choosing a health insurance plan.

The Future of Health Insurance Coverage for Pre-existing Conditions

Health insurance coverage for pre-existing medical conditions has been a topic of great concern and debate in recent years. As medical conditions can often require extensive and ongoing treatment, individuals with pre-existing conditions face unique challenges when it comes to obtaining affordable and comprehensive health insurance.

One aspect that has been discussed is the role of deductibles in health insurance plans. Deductibles are the amount of money that individuals must pay