What Is Restore Benefit In Health Insurance Policy

Health insurance policies often come with various benefits and features designed to provide comprehensive coverage for individuals and their families. One such benefit that is gaining popularity is the restore benefit. But what exactly is the restore benefit and how does it work?

The restore benefit is a feature included in some health insurance policies that allows policyholders to replenish their coverage amount once it has been exhausted during a policy year. This means that if you have used up your entire coverage amount for a particular treatment or medical procedure, the restore benefit will kick in and provide you with additional coverage for the same treatment or procedure.

This benefit can be particularly useful for individuals who require expensive or ongoing treatments, as it ensures that they have access to the necessary medical care without having to worry about exceeding their coverage limits. It provides a safety net for policyholders and can offer peace of mind knowing that their health insurance policy has their back when they need it most.

It’s important to note that the restore benefit may come with certain limitations and conditions, such as a maximum restore limit or a waiting period before it can be utilized. It’s crucial for individuals to thoroughly review their health insurance policy and understand the specifics of the restore benefit to fully take advantage of its benefits.

What is the Restore Benefit?

The restore benefit is a feature that is often included in health insurance policies. It is designed to help policyholders regain their health and financial stability in the event of a major illness or injury. This benefit provides additional coverage once the policyholder has reached their maximum coverage limit.

Health insurance policies typically have a maximum coverage limit, which is the maximum amount of money that the insurance company will pay for medical expenses in a given year. Once this limit is reached, the policyholder is responsible for paying any additional costs out of pocket. However, with the restore benefit, policyholders are provided with an additional coverage amount to help cover these costs.

The restore benefit can be a valuable addition to a health insurance policy, as it provides an extra layer of financial protection. It helps to ensure that policyholders are not left with large medical bills that they cannot afford to pay. This benefit is especially beneficial for individuals who have chronic illnesses or who are at a higher risk for major health issues.

It is important to note that the restore benefit varies between insurance policies. Some policies may offer a one-time restore benefit, while others may offer multiple restores throughout the policy term. The amount of coverage provided by the restore benefit may also vary. Policyholders should carefully review their insurance policy to understand the specific details of the restore benefit and how it can benefit them in the event of a major health issue.

Overview of Health Insurance Policies

Health insurance is a type of insurance policy that provides financial protection to individuals or families against the high costs of medical expenses. It is designed to cover the expenses related to healthcare services, including doctor visits, hospitalizations, prescription medications, and surgeries.

A health insurance policy typically includes various benefits, such as coverage for preventive care, emergency services, and specialist consultations. It is important to understand the details of your policy to ensure you are aware of what is covered and what is not.

One important benefit to consider in a health insurance policy is the restore benefit. The restore benefit is a feature that allows policyholders to reinstate their coverage after it has been exhausted. This means that if you reach your policy’s maximum limit for coverage in a given year, the restore benefit will kick in and provide additional coverage.

The restore benefit is especially useful for individuals who have chronic health conditions or require ongoing medical treatment. It ensures that they have access to the necessary healthcare services even if they have reached their coverage limit. However, it is important to note that the restore benefit is subject to certain conditions and limitations, so it is essential to review your policy documents to understand how it works.

Overall, understanding the restore benefit in health insurance policies is crucial for individuals and families to make informed decisions about their healthcare coverage. It is important to carefully review the terms and conditions of your policy to ensure that it meets your specific needs and provides adequate coverage for your healthcare expenses.

Understanding the Restore Benefit Coverage

Health insurance policies often include a restore benefit as part of their coverage. But what exactly is this benefit and how does it work?

The restore benefit is a feature in health insurance policies that provides additional coverage once the policyholder has exhausted their regular benefits. It is designed to provide financial protection in case of unexpected medical expenses that exceed the limits of the policy.

When a policyholder reaches the maximum limit of their regular benefits, the restore benefit kicks in and provides additional coverage. This can be especially helpful in situations where the cost of medical treatment is high or when the policyholder requires ongoing care.

It is important to note that the restore benefit coverage may have certain limitations and restrictions. For example, it may only apply to specific types of medical treatments or have a maximum limit for the additional coverage. Policyholders should carefully review their insurance policy to understand the details of their restore benefit coverage.

Having a restore benefit in a health insurance policy can provide peace of mind and financial security. It ensures that policyholders have access to additional coverage when they need it the most, giving them the confidence to seek necessary medical treatment without worrying about the cost.

Benefits of the Restore Benefit

The restore benefit is a valuable feature of health insurance policies that provides additional coverage for policyholders. This benefit is designed to help individuals recover from unexpected medical expenses and ensure that they have access to the necessary treatments and services.

What makes the restore benefit unique is its ability to replenish the sum assured once it has been exhausted during a policy year. This means that even if a policyholder has used up their entire coverage amount, the restore benefit will kick in and provide them with additional coverage for any future medical expenses.

This benefit can be particularly beneficial for individuals who have chronic illnesses or require ongoing medical treatments. It provides them with the peace of mind that they will not be left without coverage if they exceed their initial sum assured.

Furthermore, the restore benefit can also be helpful for policyholders who have a family floater policy. In such cases, if one family member exhausts their coverage, the restore benefit can ensure that other family members still have access to coverage for any medical expenses they may incur.

Overall, the restore benefit is a valuable addition to health insurance policies as it provides an extra layer of financial protection for policyholders. It ensures that individuals can continue to receive the necessary medical care without worrying about exceeding their coverage limits.

How Does the Restore Benefit Work?

The restore benefit is a valuable feature that can be found in some health insurance policies. But what exactly is this benefit and how does it work?

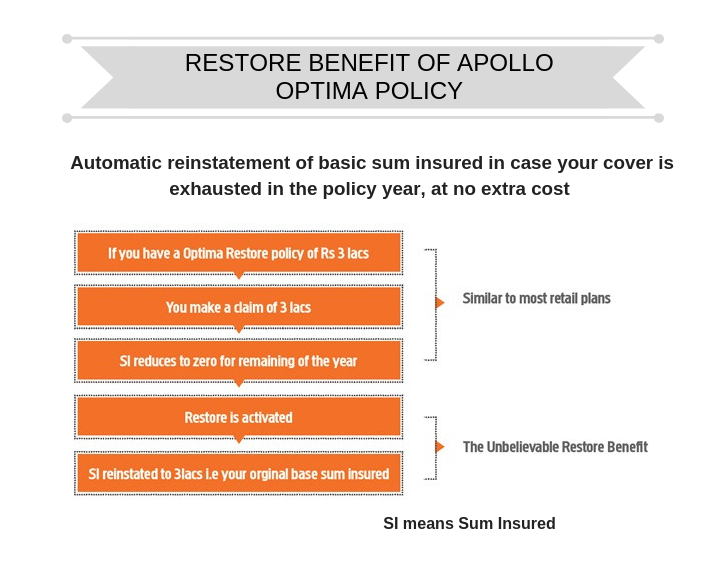

The restore benefit is a type of coverage that helps policyholders replenish their sum insured in case it gets exhausted during the policy year. In other words, if you have used up your entire sum insured for a particular ailment or treatment, the restore benefit will come into play and provide you with additional coverage.

For example, let’s say you have a health insurance policy with a sum insured of $10,000. During the policy year, you undergo a major surgery that costs $8,000, leaving you with only $2,000 of your sum insured. If you have the restore benefit in your policy, it will restore your sum insured back to the original amount of $10,000, allowing you to continue availing the benefits of your policy for other treatments or ailments.

It is important to note that the restore benefit is usually subject to certain conditions and limitations. For instance, it may only be applicable for specific treatments or after a waiting period. Additionally, there may be a limit on the number of times you can avail the restore benefit during the policy year. It is crucial to thoroughly read and understand the terms and conditions of your insurance policy to know how the restore benefit works in your particular case.

In conclusion, the restore benefit is a valuable addition to health insurance policies as it provides an extra layer of coverage when your sum insured is exhausted. It ensures that you can continue receiving the benefits of your policy even after you have used up your initial coverage. However, it is important to understand the conditions and limitations associated with the restore benefit to make the most out of it.

Eligibility for the Restore Benefit

The eligibility criteria for the restore benefit in a health insurance policy can vary depending on the specific insurance provider and policy terms. However, generally, individuals who have a health insurance policy with a restore benefit are eligible to avail of this benefit.

Typically, individuals who have a health insurance policy with a restore benefit are eligible if they have exhausted their basic sum insured during a policy year. This means that once the policyholder has utilized the entire sum insured amount for the treatment of any illness or injury, they can avail of the restore benefit.

The restore benefit in health insurance policies is designed to provide additional coverage to policyholders in case they require further medical treatment after exhausting their basic sum insured. It acts as a safety net, ensuring that individuals have access to adequate health coverage even if they have already utilized their primary insurance coverage.

It is important to note that the restore benefit is subject to certain conditions and limitations. For example, it may have a maximum limit or a waiting period before it can be utilized. Additionally, the restore benefit may only cover certain types of medical treatments or have specific exclusions. It is crucial for policyholders to carefully review the terms and conditions of their insurance policy to understand the eligibility criteria and limitations of the restore benefit.

Limitations and Exclusions

When it comes to health insurance policies, it is important to understand the limitations and exclusions that may apply to the restore benefit. This benefit is designed to help policyholders regain their health and recover from a covered illness or injury. However, there are certain circumstances where the restore benefit may not be available or may be limited.

One limitation of the restore benefit is that it may only be available for a specific period of time. This means that if a policyholder does not use the benefit within this timeframe, they may lose the opportunity to take advantage of it. It is important for policyholders to be aware of this limitation and to use the restore benefit as soon as possible to ensure they receive the maximum benefit.

Another limitation of the restore benefit is that it may only cover certain types of treatments or services. For example, the restore benefit may cover hospital stays and surgeries, but it may not cover alternative therapies or experimental treatments. Policyholders should carefully review their policy to understand exactly what treatments and services are covered by the restore benefit.

Additionally, there may be exclusions that apply to the restore benefit. These exclusions may include pre-existing conditions, certain high-risk activities, or treatments that are not considered medically necessary. Policyholders should review their policy carefully to understand any exclusions that may apply to the restore benefit.

In conclusion, while the restore benefit in health insurance policies can provide valuable coverage for regaining health, it is important to be aware of the limitations and exclusions that may apply. By understanding these limitations and exclusions, policyholders can make informed decisions about their healthcare and ensure they receive the maximum benefit from their insurance policy.

Claim Process for the Restore Benefit

The restore benefit is a valuable feature offered by health insurance policies. It is designed to provide policyholders with an additional level of coverage when they have exhausted their regular health insurance benefits. Understanding the claim process for the restore benefit is important in order to take full advantage of this feature.

When making a claim for the restore benefit, policyholders must first ensure that they have reached the maximum limit of their regular health insurance coverage. This can usually be found in the policy documents or by contacting the insurance provider. Once this limit has been reached, policyholders can then submit a claim for the restore benefit.

Policyholders will need to provide documentation to support their claim for the restore benefit. This may include medical bills, receipts, and any other relevant documentation. It is important to keep detailed records of all medical expenses in order to ensure a smooth claims process.

Once the claim has been submitted, it will be reviewed by the insurance provider. They will assess the claim to determine if it meets the criteria for the restore benefit. This may include verifying that the policyholder has indeed reached the maximum limit of their regular health insurance coverage.

If the claim is approved, the policyholder will receive reimbursement for the eligible expenses covered under the restore benefit. This may include coverage for additional medical treatments, hospital stays, or other healthcare services. The reimbursement amount will depend on the specific terms and conditions of the restore benefit outlined in the policy.

It is important to note that the restore benefit is not available in all health insurance policies. Policyholders should carefully review their policy documents to determine if this benefit is included. Understanding what the restore benefit is and how to navigate the claim process can help policyholders make the most of their health insurance coverage.

Importance of the Restore Benefit

The restore benefit is a crucial feature in health insurance policies that can greatly benefit policyholders. It is important to understand what this benefit is and how it can help individuals maintain their health and financial well-being.

Health insurance policies typically have limits on the amount of coverage they provide for certain medical procedures or treatments. Once these limits are reached, policyholders may be responsible for paying out-of-pocket for any additional expenses. This is where the restore benefit comes in.

The restore benefit is designed to provide policyholders with additional coverage once they have exhausted their original coverage limit. It essentially “restores” their coverage to its original amount, allowing them to continue receiving necessary medical care without incurring significant financial burdens.

This benefit is particularly important for individuals with chronic conditions or those who may require ongoing medical treatments. It ensures that they can access the care they need without worrying about the cost. Without the restore benefit, individuals may be forced to delay or forgo necessary treatments, which can have serious consequences for their health.

In addition to its financial benefits, the restore benefit also provides peace of mind to policyholders. Knowing that their coverage can be restored if needed offers a sense of security and protection against unexpected medical expenses.

Overall, the restore benefit is a valuable component of health insurance policies that can significantly benefit policyholders. It provides additional coverage when original limits are reached, ensuring individuals can access necessary care without financial strain. Understanding and utilizing this benefit is essential for maintaining both physical and financial well-being.

Financial Protection

Financial protection is an essential aspect of health insurance policies. Insurance is designed to provide individuals with a safety net in case of unexpected medical expenses. In a health insurance policy, the restore benefit is a valuable feature that offers additional financial protection.

The restore benefit is a special provision that allows policyholders to regain the sum insured in case it is exhausted during the policy year. It ensures that individuals have adequate coverage throughout the year, even if they have already used up their initial sum insured. This benefit is particularly beneficial for individuals who require frequent medical treatments or have chronic conditions.

What sets the restore benefit apart from other insurance features is that it replenishes the sum insured without any additional cost. It is included in the policy as a standard benefit, providing policyholders with peace of mind knowing that their financial protection is not limited to a fixed amount.

Health insurance policies with a restore benefit are especially important for individuals who want comprehensive coverage and want to avoid financial strain in the event of a medical emergency. With this benefit, they can be confident that their insurance will continue to provide financial protection even if their medical expenses exceed the initial sum insured.

Access to Quality Healthcare

Access to quality healthcare is an essential benefit provided by health insurance policies. It ensures that individuals have the opportunity to receive the necessary medical care they need to maintain and improve their health. Health insurance is designed to cover the costs of various medical services, including doctor visits, hospital stays, prescription medications, and preventive care.

One of the key benefits of health insurance is that it allows individuals to access healthcare services without worrying about the financial burden. With insurance coverage, individuals can seek medical attention when needed, without the fear of incurring high out-of-pocket costs. This enables them to receive timely and appropriate care, which can lead to better health outcomes.

Health insurance policies often include a network of healthcare providers, which ensures that individuals have access to a wide range of medical specialists and facilities. This network can include primary care physicians, specialists, hospitals, and clinics. Having a diverse network of providers allows individuals to choose the healthcare professionals that best meet their needs and preferences.

Furthermore, health insurance policies often provide coverage for preventive care services. These services, such as vaccinations, screenings, and wellness exams, are aimed at detecting and preventing potential health issues before they become more serious. By including preventive care in the policy, insurance companies promote proactive health management and help individuals maintain good health.

In summary, access to quality healthcare is a crucial benefit provided by health insurance policies. It ensures that individuals have the financial means to seek medical attention when needed and have a wide range of healthcare providers to choose from. Additionally, insurance coverage often includes preventive care services, promoting proactive health management. Overall, health insurance plays a vital role in ensuring individuals can receive the necessary medical care to improve and maintain their health.

Peace of Mind

When it comes to health insurance policies, one of the most important benefits to consider is the restore benefit. This feature ensures that policyholders can have peace of mind knowing that their health is protected. The restore benefit is an essential component of any health insurance policy, as it provides coverage for expenses that may not be covered by the regular policy.

Health insurance policies can be complex and confusing, but having the restore benefit in place can make all the difference. This benefit ensures that if a policyholder exhausts their regular policy limit, they can still receive coverage for any additional medical expenses. This means that even if unexpected health issues arise, policyholders can rest easy knowing that their insurance will provide the necessary financial support.

The restore benefit is particularly valuable for individuals and families who may have chronic health conditions or who frequently require medical treatment. It helps to alleviate the financial burden of healthcare expenses and allows policyholders to focus on their health and well-being. With this benefit in place, individuals can seek necessary medical care without worrying about the cost.

Furthermore, the restore benefit can also provide peace of mind for those who have a higher deductible or co-payment. These individuals may be hesitant to seek medical treatment due to the potential out-of-pocket costs. However, with the restore benefit, they can have the confidence to seek the care they need, knowing that their insurance will provide coverage once their regular policy limits are reached.

In conclusion, the restore benefit is a crucial feature in health insurance policies that provides peace of mind to policyholders. It ensures that individuals and families can receive coverage for additional medical expenses, even after exhausting their regular policy limits. With this benefit in place, policyholders can focus on their health without worrying about the financial burden of healthcare expenses.

Choosing a Health Insurance Policy with the Restore Benefit

When it comes to selecting a health insurance policy, it is important to consider the various benefits that are included. One such benefit that can be extremely valuable is the restore benefit. This benefit ensures that your policy will be renewed even after you have made a claim and exhausted the sum insured.

The restore benefit is designed to provide you with additional coverage in case you need it. It is especially beneficial for individuals who have a chronic illness or those who are more prone to accidents or illnesses. With this benefit, you can have peace of mind knowing that your health insurance policy will still be in effect even after a major claim.

When choosing a health insurance policy with the restore benefit, it is important to carefully review the terms and conditions. Some policies may have limitations on how many times the restore benefit can be used or the maximum amount that can be restored. It is essential to understand these details to ensure that you are getting the coverage you need.

In addition to the restore benefit, it is also important to consider other factors when selecting a health insurance policy. These factors include the premium cost, coverage for pre-existing conditions, network of hospitals and doctors, and the claim settlement process. By carefully evaluating these factors, you can choose a policy that best suits your health needs and budget.

In conclusion, the restore benefit is a valuable feature to look for when choosing a health insurance policy. It provides additional coverage and peace of mind, ensuring that your policy will still be in effect even after a major claim. By reviewing the terms and conditions and considering other factors, you can select a policy that meets your specific health needs.

Researching Insurance Providers

When it comes to selecting a health insurance policy, it is important to research various insurance providers to find the one that best suits your needs. Understanding what each provider offers and the benefits they provide is crucial in making an informed decision.

One key aspect to consider is the restore benefit offered by insurance providers. This benefit allows policyholders to restore their health insurance coverage to its original sum insured, even after it has been exhausted during the policy year. This can be extremely beneficial in case of any unforeseen medical emergencies.

Health insurance policies vary from provider to provider, so it is important to carefully review and compare the coverage and benefits offered by each. Some insurance providers may offer additional benefits such as maternity coverage, wellness programs, or coverage for pre-existing conditions. Understanding what is included in a policy can help you choose the one that best meets your specific health needs.

Researching insurance providers also involves looking into their network of healthcare providers. This includes hospitals, clinics, and doctors that are affiliated with the insurance provider. Having a wide network of healthcare providers can ensure that you have access to quality healthcare services when needed.

Another important aspect to consider when researching insurance providers is their customer service and claims process. It is important to choose a provider that is known for their prompt and efficient claims processing, as this can greatly impact your overall experience with the insurance policy.

In conclusion, researching insurance providers is essential in order to find a health insurance policy that best suits your needs. Understanding the restore benefit, coverage and benefits offered, network of healthcare providers, and customer service can help you make an informed decision and ensure that you have the necessary coverage for your health needs.

Comparing Policy Options

When choosing a health insurance policy, it is important to consider the restore benefit that is offered. The restore benefit is a feature that allows policyholders to regain their full coverage amount after it has been exhausted. This can be particularly beneficial for individuals who anticipate needing extensive medical treatment or have chronic conditions that require ongoing care.

Not all insurance policies offer a restore benefit, so it is important to carefully compare policy options. Some policies may have a restore benefit that is automatically included, while others may offer it as an optional add-on. It is important to read the policy details and understand what is included and what is not.

One key consideration when comparing policy options is the maximum coverage amount that can be restored. Some policies may have a limit on how much can be restored, while others may offer unlimited restoration. This can be an important factor for individuals with high medical expenses who may need to access their coverage multiple times throughout the year.

Another factor to consider is the waiting period before the restore benefit becomes available. Some policies may require a waiting period of several months before the benefit can be used, while others may have no waiting period at all. It is important to understand the waiting period and how it may impact your ability to access the restore benefit.

In addition to the restore benefit, it is important to consider other aspects of the policy, such as the premium cost, deductible, and network of healthcare providers. By comparing policy options and considering all of these factors, individuals can make an informed decision and choose a health insurance policy that best meets their needs.

Understanding Policy Terms and Conditions

When it comes to health insurance policies, it is crucial to thoroughly understand the terms and conditions outlined in the policy. These terms and conditions play a vital role in determining the coverage and benefits provided by the insurance policy.

One important aspect to consider is the restore benefit in a health insurance policy. The restore benefit is a feature that allows policyholders to replenish their sum insured amount, in case it gets exhausted due to medical expenses. This benefit ensures that the policyholder has access to adequate coverage even after using up the entire sum insured.

To fully comprehend the policy terms and conditions, it is essential to know what is covered under the health insurance policy. This includes understanding the inclusions and exclusions of the policy. Inclusions refer to the medical expenses that are covered by the policy, such as hospitalization costs, diagnostic tests, and surgeries. Exclusions, on the other hand, are the medical expenses that are not covered by the policy, such as cosmetic procedures or pre-existing conditions.

Another important aspect to consider is the waiting period mentioned in the policy. The waiting period is the duration during which certain medical conditions or treatments are not covered by the insurance policy. It is crucial to be aware of the waiting period to avoid any surprises or misunderstandings when it comes to claiming for specific medical treatments.

Additionally, it is essential to understand the claim process and the documentation required to file a claim. This includes knowing the deadlines for filing a claim, the necessary medical records, and any other supporting documents that may be required. Understanding the claim process ensures a smooth and hassle-free experience when it comes to availing the benefits of the health insurance policy.

In conclusion, understanding the policy terms and conditions is vital when it comes to health insurance. By thoroughly reviewing and comprehending the policy, individuals can make informed decisions about their coverage and benefits, ensuring they have the necessary protection in case of medical emergencies.

Question-answer:

What is the restore benefit in health insurance policies?

The restore benefit in health insurance policies is an additional feature that allows policyholders to restore their sum insured amount in case it gets exhausted during the policy year.

How does the restore benefit work?

The restore benefit works by reinstating the sum insured amount once it is fully utilized during the policy year. This means that if a policyholder exhausts their sum insured amount, the restore benefit will automatically provide an additional sum insured for any future medical expenses within the same policy year.