6 Reasons Why Health Insurance Premiums Change With Increasing Age

As we age, many aspects of our lives change, including our health. With these changes come increased risks and medical expenses. One significant change that individuals may experience as they grow older is the increase in health insurance premiums. Health insurance premiums are the monthly fees paid to maintain coverage, and they tend to rise as individuals get older.

There are several reasons why health insurance premiums increase with age. First and foremost, as individuals age, they become more prone to developing chronic conditions and diseases. These conditions require ongoing medical care and treatment, which can be expensive. As a result, insurance companies adjust their premiums to account for the higher potential costs associated with older individuals.

Another reason for the increase in health insurance premiums with age is the increased utilization of healthcare services. Older individuals generally require more frequent visits to healthcare providers, including regular check-ups, screenings, and tests. The higher utilization of these services leads to higher overall healthcare costs, which are reflected in the premiums.

Furthermore, as individuals age, they may experience a decline in overall health, which can lead to the need for more specialized medical care. Specialized treatments and procedures often come with higher price tags, and insurance companies adjust their premiums accordingly to cover these potential expenses.

Additionally, the cost of prescription drugs tends to rise with age. Older individuals are more likely to require multiple medications to manage their health conditions, and these medications can be expensive. Insurance companies take into account the increased cost of prescription drugs when determining premiums for older individuals.

Moreover, the overall cost of healthcare continues to rise year after year. This includes the cost of medical procedures, hospital stays, and medical equipment. Insurance companies need to adjust their premiums to keep up with these rising costs and ensure they can cover the expenses associated with older individuals’ healthcare needs.

Lastly, insurance companies consider the increased risk of insurance claims as individuals age. With age, the likelihood of needing medical care and making insurance claims becomes higher. This increased risk leads to higher premiums to account for the potential payout that insurance companies may need to make.

In conclusion, there are several reasons why health insurance premiums increase with age. These include the higher risk of developing chronic conditions, increased utilization of healthcare services, the need for specialized care, higher costs of prescription drugs, rising overall healthcare costs, and increased risk of insurance claims. It is essential for individuals to understand these factors and plan accordingly to ensure they have adequate coverage as they age.

Age and Health Insurance Premiums

As individuals age, the cost of health insurance premiums tends to increase. There are several reasons for this.

Firstly, as people get older, they are more likely to develop health conditions and require medical treatment. Insurance companies take this into account when setting premiums, as older individuals are more likely to make claims and require expensive medical procedures.

Secondly, the cost of healthcare itself tends to increase with age. As medical technology advances and new treatments become available, the cost of providing healthcare services rises. Insurance companies pass on these increased costs to policyholders in the form of higher premiums.

Thirdly, older individuals may have a higher risk of accidents or injuries, which can also drive up insurance premiums. Insurance companies consider the likelihood of these events occurring when determining premiums, and age is a factor that can impact this risk assessment.

Additionally, as individuals age, their bodies naturally become more susceptible to illness and injury. This increased vulnerability can result in higher healthcare costs and, consequently, higher insurance premiums.

Furthermore, older individuals may require more frequent and specialized medical care, such as screenings or treatments for age-related conditions. This additional healthcare usage can contribute to higher premiums as insurance companies anticipate the increased costs associated with these services.

Lastly, insurance companies use actuarial data to assess the risk and cost of insuring different age groups. This data shows that older individuals generally have higher healthcare costs, which leads to higher premiums in order to cover these expenses.

In conclusion, there are several reasons why health insurance premiums increase with age. These include the higher likelihood of health conditions, increased healthcare costs, higher risk of accidents or injuries, increased vulnerability to illness and injury, the need for specialized medical care, and actuarial data showing higher healthcare costs for older individuals. It is important for individuals to plan and budget for these increasing premiums as they age.

The Impact of Age on Health Insurance Costs

As individuals age, their health insurance costs tend to change for a variety of reasons. One of the main reasons for this change is that insurance premiums typically increase with age. This is because older individuals are more likely to require medical care and may have more chronic conditions that need ongoing treatment.

Another reason for the increasing insurance premiums with age is that older individuals are more prone to developing certain health conditions, such as heart disease, diabetes, and arthritis. These conditions often require expensive medications, surgeries, and specialized care, which can drive up the cost of health insurance.

Additionally, as individuals get older, they may need more frequent visits to healthcare providers and specialists, as well as more frequent medical tests and screenings. These additional healthcare services can contribute to the higher cost of health insurance premiums for older individuals.

Furthermore, older individuals may be more likely to require long-term care, such as nursing home or assisted living facility services. The cost of long-term care can be substantial and is often not covered by standard health insurance plans. Therefore, older individuals may need to purchase additional long-term care insurance, which can further increase their overall health insurance costs.

It is important for individuals to carefully consider their health insurance needs as they age and to explore different coverage options. Comparing insurance plans, understanding the coverage and costs associated with each plan, and considering any potential discounts or subsidies can help older individuals make informed decisions about their health insurance and manage their healthcare expenses effectively.

Increasing Healthcare Needs as You Age

As you age, there are several reasons why your healthcare needs increase, leading to changes in your health insurance premiums. These changes are often reflected in higher insurance costs due to a variety of factors.

One reason for increasing healthcare needs as you age is the natural process of aging itself. As we get older, our bodies may become more susceptible to certain health conditions and diseases. This can result in a higher frequency of doctor visits, medications, and medical procedures, all of which contribute to increased healthcare costs.

Another reason is the prevalence of chronic conditions that tend to develop with age. Conditions such as heart disease, diabetes, and arthritis require ongoing medical care and management. The treatment and monitoring of these conditions can be expensive, leading to higher insurance premiums.

Additionally, as we age, the likelihood of experiencing age-related injuries and accidents increases. Falls, fractures, and other injuries may require medical attention and rehabilitation, further adding to healthcare costs.

Furthermore, older adults often require more specialized care, such as home healthcare or assisted living services. These services can be costly and may not be covered by standard health insurance plans, leading to additional out-of-pocket expenses.

Lastly, the need for preventive care also increases with age. Regular screenings, vaccinations, and check-ups are essential for early detection and prevention of diseases. While these preventive measures can help reduce healthcare costs in the long run, they can still contribute to higher insurance premiums.

In conclusion, the increasing healthcare needs that come with age are one of the main reasons why health insurance premiums tend to rise. The combination of natural aging processes, chronic conditions, age-related injuries, specialized care, and preventive measures all contribute to the overall increase in healthcare costs as you get older.

Higher Risk of Chronic Conditions

As individuals age, they are more likely to develop chronic conditions, such as heart disease, diabetes, and arthritis. These conditions require ongoing medical care and treatment, which can lead to an increase in health insurance premiums. The risk of developing these chronic conditions increases with age, and insurance companies take this into account when determining premiums.

With age, the body becomes more susceptible to various health issues, and the cost of treating these conditions can be substantial. Insurance companies factor in the higher risk of chronic conditions when setting premiums for older individuals. The increasing prevalence of chronic conditions among older adults contributes to the overall rise in health insurance premiums.

Furthermore, managing chronic conditions often involves multiple medications, regular doctor visits, and specialized care. The cost of these treatments and services adds up, and insurance companies must increase premiums to cover these expenses. Aging individuals may require more frequent medical attention, which can lead to higher healthcare costs and, consequently, higher insurance premiums.

Moreover, as individuals age, they may require more intensive and specialized medical care, including surgeries, hospitalizations, and long-term care services. These services are often expensive and can significantly impact insurance premiums. Insurance companies take into account the higher likelihood of older individuals needing these types of care when determining premiums.

In summary, the higher risk of developing chronic conditions as individuals age contributes to the increasing health insurance premiums. The cost of treating these conditions, the need for ongoing medical care, and the potential for more intensive and specialized care all play a role in the rising premiums for older individuals. Insurance companies must account for these factors when setting premiums to ensure they can cover the costs associated with providing healthcare to aging populations.

Increased Utilization of Healthcare Services

One of the main reasons for the increasing premiums of health insurance with age is the increased utilization of healthcare services. As individuals age, they are more likely to develop chronic conditions and require more frequent medical attention. This can include regular doctor visits, specialist consultations, diagnostic tests, and prescription medications. The increased utilization of these services leads to higher costs for insurance companies, which are then passed on to the policyholders in the form of higher premiums.

Additionally, aging individuals may also require more intensive and costly treatments, such as surgeries or hospitalizations. These procedures can be expensive, and insurance companies need to account for these potential costs when setting premiums for older individuals. The higher likelihood of needing these services with age contributes to the overall increase in health insurance premiums.

Furthermore, as individuals age, their bodies become more susceptible to illnesses and injuries. This can result in more frequent visits to healthcare providers and a higher demand for medical services. Insurance companies need to consider the increased risk associated with age and adjust premiums accordingly to ensure they can cover the potential healthcare expenses of their policyholders.

In summary, the increasing premiums of health insurance with age can be attributed to the increased utilization of healthcare services. Aging individuals require more frequent medical attention, more intensive treatments, and are at a higher risk of developing health conditions. These factors contribute to the rising costs of healthcare and the need for insurance companies to adjust premiums to cover these expenses.

Rising Medical Costs

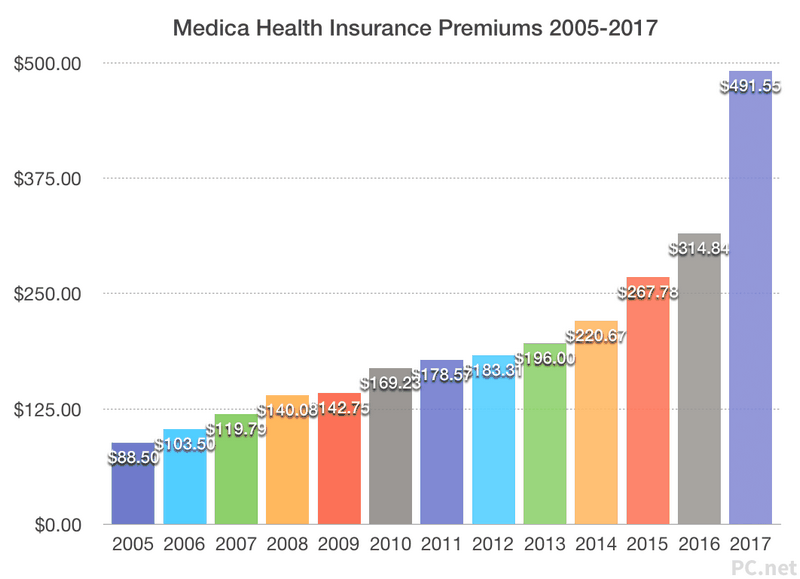

One of the main reasons for the increasing health insurance premiums with age is the rising medical costs. As people get older, their healthcare needs tend to change, and they may require more frequent medical visits and treatments. This increase in demand for medical services leads to higher costs for insurance companies, which in turn results in higher premiums for policyholders.

Another reason for the rising medical costs is the advancements in medical technology. While these advancements have improved the quality of healthcare, they have also come at a price. Newer and more advanced medical treatments and procedures often come with higher costs, which are ultimately passed on to policyholders in the form of increased premiums.

The increasing prevalence of chronic diseases is also a contributing factor to the rising medical costs. As people age, they are more likely to develop chronic conditions such as diabetes, heart disease, and arthritis. The management and treatment of these conditions require ongoing medical care and medications, which can be expensive. Insurance companies take these costs into account when determining premiums for older individuals.

The cost of prescription drugs is another significant factor in the rising medical costs. As people age, they are more likely to need medications to manage their health conditions. However, the prices of many prescription drugs have been steadily increasing in recent years. These higher drug costs directly impact insurance premiums, as insurance companies have to cover the expenses associated with providing prescription drug coverage.

In addition to these factors, the increasing administrative costs of healthcare also contribute to the rising medical costs. Insurance companies have to hire more staff to handle the growing number of claims and paperwork. These administrative costs are ultimately passed on to policyholders in the form of higher premiums.

Overall, the rising medical costs are a significant driver of the increasing health insurance premiums with age. As healthcare needs change and medical costs continue to rise, insurance companies have to adjust their premiums to cover these expenses and ensure profitability.

The Role of Medical Advances

As individuals age, their health needs change, and this can have a significant impact on health insurance premiums. One of the main reasons why premiums increase with age is due to the role of medical advances.

Medical advances have greatly improved the ability to diagnose and treat various health conditions. As a result, individuals are living longer and are able to manage chronic illnesses more effectively. However, these advancements come at a cost. The development and implementation of new medical technologies and treatments require significant investment, which is often reflected in higher insurance premiums.

Furthermore, medical advances have led to an increase in the availability and utilization of specialized treatments and procedures. These advanced treatments often come with higher costs, as they require specialized equipment, expertise, and resources. Insurance companies must account for these increased costs when determining premiums for older individuals.

Another factor related to medical advances is the increased prevalence of age-related health conditions. As individuals age, they are more likely to develop chronic illnesses such as heart disease, diabetes, and cancer. The treatment and management of these conditions can be complex and expensive, leading to higher insurance premiums for older individuals.

In conclusion, the role of medical advances is a significant factor in the increase of health insurance premiums with age. These advancements have improved the quality of healthcare and extended life expectancy, but they also come with higher costs. As individuals age and their health needs change, insurance companies must adjust premiums to account for the increased utilization of specialized treatments and the management of age-related health conditions.

The Importance of Preventive Care

Preventive care plays a crucial role in maintaining good health and can help individuals avoid serious health issues in the future. There are several reasons why preventive care is important, especially as individuals age and their health insurance premiums increase.

1. Early detection of health problems: Regular check-ups and screenings can help detect potential health issues at an early stage, when they are easier to treat. This can prevent the development of more serious conditions that may require expensive medical interventions.

2. Cost savings: Investing in preventive care can result in long-term cost savings. By addressing health concerns early on, individuals can avoid more expensive treatments down the line. This can help reduce the overall cost of healthcare and mitigate the impact of increasing insurance premiums.

3. Improved quality of life: Preventive care can help individuals maintain their overall well-being and quality of life as they age. Regular check-ups, vaccinations, and screenings can help prevent diseases and conditions that may limit their ability to enjoy daily activities and maintain independence.

4. Better management of chronic conditions: For individuals with pre-existing conditions, preventive care can help manage their conditions more effectively. Regular monitoring, medication adjustments, and lifestyle changes can prevent complications and improve their overall health outcomes.

5. Health education and awareness: Preventive care visits provide an opportunity for healthcare professionals to educate individuals about healthy lifestyle choices and disease prevention strategies. This can empower individuals to take control of their health and make informed decisions about their well-being.

6. Long-term health benefits: By prioritizing preventive care, individuals can increase their chances of living a healthier and longer life. Regular screenings, vaccinations, and lifestyle modifications can help prevent or delay the onset of chronic diseases, ensuring a higher quality of life in the later years.

In conclusion, preventive care is essential for maintaining good health, especially as individuals age and their health insurance premiums increase. By investing in preventive care, individuals can detect health problems early, save on long-term healthcare costs, improve their quality of life, better manage chronic conditions, gain health education, and enjoy long-term health benefits.

The Effect of Lifestyle Choices

One of the key factors that contribute to the increasing health insurance premiums with age is the change in lifestyle choices. As individuals grow older, their priorities and habits often shift, leading to different health behaviors. These changes can have a significant impact on their overall health and well-being, which in turn affects their insurance premiums.

For example, as people age, they may become less physically active and more sedentary, leading to a higher risk of developing chronic conditions such as obesity, diabetes, and heart disease. These conditions require more frequent medical care and treatment, which can drive up the cost of health insurance premiums.

Additionally, as individuals age, they may be more likely to engage in unhealthy behaviors such as smoking or excessive alcohol consumption. These habits can have long-term detrimental effects on their health and increase the likelihood of developing serious medical conditions. Insurance companies take these risk factors into consideration when calculating premiums, resulting in higher costs for individuals who engage in such behaviors.

Furthermore, as people age, they may also experience changes in their mental health. Conditions such as depression and anxiety are more prevalent among older adults and can impact their overall well-being. Insurance companies may factor in these mental health conditions when determining premiums, as they often require additional medical care and treatment.

In summary, the effect of lifestyle choices is one of the key reasons why health insurance premiums increase with age. Changes in physical activity levels, unhealthy behaviors, and mental health conditions can all contribute to higher costs for individuals as they grow older. It is important for individuals to be aware of the impact of their lifestyle choices on their health and insurance premiums, and to make informed decisions to maintain their well-being.

The Influence of Gender on Premiums

Gender is one of the factors that can significantly affect health insurance premiums. Insurance companies take into consideration the differences between males and females when determining the cost of coverage. These differences can be attributed to various reasons.

Firstly, the change in premiums based on gender can be related to the variation in health risks between men and women. For example, women generally have higher healthcare utilization rates due to pregnancy, childbirth, and reproductive health issues. This increased utilization can lead to higher costs for insurance companies, resulting in higher premiums for females.

Secondly, age also plays a role in determining health insurance premiums. As individuals age, their health risks tend to increase. Women, on average, have a longer life expectancy compared to men. This means that they may require coverage for a longer period, potentially leading to higher premiums.

Additionally, certain health conditions are more prevalent in one gender than the other. For example, women have a higher likelihood of developing breast cancer, while men are more prone to heart disease. Insurance companies take these differences into account when calculating premiums, as they may need to provide coverage for specific conditions that are more common in one gender.

Furthermore, insurance companies may consider the utilization of healthcare services by gender. Women tend to visit healthcare providers more frequently and utilize preventive services such as screenings and vaccinations. This increased utilization can contribute to higher premiums for females.

In conclusion, gender can have a significant influence on health insurance premiums. Factors such as health risks, age, and healthcare utilization rates can contribute to the variation in premiums between males and females. Insurance companies take these factors into account to ensure that premiums accurately reflect the expected costs of providing coverage for different genders.

The Impact of Family History

A person’s family history can have a significant impact on their health insurance premiums. Insurance companies take into account the health history of an individual’s immediate family members when determining the cost of coverage. If a person’s family has a history of certain medical conditions, such as heart disease, cancer, or diabetes, they may be more prone to developing these conditions themselves. This increased risk of developing these health issues can lead to higher insurance premiums.

Insurance companies consider family history as a risk factor because it can indicate a genetic predisposition to certain diseases. Genetic factors can play a role in the development of various health conditions, and insurance companies take this into account when assessing an individual’s overall health risk. If there is a higher likelihood of a person developing a specific condition based on their family history, insurance companies may increase their premiums to reflect this increased risk.

As individuals age, the impact of family history on health insurance premiums may become more significant. As people get older, their risk of developing certain health conditions may increase, especially if there is a family history of those conditions. Insurance companies may adjust premiums based on the combination of age and family history, as these factors can contribute to an individual’s overall health risk.

It’s important for individuals to be aware of their family’s health history and to disclose this information to insurance companies when applying for coverage. By providing accurate and detailed information about their family’s health history, individuals can ensure that their insurance premiums are based on the most accurate assessment of their risk factors. This transparency can help insurance companies make more informed decisions about coverage and pricing.

In conclusion, family history can have a significant impact on health insurance premiums, particularly as individuals age. Insurance companies take into account the health history of an individual’s immediate family members when determining the cost of coverage. By understanding and disclosing their family’s health history, individuals can help ensure that their insurance premiums are based on the most accurate assessment of their risk factors.

The Role of Insurance Provider

The insurance provider plays a crucial role in determining the health insurance premiums that individuals have to pay as they age. As individuals get older, their health risks increase, and insurance providers take this into account when calculating premiums. Insurance providers use actuarial tables and statistical data to assess the likelihood of an individual developing certain health conditions or needing medical treatments based on their age.

Insurance providers also consider the changes in healthcare costs as individuals age. As people get older, they are more likely to require medical services and treatments, which can be expensive. Insurance providers factor in these increasing healthcare costs when determining the premiums for older individuals. The higher the risk and potential costs associated with age, the higher the premiums.

Furthermore, insurance providers also consider the overall health of individuals. Age is often associated with a higher likelihood of having pre-existing health conditions, such as diabetes or heart disease. Insurance providers take these pre-existing conditions into account and adjust the premiums accordingly. Individuals with pre-existing conditions may face higher premiums due to the increased risk they pose to the insurance provider.

Insurance providers also play a role in offering different types of health insurance plans and coverage options. They may offer plans with higher deductibles or co-pays, which can affect the premiums. Younger individuals may opt for plans with lower premiums but higher out-of-pocket costs, while older individuals may prefer plans with higher premiums but lower out-of-pocket expenses.

In summary, insurance providers play a significant role in determining the health insurance premiums for individuals as they age. They consider factors such as age, healthcare costs, pre-existing conditions, and coverage options when calculating premiums. As individuals get older, their health risks and healthcare needs change, resulting in increasing premiums to account for these factors.

The Effect of Location on Premiums

The location where you live can have a significant impact on the cost of health insurance premiums. Insurance companies take into account various factors related to your location when determining the price you pay for coverage.

One factor that can affect premiums is the cost of healthcare in your area. If you live in a region where healthcare costs are generally higher, insurance premiums are likely to be higher as well. This is because insurance companies need to account for the increased expenses they may incur when providing coverage in these areas.

Another factor is the availability of healthcare providers in your area. If there are limited options for healthcare providers, insurance companies may charge higher premiums to ensure they can cover the costs of care. Additionally, if the demand for healthcare services is high in your area, insurance premiums may increase to reflect the increased risk of claims.

The demographic makeup of your location can also impact premiums. For example, if you live in an area with a higher proportion of older individuals, insurance premiums may be higher. This is because older individuals tend to have more healthcare needs and may require more frequent and costly medical treatments.

Furthermore, the overall health and lifestyle habits of the population in your area can influence premiums. If your location has a higher prevalence of certain health conditions or risky behaviors, insurance companies may increase premiums to account for the increased likelihood of claims.

Lastly, regulatory factors and state-specific laws can also affect premiums. Each state has its own regulations and requirements for health insurance, which can impact the cost of coverage. For example, some states may require insurance companies to cover certain benefits or services, which can increase premiums.

In conclusion, the location where you live can have a significant impact on the cost of health insurance premiums. Factors such as the cost of healthcare, availability of providers, demographic makeup, overall health, and state-specific laws can all contribute to increasing premiums as you age.

The Influence of Policy Type

When it comes to health insurance, the type of policy you choose can have a significant impact on the increasing premiums as you age. Different insurance policies offer varying levels of coverage and benefits, which can affect the cost of your premiums.

One reason why health insurance premiums may increase with age is because of the policy type you have. For example, if you have a comprehensive policy that covers a wide range of medical services and treatments, your premiums are likely to be higher compared to a basic policy that only covers essential services.

The level of coverage provided by your policy can also influence the cost of your premiums. Policies that offer more extensive coverage, such as access to a larger network of healthcare providers or lower deductibles, may come with higher premiums. On the other hand, policies with limited coverage options may have lower premiums but may require you to pay more out-of-pocket for certain services.

Additionally, the policy type can also affect the age rating of your premiums. Some insurance policies use an age rating system, where premiums increase as you get older. This is because older individuals tend to have higher healthcare needs and are more likely to require medical services. As a result, insurance companies adjust the premiums to account for the increased risk and cost associated with insuring older individuals.

It’s important to carefully consider the type of policy you choose and weigh the coverage options against the cost of premiums. Understanding how the policy type influences the increasing premiums with age can help you make informed decisions about your health insurance coverage.

The Importance of Coverage Limits

When it comes to health insurance, understanding c