Important Things to Keep in Mind When Filing a Health Insurance Claim

When it comes to filing a health insurance claim, there are several important details to keep in mind. Understanding the process and being prepared can help ensure a smooth and successful claim submission. Here are a few key points to remember:

1. Policy Coverage: Before filing a claim, it’s essential to review your insurance policy to understand what services and treatments are covered. Different insurance plans have varying coverage levels, so be sure to check what expenses are eligible for reimbursement.

2. Documentation: Proper documentation is crucial when filing a health insurance claim. Be sure to gather all relevant medical records, bills, receipts, and any other supporting documents. Keep copies of everything for your records.

3. Timely Filing: Most insurance companies have specific time limits for filing claims. Make sure to submit your claim within the designated timeframe to avoid any potential denial of coverage.

4. Accurate Information: Double-check all the information you provide on the claim form. Any errors or omissions could lead to delays or denials. Include accurate details such as dates of service, healthcare provider information, and a clear description of the treatment received.

5. Follow-up: After submitting your claim, it’s essential to follow up with your insurance company to ensure it is being processed. Stay in touch with the claims department and regularly inquire about the status of your claim.

By keeping these details in mind and being proactive in the claims process, you can increase the likelihood of a successful health insurance claim. Remember, it’s important to familiarize yourself with your insurance policy and maintain open communication with your insurance provider throughout the entire process.

Understanding Health Insurance Claims

When it comes to filing health insurance claims, there are a few important details to remember. Understanding the process can help ensure that you receive the coverage you need for your medical expenses.

First and foremost, it is crucial to have a clear understanding of your insurance policy. Familiarize yourself with the terms and conditions, including what is covered and what is not. This will help you determine if your claim is eligible for reimbursement.

When filing a health insurance claim, be sure to gather all necessary documentation. This may include medical bills, receipts, and any other relevant paperwork. Keeping organized records will make the process smoother and increase the likelihood of a successful claim.

Additionally, remember to submit your claim in a timely manner. Most insurance companies have specific deadlines for filing claims, so be sure to adhere to these guidelines. Failing to do so may result in your claim being denied.

Lastly, it is important to follow up on your claim. Stay in communication with your insurance provider to ensure that your claim is being processed and to address any questions or concerns that may arise. This will help expedite the process and increase your chances of receiving reimbursement.

By understanding the filing process and keeping these details in mind, you can navigate the health insurance claim process with ease and confidence.

Importance of Filing Claims

Filing insurance claims for health expenses is a crucial step in ensuring that you receive the coverage you are entitled to. By filing claims promptly and accurately, you can avoid potential delays or denials of your claims, and ensure that you are reimbursed for your medical expenses.

One of the most important details to remember when filing health insurance claims is to provide all the necessary information. This includes your personal details, such as your name, address, and contact information, as well as your insurance policy details, such as your policy number and the name of your insurance provider. Providing accurate and complete information will help expedite the claims process and reduce the chances of any discrepancies or errors.

Another important detail to remember is to keep copies of all your medical bills, receipts, and any other relevant documents. These documents serve as proof of your expenses and will be required when filing a claim. By keeping organized records, you can easily provide the necessary documentation when needed and avoid any delays in the processing of your claim.

It is also essential to familiarize yourself with your insurance policy and understand the coverage and reimbursement policies. This will help you determine which expenses are eligible for reimbursement and ensure that you are submitting claims for the correct services or treatments. Being aware of any limitations or exclusions in your policy will also help you avoid any surprises or disputes regarding your claims.

In conclusion, filing health insurance claims correctly and promptly is crucial to ensure that you receive the coverage you are entitled to. By providing accurate information, keeping organized records, and understanding your insurance policy, you can streamline the claims process and minimize any potential issues or delays. Remembering these details will help you navigate the complex world of health insurance claims and maximize your reimbursement.

Basic Information Required

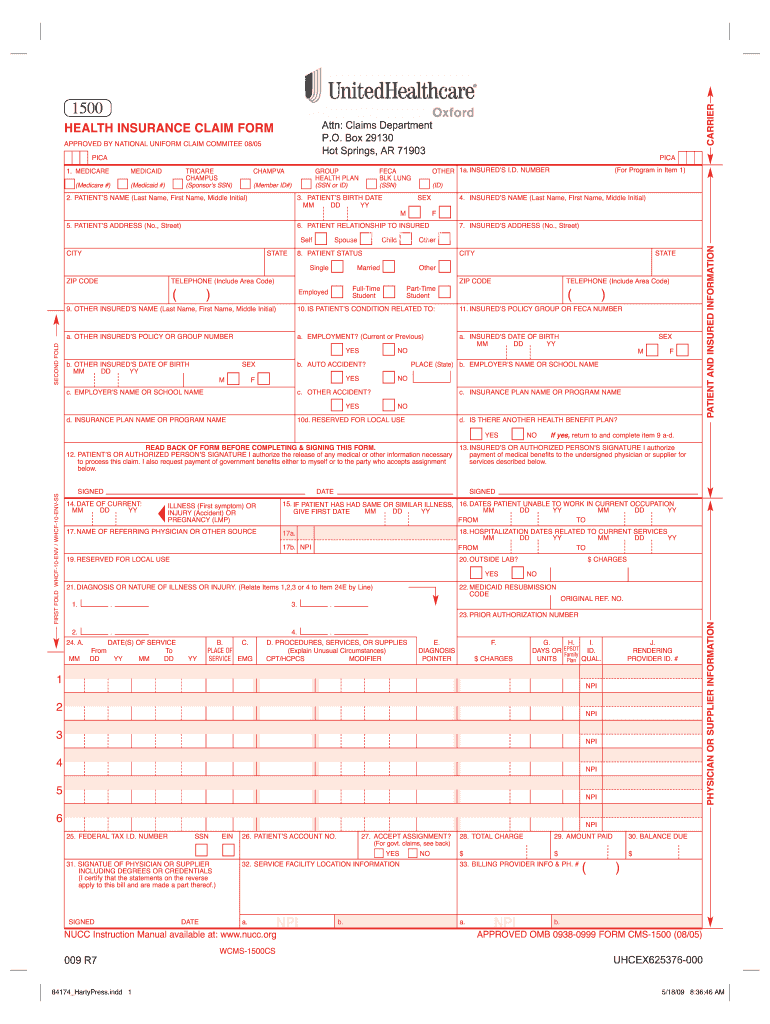

When filing a health insurance claim, there are several important details that you need to remember. Providing accurate and complete information is crucial to ensure a smooth claims process. Here is a list of basic information that you will be required to provide:

- Personal details: You will need to provide your full name, address, contact number, and date of birth. This information helps the insurance company identify you and verify your policy.

- Policy information: You will need to provide your health insurance policy number, the name of the insurance company, and the type of insurance plan you have. This information is important for the insurance company to access your policy and determine coverage.

- Date of service: You will need to provide the date when you received the health services for which you are filing a claim. This helps the insurance company track the timeline of your treatment.

- Healthcare provider details: You will need to provide the name, address, and contact information of the healthcare provider who rendered the services. This information helps the insurance company verify the legitimacy of the claim.

- Service details: You will need to provide a detailed description of the health services you received, including the name of the procedure or treatment, the diagnosis, and any medications or medical devices used. This information helps the insurance company determine the appropriateness and coverage of the services.

- Cost information: You will need to provide the total cost of the health services, including any co-pays or deductibles. This information helps the insurance company calculate the amount they will reimburse you.

Remember, providing accurate and complete information when filing a health insurance claim is essential for a successful claims process. Make sure to double-check all the details before submitting your claim to avoid any delays or complications.

Types of Health Insurance Claims

When it comes to health insurance, it’s important to understand the different types of claims that you may need to file. Whether you’re seeking reimbursement for medical expenses or submitting a claim for a prescription drug, knowing the details of your insurance coverage is crucial.

1. Medical Claims: These are the most common type of health insurance claims. They involve submitting documentation and receipts for medical services, such as doctor visits, hospital stays, or surgical procedures. It’s important to remember to include all necessary information, such as diagnosis codes and itemized bills, to ensure a smooth claims process.

2. Prescription Drug Claims: If you have a prescription drug benefit as part of your health insurance plan, you may need to file a claim for reimbursement. This typically involves submitting the prescription and pharmacy receipt to your insurance provider. Remember to check if there are any specific guidelines or limitations for prescription drug claims.

3. Dental Claims: Some health insurance plans also cover dental services. If you’ve had a dental procedure, such as a filling or a root canal, you may need to file a dental claim. Be sure to include any necessary documentation, such as X-rays or treatment plans, to support your claim.

4. Vision Claims: If your health insurance plan includes vision coverage, you may need to file a claim for eye exams, glasses, or contact lenses. Keep in mind that there may be specific requirements for vision claims, such as the need for a prescription from an eye care professional.

5. Preventive Care Claims: Many health insurance plans cover preventive care services, such as vaccinations or annual check-ups. If you’ve received any preventive care, it’s important to file a claim to ensure that you’re reimbursed for these services.

Remember, each health insurance plan may have different requirements and processes for filing claims. It’s essential to review your policy documents and contact your insurance provider for specific instructions on how to file a claim. By understanding the details of your insurance coverage and following the necessary steps, you can ensure a smooth and successful claims process.

In-Network vs. Out-of-Network Claims

When it comes to filing health insurance claims, it’s important to understand the difference between in-network and out-of-network claims. These terms refer to the providers or healthcare facilities that are covered by your insurance plan.

In-Network Claims: If you visit a healthcare provider or facility that is part of your insurance plan’s network, you are filing an in-network claim. This means that the provider has an agreement with your insurance company and has agreed to accept the negotiated rates for services.

Out-of-Network Claims: On the other hand, if you visit a provider or facility that is not part of your insurance plan’s network, you are filing an out-of-network claim. This means that the provider does not have an agreement with your insurance company and may charge higher rates for services.

It’s important to remember that filing an out-of-network claim may result in higher out-of-pocket costs for you. Your insurance plan may only cover a portion of the expenses, leaving you responsible for the remaining balance.

To determine whether a provider or facility is in-network or out-of-network, you can usually check your insurance company’s website or call their customer service helpline. It’s always a good idea to verify the network status of your healthcare providers before seeking treatment to avoid any surprises.

In conclusion, understanding the difference between in-network and out-of-network claims is crucial when filing health insurance claims. Be sure to check the network status of your providers and facilities to avoid unexpected expenses. Remember, in-network claims typically have lower out-of-pocket costs than out-of-network claims.

Filing a Claim with Your Insurance Provider

When it comes to filing a health insurance claim, there are a few important details to remember. Making sure you have all the necessary information and understanding the process can help ensure a smooth and successful filing.

First and foremost, it is crucial to remember to keep track of all your health-related expenses. This includes medical bills, pharmacy receipts, and any other relevant documentation. Having a comprehensive record will make it easier to provide accurate information when filing your claim.

Another important detail to remember is to review your insurance policy carefully. Familiarize yourself with the coverage limits, deductibles, and any other specific requirements or exclusions that may apply to your plan. This will help you understand what expenses are eligible for reimbursement and avoid any surprises.

When filing your claim, it is essential to provide accurate and complete information. This includes your personal details, such as your name, address, and policy number, as well as the details of the medical service or treatment you are claiming for. Any errors or missing information can result in delays or even denial of your claim.

Lastly, it is advisable to keep copies of all documents and correspondence related to your claim. This includes the claim form, receipts, and any communication with your insurance provider. Having a paper trail can be helpful in case of any disputes or inquiries that may arise during the claims process.

Remembering these details and following the necessary steps can make filing a health insurance claim a smoother and more efficient process. By being organized and prepared, you can increase the chances of a successful claim and ensure you receive the reimbursement you are entitled to.

Filing a Claim with a Third-Party Administrator

When it comes to filing a health insurance claim, there are important details to remember. One option is to file your claim with a third-party administrator. This can be a beneficial choice for many reasons.

Firstly, a third-party administrator specializes in handling insurance claims. They have the expertise and knowledge to ensure that your claim is processed accurately and efficiently. This can save you time and effort in dealing with the complex process of filing a claim.

Secondly, working with a third-party administrator can provide you with peace of mind. They will handle all the necessary paperwork and communicate with your insurance company on your behalf. This can alleviate any stress or confusion that may arise during the claims process.

Additionally, a third-party administrator can help you navigate any potential challenges or issues that may arise with your claim. They can provide guidance and support, ensuring that you receive the maximum benefits from your health insurance policy.

In conclusion, filing a claim with a third-party administrator can be a smart choice for managing your health insurance claims. Their expertise, efficiency, and support can make the process easier and more effective. Remember to consider this option when filing your next health insurance claim.

Common Mistakes to Avoid

When filing an insurance claim for your health, it’s important to remember certain details to ensure a smooth process. However, there are common mistakes that people often make, which can cause delays or even denials of their claims. To avoid these pitfalls, here are some key points to keep in mind:

- Provide accurate information: One of the most common mistakes is providing incorrect or incomplete details on the claim form. Make sure to double-check all the information you provide, including your personal details, policy number, and the details of the medical service or treatment.

- Submit the claim on time: Insurance companies usually have specific deadlines for filing claims. Failing to submit your claim within the given timeframe can result in the claim being denied. Be sure to check your policy for the deadline and submit your claim as soon as possible.

- Include all necessary documentation: To support your claim, it’s important to include all relevant documents, such as medical bills, receipts, and any other supporting documentation. Make sure to organize these documents properly and submit them along with your claim form.

- Follow the insurance company’s guidelines: Each insurance company may have specific guidelines and requirements for filing a claim. It’s essential to familiarize yourself with these guidelines and follow them accordingly. This can help prevent any unnecessary delays or complications in the claims process.

- Keep copies of all documents: It’s always a good idea to keep copies of all the documents you submit for your claim. This includes the claim form, supporting documents, and any correspondence with the insurance company. Having these copies can be helpful in case there are any issues or disputes regarding your claim.

By avoiding these common mistakes and following the proper procedures, you can increase your chances of a successful health insurance claim. Remember, attention to detail and adherence to the insurance company’s guidelines are key in ensuring a smooth and hassle-free claims process.

Understanding the Claim Process

Filing an insurance claim can be a complex and time-consuming process. It is important to remember that attention to details is crucial when submitting a claim to ensure that it is processed correctly and in a timely manner.

When filing a health insurance claim, it is essential to gather all the necessary documentation and information. This includes medical bills, receipts, and any other supporting documents. Make sure to double-check the accuracy of all the details provided, such as the policyholder’s name, policy number, and date of service.

One important detail to remember is to understand the specific requirements of your insurance provider. Different insurance companies may have different procedures and guidelines for filing claims. Familiarize yourself with these requirements to ensure that your claim is not rejected or delayed.

Another crucial aspect of the claim process is to keep track of all communication with your insurance provider. This includes documenting phone calls, emails, and any other correspondence. It is also advisable to maintain a record of the date and time of each interaction, as well as the name of the representative you spoke with.

Lastly, it is worth considering seeking assistance from a healthcare billing advocate or professional. They can help navigate the complexities of the claim process and ensure that all necessary details are included in the submission. Their expertise can increase the chances of a successful claim and minimize the chances of any issues or delays.

Required Documentation

When filing a health insurance claim, it is important to remember that providing the necessary documentation is crucial. Insurance companies require specific details and paperwork to process your claim efficiently. By ensuring you have the required documentation, you can avoid delays or denials in the claims process.

Firstly, you will need to provide your insurance policy information, including your policy number and the name of your insurance provider. This information is essential for the insurance company to identify your coverage and verify your eligibility for the claim.

Next, you should gather all the relevant medical records related to the treatment or services for which you are filing the claim. These records can include doctor’s notes, test results, prescriptions, and any other documentation that supports your claim. Make sure to include the dates of the services, the names of the healthcare providers, and the nature of the treatment.

In addition to medical records, you may also need to provide itemized bills or invoices from healthcare providers. These documents should include the services rendered, the cost of each service, and any applicable codes or descriptions. It is essential to ensure that these bills are accurate and match the services received.

Finally, it may be necessary to include any other relevant documentation, such as accident reports, police reports, or witness statements, depending on the nature of your claim. These additional documents can provide further evidence to support your case and help the insurance company understand the circumstances surrounding the claim.

Remember, providing all the required documentation when filing a health insurance claim is crucial for a smooth and efficient process. By organizing and submitting the necessary details, you can increase the chances of your claim being processed successfully and receiving the coverage you are entitled to.

Deadlines for Filing Claims

When it comes to filing health insurance claims, it is important to remember the deadlines. These deadlines are crucial as they determine whether or not your claim will be accepted. Missing the deadline could result in your claim being denied, leaving you responsible for the full cost of your medical expenses.

Each insurance provider has their own specific deadline for filing claims. It is essential to familiarize yourself with these details to ensure you submit your claim on time. Some insurance companies may require claims to be filed within a certain number of days after receiving treatment, while others may have a longer window of time.

It is also important to remember that the deadlines for filing claims may vary depending on the type of health insurance plan you have. For example, if you have a group health insurance plan through your employer, the deadline may be different than if you have an individual plan.

To avoid any complications or potential denial of your claim, it is recommended to file your claim as soon as possible after receiving medical treatment. This will ensure that you meet the deadline and give the insurance company ample time to process your claim.

In conclusion, filing health insurance claims requires attention to detail and adherence to deadlines. Remember to familiarize yourself with the specific deadlines set by your insurance provider and submit your claim promptly. By doing so, you can increase the chances of your claim being accepted and avoid any unnecessary financial burden.

Claim Denials and Appeals

When filing a health insurance claim, it is important to remember the details of your policy and the specific requirements for submitting a claim. However, even with careful preparation, there is still a possibility that your claim may be denied. In such cases, it is crucial to understand the appeals process and take the necessary steps to challenge the denial.

Insurance companies may deny a claim for various reasons, such as incomplete documentation, lack of medical necessity, or errors in coding. If your claim is denied, it is important to carefully review the denial letter to understand the specific reason for the denial. This will help you identify any missing information or errors that need to be addressed in your appeal.

When appealing a denied claim, it is crucial to provide additional supporting documentation, such as medical records, test results, or a letter from your healthcare provider explaining the medical necessity of the treatment or procedure. It is also important to clearly articulate your case in the appeal letter, highlighting any relevant policy provisions or guidelines that support your claim.

Keep in mind that the appeals process can be time-consuming, so it is important to act promptly. Most insurance companies have specific deadlines for submitting appeals, and failing to meet these deadlines could result in the denial being upheld. Therefore, it is important to stay organized and keep track of all correspondence related to your appeal.

Overall, dealing with claim denials can be frustrating, but it is important to remember that you have the right to appeal. By understanding the appeals process and providing thorough documentation and supporting evidence, you can increase your chances of overturning a denied claim and receiving the insurance coverage you are entitled to.

Tracking Your Claim Status

Once you have filed your health insurance claim, it is important to remember to keep track of its status. This will help you stay informed about the progress of your claim and ensure that it is being processed correctly.

One way to track your claim status is by contacting your insurance provider directly. They will be able to provide you with updates on the status of your claim and any additional information that may be needed. It is important to have your claim number and other relevant details on hand when contacting your insurance provider.

Another option is to use the online portal or mobile app provided by your insurance company. These platforms often have a dedicated section where you can track the status of your claims. Simply log in using your account credentials and navigate to the claims section to view the progress of your claim.

It is also a good idea to keep a record of all communication related to your claim. This includes any phone calls, emails, or letters exchanged with your insurance provider. Having a record of these interactions can be helpful if you ever need to escalate your claim or dispute any decisions made by your insurance company.

By tracking your claim status, you can ensure that your health insurance claim is being processed correctly and in a timely manner. This will help you avoid any delays or issues with your claim and ensure that you receive the coverage and benefits you are entitled to.

Reimbursement Process

When it comes to filing a health insurance claim, there are several important details to remember. One of the most crucial aspects is understanding the reimbursement process. This is the procedure through which you can receive financial compensation for the medical expenses you have incurred.

Firstly, it is important to keep in mind that each insurance company may have its own specific requirements and procedures for filing a claim. It is essential to carefully review your insurance policy and familiarize yourself with the guidelines provided by your insurance provider. This will help ensure that you follow the correct steps and submit all the necessary documentation.

Secondly, it is crucial to gather all the relevant details and documentation related to your health claim. This may include medical bills, receipts, prescriptions, and any other supporting documents. It is important to keep these records organized and easily accessible, as they will be required when submitting your claim.

Additionally, it is important to remember to accurately fill out all the necessary forms and provide all the required information. Any missing or incorrect information can delay the reimbursement process or even lead to a denial of your claim. It is advisable to double-check all the details before submitting your claim to ensure accuracy.

Once you have completed the necessary forms and gathered all the required documentation, you can submit your claim to the insurance company. It is recommended to keep a copy of the submitted claim for your records. After submission, it is important to regularly follow up with the insurance company to track the progress of your claim and address any potential issues or concerns.

In conclusion, understanding the reimbursement process is essential when filing a health insurance claim. By remembering these important details and following the correct procedures, you can increase the likelihood of a successful reimbursement for your medical expenses.

Tips for Smooth Claim Processing

Filing an insurance claim can be a complex process, but with a few key details in mind, you can ensure a smoother experience. When it comes to health insurance, it’s important to remember the following tips:

- Gather all necessary documents: Before filing your claim, make sure you have all the required documents, such as medical bills, receipts, and any supporting documentation from your healthcare provider.

- Double-check your information: Accuracy is crucial when filing an insurance claim. Take the time to review your personal and medical information to ensure it is correct and up-to-date.

- Submit your claim promptly: It’s best to file your claim as soon as possible after receiving healthcare services. This helps to expedite the processing time and reduces the risk of missing any important deadlines.

- Follow up with your insurance provider: After submitting your claim, stay in touch with your insurance provider to track its progress. This allows you to address any potential issues or provide additional information if needed.

- Keep copies of all documents: It’s important to keep copies of all documents related to your insurance claim, including the claim form, receipts, and any correspondence with your insurance provider. This ensures you have a record of the entire process.

By following these tips, you can streamline the filing process and increase the chances of a successful claim. Remember, attention to detail and timely submission are key when it comes to filing a health insurance claim.

Question-answer:

How long does it take for a health insurance claim to be processed?

The time it takes for a health insurance claim to be processed can vary depending on several factors, including the complexity of the claim and the efficiency of the insurance company. In general, it can take anywhere from a few days to several weeks for a claim to be processed. Some insurance companies offer online claim tracking services, which can give you an estimate of when you can expect to receive reimbursement.