Understanding the Distinction: Mediclaim versus Health Insurance

When it comes to protecting your health, it’s important to understand the difference between mediclaim and health insurance. While both provide coverage for medical expenses, there are key distinctions that can impact your financial security and access to quality healthcare.

Mediclaim:

Mediclaim is a type of health insurance policy that specifically covers hospitalization expenses. It typically offers a fixed sum insured to cover the cost of medical treatment, including room charges, doctor fees, surgery expenses, and medication. Mediclaim policies are usually limited to a specific duration, such as one year, and require the policyholder to pay a premium to maintain coverage.

Mediclaim policies are designed to provide financial protection in the event of unexpected medical emergencies or accidents. They offer a safety net to help you manage the high costs of hospitalization and ensure that you receive necessary medical care without incurring a significant financial burden.

Example:

A mediclaim policy may cover the cost of hospitalization due to an accident, such as a broken bone or a sudden illness that requires immediate medical attention.

Health Insurance:

Health insurance, on the other hand, is a broader form of coverage that extends beyond hospitalization expenses. It encompasses a wide range of medical services, including preventive care, outpatient treatment, diagnostic tests, and prescription medications. Health insurance policies are typically more comprehensive and provide coverage for both inpatient and outpatient care.

Health insurance is designed to promote overall health and well-being by offering coverage for routine check-ups, vaccinations, and screenings. It also provides financial protection for chronic conditions, long-term care, and specialized treatments, such as cancer or organ transplants.

Example:

A health insurance policy may cover the cost of preventive care, such as annual physical exams and vaccinations, as well as ongoing treatment for a chronic condition, such as diabetes or asthma.

In summary, while mediclaim focuses on hospitalization expenses, health insurance provides broader coverage for a wide range of medical services. Understanding the differences between these two types of coverage can help you make an informed decision when it comes to protecting your health and financial well-being.

Definition of Mediclaim

Mediclaim is a type of insurance that specifically covers the costs of medical expenses. It is a form of health insurance that provides financial protection to individuals and families in case of unexpected medical emergencies or illnesses. Mediclaim policies are designed to reimburse the insured for the expenses incurred due to hospitalization, surgeries, diagnostic tests, and other medical treatments.

One of the key differences between mediclaim and regular health insurance is the scope of coverage. While health insurance provides coverage for a wide range of medical expenses, including preventive care, regular check-ups, and pre-existing conditions, mediclaim policies typically focus on hospitalization and related expenses.

Mediclaim policies often come with specific limits and conditions, such as a maximum coverage amount, waiting periods for certain treatments, and exclusions for pre-existing conditions. It is important for individuals to carefully review the terms and conditions of their mediclaim policy to understand what is covered and what is not.

In summary, mediclaim is a specialized form of health insurance that provides coverage for medical expenses related to hospitalization. It is important to carefully review the terms and conditions of a mediclaim policy to understand its coverage and limitations.

Definition of Health Insurance

Health insurance is a type of insurance that provides financial coverage for medical expenses incurred by an individual or a family. It is designed to protect individuals and families from high healthcare costs and ensure access to quality healthcare services.

Health insurance differs from mediclaim in several ways. While mediclaim is a specific type of health insurance that covers only hospitalization expenses, health insurance provides a broader coverage that includes not only hospitalization but also outpatient care, preventive services, prescription drugs, and other healthcare services.

One of the key differences between mediclaim and health insurance is the scope of coverage. Mediclaim typically covers only expenses related to hospitalization, such as room charges, doctor’s fees, and surgical costs. Health insurance, on the other hand, provides coverage for a wider range of medical expenses, including diagnostic tests, ambulance services, maternity care, and even alternative treatments like Ayurveda and homeopathy.

Another difference between mediclaim and health insurance is the flexibility in choosing healthcare providers. With mediclaim, policyholders are usually restricted to a network of hospitals and doctors affiliated with the insurance company. Health insurance, on the other hand, allows policyholders to choose their healthcare providers based on their preferences and needs.

In summary, health insurance offers a comprehensive coverage for medical expenses, including hospitalization and outpatient care, while mediclaim provides coverage only for hospitalization expenses. Health insurance also offers more flexibility in choosing healthcare providers. It is important to carefully consider your healthcare needs and budget when choosing between mediclaim and health insurance to ensure that you have the right coverage for your specific requirements.

Coverage of Mediclaim

Mediclaim insurance is a type of health insurance that provides coverage for medical expenses incurred by the insured individual. It is different from regular health insurance in terms of the scope of coverage and the claims process.

One of the key differences between mediclaim and regular health insurance is the coverage provided. Mediclaim policies typically cover hospitalization expenses, including room charges, doctor’s fees, and surgical procedures. They may also cover pre and post-hospitalization expenses, such as diagnostic tests and medication. However, mediclaim policies may have certain limitations and exclusions, so it is important to carefully read the policy terms and conditions.

Another difference is the claims process. Mediclaim policies usually have a reimbursement-based claims process, where the insured individual pays for the medical expenses upfront and then submits the bills and documents to the insurance company for reimbursement. Regular health insurance, on the other hand, may offer cashless claims, where the insured individual can avail of medical services at network hospitals without having to pay upfront.

In summary, mediclaim insurance provides coverage for hospitalization and related expenses, with a reimbursement-based claims process. It is important to understand the difference between mediclaim and regular health insurance to make an informed decision when choosing a health insurance policy.

Coverage of Health Insurance

Health insurance provides a comprehensive coverage for various medical expenses and treatments. It is a type of insurance that helps individuals and families to manage their healthcare costs. Unlike mediclaim, health insurance offers a wider range of benefits and coverage.

One of the key differences between health insurance and mediclaim is the extent of coverage. Health insurance typically covers a broader range of medical expenses, including hospitalization, surgery, diagnostic tests, prescription drugs, and preventive care. It also provides coverage for chronic conditions and pre-existing diseases.

Health insurance plans often include coverage for outpatient care, such as doctor visits, specialist consultations, and laboratory tests. This ensures that individuals have access to necessary medical services without incurring high out-of-pocket expenses. Additionally, health insurance may also cover alternative treatments, such as physiotherapy, acupuncture, and naturopathy.

Another important aspect of health insurance coverage is the provision for emergency medical services. In case of accidents or sudden illness, health insurance can provide coverage for ambulance services, emergency room treatment, and intensive care. This can be crucial in ensuring timely and adequate medical care in critical situations.

Furthermore, health insurance plans often offer additional benefits such as maternity coverage, mental health services, and dental care. These additional benefits can provide individuals with comprehensive healthcare coverage, addressing their specific needs and requirements.

In summary, health insurance offers a wider coverage compared to mediclaim. It provides comprehensive coverage for various medical expenses, including hospitalization, outpatient care, emergency services, and additional benefits. With health insurance, individuals can have peace of mind knowing that their healthcare costs are covered, allowing them to focus on their well-being.

Premiums of Mediclaim

Mediclaim insurance is a type of health insurance that provides coverage for medical expenses incurred due to illness or injury. One of the key differences between Mediclaim and other health insurance plans is the premiums.

The premiums of Mediclaim are typically lower compared to other health insurance plans. This is because Mediclaim policies are designed to provide coverage for specific medical expenses, such as hospitalization and surgeries, rather than comprehensive coverage for all types of healthcare services.

When determining the premiums for Mediclaim, insurance companies take into account factors such as the age and health condition of the insured individual, as well as the sum insured. Younger and healthier individuals generally pay lower premiums, while older individuals or those with pre-existing medical conditions may have to pay higher premiums.

It is important to note that the premiums of Mediclaim may vary depending on the insurance company and the specific policy. It is recommended to compare different insurance providers and policies to find the best coverage at the most affordable premium rates.

In conclusion, the premiums of Mediclaim insurance are typically lower compared to other health insurance plans. However, it is important to carefully consider the coverage and benefits offered by the policy before making a decision.

Premiums of Health Insurance

Health insurance is a type of insurance coverage that provides financial protection for medical expenses incurred by the insured individual. It helps individuals and families to manage the costs of healthcare services, including hospitalization, doctor visits, and prescription medications. Health insurance premiums are the amount of money that individuals or their employers pay to the insurance company in exchange for coverage.

One of the main differences between health insurance and mediclaim is the way premiums are calculated. Health insurance premiums are typically based on factors such as age, gender, medical history, and the level of coverage desired. The premiums may also vary depending on the insurance company and the specific plan chosen.

Health insurance premiums can be paid on a monthly, quarterly, or annual basis. The cost of the premiums will vary depending on the age and health status of the insured individual, as well as the coverage options selected. It is important to carefully review the terms and conditions of the health insurance policy to understand the premium structure and any additional costs that may be incurred.

When comparing health insurance plans, it is important to consider the premiums along with the coverage offered. While lower premiums may be more affordable in the short term, they may also provide less comprehensive coverage. On the other hand, higher premiums may offer more extensive coverage but may be less affordable for some individuals or families.

In conclusion, health insurance premiums are an important factor to consider when choosing a health insurance plan. It is essential to evaluate the coverage options and premium structure to ensure that the chosen plan meets the individual or family’s healthcare needs and budget. By understanding the differences between health insurance and mediclaim, individuals can make informed decisions and secure the appropriate coverage for their health and well-being.

Claim Process of Mediclaim

Mediclaim is a type of health insurance that provides coverage for medical expenses incurred by the insured individual. It is important to understand the difference between insurance and mediclaim, as they have different claim processes.

The claim process of mediclaim involves several steps:

- Filing the claim: The insured individual needs to fill out a claim form, providing details of the medical treatment received and the expenses incurred.

- Submitting documents: Along with the claim form, the insured individual must submit supporting documents such as medical bills, prescriptions, diagnostic reports, and any other relevant documents.

- Verification: The insurance company verifies the claim and the submitted documents to ensure that they meet the policy terms and conditions.

- Approval: If the claim is found to be valid, the insurance company approves the claim and initiates the reimbursement process.

- Reimbursement: The insured individual is reimbursed for the approved medical expenses as per the policy terms and conditions.

It is important to note that the claim process of mediclaim may vary slightly between different insurance companies. It is advisable to carefully read the policy terms and conditions and follow the specific claim process outlined by the insurance provider.

Claim Process of Health Insurance

If you have health insurance, you may need to file a claim at some point to receive reimbursement for medical expenses. Understanding the claim process is essential to ensure a smooth and hassle-free experience. Here is a step-by-step guide on how to file a claim for your health insurance:

- Notify your insurance provider: As soon as you receive medical treatment, it is important to inform your health insurance provider about the same. This can usually be done through a phone call or an online portal. Make sure to provide all the necessary details, such as the date of treatment, the name of the healthcare provider, and the nature of the treatment.

- Gather all the required documents: To support your claim, you will need to gather all the relevant documents, such as medical bills, prescriptions, diagnostic reports, and any other supporting documents. Make sure to keep copies of these documents for your records.

- Fill out the claim form: Your insurance provider will provide you with a claim form that needs to be filled out accurately and completely. This form will require information about your policy, the treatment received, and the expenses incurred. Double-check all the information before submitting the form.

- Submit the claim: Once you have filled out the claim form and gathered all the necessary documents, submit them to your insurance provider. This can usually be done through email, mail, or an online portal. Make sure to follow the instructions provided by your insurance provider to ensure a smooth submission process.

- Follow up on the claim: After submitting the claim, it is important to follow up with your insurance provider to track the progress. Keep track of any reference numbers or communication related to your claim. If there are any discrepancies or delays, contact your insurance provider for clarification.

- Receive reimbursement: Once your claim is approved, you will receive reimbursement for the eligible expenses as per the terms and conditions of your health insurance policy. This can be in the form of direct payment to the healthcare provider or reimbursement to you.

By following these steps, you can ensure a smooth and efficient claim process for your health insurance. Remember to always read and understand the terms and conditions of your policy to know what expenses are covered and what documents are required for a successful claim.

Exclusions of Mediclaim

Mediclaim and health insurance are two different types of insurance policies that provide coverage for medical expenses. While both policies aim to protect individuals from the financial burden of medical treatments, there are some key differences between them.

One of the main differences between mediclaim and health insurance is the exclusions. Mediclaim policies often have certain exclusions, which are specific conditions or treatments that are not covered by the policy. These exclusions can vary depending on the insurance provider, but commonly include pre-existing conditions, cosmetic procedures, dental treatments, and infertility treatments.

It is important for individuals to carefully review the exclusions of their mediclaim policy before purchasing it. Understanding what is not covered can help individuals make informed decisions about their healthcare needs and avoid unexpected expenses.

Additionally, some mediclaim policies may have waiting periods for certain treatments or conditions. This means that individuals may have to wait for a specified period of time before they can claim coverage for certain treatments or conditions. It is important to be aware of these waiting periods and plan accordingly.

In contrast, health insurance policies generally provide broader coverage and have fewer exclusions. They often cover a wide range of medical treatments and conditions, including pre-existing conditions, chronic illnesses, and preventive care. However, health insurance policies may have higher premiums compared to mediclaim policies.

In conclusion, while both mediclaim and health insurance provide coverage for medical expenses, there are differences in their exclusions. It is important for individuals to carefully review the exclusions of their mediclaim policy and consider their healthcare needs before making a decision.

Exclusions of Health Insurance

Health insurance is a vital tool that provides financial protection against medical expenses. However, it is important to understand that not all medical services and treatments are covered under a health insurance policy. There are certain exclusions that policyholders need to be aware of. These exclusions vary from one insurance provider to another, but they generally include:

- Pre-existing conditions: Most health insurance policies do not cover pre-existing conditions, which are medical conditions that existed before the policy was purchased. This means that any treatment or medication related to these conditions will not be covered.

- Alternative therapies: Many health insurance policies do not cover alternative therapies such as acupuncture, homeopathy, or naturopathy.

- Cosmetic procedures: Cosmetic procedures, such as plastic surgery or hair transplant, are usually not covered by health insurance policies, unless they are deemed medically necessary.

- Dental and vision care: Health insurance policies typically do not cover routine dental and vision care, including dental check-ups, eye exams, and glasses or contact lenses.

- Maternity and fertility treatments: Some health insurance policies exclude coverage for maternity expenses, including prenatal care, childbirth, and postnatal care. Similarly, fertility treatments such as in-vitro fertilization (IVF) may not be covered.

It is important to carefully read and understand the terms and conditions of a health insurance policy to know what is covered and what is not. If you have specific medical needs or requirements, it is advisable to choose a policy that offers comprehensive coverage for those services. Always consult with the insurance provider or an insurance advisor to clarify any doubts regarding the exclusions of a health insurance policy.

Benefits of Mediclaim

Mediclaim insurance is a type of health insurance that provides coverage for medical expenses incurred by the insured individual. It is important to understand the difference between mediclaim and other types of health insurance to make an informed decision.

One of the key benefits of mediclaim insurance is that it offers financial protection against unexpected medical expenses. Medical emergencies can happen at any time, and having a mediclaim policy can help cover the cost of hospitalization, surgeries, and other medical treatments.

Another advantage of mediclaim insurance is that it provides coverage for pre-existing conditions. Unlike some other health insurance plans, mediclaim policies do not exclude coverage for conditions that were present before the policy was purchased. This can be especially beneficial for individuals with chronic illnesses or medical conditions.

Mediclaim insurance also offers the flexibility to choose the coverage amount and the duration of the policy. Individuals can select the sum insured based on their specific needs and budget. Additionally, mediclaim policies can be renewed annually, ensuring continued coverage for medical expenses.

Furthermore, mediclaim insurance often includes additional benefits such as cashless hospitalization and coverage for ambulance charges. This can help ease the financial burden during medical emergencies and provide peace of mind to the insured individual.

In conclusion, mediclaim insurance offers several benefits compared to other types of health insurance. It provides financial protection against medical expenses, covers pre-existing conditions, offers flexibility in coverage amount and duration, and includes additional benefits such as cashless hospitalization. Considering these advantages, mediclaim insurance can be a valuable investment in ensuring one’s health and well-being.

Benefits of Health Insurance

Health insurance offers numerous advantages over mediclaim policies. The main difference between health insurance and mediclaim is the scope of coverage. Health insurance provides comprehensive coverage for a wide range of medical expenses, including hospitalization, surgeries, diagnostic tests, and medication. On the other hand, mediclaim policies typically cover only hospitalization expenses.

Another key difference is the flexibility of health insurance plans. Health insurance allows you to choose from a variety of plans with different coverage levels and premiums, so you can select a plan that best suits your needs and budget. Mediclaim policies, on the other hand, often have limited options and may not provide as much flexibility.

Health insurance also offers additional benefits such as cashless hospitalization, which allows you to receive treatment at network hospitals without having to pay upfront. This can be especially beneficial in emergency situations when you may not have immediate access to funds. Mediclaim policies, on the other hand, may require you to pay for the expenses upfront and then claim reimbursement later.

Furthermore, health insurance often includes coverage for pre-existing conditions, which means that you can receive treatment for any existing health conditions without any waiting period. Mediclaim policies, on the other hand, typically have waiting periods for pre-existing conditions, during which you may not be eligible for coverage.

In summary, health insurance offers a wider scope of coverage, more flexibility in plan options, cashless hospitalization, and coverage for pre-existing conditions compared to mediclaim policies. It provides comprehensive protection for your health and financial well-being, ensuring that you can access quality healthcare without worrying about the cost.

Renewal of Mediclaim

When it comes to taking care of your health, it is important to understand the difference between health insurance and mediclaim. While both provide financial coverage for medical expenses, there are some key distinctions.

Health insurance is a comprehensive coverage that includes various types of medical expenses, such as hospitalization, surgeries, and preventive care. It typically offers a wider range of benefits and higher coverage limits. On the other hand, mediclaim is a specific type of health insurance that covers only hospitalization expenses.

Renewal of mediclaim is an important aspect to consider to ensure continued coverage for hospitalization expenses. It is recommended to review your mediclaim policy before renewal to understand any changes in coverage, premium, or terms and conditions.

During the renewal process, it is important to assess your current health needs and evaluate whether your existing mediclaim policy meets those needs. If you have experienced any changes in your health condition or require additional coverage, it may be necessary to upgrade your policy.

Renewing your mediclaim policy on time is crucial to avoid any gaps in coverage. Insurance companies usually provide a grace period for renewal, but it is advisable to renew well in advance to ensure uninterrupted coverage.

By understanding the difference between health insurance and mediclaim and properly renewing your mediclaim policy, you can ensure that you have the necessary financial protection for any hospitalization expenses that may arise.

Renewal of Health Insurance

Renewing your health insurance is an important step in ensuring the continued protection of your health and well-being. Health insurance provides coverage for medical expenses, including hospitalization, surgeries, and medication, allowing you to access the necessary healthcare services without worrying about the financial burden.

While mediclaim and health insurance are often used interchangeably, there is a difference between the two. Mediclaim typically covers only hospitalization expenses, whereas health insurance offers a wider range of coverage, including outpatient treatments, diagnostic tests, and preventive care.

Renewing your health insurance policy is crucial as it ensures that your coverage remains active and uninterrupted. By renewing your policy on time, you can continue to avail the benefits of health insurance, such as cashless hospitalization and reimbursement of medical expenses, without any hassle.

During the renewal process, it is essential to review your policy and make any necessary changes to ensure that it still meets your healthcare needs. This may include adjusting the sum insured, adding or removing family members, or opting for additional coverage options.

To renew your health insurance, you can contact your insurance provider or use their online portal for a seamless and convenient experience. It is advisable to renew your policy well in advance to avoid any last-minute complications or gaps in coverage.

By renewing your health insurance, you can continue to prioritize your health and well-being, knowing that you have the necessary financial protection in case of any medical emergencies or healthcare needs.

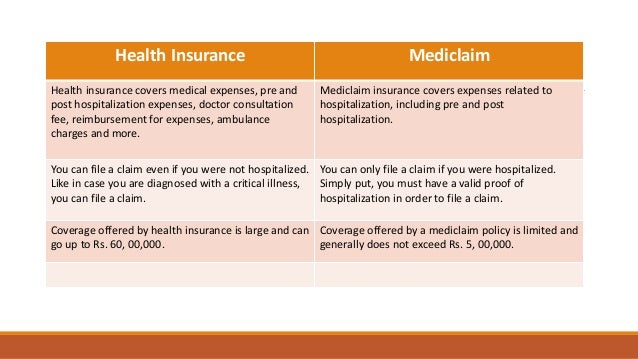

Comparison of Mediclaim and Health Insurance

Mediclaim and health insurance are two different types of policies that provide coverage for medical expenses. While both offer financial protection against healthcare costs, there are some key differences between the two.

Mediclaim: Mediclaim is a type of health insurance policy that specifically covers hospitalization expenses. It provides reimbursement for the expenses incurred during hospitalization, such as doctor’s fees, room charges, medication costs, and surgical expenses. Mediclaim policies usually have a defined sum insured and a fixed policy period. They are generally more affordable compared to comprehensive health insurance plans.

Health Insurance: Health insurance, on the other hand, is a broader term that encompasses a wide range of coverage options. It provides financial protection for various medical expenses, including hospitalization, outpatient treatments, diagnostic tests, ambulance services, and pre and post-hospitalization expenses. Health insurance policies offer more comprehensive coverage and often include additional benefits such as maternity coverage, preventive care, and wellness programs. They are usually more expensive compared to mediclaim policies.

One of the major differences between mediclaim and health insurance is the scope of coverage. Mediclaim policies focus primarily on hospitalization expenses, while health insurance policies offer a more comprehensive coverage for a wider range of medical expenses.

Another difference is the flexibility of coverage. Mediclaim policies typically have fixed sum insured and policy period, whereas health insurance policies often offer the option to choose the sum insured, policy duration, and additional coverage options based on individual needs.

In conclusion, while both mediclaim and health insurance provide coverage for medical expenses, health insurance offers a broader and more comprehensive coverage compared to mediclaim. The choice between the two depends on individual needs, budget, and the level of coverage required.

Question-answer:

What is the difference between Mediclaim and health insurance?

Mediclaim and health insurance are terms often used interchangeably, but there is a subtle difference between the two. Mediclaim typically refers to a specific type of health insurance policy that covers hospitalization expenses, while health insurance is a broader term that can encompass a wider range of medical expenses.

Does Mediclaim cover outpatient expenses?

No, Mediclaim policies typically do not cover outpatient expenses. These policies are designed to cover hospitalization expenses only, such as room charges, doctor’s fees, and medical tests. Outpatient expenses like doctor’s visits, diagnostic tests, and medication are usually not covered under Mediclaim policies.

Can I buy Mediclaim and health insurance together?

Yes, it is possible to buy both Mediclaim and health insurance policies together. In fact, having both types of coverage can provide comprehensive protection against a wide range of medical expenses. Mediclaim can cover hospitalization expenses, while health insurance can cover outpatient expenses, preventive care, and other medical costs.