Benefits of Comprehensive Health Insurance Plan

When it comes to your health, nothing is more important than having a comprehensive health insurance plan. With such a plan, you can ensure that you have access to the best healthcare services and benefits available.

A comprehensive health insurance plan offers a wide range of benefits that can help you maintain your well-being and provide financial security in case of unexpected medical expenses. With this type of plan, you can enjoy:

- Extensive Coverage: A comprehensive health insurance plan covers a wide range of medical services, including doctor visits, hospital stays, surgeries, prescription medications, and preventive care. This means that you can receive the care you need without worrying about the cost.

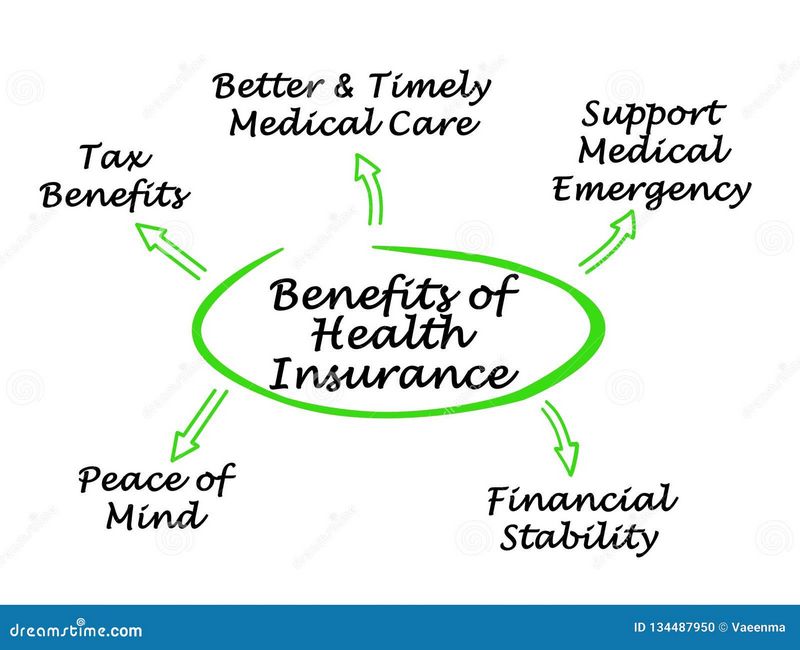

- Financial Protection: With a comprehensive health insurance plan, you can protect yourself from the high cost of medical treatments. In case of an accident or illness, your insurance will cover a significant portion of your expenses, reducing your out-of-pocket costs and preventing you from facing a financial burden.

- Peace of Mind: Knowing that you have a comprehensive health insurance plan can give you peace of mind. You can rest easy knowing that you are covered in case of any health-related emergencies or unexpected medical conditions.

- Access to Specialists: With a comprehensive health insurance plan, you have access to a network of healthcare providers and specialists. This means that you can receive specialized care, such as consultations with specialists, diagnostic tests, and treatments, without any hassle.

“A comprehensive health insurance plan is your key to a healthier and worry-free life. Don’t wait until it’s too late – get insured today!”

In conclusion, a comprehensive health insurance plan offers numerous advantages, including extensive coverage, financial protection, peace of mind, and access to specialists. By investing in such a plan, you can ensure that you and your loved ones are well-protected and have access to the best healthcare services available.

Overview

A comprehensive health insurance plan offers numerous benefits to individuals and families. Such a plan provides coverage for a wide range of medical services and treatments, ensuring that individuals have access to the care they need when they need it. With a comprehensive health insurance plan, individuals can receive preventive care, such as vaccinations and screenings, to detect and address health issues before they become more serious.

One of the key advantages of a comprehensive health insurance plan is the financial protection it provides. With this type of plan, individuals are protected from the high costs of medical care, including hospital stays, surgeries, and prescription medications. This financial protection can help individuals avoid significant medical debt and maintain their financial stability.

Another benefit of a comprehensive health insurance plan is the flexibility it offers. Individuals can choose from a variety of healthcare providers and specialists, allowing them to receive care from the providers they trust and feel comfortable with. In addition, these plans often include coverage for out-of-network providers, giving individuals the freedom to seek care from providers outside of their network when necessary.

A comprehensive health insurance plan also promotes overall wellness and preventive care. These plans often include coverage for wellness programs, such as gym memberships and weight loss programs, as well as coverage for preventive screenings and vaccinations. By promoting and supporting healthy behaviors, these plans help individuals take proactive steps towards maintaining their health and preventing future health issues.

In conclusion, a comprehensive health insurance plan offers a wide range of benefits, including access to a variety of medical services, financial protection, flexibility in choosing healthcare providers, and support for overall wellness. By investing in a comprehensive health insurance plan, individuals can ensure that they have the coverage and support they need to maintain their health and well-being.

Importance of Health Insurance

Health insurance is an essential part of comprehensive healthcare. It provides financial protection and peace of mind by covering the costs of medical treatments and services. With a comprehensive health insurance plan, individuals and families can access a wide range of benefits that can help them maintain good health and prevent future health issues.

One of the main benefits of having health insurance is the ability to receive timely and appropriate medical care. With a comprehensive plan, individuals can visit doctors and specialists, undergo necessary tests and screenings, and receive treatments without worrying about the high costs. This ensures that health issues are addressed promptly, improving the chances of successful treatment and recovery.

Health insurance also plays a crucial role in preventive care. Many comprehensive plans cover preventive services such as vaccinations, screenings, and annual check-ups. These preventive measures can help detect potential health problems early on, allowing for timely intervention and reducing the risk of developing serious conditions. Regular check-ups and screenings can also help individuals stay proactive about their health and make informed decisions about their lifestyle and healthcare choices.

In addition to medical care, health insurance often includes coverage for prescription medications. This can significantly reduce the out-of-pocket costs of necessary medications, making them more accessible and affordable. By ensuring access to medications, health insurance helps individuals manage chronic conditions and maintain their overall health and well-being.

Furthermore, having health insurance provides financial protection in case of unexpected medical emergencies or accidents. Comprehensive plans typically cover hospital stays, surgeries, and emergency services, which can be extremely costly without insurance. By having a health insurance plan, individuals can avoid the financial burden that often comes with unforeseen medical events.

In conclusion, health insurance is of utmost importance in today’s world. It offers comprehensive coverage and a wide range of benefits that promote good health, timely medical care, and financial protection. Investing in a comprehensive health insurance plan is a wise decision that can provide individuals and families with peace of mind and ensure access to quality healthcare when needed.

Comprehensive Health Insurance Explained

Comprehensive health insurance is a type of insurance plan that offers a wide range of benefits to individuals and families. It provides coverage for various medical expenses, including doctor visits, hospital stays, prescription medications, and preventive care.

One of the main advantages of a comprehensive health insurance plan is that it offers financial protection against unexpected medical costs. With this type of insurance, individuals and families can have peace of mind knowing that they are covered in case of emergencies or serious illnesses.

Another benefit of comprehensive health insurance is that it allows individuals to choose their preferred healthcare providers. This means that they can receive medical treatment from doctors and specialists of their choice, ensuring that they receive the best possible care.

Additionally, comprehensive health insurance often includes coverage for preventive care services, such as vaccinations, screenings, and wellness exams. These preventive measures can help individuals detect and address health issues early on, leading to better health outcomes and potentially lower healthcare costs in the long run.

In conclusion, a comprehensive health insurance plan offers numerous benefits to individuals and families. It provides financial protection, allows for choice of healthcare providers, and includes coverage for preventive care services. Investing in comprehensive health insurance is a wise decision for anyone looking to safeguard their health and well-being.

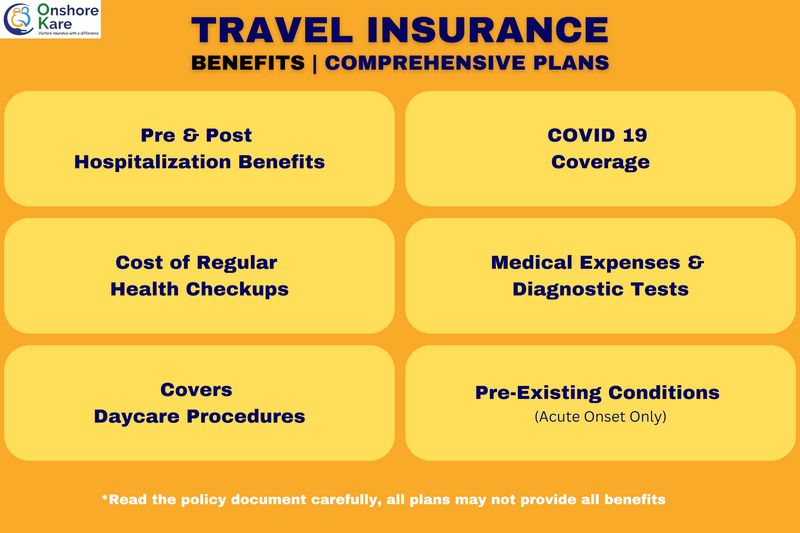

Coverage for Medical Expenses

With a comprehensive health insurance plan, you can rest assured knowing that your medical expenses will be covered. Whether it’s a routine check-up, a visit to the emergency room, or a major surgery, your insurance plan will take care of the costs. This means you won’t have to worry about the financial burden of medical bills and can focus on getting the care you need.

One of the benefits of a comprehensive health insurance plan is that it covers a wide range of medical services. This includes doctor visits, hospital stays, prescription medications, laboratory tests, and more. You’ll have access to a network of healthcare providers who accept your insurance, ensuring that you can receive the care you need from trusted professionals.

Another advantage of a comprehensive health insurance plan is that it provides coverage for both preventive and diagnostic services. This means that not only will your insurance cover the cost of regular check-ups and screenings, but it will also cover the cost of tests and procedures to diagnose and treat illnesses. This can help catch potential health issues early on and prevent them from becoming more serious and costly.

In addition to medical expenses, a comprehensive health insurance plan may also cover other healthcare services, such as mental health care, maternity care, and rehabilitation services. This ensures that you have access to a wide range of healthcare options and can receive the care you need, no matter what your health needs may be.

Access to a Wide Network of Healthcare Providers

When you have a comprehensive health insurance plan, you gain access to a wide network of healthcare providers. This means that you can choose from a large pool of doctors, specialists, hospitals, and clinics, ensuring that you receive the best care possible.

Having access to a wide network of healthcare providers is especially beneficial if you have specific medical needs or conditions. You can easily find specialists who have expertise in your particular condition and can provide you with the specialized care you require.

With a comprehensive health insurance plan, you can also take advantage of the benefits of network discounts. Many insurance plans negotiate discounted rates with healthcare providers, which can help reduce your out-of-pocket expenses. This means that you can receive high-quality care at a more affordable cost.

In addition, having access to a wide network of healthcare providers gives you the flexibility to choose the provider that best fits your needs. Whether you prefer a specific doctor or hospital, or you want to explore different options, a comprehensive health insurance plan allows you to make informed decisions about your healthcare.

In summary, a comprehensive health insurance plan offers the benefits of access to a wide network of healthcare providers. This ensures that you can receive the best care possible, have access to specialized treatment if needed, take advantage of network discounts, and have the flexibility to choose the provider that best fits your needs. Investing in a comprehensive health insurance plan is a smart choice for your overall health and well-being.

Preventive Care Services

A comprehensive health insurance plan offers a wide range of benefits, including access to preventive care services. These services play a crucial role in maintaining good health and preventing the onset of serious illnesses and conditions. By taking advantage of the preventive care services available through your insurance plan, you can stay proactive about your health and catch any potential issues early on.

Preventive care services typically include regular check-ups, screenings, and vaccinations. These services are designed to detect any potential health problems early, when they are often easier to treat and manage. By receiving regular check-ups, you can ensure that your health is on track and address any concerns before they become serious.

Screenings are another important part of preventive care. These tests can help identify risk factors and detect early signs of conditions such as cancer, heart disease, and diabetes. By catching these conditions early, you can often prevent them from progressing or manage them more effectively.

Vaccinations are also an essential component of preventive care. By staying up to date on your immunizations, you can protect yourself and others from contagious diseases. Immunizations are especially important for children, as they can help prevent the spread of diseases in schools and communities.

In conclusion, a comprehensive health insurance plan that includes preventive care services offers numerous benefits. By taking advantage of these services, you can stay proactive about your health, catch any potential issues early, and prevent the onset of serious illnesses and conditions. Investing in a comprehensive insurance plan is an investment in your long-term health and well-being.

Prescription Drug Coverage

As part of a comprehensive health insurance plan, prescription drug coverage provides numerous benefits to policyholders. With this coverage, individuals can have peace of mind knowing that their necessary medications will be affordable and accessible.

One of the key advantages of prescription drug coverage is the financial savings it offers. Rather than paying the full cost of prescription medications out of pocket, policyholders can take advantage of discounted rates negotiated by the insurance company. This can result in significant savings, especially for individuals who require multiple medications on a regular basis.

In addition to cost savings, prescription drug coverage also ensures that individuals have access to a wide range of medications. The insurance plan typically includes a formulary, which is a list of approved medications that are covered. This means that policyholders can easily obtain the medications they need without having to worry about their availability or cost.

Another benefit of prescription drug coverage is the convenience it provides. Instead of having to navigate the complicated process of purchasing medications on their own, policyholders can simply present their insurance card at the pharmacy and receive their medications. This saves time and eliminates the hassle of dealing with paperwork and reimbursement claims.

Overall, prescription drug coverage is an essential component of a comprehensive health insurance plan. It offers financial savings, access to a wide range of medications, and convenience for policyholders. By including this coverage in their insurance plan, individuals can ensure that they have the necessary medications to maintain their health and well-being.

Mental Health Services

When it comes to your overall well-being, mental health is just as important as physical health. That’s why having comprehensive health insurance coverage that includes mental health services is so important. With a comprehensive health insurance plan, you can have peace of mind knowing that you have access to the benefits and support you need to take care of your mental health.

One of the key benefits of a comprehensive health insurance plan is the coverage it provides for mental health services. This includes access to licensed therapists, psychologists, and psychiatrists who can provide counseling, therapy, and medication management. Whether you’re dealing with stress, anxiety, depression, or any other mental health issue, having access to these professionals can make a world of difference in your overall well-being.

Additionally, a comprehensive health insurance plan can also cover the cost of mental health medications. This can be a significant financial relief, as many mental health medications can be expensive. With insurance coverage, you can focus on your treatment and recovery without worrying about the cost of your medications.

Furthermore, a comprehensive health insurance plan may also cover alternative therapies for mental health, such as acupuncture, yoga, or meditation. These therapies can be beneficial for managing stress, anxiety, and other mental health conditions. Having insurance coverage for these alternative therapies can provide you with additional options for improving your mental well-being.

In conclusion, having a comprehensive health insurance plan that includes mental health services is essential for taking care of your overall well-being. With access to licensed professionals, coverage for medications, and options for alternative therapies, you can prioritize your mental health and ensure that you have the support you need. Don’t underestimate the importance of mental health, and make sure you have the insurance coverage necessary to take care of it.

Maternity and Newborn Care

When it comes to your health, having a comprehensive insurance plan is essential. One of the major benefits of such a plan is the coverage it provides for maternity and newborn care. Pregnancy and childbirth can be a wonderful but also a challenging time for women, and having the right insurance coverage can give you peace of mind knowing that you and your baby will receive the best care possible.

A comprehensive health insurance plan that includes maternity and newborn care covers a wide range of services, including prenatal care, labor and delivery, and postnatal care for both mother and baby. This means that you can have access to regular check-ups, screenings, and tests during your pregnancy to ensure the health and well-being of both you and your baby.

In addition, a comprehensive plan also covers the costs of labor and delivery, including hospital stays, medical procedures, and medications. This is especially important as childbirth can be expensive, and having insurance coverage can help alleviate the financial burden associated with these services.

Furthermore, a comprehensive insurance plan also extends coverage to postnatal care, ensuring that both mother and baby receive the necessary medical attention and support after childbirth. This may include follow-up visits, breastfeeding support, and screenings for any potential health issues that may arise during the early stages of your baby’s life.

In conclusion, having a comprehensive health insurance plan that includes maternity and newborn care is crucial for ensuring the health and well-being of both mother and baby. It provides coverage for a wide range of services, from prenatal care to postnatal care, and helps alleviate the financial burden associated with childbirth. With the right insurance plan, you can focus on enjoying this special time in your life, knowing that you and your baby are well taken care of.

Rehabilitation and Physical Therapy

As part of a comprehensive health insurance plan, rehabilitation and physical therapy services are essential for individuals recovering from injuries or surgeries. These services help patients regain their strength, mobility, and independence, allowing them to return to their normal activities as quickly as possible.

With comprehensive insurance coverage, individuals have access to a wide range of rehabilitation and physical therapy options. This includes sessions with trained therapists who specialize in various areas such as orthopedics, neurology, and sports medicine. These professionals work closely with patients to create personalized treatment plans that address their specific needs and goals.

Rehabilitation and physical therapy services can involve a variety of techniques and modalities, including exercises, manual therapy, electrical stimulation, heat and cold therapy, and more. These interventions help improve muscle strength, flexibility, balance, and endurance, while also reducing pain and inflammation.

Furthermore, comprehensive insurance plans often cover additional services that complement rehabilitation and physical therapy, such as occupational therapy and speech therapy. These services can be particularly beneficial for individuals who have experienced neurological conditions or have difficulty with daily activities and communication.

By including rehabilitation and physical therapy in a comprehensive health insurance plan, individuals can ensure that they receive the necessary care and support to recover from injuries and surgeries effectively. These services not only promote physical healing but also improve overall well-being and quality of life.

Coverage for Chronic Conditions

A comprehensive health insurance plan provides coverage for chronic conditions, ensuring that individuals with ongoing health issues receive the necessary medical care and support. This type of insurance offers numerous benefits for those living with chronic conditions, such as diabetes, asthma, or heart disease.

With comprehensive health insurance, individuals have access to a wide range of medical services and treatments for their chronic conditions. This includes regular check-ups, specialist consultations, and prescription medications. The insurance plan covers the cost of these services, reducing the financial burden on individuals and their families.

Furthermore, comprehensive health insurance often includes coverage for necessary medical equipment and supplies needed to manage chronic conditions. This may include insulin pumps for diabetics, inhalers for asthma sufferers, or blood pressure monitors for individuals with heart disease. Having access to these essential tools can greatly improve the quality of life for those with chronic conditions.

In addition to medical services and equipment, comprehensive health insurance also provides coverage for preventive care and wellness programs. This means that individuals with chronic conditions can receive regular screenings, vaccinations, and counseling to help manage their conditions and prevent further complications. These preventive measures can significantly reduce the risk of hospitalization and emergency room visits.

Overall, a comprehensive health insurance plan offers invaluable benefits for individuals living with chronic conditions. It ensures access to necessary medical care, reduces financial strain, and promotes overall well-being. With the right insurance coverage, individuals can effectively manage their chronic conditions and lead healthier, more fulfilling lives.

Emergency Medical Services

When it comes to your health, having a comprehensive health insurance plan is essential. One of the key benefits of such a plan is access to emergency medical services. Whether you have a sudden illness or a serious injury, knowing that you are covered can provide peace of mind and ensure that you receive the necessary care without delay.

A comprehensive health insurance plan includes coverage for emergency room visits, ambulance services, and urgent care facilities. This means that if you find yourself in a medical emergency, you can rest assured knowing that your insurance will cover the costs associated with these services. This can be particularly important if you are traveling or live in an area where access to medical facilities may be limited.

In addition to covering the cost of emergency medical services, a comprehensive health insurance plan also provides access to a network of healthcare providers. This means that you can choose from a wide range of doctors, specialists, and hospitals, ensuring that you receive the best possible care for your specific needs.

Furthermore, a comprehensive health insurance plan may also offer additional benefits such as coverage for prescription medications, preventive care services, and mental health treatment. This holistic approach to healthcare ensures that you have access to the necessary resources to maintain your overall well-being.

In conclusion, having a comprehensive health insurance plan that includes coverage for emergency medical services is crucial. It provides financial protection in case of unexpected medical emergencies and ensures that you receive timely and appropriate care. Don’t wait until it’s too late – invest in your health and secure a comprehensive health insurance plan today.

Out-of-Network Coverage

A comprehensive health insurance plan provides coverage for medical services received from both in-network and out-of-network providers. This means that even if you choose to see a healthcare provider who is not part of your insurance company’s network, your plan will still offer some level of coverage for those services. This can be especially beneficial if you live in an area where there are limited in-network providers or if you need to see a specialist who is not in your network.

With out-of-network coverage, you have the flexibility to choose the healthcare providers that best suit your needs, without worrying about the cost. While the coverage for out-of-network services may be lower than for in-network services, having some level of coverage can help reduce your out-of-pocket expenses and make healthcare more affordable.

It’s important to note that out-of-network coverage may come with certain limitations or requirements. For example, your plan may require you to obtain prior authorization before seeking out-of-network care, or you may be responsible for paying a higher percentage of the cost for out-of-network services. However, the ability to receive some level of coverage for out-of-network services can provide peace of mind and ensure that you have access to the healthcare you need, regardless of network restrictions.

Cost Savings and Financial Protection

A comprehensive health insurance plan offers a range of benefits that can lead to significant cost savings and provide financial protection for individuals and families. With this type of insurance, you have access to a wide network of healthcare providers, which means you can choose the most cost-effective options for your medical needs. This can help you save money by avoiding unnecessary expenses and receiving discounted rates for services.

In addition, a comprehensive health insurance plan typically covers a variety of preventive care services, such as vaccinations, screenings, and annual check-ups. By taking advantage of these services, you can detect and address potential health issues early on, which can help prevent more serious and expensive medical conditions in the future. This proactive approach to healthcare can save you money in the long run by reducing the need for costly treatments and hospitalizations.

Furthermore, comprehensive health insurance provides financial protection in the event of unexpected medical emergencies. With this type of coverage, you can have peace of mind knowing that you won’t be burdened with exorbitant medical bills if you require emergency surgery, hospitalization, or specialized treatments. Instead, your insurance plan will cover a significant portion of these costs, ensuring that you can focus on your recovery without worrying about financial strain.

In summary, a comprehensive health insurance plan offers cost savings and financial protection through its extensive network of providers, coverage of preventive care services, and assistance with unexpected medical expenses. Investing in this type of insurance can provide you and your loved ones with the peace of mind and financial security needed to navigate the complexities of healthcare.

Additional Benefits and Services

Choosing a comprehensive health insurance plan offers a wide range of benefits and services that go beyond basic medical coverage. With a comprehensive plan, you can enjoy additional benefits that help you maintain your overall well-being and provide peace of mind.

One of the key advantages of a comprehensive health insurance plan is the access to preventive care services. These services include routine check-ups, vaccinations, and screenings for various health conditions. By taking advantage of these preventive measures, you can detect any potential health issues early on and take necessary steps to address them, saving both time and money in the long run.

In addition to preventive care, comprehensive health insurance plans often offer coverage for prescription medications. This means that you can have peace of mind knowing that your essential medications are covered, reducing the financial burden of expensive prescriptions. Having access to affordable medications can significantly improve your quality of life and help you manage chronic conditions effectively.

Comprehensive health insurance plans also provide coverage for specialized services such as mental health care, maternity care, and rehabilitation services. These additional services ensure that you have access to the care you need in various situations, allowing you to receive comprehensive and holistic healthcare.

Furthermore, many comprehensive health insurance plans offer additional benefits such as discounted gym memberships, wellness programs, and access to alternative therapies like acupuncture or chiropractic care. These benefits promote a healthy lifestyle and provide you with options to explore different approaches to managing your health.

In conclusion, opting for a comprehensive health insurance plan offers numerous additional benefits and services that go beyond basic medical coverage. From preventive care services to coverage for prescription medications and specialized services, a comprehensive plan ensures that you have access to the care you need to maintain your well-being and live a healthy life.

Question-answer:

What is a comprehensive health insurance plan?

A comprehensive health insurance plan is a type of insurance that covers a wide range of medical expenses, including hospital stays, doctor visits, prescription medications, and preventive care.

What are the advantages of a comprehensive health insurance plan?

A comprehensive health insurance plan offers several advantages. Firstly, it provides coverage for a wide range of medical expenses, giving you financial protection in case of unexpected healthcare needs. Secondly, it often includes preventive care services, such as vaccinations and screenings, which can help detect and prevent illnesses early on. Additionally, comprehensive health insurance plans usually have a larger network of healthcare providers, giving you more options for choosing doctors and specialists.

How does a comprehensive health insurance plan differ from other types of health insurance?

A comprehensive health insurance plan differs from other types of health insurance, such as catastrophic or basic plans, in that it provides coverage for a wider range of medical expenses. While catastrophic plans typically only cover major medical expenses after a high deductible has been met, comprehensive plans offer more comprehensive coverage for both preventive and major medical expenses.

Are there any disadvantages to having a comprehensive health insurance plan?

While there are several advantages to having a comprehensive health insurance plan, there are also some potential disadvantages. One disadvantage is that comprehensive plans tend to have higher premiums compared to other types of health insurance. Additionally, comprehensive plans may have more restrictions and limitations on coverage, such as requiring referrals for specialist visits or pre-authorization for certain procedures. It’s important to carefully review the terms and conditions of a comprehensive health insurance plan before purchasing to ensure it meets your specific needs.

Can I choose my own doctors and hospitals with a comprehensive health insurance plan?

Yes, one of the advantages of a comprehensive