What Are the Drawbacks Of Including Your Parents In Your Existing Health Insurance Policy?

Adding your parents to your existing health insurance policy may seem like a convenient option, but it comes with its fair share of drawbacks. While it may provide them with coverage and access to healthcare services, there are several factors to consider before making this decision.

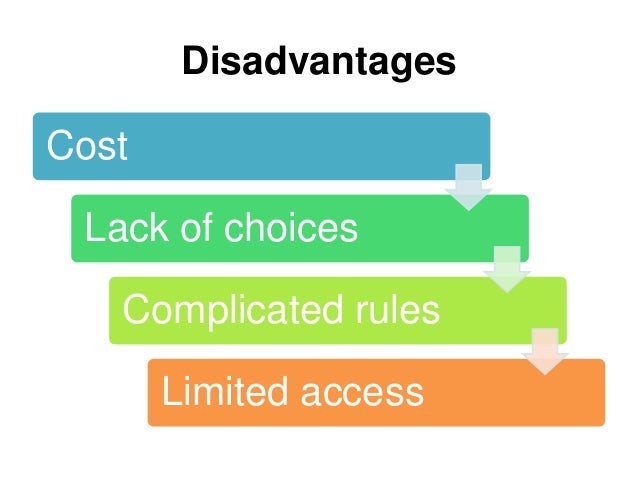

One of the main drawbacks of adding your parents to your policy is the potential increase in premiums. Insurance companies often charge higher rates for policies that cover multiple individuals, especially older adults who may require more medical attention. This can result in a significant increase in your monthly premiums, putting a strain on your budget.

Another disadvantage is the limitations it may impose on your own healthcare choices. By adding your parents to your policy, you may be limited to selecting healthcare providers within a specific network, which may not include their preferred doctors or hospitals. This can be particularly problematic if your parents have established relationships with certain healthcare professionals or require specialized care.

Additionally, adding your parents to your health insurance policy may affect the level of coverage you receive. Insurance plans often have a maximum coverage limit, and adding additional individuals to the policy may reduce the amount of coverage available to each person. This could result in higher out-of-pocket expenses for both you and your parents, making it more difficult to afford necessary medical treatments.

While adding your parents to your current health insurance policy may seem like a convenient solution, it’s important to carefully consider the potential drawbacks. Before making a decision, it’s advisable to compare the costs and coverage options of alternative insurance plans to ensure you make the best choice for both your parents’ healthcare needs and your own financial situation.

Financial Burden

Adding your parents to your existing health insurance policy can create a significant financial burden. Insurance providers often charge additional premiums for each family member added to the policy, including parents. These extra costs can quickly add up, especially if you have multiple parents to include.

Furthermore, having your parents on your health insurance policy may also increase your deductibles and out-of-pocket expenses. Insurance companies may require higher deductibles or co-pays for policies that cover more individuals. This means that you may have to pay more for medical services and prescriptions, which can strain your finances even further.

Another drawback is that your parents’ health conditions and medical needs may affect your policy’s premiums. Insurance providers take into account the age, pre-existing conditions, and overall health of each individual covered by the policy when determining the premium rates. If your parents have any chronic illnesses or require frequent medical care, it can result in higher premiums for your entire family.

Additionally, if your parents have their own health insurance policies, adding them to yours may not provide significant benefits. In this case, you would be paying extra premiums for redundant coverage, which is an unnecessary expense.

In summary, while adding your parents to your current health insurance policy may seem like a convenient option, it can create a financial burden due to additional premiums, increased deductibles, and potential higher premium rates. It is important to carefully consider the financial implications before making a decision.

Reduced Coverage

One of the drawbacks of adding your parents to your existing health insurance policy is the potential for reduced coverage. When you include your parents on your policy, the insurance company may limit the benefits and coverage options available to you. This means that you may not have access to the same level of coverage that you had before adding your parents.

Reduced coverage can have a significant impact on your health and well-being. It may mean that you have to pay higher out-of-pocket costs for medical expenses or that certain treatments and medications are no longer covered by your insurance. This can be especially problematic if you or your parents have pre-existing health conditions that require ongoing care and treatment.

Furthermore, reduced coverage can also affect your ability to choose your own healthcare providers. Some insurance policies that include parents may have a limited network of providers, which means that you may have to switch doctors or specialists to stay within your insurance network. This can disrupt your continuity of care and make it more difficult to receive the necessary medical treatment.

In conclusion, while adding your parents to your current health insurance policy may seem like a convenient option, it is important to consider the potential drawbacks, including reduced coverage. Before making a decision, carefully review your policy and speak with your insurance provider to fully understand how adding your parents will impact your coverage and healthcare options.

Higher Premiums

Adding your parents to your existing health insurance policy can result in higher premiums. Insurance companies calculate premiums based on the risk they assume by providing coverage. When you add additional individuals to your policy, such as your parents, the insurance company may consider them to be higher-risk individuals, especially if they have pre-existing medical conditions or are older. As a result, your premiums may increase to account for the increased risk.

Higher premiums can be a significant drawback of adding your parents to your current health insurance policy. You may find yourself paying more each month for the same level of coverage. This can put a strain on your finances and make it more difficult to manage your budget effectively.

In addition to higher premiums, adding your parents to your health insurance policy may also result in changes to your coverage. Some insurance companies may limit the benefits available to your parents, such as excluding coverage for certain medical conditions or treatments. It’s important to carefully review the terms of your policy before adding your parents to ensure that their healthcare needs will be adequately covered.

If you decide to add your parents to your current health insurance policy, it’s essential to consider the potential drawbacks, including higher premiums and changes to your coverage. It may be worth exploring other options, such as separate health insurance policies for your parents or alternative healthcare coverage options, to ensure that everyone’s healthcare needs are met without placing an excessive financial burden on yourself.

Increased Deductibles

One of the drawbacks of adding your parents to your current health insurance policy is the possibility of increased deductibles. When you include your parents in your policy, the insurance company may raise the deductible amount for your entire family. A deductible is the amount of money you must pay out of pocket before your insurance coverage kicks in. With higher deductibles, you may find yourself responsible for a larger portion of your medical expenses.

Higher deductibles can be particularly burdensome for families who are already struggling to meet their financial obligations. It can be difficult to budget for unexpected medical expenses when the deductible is higher. Additionally, if your parents have existing health conditions or require frequent medical care, the increased deductible can quickly add up.

It’s important to carefully review the details of your policy before adding your parents to ensure you understand the potential impact on your deductibles. Consider speaking with an insurance representative to discuss your options and determine if there are alternative insurance plans that may better suit your needs.

Longer Wait Times

One of the drawbacks of adding your parents to your existing health insurance policy is the potential for longer wait times. When you include your parents in your policy, it means that they will also have access to the same healthcare providers and services that you do. This can lead to increased demand for appointments and treatments, which may result in longer wait times for everyone.

With more people seeking medical care through the same insurance policy, it can be challenging for healthcare providers to accommodate everyone in a timely manner. This can be especially problematic for individuals with urgent or time-sensitive health issues, as they may have to wait longer to receive the necessary care. Longer wait times can also result in delayed diagnoses and treatments, potentially affecting the overall health outcomes for both you and your parents.

Additionally, longer wait times can also impact the quality of care received. When healthcare providers are rushed and overwhelmed due to increased demand, they may not have sufficient time to thoroughly evaluate and address each patient’s needs. This can lead to rushed appointments, incomplete examinations, and a reduced level of personalized care.

In some cases, longer wait times may also necessitate seeking care from alternative providers or facilities that may not be as convenient or familiar. This can result in additional travel time and inconvenience for both you and your parents.

Overall, while adding your parents to your current health insurance policy may have its benefits, it’s important to consider the potential drawbacks, including longer wait times for healthcare services. It’s crucial to weigh the pros and cons and assess whether the advantages outweigh the disadvantages in your specific situation.

Limited Provider Network

One of the drawbacks of adding your parents to your existing health insurance policy is the limited provider network. Many insurance plans have a specific network of healthcare providers that they work with, and going outside of this network can result in higher out-of-pocket costs or even denial of coverage. When you add your parents to your policy, they may not have access to the same network of providers as you do. This can limit their options for choosing doctors, specialists, and hospitals.

Having a limited provider network can be particularly problematic if your parents have established relationships with certain doctors or specialists who are not in the network. They may have to switch healthcare providers or travel further for medical care, which can be inconvenient and disruptive to their healthcare routine. Additionally, if your parents require specialized care that is only available outside of the network, they may have to pay significantly higher costs out-of-pocket.

It’s important to carefully review the provider network of your existing health insurance policy before adding your parents. Consider whether the network includes the healthcare providers that your parents currently see or would like to see in the future. If the network is limited or doesn’t meet their needs, it may be worth exploring other insurance options that provide a broader provider network.

Another consideration is that insurance plans can change their provider networks from year to year. While a plan may have a robust network now, there is no guarantee that it will remain the same in the future. This means that even if your parents are able to access their preferred providers now, they may not be able to do so in the future if the network changes.

In summary, adding your parents to your current health insurance policy can come with the drawback of a limited provider network. It’s important to carefully consider whether the network meets their healthcare needs and if there are any potential costs or inconveniences associated with accessing healthcare outside of the network. Exploring other insurance options and staying informed about potential changes to the provider network can help ensure that your parents have the necessary access to healthcare providers.

Loss of Privacy

Adding your parents to your existing health insurance policy can result in a loss of privacy. When you include your parents in your insurance coverage, they will have access to your personal health information, including medical records and claims. This means that they will be able to see details about your health conditions, treatments, and any other sensitive information that you may not want to share with them.

Furthermore, having your parents on your health insurance policy means that they may be involved in decisions about your healthcare. They may have access to information about your doctor visits, medications, and other health-related matters. This can lead to a loss of autonomy and control over your own healthcare decisions.

In addition, having your parents on your health insurance policy may also result in them having a say in your treatment options. They may have different opinions or preferences when it comes to your healthcare, and this can create conflicts or disagreements. It can be challenging to navigate these situations and maintain your own autonomy and privacy.

Overall, while adding your parents to your current health insurance policy may provide them with access to healthcare coverage, it can also result in a loss of privacy and control over your own healthcare decisions. It is important to carefully consider the implications and potential drawbacks before making this decision.

Conflicting Medical Needs

Adding your parents to your existing health insurance policy can lead to conflicting medical needs. Each person has their own health issues and may require different types of coverage and treatments. By including your parents on your policy, you may find that the coverage you previously had is no longer sufficient to meet the needs of everyone.

For example, if you have a pre-existing condition that requires regular doctor visits and specialized medication, your parents’ medical needs may not be covered under the same policy. This can result in increased out-of-pocket expenses for both you and your parents.

Additionally, the insurance company may impose certain restrictions or limitations on coverage for your parents, such as higher deductibles or co-pays. This can further complicate the situation and make it more difficult to afford necessary medical treatments for both parties.

Furthermore, including your parents on your health insurance policy may also impact the quality of care you receive. With the addition of more individuals, the network of doctors and hospitals available to you may become more limited. This can result in longer wait times for appointments and reduced access to specialized care.

In conclusion, while adding your parents to your current health insurance policy may seem like a convenient option, it can lead to conflicting medical needs and potentially inadequate coverage for everyone involved. It is important to carefully consider the potential drawbacks before making a decision.

Difficulty in Changing Plans

Adding your parents to your existing health insurance policy may seem like a convenient option, but it can also come with some disadvantages. One of the main challenges is the difficulty in changing plans once your parents are included in your policy.

Insurance policies are often structured in a way that allows for changes to be made during specific enrollment periods. However, adding your parents to your health insurance policy may limit your ability to switch to a different plan or provider outside of these enrollment periods.

This lack of flexibility can be problematic if you find that your current policy no longer meets your needs or if you come across a better insurance option. You may be stuck with your existing policy, including your parents, until the next enrollment period, which could be months away.

Additionally, changing plans within the same insurance company may also come with restrictions and limitations. Some insurance companies may require a waiting period before you can make changes, and others may only offer limited options for switching plans.

Overall, the difficulty in changing plans is an important factor to consider when deciding whether to add your parents to your current health insurance policy. It’s essential to carefully weigh the benefits and disadvantages before making a decision that could potentially limit your future insurance options.

Additional Paperwork

One of the drawbacks of adding your parents to your existing health insurance policy is the additional paperwork that may be required. When you add your parents to your policy, you will likely need to provide documentation to prove their relationship to you, such as birth certificates or marriage certificates. This paperwork can be time-consuming to gather and may require multiple trips to government offices or other institutions.

In addition to proving the relationship, you may also need to provide documentation of your parents’ income and any other relevant financial information. This is because adding your parents to your health insurance policy may affect their eligibility for certain government programs or subsidies. The insurance company will want to ensure that your parents meet the necessary criteria before approving their coverage.

Furthermore, the additional paperwork required for adding your parents to your policy may also include filling out forms and providing information about their medical history. This is because the insurance company will want to assess the health risks and potential costs associated with covering your parents. They may require detailed information about any pre-existing conditions, previous medical treatments, and current medications.

In conclusion, while adding your parents to your current health insurance policy can provide them with much-needed coverage, it also comes with additional paperwork. This includes proving the relationship, providing financial information, and disclosing medical history. It’s important to be prepared for this paperwork and to allow yourself enough time to gather all the necessary documents to ensure a smooth enrollment process for your parents.

Loss of Independence

One of the drawbacks of adding your parents to your current health insurance policy is the potential loss of independence. When you include your parents in your policy, you may no longer have full control over your own healthcare decisions. Insurance policies often have specific guidelines and restrictions, and these may limit your options for choosing healthcare providers or treatments.

In addition, including your parents in your policy may also result in a loss of privacy. Health insurance policies typically require sharing personal information and medical history, and this information may become accessible to your parents. This can be a sensitive issue, especially if you prefer to keep certain aspects of your health private.

Furthermore, adding your parents to your health insurance policy may also lead to conflicts and disagreements. Different generations may have different opinions and priorities when it comes to healthcare. This can create tension and make it difficult to make decisions that satisfy everyone involved.

Lastly, including your parents in your policy may also have financial implications. Insurance premiums may increase when additional individuals are added to the policy, and this can put a strain on your budget. Additionally, if your parents have pre-existing health conditions, the insurance company may impose higher deductibles or co-pays, which can further impact your financial situation.

In conclusion, while there may be certain benefits to adding your parents to your current health insurance policy, it is important to consider the potential loss of independence. This includes limitations on healthcare choices, a loss of privacy, conflicts and disagreements, and potential financial implications. It is crucial to weigh these factors carefully before making a decision.

Inability to Customize Coverage

One of the drawbacks of adding your parents to your existing health insurance policy is the inability to customize coverage. When you have your own insurance policy, you have the ability to choose the specific coverage options that best suit your needs. However, when you add your parents to your policy, you may not have the same level of control over the coverage they receive.

Insurance policies are designed to provide a range of coverage options, but these options may not align with your parents’ specific health needs. For example, if your parents require certain medications or treatments that are not covered by your policy, they may be left without the necessary coverage.

Additionally, insurance policies often have different deductibles, copayments, and out-of-pocket maximums for different types of coverage. If your parents have different healthcare needs than you do, they may be subject to higher costs or limited coverage under your policy.

Furthermore, adding your parents to your existing health insurance policy may also limit your ability to make changes to your coverage. For example, if you want to switch to a different insurance provider or adjust your coverage options, you may need to consider how these changes will affect your parents’ coverage as well.

Overall, while adding your parents to your current health insurance policy may seem like a convenient option, it can result in limitations and compromises in terms of coverage. It is important to carefully consider the specific healthcare needs of your parents before making a decision.

Impact on Future Eligibility

Adding your parents to your existing health insurance policy may have some drawbacks in terms of future eligibility. One of the main concerns is that it can limit your options when it comes to choosing a new insurance policy in the future. Insurance companies may view the addition of your parents as a risk factor, especially if they have pre-existing health conditions or are older.

If you decide to switch insurance providers or policies, you may find that some companies are unwilling to offer you coverage or charge you higher premiums due to the increased risk associated with covering your parents. This can limit your ability to shop around for the best insurance options and may result in higher costs for you in the long run.

Additionally, adding your parents to your current health insurance policy may impact your eligibility for certain types of insurance coverage, such as employer-sponsored plans. Some employers may have specific rules and regulations regarding who can be covered under their policies, and adding your parents may not meet their criteria.

It’s important to carefully consider the potential impact on your future eligibility before adding your parents to your current health insurance policy. While it may provide immediate benefits and coverage for your parents, it could limit your options and potentially increase your costs in the future.

Complex Coordination of Benefits

One of the drawbacks of adding your parents to your current health insurance policy is the complex coordination of benefits. When you add your parents to your policy, it can become challenging to navigate the different insurance coverages and determine which policy will cover specific health expenses. This can lead to confusion and delays in getting the necessary healthcare.

Furthermore, coordinating benefits between multiple insurance policies can result in additional paperwork and administrative tasks. You may need to submit claims to different insurance companies and provide documentation to prove that the expenses are eligible for coverage under each policy. This can be time-consuming and frustrating, especially if you are already dealing with other health-related issues.

Moreover, the coordination of benefits can also lead to potential conflicts between the insurance companies. Each insurance company may have different rules and regulations regarding coverage, deductibles, and copayments. Trying to navigate these differences and ensure that all parties involved are properly reimbursed can be a complex and stressful process.

In some cases, the existing policy may not provide sufficient coverage for both you and your parents. This means that you may need to upgrade your policy or purchase additional coverage, which can result in higher premiums and out-of-pocket expenses. It’s essential to carefully review your policy and consider the potential financial implications before adding your parents to your current health insurance policy.

Question-answer:

What are the disadvantages of adding your parents to your current health insurance policy?

Adding your parents to your current health insurance policy can result in higher premiums for you. It may also limit your coverage options, as some insurance providers have restrictions on the number of dependents that can be added to a policy. Additionally, if your parents have pre-existing conditions or require more medical care, it could increase the overall cost of your insurance.

Will adding my parents to my current health insurance policy affect my own coverage?

Yes, adding your parents to your current health insurance policy may affect your own coverage. It can result in higher premiums for you and may limit your coverage options. Additionally, if your parents have pre-existing conditions or require more medical care, it could increase the overall cost of your insurance.

Can I add my parents to my current health insurance policy without any disadvantages?

Adding your parents to your current health insurance policy may come with some disadvantages. It can result in higher premiums for you and may limit your coverage options. Additionally, if your parents have pre-existing conditions or require more medical care, it could increase the overall cost of your insurance. However, it’s important to consider your specific situation and weigh the pros and cons before making a decision.

Are there any alternatives to adding my parents to my current health insurance policy?

Yes, there are alternatives to adding your parents to your current health insurance policy. They can explore other health insurance options, such as purchasing their own individual policy or enrolling in a government-sponsored healthcare program. Additionally, they may be eligible for Medicare or Medicaid, depending on their age and income.

What factors should I consider before adding my parents to my current health insurance policy?

Before adding your parents to your current health insurance policy, you should consider several factors. These include the cost of adding them, the impact on your own coverage and premiums, the coverage options available, and whether your parents have any pre-existing conditions or require more medical care. It’s important to carefully evaluate these factors and determine whether adding them to your policy is the best option for your specific situation.