15 Terms You Must Know Before Buying Health Insurance

When it comes to buying health insurance, it’s important to know the terms and understand what they mean before making a purchase. With so many options and plans available, it can be overwhelming to navigate the world of health insurance. However, by familiarizing yourself with these essential terms, you can make an informed decision that best suits your needs.

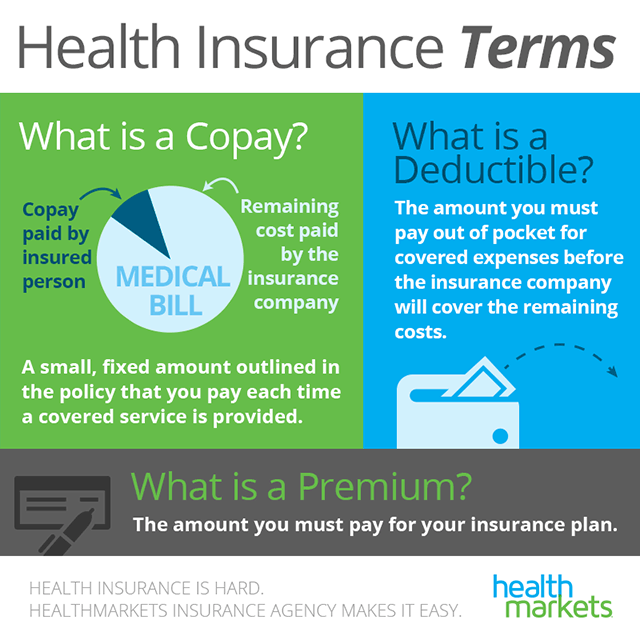

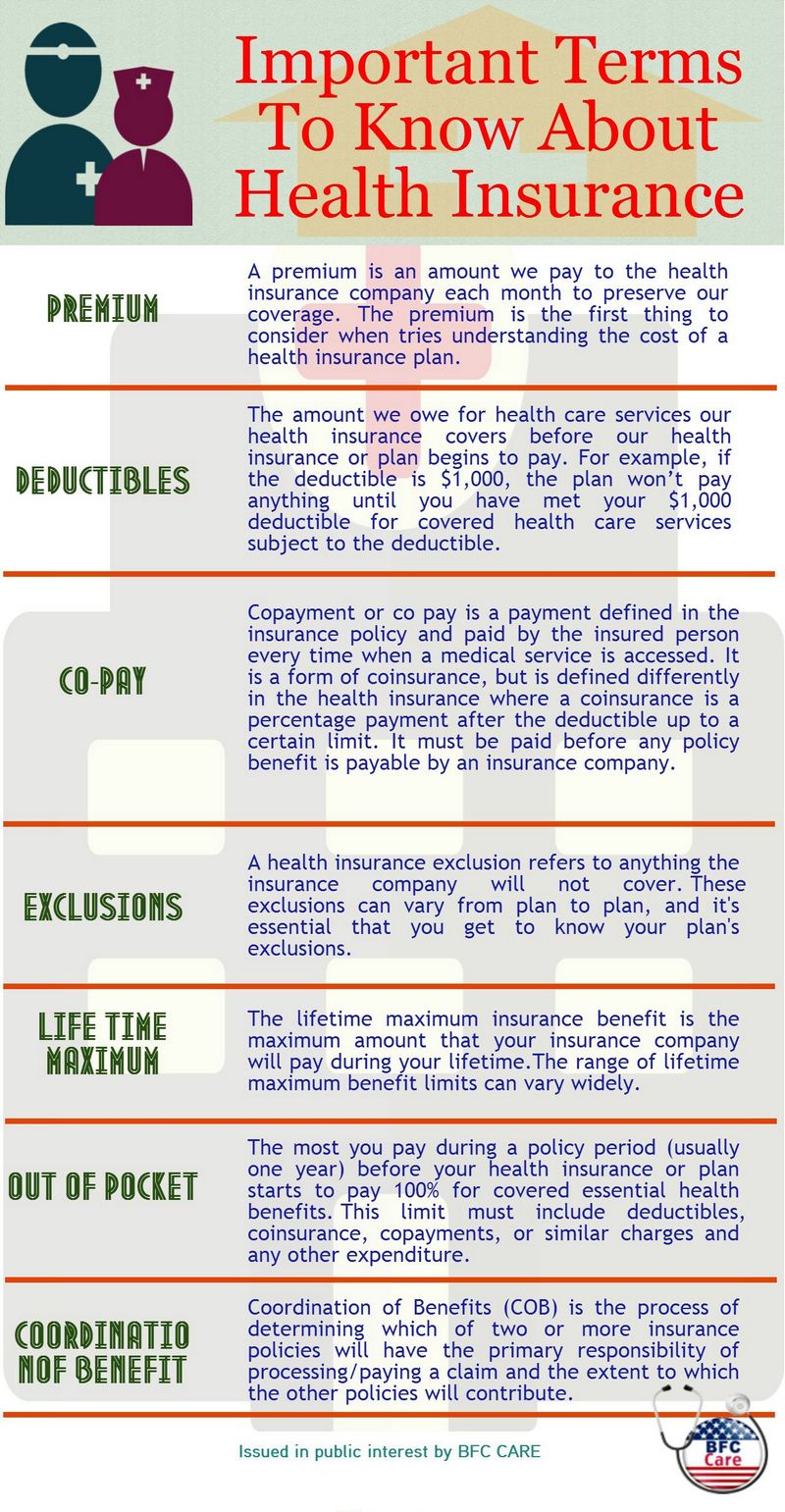

One of the most important terms to know is “premium.” This refers to the amount of money you pay each month for your health insurance coverage. Understanding the premium is crucial because it directly affects your monthly budget and overall affordability of the plan.

Another key term is “deductible.” This is the amount of money you must pay out of pocket before your insurance coverage kicks in. It’s important to consider the deductible when choosing a plan, as a higher deductible may mean lower monthly premiums but higher out-of-pocket costs.

Co-payment, or “co-pay,” is another term you should be familiar with. This is the fixed amount of money you pay for a specific medical service or prescription medication. Co-pays can vary depending on the type of service or medication, so understanding this term can help you budget for your healthcare expenses.

Other important terms to know include “out-of-pocket maximum,” which is the most you’ll have to pay for covered services in a given year, and “network,” which refers to the group of doctors, hospitals, and other healthcare providers that have agreed to provide services at discounted rates to insurance plan members. By understanding these terms and others, you can confidently navigate the world of health insurance and make the best decision for your healthcare needs.

Essential Health Insurance Terms

Before buying health insurance, there are several important terms that you need to know. Understanding these terms will help you make an informed decision and choose the right insurance plan for your needs.

1. Premium: This is the amount you pay each month for your health insurance coverage. It is important to consider both the premium and the benefits provided by the plan when making a purchase.

2. Deductible: The deductible is the amount you have to pay out of pocket before your insurance coverage kicks in. It is important to know the deductible amount and how it will affect your overall healthcare costs.

3. Copayment: A copayment is a fixed amount that you pay for certain services, such as a doctor’s visit or prescription medication. It is important to know the copayment amounts for different services to understand your out-of-pocket costs.

4. Coinsurance: Coinsurance is the percentage of the cost of a covered service that you are responsible for paying after you have met your deductible. It is important to know the coinsurance percentage to understand your financial responsibility.

5. Out-of-pocket maximum: This is the maximum amount you have to pay for covered services in a plan year. Once you reach this amount, your insurance will cover 100% of the costs. It is important to know the out-of-pocket maximum to understand your potential financial liability.

6. Network: A network is a group of healthcare providers and facilities that have agreed to provide services at discounted rates to members of a specific insurance plan. It is important to know if your preferred providers are in-network to avoid higher out-of-pocket costs.

7. Preauthorization: Preauthorization is the process of obtaining approval from your insurance company before receiving certain medical services or treatments. It is important to know if preauthorization is required for specific services to avoid potential coverage denials.

8. Exclusions: Exclusions are services or treatments that are not covered by your insurance plan. It is important to know what services are excluded to avoid unexpected costs.

9. Pre-existing condition: A pre-existing condition is a health condition that you had before obtaining health insurance coverage. It is important to know how pre-existing conditions are covered by your insurance plan.

10. In-network vs. out-of-network: In-network refers to healthcare providers and facilities that have agreed to provide services at discounted rates to members of a specific insurance plan. Out-of-network refers to providers and facilities that do not have a contract with your insurance plan. It is important to know the difference and understand the potential cost differences between in-network and out-of-network services.

11. Essential health benefits: Essential health benefits are a set of services that must be covered by all health insurance plans. These include preventive care, prescription drugs, and emergency services, among others. It is important to know what essential health benefits are covered by your insurance plan.

12. Open enrollment period: The open enrollment period is a specific time period during which you can enroll in or make changes to your health insurance plan. It is important to know the dates of the open enrollment period to ensure you have coverage.

13. Grace period: The grace period is a specified period of time after the due date of a premium payment during which the coverage remains in effect. It is important to know the length of the grace period to avoid a lapse in coverage.

14. Health savings account (HSA): A health savings account is a tax-advantaged savings account that can be used to pay for qualified medical expenses. It is important to know if your insurance plan is compatible with an HSA and the contribution limits.

15. Health maintenance organization (HMO) vs. preferred provider organization (PPO): An HMO is a type of insurance plan that requires you to choose a primary care physician and get referrals for specialist care. A PPO is a type of insurance plan that allows you to see any healthcare provider without a referral. It is important to know the differences between HMO and PPO plans to choose the right one for your needs.

Health Insurance

When it comes to buying health insurance, there are several important terms that you must know before making a purchase. Understanding these terms will help you make an informed decision and choose the right health insurance plan for your needs.

One of the most important terms to know is “premium.” This is the amount of money that you must pay each month for your health insurance coverage. It is important to consider the premium when budgeting for your healthcare expenses.

Another important term is “deductible.” This is the amount of money that you must pay out of pocket before your health insurance coverage kicks in. It is important to know the deductible amount before buying a health insurance plan, as it can greatly impact your out-of-pocket expenses.

Copayments and coinsurance are two other terms that you should be familiar with. Copayments are fixed amounts that you must pay for certain healthcare services, such as doctor visits or prescription medications. Coinsurance, on the other hand, is a percentage of the cost of a healthcare service that you must pay.

Before buying health insurance, it is also important to know the terms “network” and “out-of-network.” A network is a group of healthcare providers and facilities that have agreed to provide services at a discounted rate to the insurance company’s members. Out-of-network providers and facilities do not have this agreement, and you may have to pay more if you choose to see them.

Other important terms to know before buying health insurance include “pre-existing conditions,” “maximum out-of-pocket,” “covered services,” “excluded services,” “prior authorization,” and “appeals process.” Understanding these terms will help you navigate the complexities of health insurance and ensure that you have the coverage you need.

Premium

When it comes to buying health insurance, understanding the terms and jargon used in the industry is essential. One important term you need to know before making a purchase is “premium”.

A premium is the amount of money you pay to an insurance company in exchange for coverage. It is typically paid on a monthly basis, although some plans may offer different payment options. The premium amount can vary depending on factors such as your age, location, and the level of coverage you choose.

It’s important to note that the premium is separate from any out-of-pocket costs you may have, such as deductibles or copayments. The premium is simply the cost of the insurance itself and does not include any additional expenses you may incur when using your insurance.

When comparing health insurance plans, it’s important to consider both the premium and the level of coverage provided. A plan with a lower premium may have higher out-of-pocket costs, while a plan with a higher premium may offer more comprehensive coverage. It’s important to find a balance that fits your budget and meets your healthcare needs.

Before buying health insurance, take the time to research and understand the premium and other important terms. This will help you make an informed decision and ensure that you are getting the coverage you need at a price you can afford.

Deductible

Before buying health insurance, it is crucial to understand the terms and conditions associated with it. One of the most important terms to know is the deductible. The deductible is the amount of money you must pay out of pocket before your insurance coverage kicks in.

Knowing the deductible amount is essential because it directly impacts your out-of-pocket expenses. If you have a high deductible, you will have to pay more before your insurance starts covering your medical costs. On the other hand, if you have a low deductible, your insurance will start covering your expenses sooner.

It is important to choose a deductible that fits your budget and healthcare needs. If you rarely visit the doctor and don’t anticipate needing many medical services, a higher deductible may be more affordable. However, if you have ongoing medical conditions or anticipate needing frequent medical care, a lower deductible may be a better option.

Keep in mind that the deductible usually resets each year, so you will need to meet it again before your insurance coverage begins. Understanding the deductible is a must before making a health insurance purchase to ensure you are prepared for the potential out-of-pocket expenses.

Copayment

Before buying health insurance, it is a must to know what a copayment is. A copayment, also known as a copay, is a fixed amount of money that you must pay out of pocket for a specific healthcare service. This payment is made at the time of receiving the service, and it is usually a small portion of the total cost.

Understanding copayments is important because they can vary depending on the type of medical service you need. For example, you may have a different copayment for a routine doctor’s visit compared to a specialist consultation or a prescription medication. It is crucial to review the copayment structure of any health insurance plan you are considering to ensure you can afford the out-of-pocket expenses.

Copayments are typically listed in the insurance policy or plan documents, and they can be different for in-network and out-of-network providers. In-network providers are those who have a contract with your insurance company, while out-of-network providers do not. It is important to know the copayment amounts for both types of providers, as using out-of-network services may result in higher copayments or even no coverage at all.

When comparing health insurance plans, pay close attention to the copayment amounts and how they may affect your overall healthcare costs. Some plans may have higher copayments but lower monthly premiums, while others may have lower copayments but higher premiums. Consider your healthcare needs and budget to choose a plan that strikes the right balance for you.

Out-of-Pocket Maximum

When it comes to buying health insurance, there are several important terms that you must know before making a purchase. One of these terms is the “Out-of-Pocket Maximum”. This term refers to the maximum amount of money that you will have to pay for covered healthcare services in a given year.

Understanding the out-of-pocket maximum is crucial because it can have a significant impact on your overall healthcare costs. By knowing this limit, you can better plan and budget for your medical expenses.

Before choosing a health insurance plan, it is important to review the out-of-pocket maximum and compare it with your budget and healthcare needs. This will help you determine if the plan is affordable and suitable for you.

In addition, it is important to note that the out-of-pocket maximum may vary depending on the type of health insurance plan you choose. For example, some plans may have higher out-of-pocket maximums but lower monthly premiums, while others may have lower out-of-pocket maximums but higher monthly premiums.

To fully understand your out-of-pocket costs, it is recommended to review the plan’s summary of benefits and coverage, which provides detailed information about the out-of-pocket maximum and other important terms.

Network

When it comes to health insurance terms, one important concept you must know before buying a policy is the network. The network refers to the group of doctors, hospitals, and other healthcare providers that have contracted with the insurance company to provide services to policyholders.

Knowing the network is crucial because it can affect the cost and quality of your healthcare. If you choose a health insurance plan with a limited network, you may have to pay higher out-of-pocket costs or may not have access to certain providers or facilities. On the other hand, a plan with a broad network may offer more choices and lower costs for covered services.

There are different types of networks, such as preferred provider organizations (PPOs) and health maintenance organizations (HMOs). PPOs allow you to see any healthcare provider, but you may pay less if you choose a provider within the network. HMOs, on the other hand, typically require you to choose a primary care physician and get referrals for specialist care within the network.

Before buying a health insurance plan, it’s important to understand the network and evaluate whether it meets your healthcare needs. Consider factors such as the size and reputation of the network, the availability of providers in your area, and the cost-sharing requirements for out-of-network care. By knowing the network, you can make an informed decision and ensure that you have access to the healthcare providers you need.

Provider

When buying health insurance, there are several key terms that you must know before making a purchase. One of these terms is “provider”. A provider refers to a healthcare professional or facility that offers medical services. This can include doctors, hospitals, clinics, and other healthcare practitioners.

Understanding the concept of a provider is important because it determines which healthcare services are covered by your insurance plan. Different insurance plans may have different networks of providers, meaning that certain doctors or hospitals may be in-network and others may be out-of-network. It is crucial to know which providers are in-network for your insurance plan, as using out-of-network providers can result in higher out-of-pocket costs.

Before buying health insurance, it is essential to research the network of providers that are included in the plan. This can be done by contacting the insurance company directly or by reviewing the provider directory. The provider directory will list all the healthcare professionals and facilities that are part of the insurance plan’s network.

Knowing the providers that are covered by your insurance plan can help you make informed decisions about your healthcare. It allows you to choose doctors and hospitals that are conveniently located and meet your specific healthcare needs. Additionally, understanding the network of providers can help you anticipate and budget for any out-of-pocket costs that may be associated with using out-of-network providers.

In-Network

When buying health insurance, there are many terms that you must familiarize yourself with in order to make an informed decision. One of these terms is “in-network”.

In-network refers to the healthcare providers, doctors, hospitals, and other medical professionals that have a contract with your insurance company. These providers have agreed to provide services at a discounted rate to members of your insurance plan.

Knowing which providers are in-network is crucial when choosing a health insurance plan. If you visit an out-of-network provider, your insurance may not cover the full cost of the services, leaving you with a higher out-of-pocket expense.

Before making a purchase, it is important to review the list of in-network providers included in the health insurance plan. This list can usually be found on the insurance company’s website or by contacting their customer service. Make sure that the doctors and hospitals you regularly visit are included in the network.

Understanding the concept of in-network is essential for maximizing your health insurance benefits and minimizing your out-of-pocket expenses. By choosing a plan with a wide network of providers, you can ensure that you have access to quality healthcare without breaking the bank.

Out-of-Network

When buying health insurance, it is crucial to know the terms and conditions before making a purchase. One must understand the concept of “out-of-network” coverage and its implications.

Out-of-network refers to medical providers or facilities that are not contracted with the insurance company. This means that if you receive medical services from an out-of-network provider, the insurance company may not cover the full cost or may not cover it at all.

Before seeking medical treatment, it is important to check if the provider is in-network or out-of-network. If you choose an out-of-network provider, you may be responsible for a higher percentage of the cost, or you may have to pay the full amount upfront and then seek reimbursement from the insurance company.

Knowing the out-of-network terms will help you make informed decisions about your healthcare choices. It is essential to review your insurance plan’s network and understand the coverage limitations before seeking medical services. This way, you can avoid unexpected expenses and ensure that you receive the maximum benefits from your health insurance plan.

Pre-Existing Condition

A pre-existing condition is a medical condition or illness that you have before you apply for a health insurance policy. It is important to understand this term before buying health insurance because it can have an impact on your coverage and premiums.

When you have a pre-existing condition, it means that you already have a health issue that requires medical attention. This could include conditions such as diabetes, asthma, high blood pressure, or cancer. Insurance companies consider these conditions when determining your eligibility for coverage.

It is crucial to know about pre-existing conditions before buying health insurance because they can affect your coverage in several ways. First, some insurance plans may exclude coverage for pre-existing conditions altogether. This means that any treatment related to your pre-existing condition will not be covered by the insurance policy.

Second, if a plan does cover pre-existing conditions, there may be waiting periods before the coverage kicks in. During this waiting period, you will have to pay for any medical expenses related to your pre-existing condition out of pocket. This can be a significant financial burden, especially if you require ongoing treatment or medication.

Lastly, having a pre-existing condition can also impact the cost of your health insurance premiums. Insurance companies may charge higher premiums to individuals with pre-existing conditions to offset the potential cost of their medical care.

In summary, understanding the term “pre-existing condition” is essential before buying health insurance. It can determine whether your condition will be covered, if there will be waiting periods, and how much you will pay for your premiums.

Prescription Drug Coverage

When it comes to health insurance, one of the important terms you must know before buying a policy is prescription drug coverage. This refers to the extent to which your insurance plan will cover the cost of prescription medications. With the rising cost of prescription drugs, having adequate prescription drug coverage is crucial for managing your healthcare expenses.

Prescription drug coverage can vary from one insurance plan to another. It is important to understand the details of your coverage, including what medications are covered, the co-payments or coinsurance you may be responsible for, and any limitations or restrictions that may apply.

Some insurance plans may have a formulary, which is a list of approved medications that are covered by the plan. It is important to review the formulary to ensure that your prescription medications are included. If a medication is not on the formulary, you may have to pay the full cost out of pocket.

Another important aspect of prescription drug coverage is the tier system. Insurance plans often classify medications into different tiers, with each tier having a different cost-sharing arrangement. Typically, generic drugs are in the lowest tier and have the lowest cost-sharing, while brand-name drugs and specialty medications may be in higher tiers with higher cost-sharing.

Understanding the details of your prescription drug coverage is essential for making informed decisions about your healthcare. By knowing what medications are covered, how much you will be responsible for, and any restrictions or limitations, you can better manage your healthcare expenses and ensure that you have access to the medications you need.

Preventive Services

When buying health insurance, there are several important terms you need to know before making a purchase. One of these terms is “preventive services”. Understanding what preventive services are and how they are covered by your insurance plan is essential.

Preventive services are healthcare services that aim to prevent illness or detect health conditions early, before they become more serious and require more extensive treatment. These services are designed to keep you healthy and prevent the onset of chronic diseases.

Before purchasing insurance, you must know what preventive services are covered by your plan. This information is usually outlined in your policy documents or can be obtained by contacting your insurance provider. It is important to know which preventive services are covered at no cost to you, as some insurance plans offer certain services without requiring you to pay a copayment, coinsurance, or meet your deductible.

Some common preventive services that insurance plans may cover include vaccinations, screenings for various diseases such as cancer or diabetes, and counseling for tobacco use or obesity. These services are considered essential for maintaining good health and preventing future health issues.

Knowing what preventive services are covered by your insurance plan can help you make informed decisions about your healthcare and take advantage of the services available to you. It is important to review your policy documents and ask your insurance provider for clarification if needed, so you can fully understand the coverage and benefits provided by your insurance plan.

Primary Care Physician

When it comes to your health, having a primary care physician is a must. Before buying health insurance, you need to know what this term means and why it is important.

A primary care physician, also known as a PCP, is a doctor who serves as your main point of contact for all your healthcare needs. They are usually your first stop for any health concerns or medical issues you may have. Your primary care physician is responsible for coordinating your overall care and referring you to specialists when necessary.

Knowing who your primary care physician is before buying health insurance is crucial. They play a key role in managing your health and ensuring you receive the necessary preventive care and screenings. Your primary care physician will also be the one to provide ongoing care for chronic conditions and manage your overall health and wellness.

Before purchasing health insurance, you should check if your preferred primary care physician is included in the provider network. Some insurance plans have a limited network of doctors, and if your PCP is not included, you may have to switch doctors or pay out-of-network costs.

In summary, understanding the term “primary care physician” is essential before buying health insurance. They are your main healthcare provider and play a crucial role in managing your overall health and well-being. Knowing if your preferred PCP is included in the insurance plan’s network is important to ensure you can continue receiving care from them without additional costs.

Specialist

A specialist is a healthcare professional who focuses on a specific area of health, such as cardiology, dermatology, or orthopedics. When it comes to health insurance, it is important to know that seeing a specialist may require a referral from your primary care physician. This means that before you can make an appointment with a specialist, you must first visit your primary care doctor and obtain a referral. This is a common requirement in many health insurance plans, as it helps to ensure that you are receiving appropriate and necessary care.

Before purchasing health insurance, it is crucial to understand the terms and conditions surrounding specialist visits. Some insurance plans may have restrictions on which specialists you can see or may require you to obtain pre-authorization before scheduling an appointment. It is important to carefully review the terms of your insurance policy to understand what is covered and what is not when it comes to specialist visits.

Knowing the details of your health insurance coverage can help you make informed decisions about your healthcare. Understanding the terms related to specialists can ensure that you receive the care you need without unexpected out-of-pocket expenses. Take the time to familiarize yourself with the terms and conditions of your health insurance policy before making a purchase to ensure that you have the coverage you need for specialist visits.

Open Enrollment Period

The Open Enrollment Period is a specific time frame during which individuals can sign up for health insurance or make changes to their existing coverage. It is a must-know term before buying insurance as it determines when you can enroll in a health insurance plan or switch to a different one.

During the Open Enrollment Period, you have the opportunity to review different health insurance options and choose the plan that best meets your needs. This period typically occurs once a year and is an important time for individuals to evaluate their health insurance needs and make any necessary changes.

It is crucial to understand the specific dates of the Open Enrollment Period as missing this window can result in being uninsured or limited in your options. The Open Enrollment Period typically lasts for a few weeks or months, so it is essential to mark your calendar and be prepared to take action during this time.

Additionally, it is important to note that some qualifying life events may allow you to enroll in or make changes to your health insurance outside of the Open Enrollment Period. Examples of qualifying life events include getting married, having a baby, or losing other health coverage.

To ensure you have the coverage you need, it is essential to familiarize yourself with the Open Enrollment Period and understand the terms associated with health insurance before making a purchase. By doing so, you can make informed decisions about your health insurance coverage and ensure you have the necessary protection for yourself and your family.

Question-answer:

What is a deductible in health insurance?

A deductible is the amount you have to pay out-of-pocket before your insurance starts covering costs. For example, if you have a $1,000 deductible and you receive a medical bill for $1,500, you would have to pay $1,000 before your insurance begins to cover the remaining $500. Deductibles can vary depending on the insurance plan, and some plans may have separate deductibles for different types of services, such as medical care and prescription drugs.

What is coinsurance in health insurance?

Coinsurance is the percentage of costs you pay for a covered service after you’ve met your deductible. For example, if you have a coinsurance rate of 20% and your insurance plan covers a medical procedure that costs $1,000, you would be responsible for paying $200 (20% of $1,000) while your insurance would cover the remaining $800. Coinsurance is typically applied after you’ve met your deductible and can vary depending on the insurance plan.

What is an out-of-pocket maximum in health insurance?

An out-of-pocket maximum is the most you have to pay for covered services in a plan year. Once you reach this maximum amount, your insurance plan will cover 100% of the costs for covered services. This includes deductibles, copayments, and coinsurance. It’s important to note that the out-of-pocket maximum only applies to services that are covered by your insurance plan, so if you receive care from an out-of-network provider or receive a service that is not covered, it may not count towards your out-of-pocket maximum.