Is Coronavirus covered under health insurance?

Coronavirus, also known as COVID-19, has had a significant impact on the world, affecting individuals and communities on a global scale. As the virus continues to spread, many people are concerned about the financial implications of getting sick. One question that arises is whether health insurance covers the costs associated with coronavirus.

Health insurance is designed to provide coverage for medical expenses, including hospital stays, doctor visits, and prescription medications. However, the coverage provided varies depending on the specific insurance plan. Some insurance plans may cover the costs associated with testing, treatment, and hospitalization for coronavirus, while others may not.

It is important to review your insurance policy and contact your insurance provider to understand what is covered and what is not. Many insurance companies have released statements regarding their coverage for coronavirus, providing information on what expenses will be covered and any limitations or exclusions that may apply. It is recommended to reach out to your insurance provider for specific details.

Understanding health insurance coverage for Coronavirus

Health insurance plays a crucial role in providing financial protection and access to necessary medical services in the event of an illness or injury. With the ongoing Coronavirus pandemic, it is important to understand how health insurance coverage applies to this specific situation.

Firstly, it is important to note that health insurance typically covers the cost of testing for Coronavirus. This includes both the diagnostic test to determine if an individual has the virus and any subsequent tests required for monitoring or treatment purposes. Insurance providers understand the importance of widespread testing to control the spread of the virus and ensure the well-being of their policyholders.

Furthermore, health insurance coverage for Coronavirus extends to the treatment of the illness. If an individual is diagnosed with Coronavirus and requires medical care, their insurance policy should cover the cost of hospitalization, doctor visits, medications, and other necessary treatments. It is important to review the specific details of your insurance policy to understand the extent of coverage and any potential limitations or exclusions.

It is worth noting that health insurance coverage for Coronavirus may vary depending on the type of plan you have. For example, employer-sponsored health insurance plans may have different coverage options compared to individual or family plans. Additionally, some insurance providers may have specific guidelines or requirements for coverage, such as pre-authorization for certain treatments or medications.

In conclusion, health insurance typically covers the cost of testing and treatment for Coronavirus. However, it is important to review the specifics of your insurance policy to understand the extent of coverage and any limitations or requirements that may apply. Staying informed about your health insurance coverage can help ensure that you have the necessary financial protection and access to medical services during these uncertain times.

What is Coronavirus?

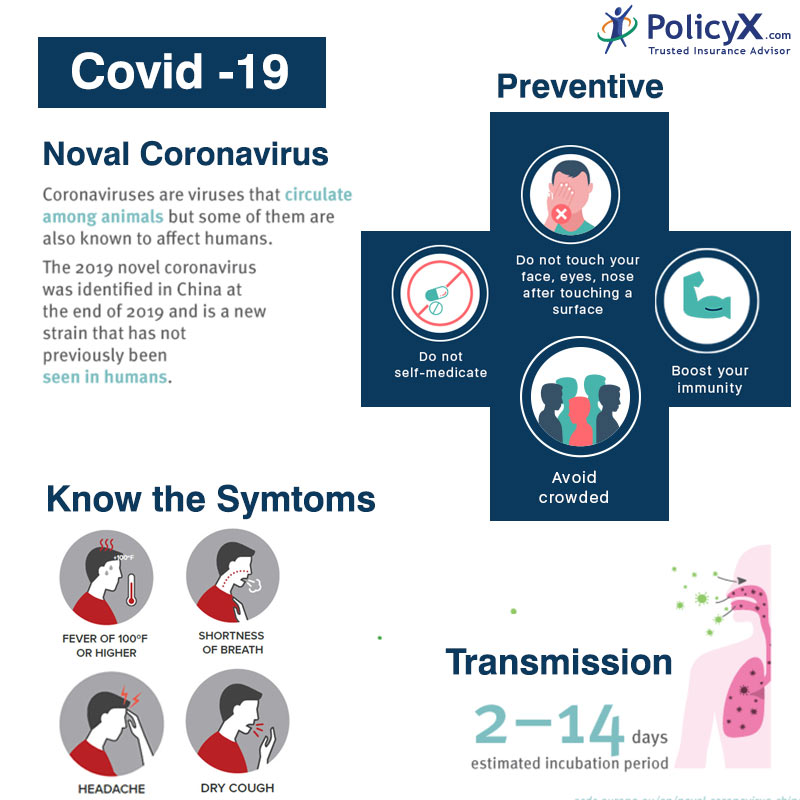

Coronavirus is a type of virus that can cause illness in animals and humans. The current outbreak, known as COVID-19, was first identified in December 2019 in Wuhan, China. It has since spread globally, leading to a pandemic. The virus primarily spreads through respiratory droplets when an infected person coughs or sneezes.

COVID-19 can cause a range of symptoms, from mild to severe. Common symptoms include fever, cough, and difficulty breathing. In some cases, the virus can lead to pneumonia and organ failure, particularly in older adults or individuals with pre-existing health conditions.

Given the health risks associated with COVID-19, it is important for individuals to take precautions to prevent the spread of the virus. This includes practicing good hygiene, such as washing hands frequently, wearing masks in public settings, and maintaining social distancing.

As for health insurance coverage, it depends on the specific policy and provider. Many health insurance plans cover medical expenses related to COVID-19, including testing, treatment, and hospitalization. However, it is crucial to review the terms of your insurance policy to understand what is covered and any potential limitations or exclusions.

During this pandemic, it is advisable to stay informed about the latest updates from health authorities and follow their guidelines to protect your health and the health of others. Additionally, maintaining a healthy lifestyle and seeking medical attention when necessary can help minimize the impact of COVID-19 on individuals and communities.

Importance of health insurance during the Coronavirus pandemic

Health insurance is of utmost importance during the Coronavirus pandemic. With the rapid spread of the virus and the increasing number of cases, having health insurance ensures that individuals are covered for any medical expenses related to the virus. This includes testing, treatment, hospitalization, and medication.

Having health insurance during the Coronavirus pandemic provides individuals with peace of mind, knowing that they will not have to bear the financial burden of medical costs if they were to contract the virus. This is especially important considering the high cost of healthcare, which can be overwhelming for many individuals.

Health insurance also plays a crucial role in ensuring that individuals have access to timely and appropriate healthcare during the pandemic. It allows individuals to seek medical help without hesitation, as they know that their insurance will cover the costs. This is particularly important for individuals who may be at a higher risk of contracting the virus or have pre-existing conditions that make them more vulnerable.

Furthermore, health insurance can provide additional benefits and support during the Coronavirus pandemic. Many insurance plans offer telehealth services, which allow individuals to consult with healthcare professionals remotely, minimizing the risk of exposure to the virus. Additionally, some insurance plans may cover the cost of vaccines and preventive measures, such as face masks and hand sanitizers.

In conclusion, health insurance is essential during the Coronavirus pandemic as it ensures individuals are covered for any medical expenses related to the virus. It provides financial security, access to timely healthcare, and additional benefits that can help mitigate the impact of the pandemic. Therefore, it is crucial for individuals to have health insurance to protect themselves and their loved ones during these challenging times.

Types of health insurance plans

There are several types of health insurance plans available to individuals and families. These plans vary in terms of coverage and cost. It is important to understand the different types of health insurance plans to ensure that you have the coverage you need.

1. Health maintenance organization (HMO) plans: These plans generally have lower premiums but require you to choose a primary care physician (PCP) who will oversee your care. You will need a referral from your PCP to see a specialist. HMO plans typically have a network of healthcare providers and only cover services provided by these providers.

2. Preferred provider organization (PPO) plans: PPO plans offer more flexibility in choosing healthcare providers. You do not need a referral to see a specialist, but you will pay higher out-of-pocket costs if you choose an out-of-network provider. PPO plans often have higher premiums compared to HMO plans.

3. Exclusive provider organization (EPO) plans: EPO plans are similar to HMO plans in that they require you to choose a primary care physician and only cover services provided by in-network providers. However, EPO plans do not require referrals to see specialists.

4. Point of service (POS) plans: POS plans combine elements of both HMO and PPO plans. You will need to choose a primary care physician and obtain referrals for specialists, but you also have the option to see out-of-network providers, although at a higher cost.

5. High-deductible health plans (HDHPs) with health savings accounts (HSAs): These plans have higher deductibles, meaning you will need to pay a larger amount out-of-pocket before your insurance coverage kicks in. However, they often have lower premiums. HDHPs can be paired with HSAs, which allow you to save money tax-free to use for qualified medical expenses.

It is important to review the details of each type of health insurance plan to determine which one best fits your needs. Keep in mind that health insurance plans may have specific exclusions or limitations, so it is important to understand what is covered and what is not. This includes coverage for illnesses such as the coronavirus, which may have specific requirements or limitations depending on the insurance provider.

Does private health insurance cover Coronavirus?

Private health insurance plans may provide coverage for the treatment of Coronavirus, depending on the specific policy and coverage options. It is important to review the terms and conditions of your insurance policy to understand what is covered and what is not.

Health insurance plans typically cover medical expenses for illnesses and diseases, and Coronavirus is no exception. However, coverage may vary depending on the type of plan and the specific benefits included.

In general, private health insurance plans may cover the cost of diagnostic tests, hospitalization, doctor’s visits, and prescription medications related to the treatment of Coronavirus. Some plans may also provide coverage for telemedicine services, which allow individuals to consult with healthcare providers remotely.

It is important to note that there may be certain limitations and exclusions in your insurance policy. For example, some plans may require pre-authorization for certain treatments or medications, and may have specific criteria for coverage. Additionally, coverage for Coronavirus may be subject to deductibles, co-pays, and co-insurance.

If you have private health insurance, it is recommended to contact your insurance provider or review your policy documents to understand the specific coverage options for Coronavirus. They will be able to provide you with the most accurate and up-to-date information regarding your policy.

Does employer-provided health insurance cover Coronavirus?

Employer-provided health insurance plans typically cover a wide range of medical expenses, including those related to infectious diseases such as Coronavirus (COVID-19). However, the coverage may vary depending on the specific terms and conditions of the insurance plan.

Most health insurance plans offer coverage for diagnosis, testing, and treatment of Coronavirus. This includes expenses related to laboratory tests, hospitalization, doctor visits, and prescribed medications. Some insurance plans may also cover telemedicine services, allowing individuals to consult with healthcare professionals remotely.

It is important to note that the coverage for Coronavirus may be subject to certain limitations and exclusions. For example, some insurance plans may require individuals to meet a deductible or co-payment before the coverage kicks in. Additionally, the coverage may only be available for in-network healthcare providers.

Employers and insurance providers have been taking steps to ensure that individuals have access to the necessary healthcare services during the Coronavirus pandemic. They may have implemented special provisions or waivers to facilitate testing and treatment for COVID-19.

To determine the specific coverage for Coronavirus under your employer-provided health insurance plan, it is recommended to review the policy documents or contact the insurance provider directly. They can provide detailed information about the coverage, any limitations, and the steps you need to take to access the benefits.

Does government health insurance cover Coronavirus?

Government health insurance plans, such as Medicare and Medicaid, typically cover a wide range of medical conditions and treatments. However, the coverage for coronavirus may vary depending on the specific plan and the guidelines set by the government.

It is important to check with your government health insurance provider to understand what is covered in relation to the coronavirus. Many government health insurance plans have taken steps to ensure that testing and treatment for COVID-19 are covered, as it is a global health crisis.

Some government health insurance plans may cover the cost of testing for coronavirus, including laboratory tests and diagnostic tests. They may also cover the cost of treatment, such as hospitalization, medications, and doctor visits. However, it is important to note that there may be certain limitations and restrictions on coverage, such as the need for prior authorization or specific criteria for testing or treatment.

If you have government health insurance and believe you have been exposed to or have symptoms of coronavirus, it is important to contact your healthcare provider or the designated hotline to seek guidance on testing and treatment options. They can provide you with information on coverage and help you navigate the healthcare system during this challenging time.

Understanding the coverage limits for Coronavirus treatment

When it comes to the Coronavirus, many people are concerned about whether their health insurance will cover the costs of treatment. While every insurance plan is different, it is important to understand the coverage limits and what is covered.

Most health insurance plans will cover the cost of testing for the Coronavirus. This includes the cost of the test itself as well as any associated fees. However, when it comes to treatment, the coverage may vary.

Some health insurance plans will cover the cost of treatment for the Coronavirus. This can include hospital stays, medications, and other necessary medical interventions. However, there may be limits on the coverage, such as a maximum amount that the insurance will pay or a certain number of days that are covered.

It is important to review your health insurance policy to understand what is covered and what the limits are. If you have any questions, it is recommended to contact your insurance provider directly. They can provide you with specific information about your coverage and any limitations that may apply.

Overall, while health insurance can provide coverage for Coronavirus testing and treatment, it is essential to understand the coverage limits and any potential out-of-pocket costs that may be incurred. Being informed about your insurance coverage can help alleviate some of the financial stress that may come with seeking medical treatment for the Coronavirus.

What expenses are covered by health insurance for Coronavirus?

Health insurance coverage for Coronavirus varies depending on the specific plan and provider. However, in general, health insurance will cover a range of expenses related to Coronavirus, including:

- Testing: Health insurance typically covers the cost of Coronavirus testing, including laboratory fees and diagnostic tests.

- Treatment: If you require medical treatment for Coronavirus, health insurance will generally cover the cost of hospital stays, doctor visits, and medications.

- Telehealth services: Many health insurance plans now offer coverage for telehealth services, allowing you to consult with a healthcare provider remotely for Coronavirus-related concerns.

- Emergency care: If you require emergency medical care due to Coronavirus, health insurance will typically cover the cost of emergency room visits and ambulance services.

- Quarantine expenses: Some health insurance plans may cover the cost of quarantine accommodations, such as a hotel stay, if you need to isolate due to Coronavirus.

It’s important to note that the coverage and extent of coverage may vary depending on your specific health insurance plan. It is recommended to review your policy or contact your insurance provider to understand the exact details of your coverage for Coronavirus-related expenses.

How to check if your health insurance covers Coronavirus?

If you have health insurance, it is important to check if it covers the costs related to the coronavirus. Here are some steps to help you determine if your insurance policy provides coverage for this specific situation:

- Contact your insurance provider: Reach out to your insurance company and inquire about the coverage for coronavirus. They will be able to provide you with detailed information on what is covered and what is not.

- Check your policy documents: Review your health insurance policy documents. Look for any specific mention of coverage for infectious diseases or pandemics. This will give you a better understanding of what expenses are covered.

- Review the terms and conditions: Pay attention to the terms and conditions of your policy. Look for any exclusions or limitations related to contagious diseases or emergency situations. This will help you determine if you are eligible for coverage.

- Understand the cost-sharing: Find out how much you would need to pay out-of-pocket for coronavirus-related expenses. This includes deductibles, copayments, and coinsurance. Knowing these details will help you plan your budget accordingly.

- Check for any updates: Keep yourself informed about any updates or changes to your health insurance coverage. Insurance companies may modify their policies in response to the evolving situation. Stay in touch with your insurance provider to stay up to date.

Remember, it is crucial to understand your health insurance coverage for coronavirus. Being aware of what is covered will help you make informed decisions and ensure you receive the necessary medical care without any unexpected financial burden.

Can you get health insurance coverage for Coronavirus if you are uninsured?

If you are uninsured, it may be challenging to get health insurance coverage for Coronavirus. Health insurance typically covers medical expenses, including those related to infectious diseases. However, without an insurance policy in place, you may have to bear the cost of treatment for Coronavirus on your own.

It is recommended that you explore your options for obtaining health insurance coverage. This could include applying for government-sponsored programs such as Medicaid or the Affordable Care Act (ACA) marketplace. These programs may provide coverage for Coronavirus-related medical expenses, depending on your eligibility.

Additionally, some states have implemented special enrollment periods due to the Coronavirus pandemic. During these periods, individuals who are uninsured may have the opportunity to enroll in health insurance plans. It is important to check with your state’s healthcare marketplace or insurance department to see if any special enrollment options are available.

If you are unable to obtain health insurance coverage for Coronavirus, there may still be resources available to help you. Many hospitals and healthcare providers have implemented financial assistance programs to assist individuals who are uninsured or underinsured. These programs may help cover the cost of testing, treatment, and other related medical expenses.

Overall, while it may be challenging, it is important to explore all available options for obtaining health insurance coverage if you are uninsured and in need of Coronavirus-related medical care. Taking proactive steps to protect your health and financial well-being is crucial during these uncertain times.

How does health insurance coverage for Coronavirus differ by country?

Health insurance coverage for Coronavirus varies from country to country. In some countries, such as Canada and the United Kingdom, healthcare is provided by the government and is generally available to all citizens. This means that testing, treatment, and other medical services related to Coronavirus are covered by the government-funded healthcare system.

In other countries, such as the United States, health insurance coverage for Coronavirus is typically provided by private insurance companies. The coverage may vary depending on the specific insurance plan, but most plans should cover testing and treatment for Coronavirus. However, individuals may still be responsible for copayments, deductibles, and other out-of-pocket expenses.

Some countries, like Germany and France, have a combination of government-funded healthcare and private insurance options. In these countries, health insurance coverage for Coronavirus may depend on the type of insurance plan an individual has. Government-funded insurance plans are likely to cover testing and treatment for Coronavirus, while private insurance plans may have varying levels of coverage.

It is important for individuals to check with their specific health insurance provider to understand what is covered under their plan. Additionally, it is worth noting that health insurance coverage for Coronavirus may be subject to change as the situation evolves, so it is important to stay informed and updated on any changes in coverage.

Are there any exclusions or waiting periods for Coronavirus coverage?

When it comes to health insurance, it is important to understand if there are any exclusions or waiting periods for Coronavirus coverage. While most health insurance plans do cover Coronavirus, there may be certain limitations or waiting periods that you should be aware of.

One common exclusion for Coronavirus coverage is if you have a pre-existing condition. If you have a pre-existing condition that is related to the Coronavirus, such as respiratory issues, your health insurance may not cover the costs associated with treating the virus.

Another exclusion to be aware of is if you have recently traveled to a high-risk area. Some health insurance plans may have a waiting period before they will cover any medical expenses related to the Coronavirus if you have traveled to a high-risk area within a certain time frame.

It is also important to note that some health insurance plans may have limitations on coverage for certain types of treatment or medications related to the Coronavirus. For example, experimental treatments or medications that are not yet approved by the FDA may not be covered by your health insurance.

It is crucial to review your health insurance policy carefully to understand any exclusions or waiting periods that may apply to Coronavirus coverage. If you have any questions or concerns, it is recommended to contact your health insurance provider directly for clarification.

Tips for navigating health insurance claims for Coronavirus treatment

As the Coronavirus continues to spread, it is important to understand how your health insurance coverage may apply to the treatment of this virus. Here are some tips to help you navigate the claims process:

- Contact your insurance provider: Reach out to your insurance company to inquire about coverage for Coronavirus treatment. Ask about any specific requirements or documentation that may be needed for filing a claim.

- Review your policy: Take the time to carefully read through your insurance policy to understand what is covered and what is not. Look for any exclusions or limitations that may apply to Coronavirus-related treatment.

- Keep all documentation: Make sure to keep copies of all medical records, bills, and receipts related to your Coronavirus treatment. These documents will be necessary when filing a claim with your insurance provider.

- Follow the proper procedures: Be sure to follow any procedures or protocols set forth by your insurance company when seeking treatment for Coronavirus. This may include obtaining pre-authorization or seeking treatment from in-network providers.

- Stay informed: Stay updated on any changes or updates to your insurance coverage related to Coronavirus. Insurance companies may make adjustments to their policies as the situation evolves.

Remember, each insurance policy may have different coverage and requirements, so it is important to familiarize yourself with your specific plan. By following these tips and staying informed, you can navigate the health insurance claims process for Coronavirus treatment more effectively.

What to do if your health insurance denies coverage for Coronavirus?

If your health insurance denies coverage for the coronavirus, it can be a frustrating and stressful situation. However, there are steps you can take to address this issue:

- Review your policy: Carefully read through your health insurance policy to understand the specific coverage it provides. Look for any exclusions or limitations related to infectious diseases or pandemics.

- Contact your insurance company: Reach out to your health insurance company to clarify why your claim was denied. Ask for a detailed explanation and make sure to document all communication.

- Appeal the decision: If you believe that your claim should be covered, consider filing an appeal with your insurance company. Provide any additional information or documentation that supports your case, such as medical records or doctor’s notes.

- Seek assistance: If you are having difficulty navigating the appeals process or need further guidance, consider seeking assistance from a healthcare advocate or a legal professional who specializes in health insurance issues.

- Explore other options: If your health insurance continues to deny coverage, you may want to explore alternative options such as applying for government-funded programs or seeking financial assistance from healthcare organizations.

Remember, it is important to stay informed and proactive when dealing with health insurance denials related to the coronavirus. Don’t hesitate to seek help and advocate for your rights as a policyholder.

Question-answer:

Does health insurance cover treatment for Coronavirus?

Yes, most health insurance plans cover treatment for Coronavirus. However, it is important to check the specific details of your plan to understand what is covered and any potential limitations.

Will my health insurance cover the cost of a Coronavirus test?

Many health insurance plans do cover the cost of a Coronavirus test. However, coverage may vary depending on the specific plan and provider. It is recommended to contact your insurance company directly to confirm coverage and any associated costs.