Hospital Cash Insurance

Medical emergencies can happen unexpectedly, leaving you with hefty bills and financial stress. That’s why it’s essential to have the right coverage in place. With Hospital Cash Insurance, you can protect your finances and focus on your health without worrying about the expenses.

Our Hospital Cash Insurance provides you with a range of benefits that can make a significant difference during your hospital stay. When you have this policy, you can rest assured knowing that you’ll receive cash benefits to help cover your medical expenses.

Unlike traditional health insurance, our Hospital Cash Insurance offers you direct cash payments. This means that you can use the cash as you see fit, whether it’s for medical bills, transportation, or any other expenses that arise during your hospitalization.

When you make a claim with our Hospital Cash Insurance, you can expect a hassle-free process. Our dedicated team will guide you through the entire process and ensure that you receive your cash benefits promptly. We understand that dealing with a medical emergency is stressful enough, so we strive to make the claims process as smooth as possible.

Don’t let a hospital stay drain your savings or put you in debt. Take control of your finances with our Hospital Cash Insurance policy. Contact us today to learn more about how we can provide you with the financial security you need during medical emergencies.

Protect your health, protect your finances

What is Hospital Cash Insurance?

Hospital Cash Insurance is a type of medical insurance that provides financial protection during hospitalization. It offers a cash benefit to policyholders, which can be used to cover various expenses that may arise during their stay in the hospital.

This insurance policy is designed to complement existing health insurance coverage by providing additional financial support. It helps policyholders to cope with the unexpected costs associated with hospitalization, such as transportation, accommodation, and non-medical expenses.

With Hospital Cash Insurance, policyholders can claim cash benefits for each day they spend in the hospital. The amount of coverage varies depending on the policy and can be tailored to meet individual needs. This ensures that policyholders have access to financial assistance when they need it the most.

One of the key advantages of Hospital Cash Insurance is the flexibility it offers. Policyholders have the freedom to use the cash benefits as they see fit, whether it’s to pay for medical bills, childcare, or any other expenses that may arise during their hospital stay.

Overall, Hospital Cash Insurance provides peace of mind and financial security during medical emergencies. It offers an additional layer of protection to ensure that policyholders can focus on their recovery without having to worry about the financial burden of hospitalization.

Why is Hospital Cash Insurance Important?

When it comes to protecting your finances during medical emergencies, hospital cash insurance is crucial. This type of policy provides you with cash benefits that can help cover the costs associated with hospital stays, medical treatments, and other related expenses. With hospital cash insurance, you can have peace of mind knowing that you have financial coverage in case of unexpected health issues.

One of the main advantages of hospital cash insurance is that it provides cash benefits directly to you, rather than paying the healthcare provider. This means that you have the flexibility to use the funds as needed, whether it’s for medical bills, transportation to and from the hospital, or even everyday expenses while you’re recovering.

Another important aspect of hospital cash insurance is that it can be used in addition to your existing health insurance coverage. While health insurance typically covers the cost of medical treatments, hospital cash insurance provides additional financial support that can help you manage any out-of-pocket expenses or gaps in coverage.

In the unfortunate event that you need to make a claim, hospital cash insurance can provide a quick and hassle-free process. The claim process is typically straightforward, allowing you to receive the cash benefits you’re entitled to without unnecessary delays or complications.

In conclusion, hospital cash insurance is an essential component of your overall financial protection. By having this type of insurance coverage, you can ensure that you have the necessary funds to cover medical expenses and maintain your financial stability during unexpected health emergencies.

Financial Protection

When it comes to your health, it’s important to have the right coverage. Medical emergencies can happen unexpectedly, and the costs can quickly add up. That’s where hospital cash insurance comes in. With a hospital cash policy, you can have peace of mind knowing that you’ll receive a cash benefit to help cover the expenses associated with a hospital stay.

Unlike traditional health insurance, hospital cash insurance provides you with a lump sum cash payment that you can use however you see fit. Whether it’s paying for medical bills, covering lost wages, or even just helping with everyday expenses, the cash benefit can provide a much-needed financial boost during a challenging time.

With hospital cash insurance, you can be prepared for the unexpected. No one plans to get sick or injured, but having a policy in place can help alleviate the financial stress that often comes with medical emergencies. Whether you’re facing a short hospital stay or a more serious procedure, having the financial protection of hospital cash insurance can make a difference.

Don’t let medical expenses drain your savings or put you in debt. Invest in your financial well-being by getting hospital cash insurance today. It’s a smart way to protect your finances and ensure that you have the means to get the care you need, without worrying about the cost.

How Does Hospital Cash Insurance Protect Your Finances?

Hospital cash insurance is a type of medical coverage that provides financial protection in case of a hospital stay. With this insurance, you can make a claim for cash benefits that can be used to cover various expenses that are not covered by your regular health insurance policy.

One of the main benefits of hospital cash insurance is that it provides coverage for medical emergencies. In the event that you need to be hospitalized, this insurance will provide you with a cash payout that can help you pay for your medical bills, transportation costs, and other related expenses.

Having hospital cash insurance can also help protect your finances by providing you with a source of income while you are unable to work. If you are hospitalized and unable to work, the cash benefits from your insurance policy can help replace some of your lost income, ensuring that you can continue to meet your financial obligations.

Additionally, hospital cash insurance can provide you with peace of mind knowing that you are financially protected in case of a medical emergency. This insurance can help alleviate the stress and worry that often comes with unexpected hospital stays, allowing you to focus on your recovery instead.

In conclusion, hospital cash insurance is an important tool for protecting your finances during medical emergencies. By providing coverage for medical expenses, replacing lost income, and offering peace of mind, this insurance policy can help ensure that you are financially prepared for any unexpected hospital stay.

Benefits of Hospital Cash Insurance

Health emergencies can occur at any time and can often result in unexpected medical expenses. Hospital cash insurance is a type of insurance that provides cash benefits to policyholders during hospital stays. This coverage can help alleviate the financial burden of medical bills and other expenses.

With hospital cash insurance, policyholders can claim a fixed amount of cash for each day they are admitted to the hospital. This cash benefit can be used for any purpose, such as covering medical expenses not covered by regular health insurance, paying for transportation to and from the hospital, or even helping with everyday living expenses while hospitalized.

Having hospital cash insurance can provide peace of mind, knowing that you have financial coverage in the event of a medical emergency. It can also help you avoid dipping into your savings or going into debt to pay for hospital expenses. By having this additional layer of coverage, you can focus on your health and recovery without worrying about the financial implications.

When choosing a hospital cash insurance policy, it is important to carefully review the coverage details and policy terms. Some policies may have restrictions on the types of medical conditions covered or the maximum number of days for which cash benefits can be claimed. It is also important to consider the premium costs and any deductibles or co-pays associated with the policy.

In conclusion, hospital cash insurance provides valuable financial coverage during medical emergencies. It can help policyholders manage the costs associated with hospital stays and alleviate the stress of unexpected medical expenses. By having this type of insurance, individuals can ensure that their health and finances are protected.

Coverage

When it comes to your health, having the right insurance coverage is crucial. With Hospital Cash Insurance, you can protect your finances during medical emergencies. This policy provides you with cash benefits that can be claimed when you are admitted to the hospital.

With Hospital Cash Insurance, you can rest easy knowing that you have financial support in case of unexpected hospitalization. The policy offers coverage for a wide range of medical expenses, including hospital room charges, doctor’s fees, laboratory tests, and medications.

One of the key benefits of Hospital Cash Insurance is the flexibility it offers. You can choose the coverage amount that suits your needs and budget. Whether you want a basic policy that provides coverage for a specific number of days or a comprehensive policy that covers a longer duration, there are options available to meet your requirements.

In addition to providing financial protection, Hospital Cash Insurance also offers peace of mind. Knowing that you have a policy in place can alleviate the stress and worry that often comes with medical emergencies. You can focus on your health and recovery, knowing that your finances are taken care of.

Don’t wait until it’s too late. Get the coverage you need with Hospital Cash Insurance and protect yourself from the financial burden of medical emergencies. Take control of your health and your finances by investing in a policy that provides you with the peace of mind you deserve.

What Does Hospital Cash Insurance Cover?

Medical emergencies can be financially draining, especially if you don’t have adequate health insurance coverage. Hospital cash insurance is designed to provide additional financial benefits to policyholders during their hospital stay.

With hospital cash insurance, you can receive a fixed daily cash benefit for each day you are admitted to the hospital. This cash benefit can help cover various expenses that may not be covered by your regular health insurance policy, such as transportation costs, accommodation for family members, and additional medical expenses.

One of the main benefits of hospital cash insurance is that it provides you with flexibility in how you use the cash benefit. Whether you need to pay for prescription medications, hire a caregiver, or cover lost income during your hospital stay, the cash benefit can be used to meet your specific needs.

Additionally, hospital cash insurance provides coverage for a wide range of medical emergencies, including surgeries, accidents, and illnesses. This means that regardless of the reason for your hospitalization, you can be confident that you have financial support to help ease the burden.

In summary, hospital cash insurance offers a valuable additional layer of financial protection during medical emergencies. It provides a fixed daily cash benefit that can be used to cover various expenses not covered by your regular health insurance policy. With coverage for a wide range of medical emergencies, hospital cash insurance can give you peace of mind knowing that your finances are protected.

Limitations of Hospital Cash Insurance

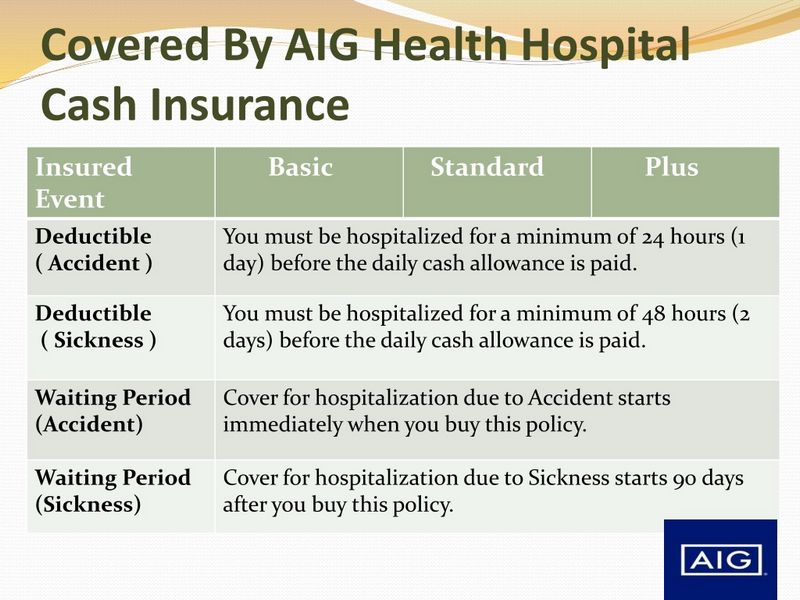

While hospital cash insurance can provide valuable financial support during medical emergencies, it is important to understand its limitations. One limitation is that the policy may have a waiting period before coverage begins. This means that if you are hospitalized within a certain time frame after purchasing the insurance, you may not be eligible to receive cash benefits.

Another limitation is that the coverage provided by hospital cash insurance may not be sufficient to cover all medical expenses. The cash benefits are typically fixed amounts per day of hospitalization, and may not fully cover the cost of medical treatments, medications, or other healthcare services.

It is also important to note that hospital cash insurance only provides benefits for hospital stays, and does not cover outpatient medical treatments or preventive care. If you require medical care that does not require hospitalization, such as doctor visits or diagnostic tests, you may not be able to claim cash benefits from your policy.

Additionally, hospital cash insurance may have certain exclusions or limitations on pre-existing conditions. If you have a pre-existing medical condition, it is important to carefully review the policy terms to determine if you will be eligible for cash benefits related to that condition.

Overall, while hospital cash insurance can provide financial support during medical emergencies, it is important to carefully review the policy terms and understand its limitations to ensure it meets your specific healthcare needs.

Eligibility

To be eligible for hospital cash insurance, you must meet certain criteria. Firstly, you must be at least 18 years old and residing in the country where the policy is offered. Additionally, you must not have any pre-existing medical conditions that would exclude you from coverage. It is important to note that eligibility requirements may vary depending on the insurance provider and policy.

When applying for hospital cash insurance, you will need to provide information about your health and medical history. This includes details about any previous hospitalizations, surgeries, or ongoing medical treatments. The insurance provider will assess your application and determine if you meet the eligibility criteria.

Once you are approved for hospital cash insurance, you can enjoy the benefits of the policy. This includes financial coverage for hospital stays, medical expenses, and other related costs. In the event of a medical emergency, you can file a claim with the insurance provider to receive reimbursement for eligible expenses.

It is important to review the policy terms and conditions to understand the coverage and benefits provided by the hospital cash insurance. This will help you make an informed decision and ensure that the policy meets your specific needs. Remember that hospital cash insurance is designed to provide financial protection during medical emergencies, so it is essential to choose a policy that offers comprehensive coverage.

Who is Eligible for Hospital Cash Insurance?

Hospital Cash Insurance is a policy that provides financial protection for individuals during medical emergencies. It is available to anyone who is looking to safeguard their finances in the event of hospitalization or medical treatment.

This insurance is suitable for individuals of all ages, as it offers a range of benefits that can help cover the costs associated with hospital stays, surgeries, and other medical procedures. Whether you are young and healthy or have pre-existing medical conditions, Hospital Cash Insurance can provide you with the financial security you need.

Health is unpredictable, and medical expenses can quickly add up. With Hospital Cash Insurance, you can rest assured knowing that you have coverage in place to help ease the financial burden. In the event of hospitalization, you can make a claim and receive a cash benefit that can be used to cover expenses such as medical bills, transportation, accommodation, and other related costs.

Hospital Cash Insurance offers flexibility and peace of mind. It allows you to focus on your recovery without having to worry about the financial implications of your medical treatment. Whether you are planning for the future or currently facing a medical emergency, investing in Hospital Cash Insurance is a smart decision that can protect your financial well-being.

How to Apply for Hospital Cash Insurance?

Applying for hospital cash insurance is a simple and straightforward process. To get started, you will need to gather some basic information about yourself, such as your name, age, and contact details. You will also need to provide details about your medical history, including any pre-existing conditions or previous hospitalizations.

Once you have gathered all the necessary information, you can begin the application process. This can typically be done online or by contacting a representative from the insurance company. They will guide you through the application and answer any questions you may have.

During the application process, you will have the opportunity to choose the level of coverage that best suits your needs. Hospital cash insurance typically offers a range of benefits, including daily cash benefits for each day spent in the hospital, coverage for medical expenses, and additional benefits for surgeries or intensive care stays.

After submitting your application, it will be reviewed by the insurance company. If approved, you will receive a policy document outlining the terms and conditions of your coverage. It is important to carefully review this document and understand the benefits and limitations of your hospital cash insurance.

In the event that you need to make a claim, you will need to provide the necessary documentation, such as medical records and receipts for expenses incurred. The insurance company will then assess your claim and provide you with the cash benefits you are entitled to.

By applying for hospital cash insurance, you can ensure that your finances are protected during medical emergencies. With the right coverage, you can focus on your health and recovery without worrying about the financial burden of hospitalization.

Claim Process

When it comes to insurance, the claim process is an essential part of ensuring that you receive the cash benefits you are entitled to. With hospital cash insurance, the claim process is designed to be simple and efficient, so you can focus on your health and recovery.

Once you have purchased a hospital cash insurance policy, it is important to understand the coverage and benefits it provides. In the event of a medical emergency that requires hospitalization, you can file a claim with your insurance provider to receive cash benefits. These benefits can help cover the costs of hospitalization, medical treatments, and other related expenses.

To initiate the claim process, you will need to provide relevant documents such as your policy details, medical reports, and hospital bills. It is important to carefully review your insurance policy to understand the specific requirements and documentation needed for a successful claim.

After submitting your claim, the insurance provider will review the documents and assess the validity of the claim. Once approved, you will receive the cash benefits as per the terms of your policy. It is important to keep track of the claim status and communicate with your insurance provider if you have any questions or concerns.

Having hospital cash insurance can provide peace of mind knowing that your finances are protected during medical emergencies. By understanding the claim process and being prepared with the necessary documentation, you can ensure a smooth and hassle-free experience when filing a claim for your health-related expenses.

How to File a Claim for Hospital Cash Insurance?

When it comes to your health, having the right insurance coverage can provide you with peace of mind and financial security. Hospital cash insurance is designed to offer additional benefits on top of your regular health insurance policy, providing you with a cash payout if you are hospitalized due to an illness or injury.

If you find yourself in need of filing a claim for hospital cash insurance, here are the steps you need to follow:

- Collect all necessary documents: To file a claim, you will need to gather important documents such as your policy details, medical records, hospital bills, and any other supporting documents that prove your hospitalization.

- Fill out the claim form: Contact your insurance provider and request a claim form. Fill out the form accurately and provide all the required information, including your personal details, policy number, and a detailed description of the hospitalization.

- Submit the claim form and supporting documents: Once you have completed the claim form, attach all the necessary supporting documents and submit them to your insurance provider. Make sure to keep copies of all documents for your records.

- Follow up with your insurance provider: After submitting your claim, it is important to stay in touch with your insurance provider to track the progress of your claim. They may require additional information or documentation, so be prepared to provide any necessary updates.

- Receive your cash benefits: Once your claim is approved, you will receive the cash benefits as outlined in your policy. These benefits can help cover any expenses incurred during your hospital stay, such as medical bills, transportation costs, or loss of income.

Filing a claim for hospital cash insurance can be a straightforward process if you have all the necessary documents and follow the correct steps. It is important to review your policy and understand the terms and conditions before making a claim to ensure you meet the eligibility criteria for receiving cash benefits.

By having a hospital cash insurance policy in place, you can protect your finances and receive the financial support you need during medical emergencies. Remember to always keep your policy details and contact information for your insurance provider easily accessible, so you can file a claim promptly when needed.

Documents Required for Claiming Hospital Cash Insurance

When you need to make a claim on your hospital cash insurance policy, it is important to have all the necessary documents ready. These documents will help ensure a smooth and efficient claims process, allowing you to receive the cash benefits you are entitled to.

Here is a list of the documents you will typically need to provide when filing a claim:

- Claim form: This is the official document provided by the insurance company that you need to fill out with your personal details and the details of your hospitalization.

- Hospital bills: You will need to provide the original bills from the hospital, including the itemized breakdown of charges for each service or treatment received.

- Medical reports: These reports should include all the relevant medical information related to your hospitalization, such as the diagnosis, treatment plan, and any laboratory or imaging tests conducted.

- Prescriptions: If you were prescribed any medications during your hospital stay, make sure to keep the original prescriptions as they may be required for the claim.

- Discharge summary: This document is provided by the hospital and contains a summary of your treatment, the duration of your stay, and any follow-up instructions.

- Proof of payment: If you have made any payments towards your hospital bills, keep the receipts as proof of payment.

It is important to note that the specific documents required may vary depending on your insurance provider and the terms of your policy. It is always a good idea to review your policy documents or contact your insurance company to ensure you have all the necessary documents before filing a claim.

By having all the required documents ready, you can expedite the claims process and ensure that you receive the cash benefits provided by your hospital cash insurance policy. Remember to keep copies of all the documents for your records and submit the originals to the insurance company.

Question-answer:

What is hospital cash insurance?

Hospital cash insurance is a type of insurance policy that provides financial protection in case of medical emergencies. It pays a fixed daily amount for each day you are hospitalized, which can be used to cover expenses such as medical bills, transportation, and accommodation.

Why should I consider getting hospital cash insurance?

Hospital cash insurance can provide you with peace of mind and financial security during medical emergencies. It ensures that you have a source of income to cover your everyday expenses while you are hospitalized, allowing you to focus on your recovery instead of worrying about financial matters.

How does hospital cash insurance work?

Hospital cash insurance works by paying you a fixed daily amount for each day you are hospitalized. The amount is predetermined when you purchase the policy and is usually paid out directly to you. You can use the money to cover any expenses related to your hospitalization, such as medical bills, transportation, and accommodation.

What expenses does hospital cash insurance cover?

Hospital cash insurance covers a wide range of expenses related to your hospitalization. These can include medical bills, transportation costs to and from the hospital, accommodation if you need to stay overnight, and even daily living expenses such as food and toiletries. The exact coverage may vary depending on the policy you choose.

Can I get hospital cash insurance if I already have health insurance?

Yes, you can still get hospital cash insurance even if you already have health insurance. Hospital cash insurance is designed to complement your existing health insurance coverage by providing additional financial support during your hospitalization. It can help cover expenses that may not be fully covered by your health insurance, such as transportation and accommodation.