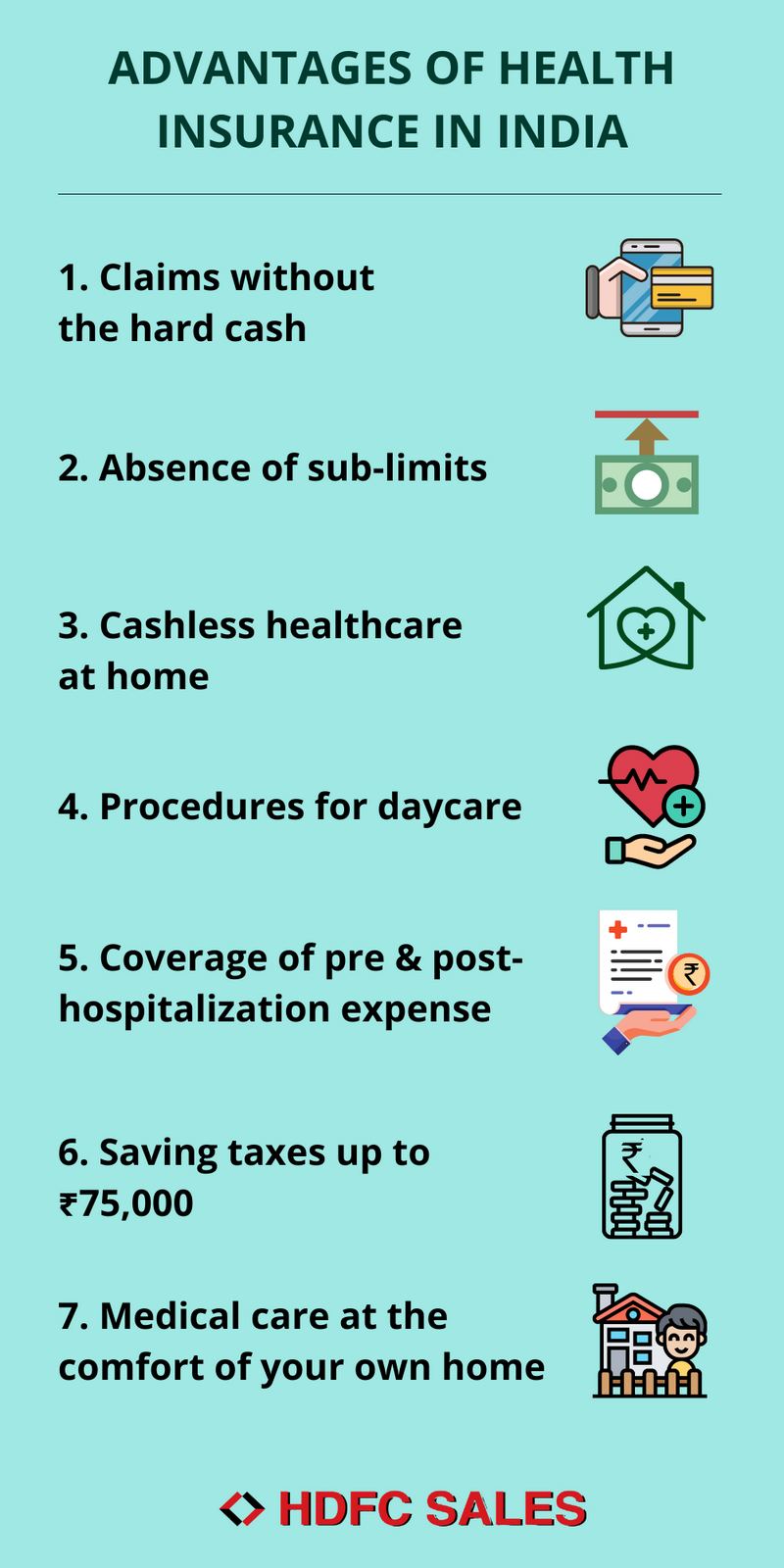

Benefits of Health Insurance

Medical emergencies can happen unexpectedly, and without proper protection, the costs of healthcare can quickly add up. That’s why having health insurance is crucial for your well-being and financial security.

Health insurance provides a wide range of benefits that ensure you have access to quality healthcare when you need it most. It offers peace of mind knowing that you are covered for medical expenses, including doctor’s visits, hospital stays, and prescription medications.

One of the greatest advantages of health insurance is the financial protection it provides. Without insurance, medical costs can be overwhelming and can quickly deplete your savings. However, with health insurance, you have the option to choose a plan that suits your needs and budget, allowing you to manage your healthcare costs effectively.

Health insurance also offers various options to cater to your specific needs. Whether you are an individual, a family, or a small business owner, there are different plans available that can provide the coverage you require. These options allow you to customize your insurance plan and select the benefits that are most important to you.

In addition to financial protection and customizable options, health insurance offers numerous other benefits. It provides preventive care services, such as vaccinations and screenings, to help you maintain good health and detect any potential health issues early. Health insurance also gives you access to a network of healthcare providers, ensuring that you receive quality care from trusted professionals.

In conclusion, health insurance is essential for your overall well-being. It offers financial protection, customizable options, and a wide range of benefits that provide peace of mind and ensure that you have access to the medical care you need. Don’t wait until it’s too late – invest in health insurance today and secure a healthier future.

Financial Protection

Health insurance provides a crucial financial protection for individuals and families. With the right coverage, you can have peace of mind knowing that your medical expenses will be taken care of. Whether it’s a routine check-up or a major surgery, health insurance ensures that you are protected from the high costs of medical treatments.

One of the main benefits of health insurance is that it helps to reduce the financial burden of healthcare. Without insurance, the costs of medical treatments can quickly add up and become unaffordable. However, with the right insurance plan, you can receive the necessary medical care without worrying about the high costs.

Health insurance also provides protection against unexpected medical expenses. Accidents and illnesses can happen at any time, and the costs of emergency medical treatments can be overwhelming. With health insurance, you can have the peace of mind knowing that you are covered in case of any unexpected medical events.

In addition to financial protection, health insurance also offers a range of other benefits. Many insurance plans include coverage for preventive care, such as vaccinations and screenings, which can help you maintain good health and prevent future health problems. Insurance plans may also offer discounts on prescription medications, making them more affordable for individuals and families.

In conclusion, health insurance provides essential financial protection and peace of mind. By having the right coverage, you can protect yourself and your family from the high costs of medical treatments. Additionally, health insurance offers a range of benefits that can help you maintain good health and save money on healthcare expenses.

Access to Quality Healthcare

Health insurance provides individuals with access to quality healthcare, ensuring that they receive the medical attention they need without worrying about the costs. With health insurance, individuals have the financial protection they need to cover the expenses associated with healthcare services.

Having health insurance offers numerous benefits, including access to a wide range of healthcare options. Individuals can choose from a network of doctors, specialists, and hospitals, allowing them to receive the best medical care available. This ensures that individuals can receive the necessary treatment for their health conditions, promoting overall well-being.

One of the main advantages of health insurance is the peace of mind it provides. With insurance coverage, individuals can rest assured knowing that they are protected in case of unexpected medical expenses. This eliminates the stress and worry associated with high healthcare costs, allowing individuals to focus on their health and recovery.

Health insurance also offers individuals the flexibility to choose the healthcare options that best suit their needs. Whether it’s preventive care, routine check-ups, or specialized treatments, health insurance provides individuals with the freedom to select the medical services that are most beneficial for their health.

In conclusion, health insurance grants individuals access to quality healthcare, offering financial protection, a wide range of healthcare options, peace of mind, and flexibility in choosing medical services. It is an essential investment that ensures individuals can receive the necessary medical care for their overall well-being.

Preventive Care

Preventive care is an essential aspect of maintaining peace and health in our lives. With health insurance coverage, individuals can ensure that they have access to preventive care services that can help protect their overall well-being.

Medical costs can be a burden for many individuals, but with health insurance, the financial strain is reduced. Health insurance provides coverage for preventive care services such as regular check-ups, vaccinations, and screenings. This coverage not only helps individuals save money but also encourages them to prioritize their health and seek timely medical attention.

One of the benefits of health insurance is that it offers protection against unexpected medical expenses. In the event of an illness or injury, having health insurance can provide individuals with the peace of mind that they will be able to receive the necessary medical treatment without worrying about the financial implications.

Preventive care plays a crucial role in early detection and prevention of diseases. With health insurance, individuals can have access to regular screenings and tests that can help identify potential health issues at an early stage. This early detection allows for timely intervention and treatment, improving the chances of successful recovery and reducing the overall healthcare costs.

Overall, health insurance coverage offers numerous benefits, including access to preventive care services. By prioritizing preventive care, individuals can take proactive steps towards maintaining their health and well-being, while also saving on medical costs in the long run.

Prescription Drug Coverage

One of the key benefits of health insurance is prescription drug coverage. This coverage helps to reduce the costs of necessary medications, ensuring that individuals can afford the drugs they need to maintain their health and well-being.

With prescription drug coverage, individuals have the peace of mind knowing that they are protected against the high costs of medications. Without insurance, the cost of prescription drugs can be overwhelming, especially for those with chronic conditions or multiple prescriptions.

Health insurance offers different options for prescription drug coverage, allowing individuals to choose the plan that best fits their needs. Some plans may have a co-pay system, where individuals pay a fixed amount for each prescription, while others may have a deductible that needs to be met before the coverage kicks in.

Regardless of the specific coverage options, having insurance for prescription drugs provides a safety net for individuals, ensuring that they can access the medications they need without breaking the bank. This coverage not only protects their health but also their financial well-being.

Emergency Medical Services

When it comes to your health, peace and protection are of utmost importance. That’s why having health insurance is essential. With emergency medical services coverage, you can have peace of mind knowing that you are protected in case of any unforeseen medical emergencies.

Health insurance provides a range of benefits, including coverage for emergency medical services. In the event of an accident, injury, or sudden illness, your insurance will cover the costs of necessary medical treatments, hospital stays, and ambulance services.

Having insurance for emergency medical services gives you the flexibility to choose from a variety of medical options. Whether you need emergency surgery, specialized treatment, or immediate care, your insurance will ensure that you have access to the best healthcare professionals and facilities.

Health insurance not only protects your physical well-being but also safeguards your financial health. The costs of emergency medical services can be overwhelming, but with insurance, you can avoid the burden of high medical bills. Insurance coverage will help you manage the costs and focus on your recovery without the stress of financial strain.

Don’t wait until an emergency strikes to realize the importance of having health insurance. Invest in your health and secure your future by getting insurance coverage for emergency medical services. It’s a smart choice that provides you with peace, protection, and the assurance that you will receive the best medical care whenever you need it.

Specialist Referrals

When it comes to your health, peace of mind is priceless. With health insurance, you can have the peace of mind knowing that you have access to specialist referrals. This means that if you need to see a specialist for a specific medical condition or treatment, your insurance will cover the costs of the referral.

One of the benefits of specialist referrals is the cost savings. Without insurance, seeing a specialist can be expensive, with consultation fees and additional tests or procedures adding up quickly. With health insurance, you can save on these costs and receive the medical attention you need without breaking the bank.

Another advantage of specialist referrals is the protection it provides. By having access to a network of specialists, you can ensure that you are receiving the best possible care for your specific health needs. Specialists have the expertise and knowledge to diagnose and treat complex medical conditions, giving you the confidence that you are in good hands.

With specialist referrals, you also have more options when it comes to your medical care. Your insurance may have a list of approved specialists that you can choose from, giving you the flexibility to find a specialist that suits your needs and preferences. This allows you to take control of your health and make informed decisions about your medical treatment.

Overall, specialist referrals are a valuable part of health insurance coverage. They provide peace of mind, cost savings, protection, and options for your medical care. So, take advantage of your health insurance and ensure that you have access to specialist referrals when you need them.

Maternity Benefits

Health insurance provides comprehensive coverage for maternity costs, ensuring the health and well-being of both mother and child. With maternity benefits, expectant mothers can receive the necessary medical care and support throughout their pregnancy journey.

One of the key advantages of maternity benefits is the financial protection it offers. Pregnancy and childbirth can be expensive, but with health insurance, the costs are significantly reduced. From prenatal visits and ultrasounds to labor and delivery, insurance coverage ensures that these expenses are covered, giving expectant parents peace of mind.

Maternity benefits also provide a wide range of options for expectant mothers. Whether it’s choosing the right healthcare provider, selecting a birthing plan, or deciding on postpartum care, health insurance offers flexibility and choices. This allows mothers to make informed decisions about their healthcare and the well-being of their newborn.

Furthermore, maternity benefits extend beyond just medical coverage. Many insurance plans include additional benefits such as lactation support, prenatal vitamins, and counseling services. These additional benefits contribute to the overall health and wellness of both mother and child.

In summary, maternity benefits offered by health insurance provide essential protection, options, and coverage for expectant mothers. From financial security to a wide range of healthcare choices, insurance ensures that mothers can focus on their health and the well-being of their newborn, knowing that they have the support they need.

Mental Health Support

When it comes to taking care of your health, it’s important to have insurance coverage that includes mental health support. Mental health is just as important as physical health, and having access to the right resources can make all the difference in your overall well-being.

With health insurance that covers mental health, you can have peace of mind knowing that you have financial protection against the high costs of therapy and counseling. Mental health services can be expensive, but with the right insurance, you can receive the care you need without breaking the bank.

Having mental health coverage also gives you more options when it comes to finding the right therapist or counselor. You can choose from a wide network of providers, ensuring that you find someone who meets your needs and preferences. This flexibility allows you to receive personalized care that is tailored to your specific situation.

In addition to financial protection and increased options, mental health insurance offers a range of benefits. You can receive coverage for medication, hospitalization, and outpatient services. This comprehensive coverage ensures that you have access to the necessary medical treatments and support for your mental health.

Overall, having health insurance that includes mental health coverage is essential for your well-being. It provides you with the necessary protection, options, and benefits to take care of your mental health. Don’t overlook the importance of mental health support – invest in insurance that prioritizes your overall health and well-being.

Dental and Vision Coverage

When it comes to your overall health and well-being, dental and vision coverage are essential forms of protection. While medical insurance covers the costs of many health-related expenses, it often does not include dental and vision care. That’s where dental and vision coverage comes in, offering you additional coverage options for these specific areas of your health.

Having dental and vision coverage provides you with peace of mind, knowing that you are covered for routine check-ups, cleanings, and necessary treatments. Regular dental and vision exams are important for maintaining good oral and visual health, as they can detect any potential issues early on. With dental and vision coverage, you can take care of your teeth and eyes without worrying about the financial burden.

With dental coverage, you can have access to a network of dentists and specialists who can provide the necessary treatments for your dental health. From fillings and crowns to root canals and orthodontic treatments, dental coverage ensures that you have the coverage you need for a healthy smile.

Vision coverage, on the other hand, allows you to have regular eye exams and provides coverage for prescription glasses, contact lenses, and even corrective eye surgeries. Your eyes are an important part of your overall health, and having vision coverage ensures that you can maintain good vision and address any vision-related issues that may arise.

By investing in dental and vision coverage, you are investing in your overall health and well-being. Don’t let the costs of dental and vision care hold you back from taking care of yourself. Explore your options for dental and vision coverage today and enjoy the peace of mind that comes with knowing you are covered.

Rehabilitation Services

When it comes to your health, it’s important to have the right medical coverage. With our rehabilitation services, you can have peace of mind knowing that you have access to the care you need. Whether you’re recovering from an injury or managing a chronic condition, our services can provide you with the support and guidance you need to get back on track.

Our rehabilitation services offer a range of benefits for your health and well-being. From physical therapy to occupational therapy, our team of experts will work with you to develop a personalized plan that meets your unique needs. With our comprehensive coverage options, you can rest assured knowing that you’re protected from unexpected medical expenses.

With our rehabilitation services, you have the flexibility to choose the treatment options that work best for you. Whether you prefer traditional therapies or alternative approaches, we have a variety of options to suit your preferences. Our goal is to provide you with the tools and resources you need to achieve optimal health and wellness.

Don’t wait until it’s too late. Invest in your health today with our rehabilitation services. With our insurance coverage, you can have peace of mind knowing that you’re protected and supported every step of the way. Take control of your health and start living your best life today.

Health and Wellness Programs

Health and Wellness Programs provide comprehensive coverage for all your health needs. With our programs, you can enjoy the peace of mind that comes with knowing you have access to top-quality medical care and protection.

Our programs offer a wide range of options to suit your individual needs and budget. Whether you’re looking for basic coverage or a more comprehensive plan, we have the right insurance solution for you.

One of the key benefits of our Health and Wellness Programs is the ability to manage your health costs effectively. With our programs, you can reduce your out-of-pocket expenses and ensure that you have access to affordable medical care when you need it most.

Our programs also provide a range of additional benefits, such as preventive care services and wellness incentives. By participating in these programs, you can proactively manage your health and prevent costly medical conditions in the future.

Don’t wait until it’s too late. Invest in your health and well-being with our Health and Wellness Programs. Contact us today to learn more about our insurance options and how we can help you achieve optimal health and financial security.

Coverage for Pre-existing Conditions

Health insurance provides peace of mind by offering coverage for pre-existing conditions. This means that individuals with existing health issues can still receive medical care and treatment without worrying about the costs. With health insurance, you have the assurance that your medical expenses will be covered, regardless of your pre-existing conditions.

Having coverage for pre-existing conditions also allows individuals to access a wide range of benefits. This includes regular check-ups, preventive care, and ongoing treatments for chronic illnesses. With health insurance, you have the opportunity to take proactive steps towards maintaining your health and managing your condition effectively.

Health insurance offers various options for coverage, ensuring that you can find a plan that suits your specific needs and budget. Whether you require basic coverage or comprehensive protection, there are different plans available to cater to your individual requirements. This flexibility allows you to choose the coverage that best fits your health needs and financial situation.

By having health insurance coverage for pre-existing conditions, you can also avoid high medical costs. Without insurance, the expenses associated with doctor visits, medications, and hospital stays can quickly add up. With coverage, you can receive the necessary medical care without worrying about the financial burden it may impose.

In summary, having health insurance that covers pre-existing conditions provides peace of mind, reduces financial stress, and ensures access to necessary medical care. It offers a range of benefits, options, and protection for your health. Don’t wait until you need medical attention to consider health insurance. Invest in your well-being and secure your future by getting the coverage you need today.

Flexibility in Choosing Providers

With medical insurance, you have the advantage of flexibility in choosing healthcare providers. Whether you need to see a doctor, visit a specialist, or receive treatment at a hospital, having insurance coverage gives you the freedom to choose the providers that best meet your needs.

By having access to a wide network of providers, you can select the medical professionals who specialize in the specific care or treatment you require. This ensures that you receive the highest quality of care and have peace of mind knowing that you are in capable hands.

Additionally, medical insurance provides financial benefits when it comes to choosing providers. With insurance coverage, you can often receive discounted rates for services rendered by in-network providers. This helps to reduce your out-of-pocket costs and makes healthcare more affordable.

Furthermore, having insurance coverage offers protection against unexpected medical costs. Without insurance, a single medical emergency or serious illness could result in overwhelming medical bills, potentially leading to financial hardship. However, with insurance, you can rest assured knowing that you are protected and can focus on your health without the added stress of excessive medical expenses.

In summary, the flexibility in choosing providers that comes with medical insurance provides numerous benefits. From having access to a wide network of healthcare professionals to receiving discounted rates and protection against unexpected costs, insurance coverage ensures that you receive the care you need while maintaining your financial stability and peace of mind.

Peace of Mind

When it comes to your health, having the right coverage is essential. Health insurance provides you with the peace of mind knowing that you have access to a wide range of medical options. Whether it’s routine check-ups, emergency care, or specialized treatments, having insurance ensures that you can receive the best care without worrying about the costs.

One of the key benefits of health insurance is the financial protection it offers. Medical costs can quickly add up, especially in the case of unexpected illnesses or accidents. With insurance, you have the assurance that your expenses will be covered, preventing you from experiencing financial strain during times of medical need.

Having health insurance also gives you the freedom to choose the healthcare providers and facilities that best suit your needs. You can select from a network of doctors, specialists, and hospitals, ensuring that you receive the highest quality of care. Additionally, insurance often provides access to additional services such as preventative screenings and wellness programs, helping you maintain optimal health.

Another advantage of health insurance is the peace of mind it brings to your loved ones. Knowing that you are covered in case of a medical emergency can alleviate the stress and worry that comes with unexpected health issues. Your family can focus on supporting you during your recovery instead of being burdened by the financial costs of medical treatments.

In summary, health insurance offers numerous advantages, including financial protection, access to a variety of healthcare options, and peace of mind for both you and your family. Don’t wait until it’s too late – invest in your health and secure the benefits of health insurance today.

Question-answer:

What are the advantages of health insurance?

Health insurance provides financial protection against high medical costs. It helps cover the expenses for doctor visits, hospital stays, prescription medications, and other healthcare services. It also ensures that you have access to quality healthcare and can receive timely treatment without worrying about the financial burden.

Why is health insurance important?

Health insurance is important because it helps protect you and your family from the high costs of medical care. It provides coverage for preventive services, such as check-ups and vaccinations, which can help detect and prevent potential health problems. It also provides coverage for unexpected medical emergencies, giving you peace of mind knowing that you are financially protected.