What To Know About Cumulative Bonus in Health Insurance

When it comes to health insurance, it is important to know what benefits are available to you. One such benefit that many people may not be aware of is the cumulative bonus. This bonus is a unique feature of health insurance policies that can provide you with additional coverage over time.

The cumulative bonus is a reward system that encourages policyholders to stay insured and maintain their policies over the long term. It works by increasing the sum insured by a certain percentage for every claim-free year. This means that the longer you go without making a claim, the higher your coverage will be.

One of the main advantages of the cumulative bonus is that it provides a financial safety net for policyholders. As medical costs continue to rise, having a higher sum insured can give you peace of mind knowing that you are adequately covered. In the event of a medical emergency or unexpected illness, you can rest assured that your insurance will provide the necessary financial support.

Another benefit of the cumulative bonus is that it rewards policyholders for their commitment to their health. By staying healthy and avoiding claims, you can enjoy the added benefit of increased coverage. This can serve as a motivation to maintain a healthy lifestyle and take preventive measures to avoid illnesses.

In conclusion, the cumulative bonus is a valuable feature of health insurance that offers several benefits. It not only increases your coverage over time but also rewards you for staying insured and maintaining your policy. If you are considering health insurance, it is important to understand the benefits of the cumulative bonus and how it can provide you with added financial protection and peace of mind.

What is a Cumulative Bonus?

A cumulative bonus is a benefit that is offered by health insurance companies to policyholders. It is a reward for policyholders who do not make any claims during a policy year. The bonus is added to the sum insured for the next policy year, providing the policyholder with additional coverage.

Health insurance is important for everyone to have, as it provides financial protection in case of unexpected medical expenses. However, many people are not aware of the benefits of a cumulative bonus in health insurance.

The cumulative bonus is a way for insurance companies to incentivize policyholders to stay healthy and avoid making claims. By not making any claims, policyholders can accumulate a bonus that can be used to increase their coverage in the future.

It is important to know about the cumulative bonus when choosing a health insurance policy. Some policies offer a higher cumulative bonus percentage than others, so it is important to compare different policies to find the best option.

Overall, a cumulative bonus is a valuable benefit that can help policyholders increase their coverage and save money on health insurance. It is a reward for staying healthy and not making any claims, and it can provide peace of mind knowing that additional coverage is available if needed.

How Does Cumulative Bonus Work?

If you have health insurance, you may have heard about the concept of a cumulative bonus. But what exactly is it and how does it work? Let’s take a closer look.

A cumulative bonus is a benefit that is offered by some health insurance providers. It is a reward for policyholders who do not make any claims during a policy year. The bonus is usually a percentage of the sum insured and is added to the policyholder’s coverage for the next policy year.

For example, let’s say you have a health insurance policy with a sum insured of $10,000 and a cumulative bonus of 10%. If you do not make any claims in the first year, your sum insured for the next year will be increased to $11,000 ($10,000 + $1,000 bonus).

This cumulative bonus can be a great financial benefit for policyholders, as it allows them to increase their coverage without any additional cost. It also encourages policyholders to stay healthy and avoid unnecessary medical expenses.

It’s important to note that the cumulative bonus is usually capped at a certain percentage, such as 50%. This means that even if you do not make any claims for several years, your coverage will not exceed the capped percentage.

To take advantage of the cumulative bonus, it’s important to choose a health insurance policy that offers this benefit. You should also understand the terms and conditions associated with the bonus, such as the percentage increase and the cap limit.

In conclusion, the cumulative bonus is a valuable feature of health insurance that rewards policyholders for staying healthy and not making any claims. It allows them to increase their coverage without any additional cost. If you’re considering health insurance, be sure to inquire about the cumulative bonus and how it can benefit you.

Why is Cumulative Bonus Important?

When it comes to health insurance, it is important to know what cumulative bonus is and how it can benefit you. A cumulative bonus is a type of bonus that is added to your health insurance policy for every claim-free year. This means that if you do not make any claims during a policy year, your cumulative bonus will increase.

The cumulative bonus is important because it provides you with additional benefits and rewards for maintaining a healthy lifestyle and avoiding any major health issues. It acts as an incentive for policyholders to take care of their health and make the most of their insurance coverage.

One of the key benefits of a cumulative bonus is that it can help you save money on your health insurance premiums. As your cumulative bonus increases, the insurance company may offer you a discount on your premiums, making your policy more affordable.

In addition to saving money, a cumulative bonus can also provide you with additional coverage. As your cumulative bonus increases, you may be eligible for higher coverage limits, allowing you to receive more benefits and services from your health insurance policy.

Overall, understanding the benefits of a cumulative bonus in health insurance is important as it can help you save money, receive additional coverage, and incentivize you to maintain a healthy lifestyle. So, make sure to inquire about the cumulative bonus when choosing a health insurance policy.

Benefits of Cumulative Bonus

If you care about your health, it is important to know about the benefits of cumulative bonus in health insurance. Cumulative bonus is an additional benefit that you can avail if you do not make any claims during a policy year. This means that if you stay healthy and do not require any medical treatment, you will be rewarded with a cumulative bonus.

The cumulative bonus is a great way to save money on your health insurance premiums. With each claim-free year, the bonus amount increases, providing you with a higher discount on your premiums. This can result in significant savings over time, allowing you to allocate your funds towards other important expenses.

Not only does the cumulative bonus help you save money, but it also encourages you to maintain a healthy lifestyle. By avoiding unnecessary medical treatments and taking preventive measures, you can not only prevent illnesses but also earn a higher cumulative bonus. This creates a win-win situation for both your health and your finances.

It is important to note that the cumulative bonus is a feature offered by many health insurance providers. However, the terms and conditions may vary, so it is essential to read the policy documents carefully to understand the specific benefits and eligibility criteria. By staying informed, you can make the most out of the cumulative bonus and enjoy its advantages.

In conclusion, if you want to save money on your health insurance premiums and maintain a healthy lifestyle, the cumulative bonus is something you should know about. It rewards you for staying healthy and not making any claims, providing you with financial benefits and encouraging you to prioritize your well-being. Take advantage of this feature and make the most out of your health insurance policy.

Increased Coverage

When it comes to health insurance, it is important to know about the cumulative bonus and how it can benefit you. A cumulative bonus is an additional coverage that you can receive over time. It is a reward for staying healthy and not making any claims. By understanding what a cumulative bonus is, you can make the most out of your health insurance policy.

With a cumulative bonus, your coverage increases each year that you do not make a claim. This means that if you have a policy with a cumulative bonus of 10%, your coverage will increase by 10% for each claim-free year. This can be a significant benefit, as it provides you with extra protection and peace of mind.

The cumulative bonus is a great incentive to take care of your health and avoid making unnecessary claims. By staying healthy and not making claims, you can enjoy increased coverage without any additional cost. It is a win-win situation for both the policyholder and the insurance company.

To make the most out of your health insurance policy, it is important to know about the cumulative bonus and how it works. By understanding the benefits of a cumulative bonus, you can make informed decisions about your health insurance coverage. So, take the time to learn about the cumulative bonus and make the most out of your health insurance policy.

Cost Savings

When it comes to health insurance, it’s important to know about the cumulative bonus and how it can help you save on costs. A cumulative bonus is a benefit that rewards policyholders for not making any claims during a policy year. This means that if you have a health insurance policy and you don’t make any claims, you will be eligible for a cumulative bonus.

The cumulative bonus in health insurance works by increasing the sum insured for every claim-free year. This means that the longer you go without making a claim, the higher your sum insured will be. This is a great way to save on costs because it allows you to have higher coverage without having to pay higher premiums.

By taking advantage of the cumulative bonus in health insurance, you can ensure that you are adequately covered for any unexpected medical expenses. This can provide you with peace of mind knowing that you have financial protection in case of any health emergencies.

To understand the benefits of cumulative bonus in health insurance, it’s important to know what your policy offers and how it can help you save on costs. By speaking with an insurance agent or reading through your policy documents, you can get a better understanding of how the cumulative bonus works and how it can benefit you.

Overall, the cumulative bonus in health insurance is a valuable benefit that can help you save on costs. By not making any claims and taking advantage of the increased sum insured, you can have higher coverage without paying higher premiums. So, make sure to know about the cumulative bonus in your health insurance policy and take advantage of the cost savings it can provide.

Financial Protection

When it comes to health insurance, it’s important to know what kind of financial protection you have. One option to consider is a cumulative bonus. But what exactly is a cumulative bonus in health insurance?

A cumulative bonus is a feature of health insurance policies that rewards policyholders for staying healthy. It works by providing a bonus amount for every claim-free year. This bonus can be used to cover future medical expenses or can be accumulated over time to provide a significant financial safety net.

With a cumulative bonus, you can have peace of mind knowing that your health insurance policy not only provides coverage for medical expenses but also rewards you for maintaining good health. This can be especially beneficial in the long run, as the bonus amount increases with each claim-free year.

Not only does a cumulative bonus provide financial protection, but it also incentivizes individuals to take preventive measures to maintain their health. By staying healthy and avoiding claims, policyholders can continue to accumulate bonuses and further enhance their financial security.

So, if you’re looking for a health insurance policy that offers both coverage and financial protection, consider one with a cumulative bonus. It’s a great way to ensure that you’re not only protected in case of medical emergencies but also rewarded for staying healthy.

Flexibility

When it comes to health insurance, flexibility is key. With cumulative bonus in health insurance, you have the freedom to choose the coverage that suits your needs. Whether you’re a young individual looking for basic coverage or a family needing comprehensive protection, cumulative bonus allows you to customize your insurance plan.

One of the great things about cumulative bonus in health insurance is that it accumulates over time. This means that the longer you hold the policy without making any claims, the higher your bonus will be. This can be a significant advantage, as it allows you to build up a substantial amount of coverage over the years.

Another important aspect to know about cumulative bonus is that it is transferable. This means that if you decide to switch insurance providers, you can carry your accumulated bonus with you. This ensures that you don’t lose out on the benefits you have earned.

Cumulative bonus in health insurance is a valuable feature that provides added financial protection for you and your loved ones. It rewards you for maintaining a healthy lifestyle and encourages you to continue taking care of your health. So, if you’re looking for a flexible and rewarding health insurance option, consider choosing a plan with cumulative bonus.

Peace of Mind

When it comes to insurance, peace of mind is invaluable. And with a cumulative bonus in health insurance, you can have even greater peace of mind knowing that you are protected against unexpected medical expenses.

So, what exactly is a cumulative bonus in health insurance? It is a reward that insurance companies offer to policyholders who do not make any claims during a policy year. This bonus accumulates over time and can be used to offset future premiums or increase the sum insured.

Why is this bonus important? Well, it provides an added financial benefit for policyholders who prioritize their health and take preventive measures to stay healthy. It encourages individuals to maintain a healthy lifestyle and seek regular medical check-ups, knowing that their efforts will be rewarded.

It’s important to know that not all insurance policies offer a cumulative bonus. Therefore, when choosing a health insurance policy, it’s essential to consider this factor and opt for a policy that includes this benefit. The cumulative bonus can significantly enhance the overall value of your insurance coverage.

So, if you’re looking for comprehensive health insurance coverage that rewards your commitment to staying healthy, consider a policy that offers a cumulative bonus. It’s a win-win situation – you protect yourself against unexpected medical expenses while enjoying the added benefit of accumulating a bonus that can be used to further enhance your coverage.

How to Qualify for Cumulative Bonus

If you have health insurance, it is important to know about the benefits of cumulative bonus. A cumulative bonus is a reward that you can earn for not making any claims on your health insurance policy. It is a way for insurance companies to encourage policyholders to stay healthy and avoid unnecessary medical expenses.

To qualify for a cumulative bonus, you need to have a health insurance policy that offers this benefit. Check with your insurance provider to see if they offer cumulative bonus and what the eligibility criteria are. Typically, you need to have a policy with no claims for a certain period of time to qualify for the bonus.

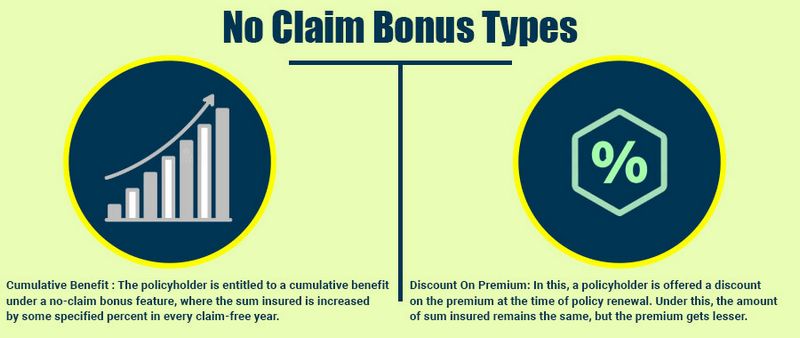

It is important to understand that the cumulative bonus is not the same as a no-claim bonus. A no-claim bonus is a discount on your premium for not making any claims in a policy year, while a cumulative bonus is an increase in the sum insured for every claim-free year. The cumulative bonus can help to increase your coverage over time, providing you with more financial protection.

When you qualify for a cumulative bonus, it is important to know how it will be applied to your policy. Some insurance companies may apply the bonus as a discount on your premium, while others may increase the sum insured. Make sure to read the terms and conditions of your policy to understand how the bonus will be applied.

In conclusion, if you have health insurance, it is important to know about the benefits of cumulative bonus. To qualify for this bonus, you need to have a policy with no claims for a certain period of time. The bonus can help to increase your coverage over time, providing you with more financial protection. Make sure to check with your insurance provider to see if they offer cumulative bonus and what the eligibility criteria are.

Continuous Coverage

In the world of health insurance, it’s important to have continuous coverage to ensure that you’re protected against unexpected medical expenses. That’s where the concept of cumulative bonus comes into play. But what exactly is cumulative bonus and why is it important for your health?

Cumulative bonus is a feature in health insurance that rewards you for staying insured without making any claims. It works like a loyalty program, where the longer you have continuous coverage, the higher your bonus becomes. This bonus can be used to enhance your health insurance coverage or reduce your premiums.

So, what do you need to know about cumulative bonus in health insurance? First, it’s important to understand that the bonus is cumulative, meaning it keeps adding up over the years. This means that the longer you have continuous coverage, the more bonus you accrue.

Second, the cumulative bonus can be used to enhance your health insurance coverage. For example, if you have a cumulative bonus of 20%, it means that you can avail an additional 20% coverage on top of your existing sum insured.

Lastly, the cumulative bonus can also be used to reduce your premiums. The bonus can be applied as a discount on your premium amount, helping you save money on your health insurance policy.

In conclusion, having continuous coverage in health insurance is crucial, and the cumulative bonus is a great incentive to encourage you to stay insured. It not only rewards you for your loyalty but also provides additional coverage and cost savings. So, make sure to understand and take advantage of the cumulative bonus feature when choosing a health insurance policy.

No Claims Made

Do you want to know more about cumulative bonus in health insurance? Well, one of the key benefits of a cumulative bonus is the “No Claims Made” feature. This means that if you do not make any claims during a policy year, you will be eligible for a bonus at the end of the year.

But what exactly is a cumulative bonus? It is an additional amount that is added to your health insurance coverage each year, without any increase in premium. This bonus can be used to cover future medical expenses or to enhance your existing coverage.

So, how does it work? Let’s say you have a health insurance policy with a cumulative bonus feature. If you do not make any claims in the first year, your coverage amount will increase by a certain percentage. This percentage increases for each consecutive claim-free year.

For example, if your policy has a cumulative bonus of 10% and you do not make any claims in the first year, your coverage amount will increase by 10% in the second year. If you continue to not make any claims, the coverage amount will increase by another 10% in the third year, and so on.

This cumulative bonus can be a great advantage for those who maintain good health and do not require frequent medical attention. It rewards policyholders for staying healthy and encourages them to take preventive measures to avoid illnesses and accidents.

So, if you want to enjoy the benefits of a cumulative bonus in your health insurance policy, make sure to choose a plan that offers this feature. It can provide you with additional coverage and financial security in the long run.

Renewal Without Gaps

When it comes to health insurance, it’s important to know what you’re getting into. That’s why understanding the benefits of cumulative bonus is crucial. With cumulative bonus, you can enjoy renewal without any gaps in your coverage.

So, what exactly is cumulative bonus? It’s a feature in health insurance that rewards you for not making any claims during a policy year. For every claim-free year, your sum insured increases by a certain percentage. This means that if you don’t make any claims, your health insurance coverage will continue to grow, giving you added protection.

Renewal without gaps is a great advantage of cumulative bonus. It ensures that you have continuous coverage without any breaks. This is important because any gaps in your insurance can leave you vulnerable to unexpected medical expenses. With renewal without gaps, you can have peace of mind knowing that you’re always protected.

To make the most of the cumulative bonus and renewal without gaps, it’s important to choose a health insurance plan that offers this feature. Look for policies that have a high percentage increase in sum insured for every claim-free year. This way, you can maximize your coverage and enjoy the benefits of cumulative bonus for years to come.

Don’t miss out on the advantages of cumulative bonus and renewal without gaps in your health insurance. Talk to an insurance agent today to find the best plan for you and ensure that you have continuous coverage for all your healthcare needs.

Question-answer:

What is a cumulative bonus in health insurance?

A cumulative bonus in health insurance is a benefit that is added to your policy for every claim-free year. It is a reward for not making any claims and can help you reduce your premium or increase your sum insured.

How does a cumulative bonus work in health insurance?

A cumulative bonus works by increasing your sum insured or reducing your premium for every claim-free year. For example, if you have a cumulative bonus of 10%, your sum insured will increase by 10% or your premium will be reduced by 10% for the next policy year.