How Health Insurance Works

Health insurance is a crucial aspect of managing your healthcare costs and ensuring access to quality medical services. It provides financial protection against unexpected medical expenses and helps individuals and families receive the necessary care without incurring significant financial burdens. To fully comprehend how health insurance works, it is important to understand key terms such as premiums, deductibles, copayments, and claims.

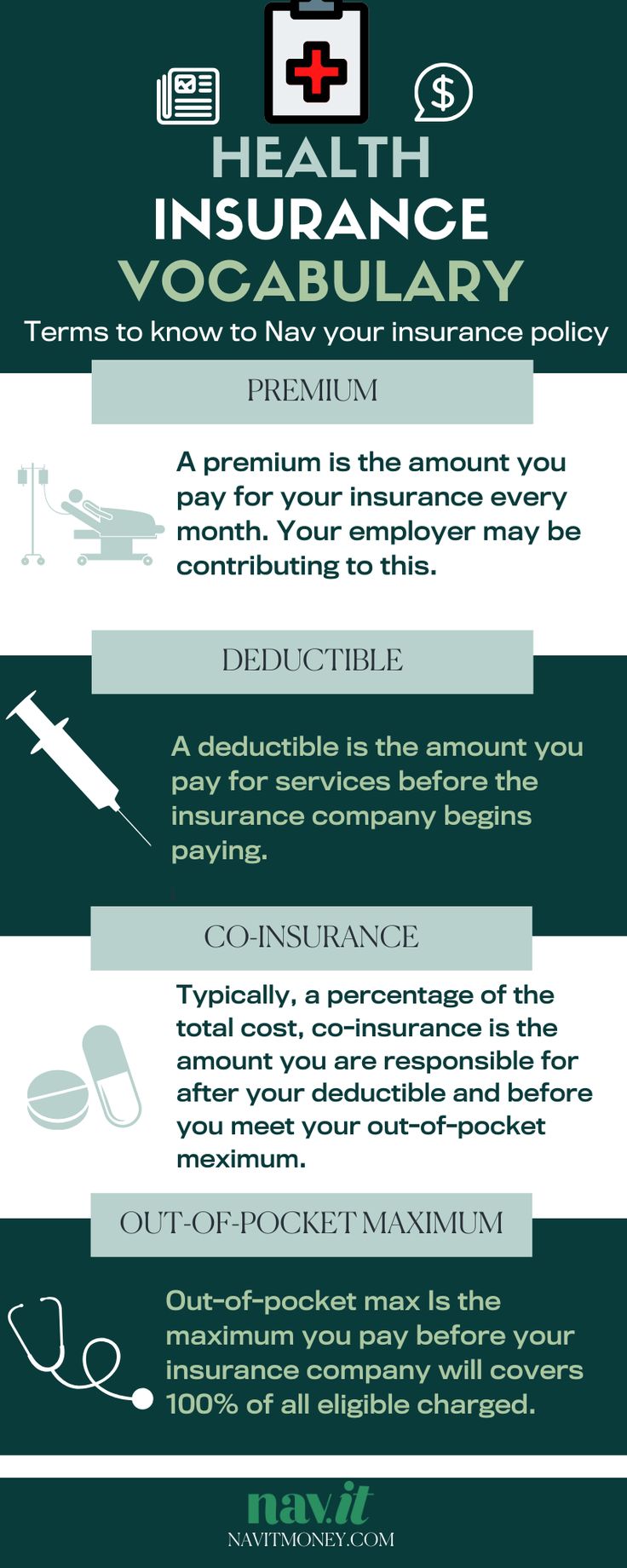

First and foremost, premiums are the regular payments individuals make to maintain their health insurance coverage. These payments can be made on a monthly or annual basis and are typically determined by factors such as age, location, and plan type. Premiums contribute to the overall cost of insurance and vary depending on the level of coverage and benefits offered.

Health insurance operates within a network of healthcare providers, which consists of doctors, hospitals, and clinics that have agreed to provide services to plan members at negotiated rates. This network is an essential component of health insurance as it helps control costs and ensures that individuals receive care from approved providers. It is important to understand the network restrictions of your insurance plan to avoid unexpected out-of-pocket expenses.

When seeking medical care, individuals may need to pay a deductible before their health insurance coverage begins. A deductible is the amount a person must pay out of pocket for healthcare services before the insurance company starts covering costs. Once the deductible is met, the insurance company will typically pay a percentage of the remaining expenses, while the individual is responsible for paying the remaining portion, known as copayments or coinsurance.

Claims are an integral part of the health insurance process. They are requests for payment submitted by healthcare providers to the insurance company for services rendered to patients. The insurance company reviews these claims, determines the appropriate amount to be paid, and reimburses the provider accordingly. It is essential for individuals to keep track of their medical bills and understand the claims process to ensure accurate and timely reimbursement.

What is Health Insurance?

Health insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured. It is an agreement between the insured and the insurance company, where the insured pays regular premiums in exchange for financial protection in case of medical expenses.

Health insurance provides coverage for a wide range of health-related services, such as doctor visits, hospital stays, prescription medications, and preventive care. It helps individuals and families manage the costs of healthcare by sharing the expenses with the insurance company.

When you have health insurance, you typically have to pay certain out-of-pocket costs, such as copayments, deductibles, and coinsurance. Copayments are fixed amounts that you pay for specific services, such as a doctor’s visit or a prescription. Deductibles are the amount of money you have to pay before your insurance starts to cover the costs. Coinsurance is the percentage of the costs that you have to pay after you meet your deductible.

In order to receive coverage, you need to file claims with your insurance company. Claims are requests for payment of medical services or treatments. The insurance company reviews the claims and determines if they are covered under your policy. If approved, the insurance company will reimburse you or pay the healthcare provider directly.

Health insurance plans often have networks of healthcare providers, known as a network. These networks include doctors, hospitals, and other healthcare professionals who have agreed to provide services at discounted rates to insured individuals. It’s important to check if your preferred healthcare providers are in-network to ensure that you receive the maximum coverage and minimize your out-of-pocket costs.

Overall, health insurance is essential for protecting your financial well-being in case of unexpected medical expenses. It helps individuals and families access the healthcare they need without facing exorbitant costs. By understanding the basics of health insurance, you can make informed decisions about your coverage and ensure that you have the necessary protection for your health.

Benefits of Health Insurance

Health insurance provides numerous benefits to individuals and families. One of the main advantages is the financial protection it offers. When someone has health insurance, they are protected from the high costs of medical expenses. This is especially important in cases of unexpected illnesses or accidents, where medical bills can quickly add up.

Another benefit of health insurance is the ability to access a wide network of healthcare providers. Insurance companies have agreements with various doctors, specialists, hospitals, and clinics, allowing policyholders to receive care from a diverse range of healthcare professionals. This ensures that individuals can choose the best healthcare providers for their specific needs.

Health insurance also covers a wide range of medical services. From preventive care, such as vaccinations and screenings, to more complex treatments and surgeries, insurance policies provide coverage for a variety of healthcare needs. This ensures that individuals can receive the necessary care without worrying about the financial burden.

One aspect of health insurance that many people appreciate is the ability to file claims. When individuals receive medical services covered by their insurance, they can submit a claim to the insurance company for reimbursement. This helps individuals recoup some or all of the expenses they incurred for their healthcare.

Health insurance policies often have deductibles and premiums. A deductible is the amount of money that individuals must pay out of pocket before their insurance coverage kicks in. Premiums are the monthly or annual payments individuals make to maintain their insurance coverage. While these costs can be a financial burden, they are often much lower than the cost of medical services without insurance.

In summary, health insurance provides financial protection, access to a network of healthcare providers, coverage for a wide range of medical services, the ability to file claims, and helps manage the costs of deductibles and premiums. It is an essential tool for individuals and families to ensure their health and well-being.

Types of Health Insurance Plans

When it comes to health insurance, there are several types of plans available that offer different levels of coverage and benefits. Understanding these different types of plans can help you choose the one that best suits your needs and budget.

1. Premiums: Premiums are the monthly payments you make to your insurance company to maintain your coverage. The amount you pay can vary depending on the type of plan you choose and the level of coverage it provides.

2. Deductible: A deductible is the amount you must pay out of pocket for medical expenses before your insurance coverage kicks in. The higher the deductible, the lower your monthly premiums may be.

3. Claims: When you receive medical services, you or your healthcare provider will submit a claim to your insurance company to request reimbursement for the costs incurred. The insurance company will review the claim and determine the amount they will cover.

4. Copayments: Copayments are the fixed amounts you must pay for certain medical services, such as doctor visits or prescription medications. These amounts are typically set by your insurance plan and may vary depending on the specific service.

5. Network: Many health insurance plans have a network of healthcare providers and facilities that have agreed to provide services at reduced rates. Using providers within your plan’s network can help you save money on out-of-pocket costs.

6. Health: Different health insurance plans may focus on different aspects of healthcare, such as preventive care, prescription medications, or specialized treatments. It’s important to choose a plan that aligns with your specific health needs.

7. How it works: Each health insurance plan operates differently in terms of how it pays for medical services. Some plans may require you to pay the full cost upfront and then submit a claim for reimbursement, while others may have a set copayment for each service.

Overall, understanding the different types of health insurance plans can help you make an informed decision about which plan is best for you and your family’s healthcare needs. It’s important to carefully review the details of each plan, including the coverage, costs, and network, before making a decision.

How Does Health Insurance Work?

Health insurance works by providing financial protection for individuals and families in case of medical expenses. When you have health insurance, you pay a monthly premium to your insurance company. In return, the insurance company agrees to cover a portion of your medical costs.

When you need medical care, you typically have to pay a copayment, which is a fixed amount that you pay out of pocket for each visit or service. The insurance company then pays the remaining balance. However, copayments may vary depending on the type of service and your specific plan.

Health insurance plans often have a network of healthcare providers, such as doctors, hospitals, and specialists. If you receive care from a provider within your insurance network, the insurance company will typically cover a higher percentage of the cost. If you go to a provider outside of the network, you may have to pay a larger portion of the cost.

When you receive medical services, the healthcare provider will submit a claim to your insurance company. The insurance company will review the claim and determine how much they will pay. If you have met your deductible, which is the amount you must pay before the insurance starts covering costs, the insurance company will pay a portion of the claim. If you haven’t met your deductible, you will be responsible for paying the full amount.

It’s important to understand the coverage provided by your health insurance plan. Different plans may have different levels of coverage for various services, such as preventive care, prescription drugs, or hospital stays. Make sure to review your plan’s benefits and limitations to ensure you understand what is covered and what you may be responsible for paying out of pocket.

Understanding Premiums

When it comes to health insurance, premiums are a key aspect to understand. Premiums are the amount of money that individuals or employers pay to the insurance company on a regular basis in order to maintain coverage. These payments are typically made monthly, but can also be made quarterly or annually.

Health insurance premiums are determined based on a variety of factors, including the age, health, and location of the insured individual or group. Other factors that can impact premiums include the type of coverage selected and the size of the insurance network.

It is important to note that premiums are separate from other out-of-pocket expenses, such as copayments and deductibles. While premiums are paid regardless of whether or not any claims are made, copayments and deductibles are additional costs that individuals may be required to pay when receiving healthcare services.

Understanding how premiums work is essential in order to choose the right health insurance coverage for your needs. It is important to carefully consider the cost of premiums in relation to the level of coverage provided. Additionally, individuals should also consider the size and quality of the insurance network, as this can impact the availability of healthcare providers and facilities.

In conclusion, premiums are a fundamental aspect of health insurance. They are the regular payments made to the insurance company in order to maintain coverage. It is important to understand how premiums are determined and how they relate to other out-of-pocket expenses. By considering these factors, individuals can make informed decisions when selecting health insurance coverage.

Deductibles and Copayments

When it comes to health insurance, deductibles and copayments are two important terms to understand. These terms are related to the cost-sharing aspect of health insurance, which refers to the portion of medical expenses that the insured individual is responsible for paying.

A deductible is the amount of money that the insured person must pay out of pocket before the insurance company starts covering the cost of healthcare services. For example, if a health insurance plan has a $1,000 deductible, the insured person will need to pay the first $1,000 of their medical expenses before the insurance company will start paying. Deductibles can vary depending on the insurance plan, with some plans having higher deductibles and others having lower deductibles.

Copayments, also known as copays, are fixed amounts that the insured person must pay for certain healthcare services. These amounts are usually specified in the insurance policy. For instance, a health insurance plan might require a $20 copayment for a doctor’s visit or a $10 copayment for a prescription medication. Copayments are typically lower than the actual cost of the service, as the insurance company covers the remaining amount.

It is important to note that deductibles and copayments are separate from insurance premiums. Insurance premiums are the monthly or yearly payments that individuals make to maintain their health insurance coverage. Deductibles and copayments are additional costs that individuals may have to pay when they receive healthcare services.

Understanding how deductibles and copayments work can help individuals make informed decisions about their health insurance coverage. It is important to review the terms of the insurance policy and familiarize oneself with the network of healthcare providers that are covered by the insurance plan. By doing so, individuals can ensure that they have a clear understanding of their coverage and can navigate the healthcare system effectively.

Network Providers

When it comes to health insurance, understanding network providers is essential. A network is a group of doctors, hospitals, and other healthcare providers that have agreed to provide services to members of a specific health insurance plan. When you have health insurance, you will typically have a network of providers that you can choose from for your healthcare needs.

Choosing a network provider is important because it can affect the cost and coverage of your healthcare services. In-network providers have negotiated rates with the insurance company, which means they have agreed to accept a certain amount for their services. This can result in lower costs for you, such as lower copayments or coinsurance.

On the other hand, going to an out-of-network provider can be more expensive. Out-of-network providers do not have negotiated rates with the insurance company, so you may be responsible for a larger portion of the cost. In some cases, out-of-network services may not be covered at all.

Understanding how the network works is important for filing claims and accessing the coverage you need. When you receive services from an in-network provider, they will typically handle the claims process for you. This means they will bill the insurance company directly, and you will only be responsible for paying your share of the costs, such as copayments or deductibles.

Overall, choosing network providers is an important aspect of managing your health insurance. It can impact the cost and coverage of your healthcare services, so it’s important to understand how your insurance works and to choose providers that are in-network whenever possible.

Out-of-Network Coverage

When it comes to health insurance, understanding the basics of out-of-network coverage is essential. In simple terms, out-of-network coverage refers to the healthcare services that are provided by healthcare providers who are not part of your insurance network. This means that if you visit a doctor or hospital that is not in your insurance network, you may have to pay more out of pocket for your healthcare expenses.

Out-of-network coverage typically works differently compared to in-network coverage. While your insurance plan may cover a certain percentage of your healthcare costs for in-network providers, out-of-network providers may not have the same level of coverage. This means that you may be responsible for a larger portion of the cost, including higher copayments, deductibles, and coinsurance.

It is important to note that not all health insurance plans offer out-of-network coverage. Some plans may only provide coverage for services received from in-network providers. Before selecting a health insurance plan, it is crucial to review the details of the plan and understand what type of coverage it offers.

If you do require out-of-network coverage, it is important to keep track of your claims and submit them to your insurance company for reimbursement. This process may involve providing documentation such as receipts and invoices. It is also important to note that insurance companies may have specific guidelines and limitations when it comes to out-of-network coverage, so it is essential to familiarize yourself with these details.

In summary, out-of-network coverage refers to healthcare services provided by providers who are not part of your insurance network. It may involve higher out-of-pocket costs and may not be available in all health insurance plans. Understanding the basics of out-of-network coverage is crucial for making informed decisions about your health insurance and managing your healthcare expenses effectively.

Pre-existing Conditions

A pre-existing condition is a health condition that existed before the start of a new health insurance policy. These conditions can range from chronic illnesses, such as diabetes or asthma, to previous injuries or surgeries. Pre-existing conditions can have an impact on the coverage and cost of health insurance.

When applying for health insurance, individuals with pre-existing conditions may face certain limitations. Some insurance plans may exclude coverage for pre-existing conditions for a certain period of time, known as a waiting period. During this waiting period, individuals may have to pay for their medical expenses out of pocket.

However, under the Affordable Care Act (ACA), insurance companies are no longer allowed to deny coverage or charge higher premiums to individuals with pre-existing conditions. This means that individuals with pre-existing conditions can still obtain health insurance coverage, and the insurance company cannot discriminate against them based on their health status.

In addition to the ACA protections, health insurance plans often have certain terms and conditions regarding pre-existing conditions. For example, some plans may require individuals to meet a deductible before coverage for pre-existing conditions kicks in. Others may have copayments or coinsurance for visits related to pre-existing conditions.

It’s important for individuals with pre-existing conditions to carefully review the terms and conditions of their health insurance plans. They should understand how the deductible, claims, premiums, and copayments work in relation to their pre-existing condition. It’s also important to ensure that their healthcare providers are in-network, as out-of-network providers may not be covered for pre-existing conditions.

Health Insurance Marketplace

The Health Insurance Marketplace is a platform where individuals and families can compare and purchase health insurance plans. It is a centralized marketplace that offers a range of health insurance options from different insurance companies.

When shopping for health insurance through the Marketplace, individuals can choose from different types of plans, such as HMOs, PPOs, and EPOs. Each plan has its own set of benefits and coverage options.

One important aspect to consider when selecting a health insurance plan is the deductible. The deductible is the amount of money that the insured person must pay out of pocket before the insurance company starts covering the costs. It is important to choose a deductible that is affordable and manageable for your budget.

In addition to the deductible, health insurance plans may also have copayments and coinsurance. Copayments are fixed amounts that the insured person pays for specific services, such as doctor visits or prescription medications. Coinsurance is a percentage of the cost of a service that the insured person is responsible for paying.

When using health insurance, individuals will need to submit claims to the insurance company to receive reimbursement for covered expenses. Claims can be submitted online or through mail, and the insurance company will review the claim and determine the amount to be reimbursed.

Health insurance premiums are the monthly payments that individuals must make to maintain their coverage. Premiums can vary based on factors such as age, location, and the level of coverage selected. It is important to budget for these premiums to ensure continuous coverage.

Health insurance plans also have networks, which are groups of doctors, hospitals, and other healthcare providers that have agreed to provide services at discounted rates to plan members. It is important to choose a plan with a network that includes the healthcare providers you prefer or need.

Employer-Sponsored Health Insurance

Employer-sponsored health insurance is a type of health insurance that is provided by an employer to its employees. This type of insurance is typically offered as part of an employee benefits package, and is often more affordable than individual health insurance plans.

One of the key features of employer-sponsored health insurance is the network of healthcare providers. The insurance plan works with a network of doctors, hospitals, and other healthcare professionals to provide medical services to the insured individuals. This network ensures that the insured individuals have access to quality healthcare services.

When it comes to claims, employer-sponsored health insurance typically covers a portion of the medical expenses incurred by the insured individuals. The amount of coverage varies depending on the specific insurance plan. Insured individuals are responsible for paying a deductible, which is the amount they must pay out of pocket before the insurance coverage kicks in.

Premiums for employer-sponsored health insurance are usually deducted from the employee’s paycheck on a regular basis. The amount of the premium depends on factors such as the employee’s age, health status, and the level of coverage chosen. Employers may also contribute a portion of the premium cost.

In addition to deductibles and premiums, insured individuals may also be required to pay copayments for certain services. A copayment is a fixed amount that the insured individual must pay at the time of service. This helps to cover the cost of the service and encourages individuals to seek necessary medical care.

Overall, employer-sponsored health insurance plays a crucial role in ensuring that employees have access to affordable healthcare. It provides coverage for a wide range of medical services and helps to protect individuals from high healthcare costs. Understanding the basics of employer-sponsored health insurance is important for both employees and employers to make informed decisions about their health insurance coverage.

Medicaid and Medicare

Medicaid and Medicare are two government programs that provide health insurance coverage to different groups of people in the United States.

Medicaid is a joint federal and state program that provides health insurance to low-income individuals and families. It is administered by the states, so the eligibility requirements and coverage may vary. Medicaid covers a wide range of medical services, including doctor visits, hospital stays, prescription medications, and preventive care. Eligible individuals typically do not have to pay premiums for Medicaid coverage, but they may be responsible for copayments or deductibles for certain services.

Medicare, on the other hand, is a federal program that provides health insurance to individuals who are 65 years old or older, as well as younger individuals with certain disabilities. It is divided into different parts, each covering different aspects of healthcare. Part A covers hospital stays, Part B covers doctor visits and outpatient services, Part C offers private insurance options, and Part D provides prescription drug coverage. Medicare beneficiaries typically pay monthly premiums for Part B and Part D coverage, as well as deductibles and copayments for certain services.

Both Medicaid and Medicare help individuals and families access the healthcare they need, but they have different eligibility criteria and coverage options. It is important to understand the specifics of each program to ensure that you are getting the right insurance coverage for your needs.

Health Insurance for Self-Employed Individuals

Health insurance is an important aspect of self-employment, as it provides coverage for medical expenses and helps protect individuals from high healthcare costs. Self-employed individuals have the option to purchase health insurance plans on their own, rather than relying on employer-provided coverage.

When selecting a health insurance plan, self-employed individuals need to consider factors such as premiums, deductibles, copayments, and coverage. Premiums are the monthly payments made to the insurance company in exchange for coverage. Deductibles are the amount of money that individuals must pay out of pocket before the insurance coverage kicks in. Copayments are fixed amounts that individuals must pay for certain healthcare services. Coverage refers to the range of medical services and treatments that are included in the insurance plan.

Self-employed individuals can choose from different types of health insurance plans, such as HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and EPOs (Exclusive Provider Organizations). These plans differ in terms of how they work and the network of healthcare providers they offer. HMOs require individuals to choose a primary care physician and obtain referrals for specialists, while PPOs and EPOs offer more flexibility in choosing healthcare providers.

It is important for self-employed individuals to carefully review and compare different health insurance plans to find the one that best suits their needs and budget. They can use online resources and insurance brokers to gather information and make informed decisions. Additionally, self-employed individuals may be eligible for certain tax deductions related to health insurance premiums, so it is advisable to consult with a tax professional for guidance.

Coverage for Prescription Drugs

When it comes to health insurance, coverage for prescription drugs is an important aspect to consider. Prescription drugs can be expensive, and having insurance coverage can help alleviate some of the financial burden.

How coverage for prescription drugs works varies depending on the insurance plan. Some plans may require individuals to meet a deductible before coverage for prescription drugs kicks in. A deductible is the amount of money that an individual must pay out of pocket before the insurance company starts paying for covered services. Once the deductible is met, the insurance company will typically cover a percentage of the cost of prescription drugs.

In addition to the deductible, individuals may also have to pay copayments for prescription drugs. A copayment is a fixed amount that an individual must pay for each prescription filled. The amount of the copayment can vary depending on the specific medication and the insurance plan.

Another factor to consider when it comes to coverage for prescription drugs is the network of pharmacies that are covered by the insurance plan. Some insurance plans have a network of preferred pharmacies where individuals can get their prescriptions filled at a lower cost. It’s important to check if your preferred pharmacy is in-network to ensure you get the most coverage for your prescription drugs.

Lastly, the cost of coverage for prescription drugs is typically included in the premiums individuals pay for their health insurance. Premiums are the monthly payments individuals make to maintain their insurance coverage. It’s important to review the details of your insurance plan to understand how much coverage you have for prescription drugs and what costs you may be responsible for.

Preventive Services Covered by Health Insurance

Health insurance plans typically cover a range of preventive services to help individuals maintain their health and catch potential issues early. These services are designed to prevent or detect health problems before they become more serious. Preventive services can include screenings, vaccinations, and counseling.

When it comes to preventive services, it’s important to understand how your health insurance works. Many plans have a network of preferred providers, and it’s best to visit a provider within this network to ensure coverage. If you visit an out-of-network provider, you may have to pay higher copayments or even be responsible for the full cost of the service.

Some preventive services may require a deductible to be met before they are covered by insurance. A deductible is the amount you must pay out of pocket before your insurance starts to pay. However, many plans offer preventive services that are exempt from the deductible, meaning they are covered at no cost to you.

When you receive a preventive service covered by your health insurance, the provider will typically submit a claim to the insurance company on your behalf. The insurance company will then process the claim and determine the amount they will pay. It’s important to review any claims you receive to ensure they are accurate and that you are not being overcharged.

Remember that health insurance premiums are a regular expense you must pay to maintain coverage. These premiums can vary depending on factors such as your age, location, and the level of coverage you choose. It’s important to budget for these premiums and consider them as part of your overall healthcare costs.

Overall, understanding the preventive services covered by your health insurance is essential for maintaining your health and preventing more serious health issues. By taking advantage of these services, you can catch potential problems early and ensure you are taking the necessary steps to stay healthy.

Choosing the Right Health Insurance Plan

When it comes to choosing the right health insurance plan, there are several factors to consider. One of the most important things to look at is the coverage that the plan provides. You want to make sure that the plan covers all of your healthcare needs, including doctor visits, hospital stays, and prescription medications. Additionally, you should also check if the plan includes coverage for specialist visits and any specific treatments or procedures that you may require.

Another important factor to consider is the network of healthcare providers that the insurance plan works with. It’s essential to check if your preferred doctors, hospitals, and specialists are in-network. Going to an out-of-network provider can result in higher out-of-pocket costs or even denied claims. Therefore, it’s crucia