Health Insurance GST Rate

When it comes to health insurance, it’s important to understand the GST rate that applies to your policy. Goods and Services Tax (GST) is a consumption tax charged on most goods and services in many countries around the world, including India. Insurance policies, including health insurance, are also subject to GST.

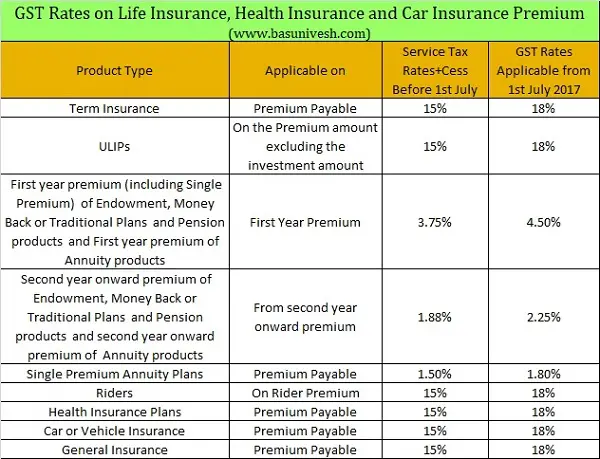

The GST rate for health insurance in India is currently set at 18%. This means that when you purchase a health insurance policy, you will be required to pay an additional 18% on top of the premium amount. The GST is charged by the insurance company and is collected on behalf of the government.

It’s important to note that the GST rate for health insurance may vary depending on the type of policy and the insurance company. Some policies may have a lower GST rate, while others may have a higher rate. It’s always a good idea to check with your insurance provider to confirm the applicable GST rate for your specific policy.

Understanding the GST rate for health insurance is crucial as it helps you calculate the total cost of your policy. By knowing the GST rate, you can accurately budget for your health insurance premium and avoid any surprises when it comes time to make a payment.

In conclusion, the GST rate for health insurance in India is currently set at 18%. Make sure to check with your insurance provider to confirm the applicable GST rate for your specific policy. Understanding the GST rate will help you budget for your health insurance premium and ensure that you are prepared for any additional costs.

What is GST?

GST, or Goods and Services Tax, is a consumption tax that is levied on the supply of goods and services in India. It is an indirect tax that is collected from the end consumer, but it is paid by the businesses that supply the goods or services. The rate of GST varies depending on the type of product or service, and it is regulated by the Government of India.

When it comes to health insurance, GST is applicable on the premium that you pay for your insurance policy. The rate of GST on health insurance is currently set at 18%. This means that if you pay a premium of Rs. 10,000 for your health insurance policy, you will have to pay an additional Rs. 1,800 as GST.

It is important to note that GST is only applicable on the premium amount and not on the entire policy amount. So, if your health insurance policy has a sum insured of Rs. 5 lakhs, the GST will only be charged on the premium amount and not on the sum insured.

Understanding the GST rate for health insurance is important as it helps you calculate the total cost of your insurance policy. By knowing the GST rate, you can accurately budget for your health insurance premium and avoid any surprises when it comes to paying your premium.

Importance of Health Insurance

Health insurance is a crucial financial product that provides coverage for medical expenses incurred by individuals. It plays a vital role in ensuring that people have access to quality healthcare without worrying about the high costs involved. With the rising healthcare expenses, having health insurance has become more important than ever.

One of the key factors to consider when choosing health insurance is the rate of coverage it offers. The rate determines the amount of financial protection you will receive for medical treatments and hospitalization. It is essential to carefully evaluate the rate of coverage offered by different insurance providers to ensure that you are adequately protected.

Another important aspect to consider is the impact of the Goods and Services Tax (GST) on health insurance. GST is a tax levied on the supply of goods and services in India. It is applicable to health insurance premiums as well. Understanding the GST rate for health insurance is crucial as it affects the overall cost of the insurance policy.

By opting for health insurance, you can safeguard yourself and your family from unexpected medical expenses. It provides financial security and peace of mind, knowing that you are covered in case of any medical emergencies. Additionally, health insurance often offers additional benefits such as cashless hospitalization, coverage for pre-existing conditions, and access to a wide network of healthcare providers.

In conclusion, health insurance is a vital investment that offers financial protection and peace of mind. It is important to carefully consider the rate of coverage and the impact of GST when choosing a health insurance policy. By doing so, you can ensure that you and your loved ones are adequately protected in times of medical need.

GST Rate for Health Insurance

Understanding the GST rate for health insurance is crucial for individuals looking to protect themselves and their loved ones. The GST, or Goods and Services Tax, is a consumption tax imposed on the sale of goods and services in India. When it comes to health insurance, the GST rate is currently set at 18%.

Health insurance is an essential financial tool that provides coverage for medical expenses and helps individuals and families manage the costs associated with healthcare. With the GST rate of 18%, it is important to factor in this tax when considering the overall cost of health insurance premiums.

It is worth noting that the GST rate for health insurance may vary depending on the type of policy and the insurance provider. It is advisable to carefully review the terms and conditions of the policy and consult with an insurance expert to understand the specific GST rate applicable to your health insurance plan.

By understanding the GST rate for health insurance, individuals can make informed decisions when it comes to choosing the right policy and managing their healthcare expenses. It is important to stay updated on any changes in the GST rate and ensure compliance with the tax regulations to avoid any penalties or legal issues.

Understanding the GST Rate

When it comes to health insurance, it is important to understand the Goods and Services Tax (GST) rate that applies to your policy. The GST is a tax levied on the supply of goods and services in India, and it is applicable to health insurance as well.

Health insurance policies are subject to a GST rate of 18%. This means that when you purchase a health insurance policy, you will need to pay an additional 18% of the premium amount as GST. It is important to factor in this additional cost when budgeting for your health insurance.

The GST rate for health insurance is determined by the government and is subject to change. It is important to stay updated on any changes in the GST rate to ensure that you are paying the correct amount. Additionally, it is advisable to consult with a tax professional or insurance advisor to understand the impact of GST on your health insurance policy.

Understanding the GST rate for health insurance is crucial for making informed decisions about your coverage. By knowing the GST rate and factoring it into your budget, you can ensure that you are financially prepared for any medical emergencies or expenses that may arise.

Factors Affecting GST Rate

When it comes to health insurance, the GST rate is influenced by several factors. These factors determine the percentage of GST that needs to be paid on the premium amount. Understanding these factors can help you make an informed decision when purchasing health insurance.

Type of Insurance: The type of health insurance you choose can affect the GST rate. Different types of insurance, such as individual plans, family plans, and group plans, may have different GST rates. It is important to consider the type of insurance you need and its associated GST rate.

Sum Insured: The sum insured, or the maximum amount that the insurance company will pay in case of a claim, can also impact the GST rate. Higher sum insured policies may attract a higher GST rate compared to lower sum insured policies. It is important to evaluate your coverage needs and choose a sum insured that suits your requirements.

Insurance Provider: The insurance provider you choose can also influence the GST rate. Different insurance companies may have different GST rates based on their pricing strategies and policies. It is advisable to compare quotes from multiple insurance providers to find the best combination of coverage and GST rate.

Additional Benefits: Some health insurance policies may offer additional benefits such as maternity coverage, critical illness coverage, or wellness programs. These additional benefits can also impact the GST rate. Policies with more comprehensive coverage may have a higher GST rate compared to basic policies. It is important to consider your specific needs and priorities when choosing a policy.

Terms and Conditions: The terms and conditions of the health insurance policy can also affect the GST rate. Certain policy features, such as waiting periods, deductibles, or co-payments, may impact the GST rate. It is essential to carefully read and understand the terms and conditions of the policy to determine the applicable GST rate.

In conclusion, several factors can influence the GST rate for health insurance. By considering factors such as the type of insurance, sum insured, insurance provider, additional benefits, and terms and conditions, you can choose a policy that offers the right coverage at a competitive GST rate.

Benefits of Health Insurance

Health insurance is an essential investment that provides financial protection in case of medical emergencies. It offers coverage for various healthcare expenses, including hospitalization, surgeries, and treatments. With the increasing cost of healthcare services, having health insurance ensures that you are prepared for any unforeseen medical expenses.

One of the key benefits of health insurance is that it helps you save money on medical bills. By paying a monthly premium, you can avail of cashless treatment at network hospitals, where the insurance company directly settles the bills with the hospital. This relieves you from the burden of paying large sums of money upfront and allows you to focus on your recovery.

Additionally, health insurance provides access to a wide network of healthcare providers, ensuring that you receive quality medical care. You can choose from a list of empaneled hospitals and doctors, guaranteeing that you receive the best possible treatment. This network also allows for easy and convenient cashless claims, making the entire process hassle-free.

Moreover, health insurance policies often come with additional benefits such as coverage for pre-existing conditions, maternity expenses, and preventive healthcare services. These additional benefits ensure that you receive comprehensive coverage for all your healthcare needs, giving you peace of mind.

In conclusion, health insurance is a wise investment that provides numerous benefits. It not only protects you financially during medical emergencies but also offers access to quality healthcare services. With the implementation of GST in the insurance sector, it is important to understand the applicable rates and choose a plan that best suits your needs. Invest in health insurance today and secure your well-being.

Financial Protection

When it comes to your health, having the right insurance coverage is essential. Health insurance provides financial protection against unexpected medical expenses, ensuring that you receive the care you need without worrying about the cost. Understanding the GST rate for health insurance is crucial in determining the affordability and benefits of your coverage.

Health insurance rates vary based on several factors, including your age, medical history, and the type of coverage you choose. The GST rate for health insurance is an additional cost that is added to the premium you pay for your policy. It is important to review the GST rate when selecting a health insurance plan to ensure that it fits within your budget.

Having health insurance not only provides financial protection but also offers peace of mind. With the right coverage, you can access quality healthcare services without the fear of incurring significant expenses. Whether it’s routine check-ups, emergency medical care, or specialized treatments, health insurance ensures that you have access to the care you need when you need it.

Investing in health insurance is a wise decision to safeguard your financial well-being. It is important to compare different insurance providers and their rates to find the best coverage that suits your needs. Take the time to understand the GST rate for health insurance and evaluate the benefits and coverage options offered by different providers. With the right health insurance policy, you can have peace of mind knowing that you are financially protected in case of any medical emergencies.

Access to Quality Healthcare

Health insurance plays a crucial role in ensuring access to quality healthcare. With rising medical costs, having insurance coverage provides financial protection and peace of mind. It helps individuals and families afford necessary medical treatments and services.

When considering health insurance options, it is important to understand the GST rate. Goods and Services Tax (GST) is a tax levied on the supply of goods and services in India. The GST rate for health insurance varies depending on the type of policy and the sum insured.

By opting for health insurance with a lower GST rate, individuals can save on their premiums and enjoy comprehensive coverage at affordable prices. It is essential to compare different policies and understand the GST implications to make an informed decision.

Insurance providers offer a range of health insurance plans to suit different needs and budgets. It is advisable to assess one’s healthcare requirements and choose a policy that provides adequate coverage. Additionally, individuals should review the policy terms and conditions, including the GST rate, to ensure they are getting the best value for their money.

Access to quality healthcare is a fundamental right, and having health insurance is a step towards achieving that. By understanding the GST rate for health insurance and selecting the right policy, individuals can safeguard their health and financial well-being.

How to Choose the Right Health Insurance

When it comes to selecting the right health insurance, there are several factors to consider. One of the most important factors is the coverage provided by the insurance plan. It is essential to understand what services and treatments are covered, as well as any limitations or exclusions. This will ensure that you have the necessary coverage for your specific health needs.

Another important factor to consider is the cost of the insurance plan. This includes both the premium, or the amount you pay for the insurance, as well as any deductibles or co-pays. It is important to choose a plan that fits within your budget while still providing adequate coverage.

Additionally, it is important to consider the network of healthcare providers that are covered by the insurance plan. You should ensure that your preferred doctors, hospitals, and specialists are included in the network. This will ensure that you have access to the healthcare providers you trust and prefer.

Furthermore, it is important to review the reputation and customer satisfaction of the insurance provider. You can research online reviews and ratings to get a sense of the quality of service provided by the company. This will help ensure that you are choosing a reliable and trustworthy insurance provider.

Lastly, it is important to consider any additional benefits or features offered by the insurance plan. This could include things like wellness programs, preventive care services, or coverage for alternative treatments. These additional benefits can provide added value and enhance your overall healthcare experience.

By considering these factors and doing thorough research, you can choose the right health insurance plan that meets your needs and provides you with peace of mind. Remember to carefully review all the details of the plan and consult with a healthcare professional if you have any questions or concerns.

Evaluating Coverage Options

When it comes to health insurance, it is important to evaluate your coverage options carefully. This includes understanding the GST rate for health insurance. The GST, or Goods and Services Tax, is a tax levied on the supply of goods and services in many countries including India. It is important to know the applicable GST rate for health insurance as it can have an impact on the cost of your coverage.

Health insurance providers may charge different GST rates depending on the type of policy and the services covered. It is important to review the terms and conditions of each policy to determine the applicable GST rate. This can help you understand the total cost of your health insurance coverage and make an informed decision.

When evaluating coverage options, it is also important to consider the benefits and coverage provided by each policy. Some policies may offer comprehensive coverage for a wide range of medical services, while others may have limited coverage. It is important to assess your individual health needs and choose a policy that provides the necessary coverage.

In addition to the GST rate and coverage benefits, it is also important to consider the reputation and financial stability of the health insurance provider. You want to choose a provider that has a good track record of paying claims and providing quality customer service. Researching customer reviews and ratings can help you assess the reliability of a provider.

Overall, evaluating coverage options for health insurance involves considering the GST rate, coverage benefits, and the reputation of the provider. By carefully assessing these factors, you can choose a policy that meets your health needs and provides the necessary financial protection.

Considering Premiums and Deductibles

When it comes to health insurance, understanding the rate is crucial. One important factor to consider is the premiums and deductibles. Premiums are the amount of money you pay to the insurance company on a regular basis, usually monthly or annually. Deductibles, on the other hand, are the amount of money you have to pay out of pocket before your insurance coverage kicks in.

It is important to carefully consider the premiums and deductibles when choosing a health insurance plan. A high premium may mean that you have to pay more each month, but it can also mean that you have a lower deductible. On the other hand, a low premium may save you money each month, but it can also mean that you have a higher deductible.

Choosing the right balance between premiums and deductibles depends on your individual needs and financial situation. If you anticipate needing frequent medical care or have a chronic condition, a plan with a higher premium and lower deductible may be more beneficial. However, if you are generally healthy and rarely visit the doctor, a plan with a lower premium and higher deductible may be a better option.

It is also worth noting that some health insurance plans offer additional benefits, such as coverage for prescription drugs or preventive care, which can affect the overall value of the plan. When comparing different plans, it is important to consider these additional benefits along with the premiums and deductibles.

In summary, when considering health insurance, it is important to carefully evaluate the premiums and deductibles. Finding the right balance between the two can help ensure that you have the coverage you need at a price that fits your budget.

Question-answer:

What is the GST rate for health insurance?

The GST rate for health insurance is 18%.

Why is there a GST rate for health insurance?

The GST rate is applied to health insurance to generate revenue for the government and to ensure that the insurance industry is regulated.

Does the GST rate for health insurance vary across different states in India?

No, the GST rate for health insurance is the same across all states in India.

Is the GST rate for health insurance applicable to all types of health insurance plans?

Yes, the GST rate of 18% is applicable to all types of health insurance plans, including individual, family, and group health insurance.