Understanding the Importance of Claim Settlement Ratio in Health Insurance: Everything You Need to Know

When it comes to health insurance, it is important to understand the claim settlement ratio. This ratio represents the percentage of claims that an insurance company settles out of the total number of claims received. It is a crucial factor to consider when choosing a health insurance provider, as it reflects the company’s ability to honor claims and provide timely settlements.

Knowing the claim settlement ratio can give you insights into the insurer’s track record in handling claims. A higher ratio indicates that the company has a good track record of settling claims, which is crucial for policyholders. On the other hand, a lower ratio may indicate that the insurer has a history of rejecting or delaying claims, which can be a red flag.

It is important to note that the claim settlement ratio should not be the sole factor in choosing a health insurance provider. Other factors such as coverage, premium, network hospitals, and customer service should also be considered. However, the claim settlement ratio can serve as a useful indicator of an insurer’s reliability and trustworthiness.

In conclusion, understanding the claim settlement ratio is essential when it comes to health insurance. It provides valuable insights into an insurer’s ability to settle claims and can help you make an informed decision when choosing a health insurance provider. Remember to consider other factors as well and choose a provider that offers comprehensive coverage, competitive premiums, and excellent customer service.

All You Need to Know About Claim Settlement Ratio

When it comes to health insurance, one of the most important factors to consider is the claim settlement ratio. This ratio represents the percentage of claims that an insurance company settles successfully. It is a crucial piece of information that can help you make an informed decision when choosing a health insurance provider.

The claim settlement ratio provides insights into the company’s ability to settle claims and fulfill its obligations towards policyholders. A higher ratio indicates a higher likelihood of the insurance company settling claims promptly and efficiently. On the other hand, a lower ratio may indicate potential difficulties in claim settlement, which could lead to delays or denials.

It is important to note that the claim settlement ratio should not be the sole determining factor when selecting a health insurance provider. Other factors such as coverage, premium, network hospitals, and customer service should also be considered. However, a high claim settlement ratio can give you confidence in the insurance company’s ability to fulfill its promises.

When researching health insurance providers, it is advisable to compare their claim settlement ratios. You can find this information on the insurance company’s website or by contacting their customer service. Additionally, you can also check with regulatory authorities or independent insurance rating agencies for the claim settlement ratios of different insurance companies.

By understanding and considering the claim settlement ratio, you can make a more informed decision when selecting a health insurance provider. Remember to evaluate other factors as well, and choose a policy that best fits your needs and budget.

Importance of Claim Settlement Ratio in Health Insurance

When it comes to health insurance, it is crucial to have a good understanding of the claim settlement ratio. This ratio provides valuable information about the insurance company’s track record in settling claims.

The claim settlement ratio is a percentage that represents the number of claims settled by an insurance company compared to the total number of claims received. It is an important indicator of the company’s efficiency and reliability in handling claims.

Knowing the claim settlement ratio can help you make an informed decision when choosing a health insurance provider. A higher ratio indicates that the company is more likely to settle claims promptly and fairly, giving you peace of mind in times of medical emergencies.

Additionally, a high claim settlement ratio also reflects the company’s financial strength and stability. It shows that the insurer has the necessary funds to meet its obligations and pay out claims, ensuring that you will be reimbursed for your medical expenses.

It is important to note that the claim settlement ratio should not be the sole factor in choosing a health insurance policy. Other factors, such as coverage, network hospitals, and customer service, should also be considered. However, the claim settlement ratio provides a valuable insight into the insurer’s ability to fulfill its promises and protect your financial interests.

Understanding Claim Settlement Ratio

The claim settlement ratio is an important factor to consider when choosing a health insurance policy. It represents the percentage of claims that an insurance company has successfully settled out of the total claims received. The higher the ratio, the better the chances of your claim being settled.

When it comes to health insurance, you need to know about the claim settlement ratio of different insurance companies. This information can help you make an informed decision and choose a company that has a good track record of settling claims.

The claim settlement ratio reflects the efficiency and reliability of an insurance company in processing and settling claims. It is an indicator of how likely you are to receive a hassle-free claim settlement experience.

It is important to note that a high claim settlement ratio does not guarantee that all claims will be settled. Other factors such as policy terms and conditions, exclusions, and documentation requirements also play a role in claim settlement. However, a high ratio indicates that the company has a good track record and is more likely to settle claims in a timely manner.

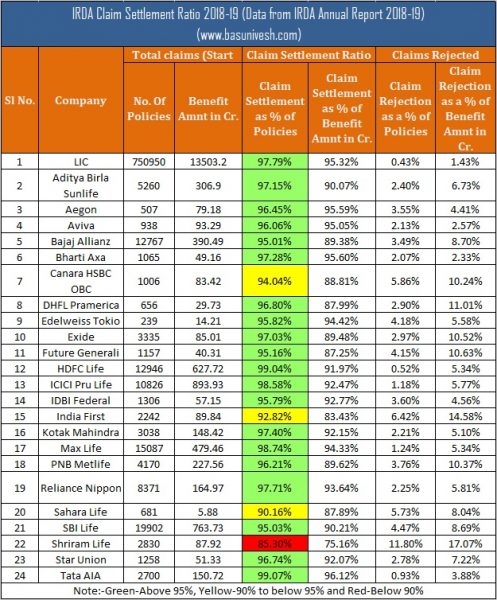

When researching health insurance policies, make sure to compare the claim settlement ratios of different companies. You can find this information on the website of the Insurance Regulatory and Development Authority of India (IRDAI) or through independent insurance rating agencies. This will help you make an informed decision and choose a policy that offers a high probability of claim settlement.

Factors Affecting Claim Settlement Ratio

When it comes to health insurance, it is important to understand the factors that can affect the claim settlement ratio. This ratio is a measure of how efficiently an insurance company processes and settles claims. Knowing about these factors can help you make an informed decision when choosing a health insurance policy.

1. Policy Terms and Conditions: The terms and conditions of your health insurance policy play a crucial role in determining the claim settlement ratio. It is important to carefully read and understand the policy document to know what is covered and what is not.

2. Network Hospitals: Insurance companies have tie-ups with a network of hospitals where policyholders can avail cashless treatment. The availability and quality of network hospitals can impact the claim settlement ratio. It is advisable to choose a policy that offers a wide network of hospitals.

3. Pre-Existing Conditions: If you have any pre-existing medical conditions, it is important to disclose them at the time of purchasing the policy. Failure to disclose such conditions can lead to claim rejection. It is important to choose a policy that covers pre-existing conditions, if applicable.

4. Timely Submission of Documents: To ensure a smooth claim settlement process, it is important to submit all the required documents and information in a timely manner. Delay in submitting documents can lead to delays or rejection of claims.

5. Claim Settlement Process: The efficiency and transparency of the claim settlement process followed by the insurance company can also affect the claim settlement ratio. It is important to choose a company that has a streamlined and customer-friendly claims process.

6. Premium Payment: Regular and timely payment of premiums is essential to maintain the validity of your health insurance policy. Non-payment of premiums can lead to policy cancellation and rejection of claims.

7. Claim History: Your claim history can also impact the claim settlement ratio. If you have a history of frequent or fraudulent claims, it can affect the trust and credibility of the insurance company, leading to a lower claim settlement ratio.

8. Sum Insured: The sum insured or the coverage amount of your health insurance policy can also affect the claim settlement ratio. Higher sum insured policies may have a higher claim settlement ratio as they offer better coverage.

By considering these factors, you can make an informed decision when choosing a health insurance policy and ensure a higher claim settlement ratio.

How to Calculate Claim Settlement Ratio

Calculating claim settlement ratio is an important step in evaluating the performance of an insurance company. The claim settlement ratio is the ratio of the number of claims settled by the insurance company to the total number of claims received. It is a measure of the company’s ability to settle claims and provide financial support to its policyholders.

To calculate the claim settlement ratio, you need to know the total number of claims received by the insurance company during a specific period and the number of claims settled by the company during the same period. The formula for calculating the claim settlement ratio is:

Claim Settlement Ratio = (Number of Claims Settled / Total Number of Claims Received) x 100

For example, if an insurance company received 100 claims and settled 90 claims during a particular year, the claim settlement ratio would be:

Claim Settlement Ratio = (90 / 100) x 100 = 90%

A higher claim settlement ratio indicates that the insurance company has a good track record of settling claims and providing financial support to its policyholders. On the other hand, a lower claim settlement ratio may indicate that the company is facing difficulties in settling claims or is not providing adequate financial support.

It is important to note that the claim settlement ratio should not be the only factor considered when choosing an insurance company. Other factors such as the company’s financial stability, customer service, and coverage options should also be taken into account.

High Claim Settlement Ratio vs Low Claim Settlement Ratio

When it comes to health insurance, the claim settlement ratio is an important factor to consider. The claim settlement ratio refers to the percentage of claims that an insurance company settles successfully. A high claim settlement ratio indicates that the insurance company is more likely to settle claims in a timely and efficient manner.

Having a high claim settlement ratio is important because it gives policyholders peace of mind knowing that their claims will be settled when they need it the most. It also shows that the insurance company has a good track record of honoring its commitments to its customers.

On the other hand, a low claim settlement ratio can be a cause for concern. It may indicate that the insurance company has a higher rate of rejecting or delaying claims. This can lead to frustration and financial burden for policyholders who are in need of medical assistance.

It is important for policyholders to know about the claim settlement ratio of an insurance company before purchasing a health insurance policy. This information can be found on the company’s website or by contacting their customer service. By choosing an insurance company with a high claim settlement ratio, policyholders can ensure that they will receive the financial support they need in case of a medical emergency.

In conclusion, the claim settlement ratio is a crucial factor to consider when choosing a health insurance policy. A high claim settlement ratio indicates that the insurance company is reliable and trustworthy, while a low claim settlement ratio may raise red flags. Policyholders should take the time to research and compare the claim settlement ratios of different insurance companies to make an informed decision.

Claim Settlement Ratio and Premiums

When it comes to health insurance, the claim settlement ratio is an important factor to consider. The claim settlement ratio refers to the percentage of claims that an insurance company settles out of the total claims it receives. It is a measure of how efficiently and effectively an insurance company processes and pays out claims.

Understanding the claim settlement ratio is crucial because it gives you an idea of the insurance company’s track record in terms of settling claims. A higher claim settlement ratio indicates that the company is more likely to honor your claim and provide you with the financial support you need in case of a medical emergency.

However, it’s important to note that the claim settlement ratio should not be the only factor you consider when choosing a health insurance policy. Premiums also play a significant role in your decision-making process. Premiums are the amount of money you pay to the insurance company in exchange for coverage.

While a higher claim settlement ratio is desirable, it often comes with higher premiums. This is because insurance companies with a higher claim settlement ratio are typically more experienced and have a better understanding of the risks involved. As a result, they may charge higher premiums to compensate for the increased likelihood of paying out claims.

On the other hand, insurance companies with a lower claim settlement ratio may offer lower premiums to attract customers. However, it’s important to carefully consider the trade-off between lower premiums and the potential risk of your claim not being settled in a timely manner or at all.

In conclusion, when choosing a health insurance policy, it’s essential to consider both the claim settlement ratio and the premiums. Finding a balance between the two factors is key to ensuring that you have adequate coverage and peace of mind in case of a medical emergency.

Claim Settlement Ratio and Policyholder Satisfaction

When it comes to health insurance, the claim settlement ratio is a crucial factor that policyholders need to know. The claim settlement ratio represents the percentage of claims that an insurance company settles successfully. It is an important indicator of how reliable and efficient an insurance company is in fulfilling its obligations towards policyholders.

Policyholders need to be aware of the claim settlement ratio because it directly affects their satisfaction with the insurance company. A high claim settlement ratio indicates that the insurance company is more likely to settle claims in a timely and hassle-free manner. This gives policyholders the assurance that their medical expenses will be covered when they need it the most.

Knowing the claim settlement ratio can also help policyholders make informed decisions when choosing a health insurance policy. By comparing the claim settlement ratios of different insurance companies, policyholders can identify those that have a higher likelihood of settling claims and providing a satisfactory experience. This ensures that policyholders receive the benefits they are entitled to without unnecessary delays or disputes.

It is important for policyholders to have all the information they need about the claim settlement ratio in order to make the right decisions regarding their health insurance. By understanding the significance of this ratio and its impact on policyholder satisfaction, individuals can choose insurance companies that prioritize customer service and prompt claim settlements. This ultimately leads to a better overall experience and peace of mind for policyholders.

Claim Settlement Ratio and Insurance Company Reputation

The claim settlement ratio is an important factor to consider when choosing a health insurance company. It represents the percentage of claims that the company has successfully settled compared to the total number of claims received. A high claim settlement ratio indicates that the company has a good track record of honoring claims and providing timely settlements.

Knowing the claim settlement ratio of an insurance company is crucial as it gives you an idea of how likely your claim will be settled if the need arises. It is an indicator of the company’s financial stability and ability to fulfill its obligations towards policyholders.

When researching health insurance options, it is recommended to look for companies with a high claim settlement ratio. This information can usually be found on the company’s website or obtained from insurance regulatory authorities. A higher ratio indicates that the company has a reputation for being reliable and trustworthy in meeting its policyholder’s claims.

In addition to the claim settlement ratio, it is also important to consider the overall reputation of the insurance company. This can be assessed by reading customer reviews, checking their financial strength ratings, and evaluating their customer service and support. A reputable company with a high claim settlement ratio will likely provide better customer service and support, ensuring a smooth and hassle-free claim settlement process.

In conclusion, the claim settlement ratio is an essential factor to consider when choosing a health insurance company. It provides valuable insights into the company’s reliability and ability to honor claims. Coupled with the overall reputation of the company, it helps in making an informed decision and ensuring you choose a trustworthy insurance provider.

Claim Settlement Ratio and Network Hospitals

When it comes to health insurance, it is important to know about the claim settlement ratio and network hospitals. The claim settlement ratio is a measure of how efficiently an insurance company settles the claims made by its policyholders. It is calculated by dividing the total number of claims settled by the total number of claims received. A higher claim settlement ratio indicates that the insurance company is more likely to settle claims in a timely manner.

Network hospitals are healthcare facilities that have a tie-up with an insurance company. Policyholders can avail cashless treatment at these hospitals, where the insurance company settles the claim directly with the hospital. This eliminates the need for the policyholder to pay for the treatment upfront and then claim reimbursement from the insurance company.

Knowing about the claim settlement ratio and network hospitals is important when choosing a health insurance policy. A high claim settlement ratio indicates that the insurance company has a good track record of settling claims, giving policyholders peace of mind. Similarly, having a wide network of hospitals ensures that policyholders have access to quality healthcare services without any financial burden.

It is recommended to check the claim settlement ratio and network hospitals of an insurance company before buying a health insurance policy. This can be done by visiting the insurance company’s website or contacting their customer service. Additionally, it is also advisable to read reviews and feedback from existing policyholders to get a better understanding of the claim settlement process and the network hospitals associated with the insurance company.

Claim Settlement Ratio and Cashless Claims

When it comes to health insurance, it is important to understand the claim settlement ratio and how it relates to cashless claims. The claim settlement ratio is the percentage of claims that an insurance company settles out of the total number of claims received. This ratio is an important factor to consider when choosing a health insurance provider, as it gives you an idea of how likely your claim will be settled if you need to make one.

Understanding the claim settlement ratio is crucial because it reflects the insurer’s ability to handle claims efficiently and in a timely manner. A higher claim settlement ratio indicates that the insurance company is more likely to honor your claims and provide a hassle-free settlement process. On the other hand, a lower claim settlement ratio may indicate that the insurer has a history of rejecting or delaying claims, which can be a red flag.

When it comes to cashless claims, they are a convenient feature offered by many health insurance providers. With cashless claims, you can receive medical treatment at network hospitals without having to pay for it upfront. The insurance company settles the bill directly with the hospital, making the process seamless and hassle-free for the policyholder.

It is important to note that the claim settlement ratio and the availability of cashless claims are not directly related. While a high claim settlement ratio is indicative of a reliable insurer, it does not guarantee the availability of cashless claims. Similarly, a low claim settlement ratio does not necessarily mean that cashless claims are not available. It is essential to check with the insurance provider about their cashless claims network and procedures.

In conclusion, understanding the claim settlement ratio and its relationship to cashless claims is crucial when choosing a health insurance provider. It is important to consider both factors and do thorough research to ensure that you select an insurer that offers a high claim settlement ratio and convenient cashless claims option.

Claim Settlement Ratio and Rejection of Claims

When it comes to health insurance, it is important to understand the claim settlement ratio and the reasons behind the rejection of claims. The claim settlement ratio refers to the percentage of claims that an insurance company settles compared to the total number of claims received. It is a crucial factor to consider when choosing a health insurance provider.

It is essential to know that not all claims are settled by insurance companies. There can be various reasons for the rejection of claims, such as incomplete documentation, non-disclosure of pre-existing conditions, or claims for non-covered treatments. It is important for policyholders to carefully read and understand their policy documents to ensure that they meet all the requirements for a successful claim.

One common reason for claim rejection is the failure to disclose pre-existing conditions. Insurance companies require policyholders to provide accurate and complete information about their health history at the time of purchasing the policy. If a policyholder fails to disclose a pre-existing condition, the insurance company may reject the claim based on non-disclosure.

Another reason for claim rejection is the submission of incomplete documentation. Insurance companies require policyholders to submit all relevant documents, such as medical reports, bills, and prescriptions, to support their claim. If any of these documents are missing or incomplete, the claim may be rejected.

It is important for policyholders to be aware of the claim settlement ratio of their insurance company. A high claim settlement ratio indicates that the company has a good track record of settling claims, while a low ratio may indicate a higher chance of claim rejection. Policyholders should also keep in mind that the claim settlement ratio may vary depending on the type of policy and the nature of the claim.

Improving Claim Settlement Ratio

Claim settlement ratio is an important factor to consider when choosing a health insurance policy. It represents the percentage of claims that an insurance company has successfully settled compared to the total number of claims received. A higher claim settlement ratio indicates that the insurance company has a good track record of settling claims, which is crucial for policyholders.

To improve the claim settlement ratio, insurance companies need to focus on several key areas. First, they need to ensure that their claims processing procedures are efficient and streamlined. This includes having a dedicated team of claims experts who can handle claims quickly and accurately. Additionally, insurance companies should invest in advanced technology and automation tools to reduce human errors and speed up the claims settlement process.

Another important factor in improving the claim settlement ratio is effective communication with policyholders. Insurance companies need to provide clear and comprehensive information about the claims process, including what documents are required and how long it will take to settle a claim. This helps to manage policyholders’ expectations and reduces the likelihood of disputes or delays in the settlement process.

Insurance companies should also focus on building strong relationships with healthcare providers and hospitals. This includes negotiating fair and transparent reimbursement rates and establishing clear guidelines for claims submission. By working closely with healthcare providers, insurance companies can ensure that claims are processed efficiently and accurately, further improving the claim settlement ratio.

In conclusion, improving the claim settlement ratio is crucial for insurance companies to build trust and confidence among policyholders. By focusing on efficient claims processing procedures, effective communication, and strong relationships with healthcare providers, insurance companies can enhance their claim settlement ratio and provide better service to their policyholders.

Claim Settlement Ratio and Pre-existing Conditions

When it comes to health insurance, it is important to understand the claim settlement ratio and how it can be affected by pre-existing conditions. The claim settlement ratio is a measure of the percentage of claims that an insurance company settles as compared to the total number of claims received. It is an important factor to consider when choosing a health insurance provider.

Pre-existing conditions refer to any health condition that a person has before purchasing a health insurance policy. These conditions can range from chronic illnesses like diabetes or high blood pressure to previous surgeries or injuries. It is crucial to disclose these conditions when applying for health insurance, as they can impact the claim settlement ratio.

Insurance companies take pre-existing conditions into account when determining the premium and coverage for a policy. It is essential to provide accurate information about any pre-existing conditions to avoid claim rejections or disputes in the future. Failure to disclose pre-existing conditions can lead to claim denial or cancellation of the policy.

Insurance companies may have different policies regarding pre-existing conditions. Some may offer coverage for pre-existing conditions after a waiting period, while others may exclude coverage altogether. It is important to carefully review the policy terms and conditions to understand how pre-existing conditions are treated.

When comparing health insurance providers, it is advisable to consider their claim settlement ratio and their approach towards pre-existing conditions. A higher claim settlement ratio indicates that the insurance company has a good track record of settling claims, which can be beneficial when it comes to receiving timely and hassle-free claim settlements.

In conclusion, understanding the claim settlement ratio and how it is affected by pre-existing conditions is crucial when choosing a health insurance provider. It is important to provide accurate information about pre-existing conditions and carefully review the policy terms and conditions to ensure adequate coverage and a smooth claim settlement process.

Claim Settlement Ratio and Time Taken for Settlement

The claim settlement ratio is a crucial factor to consider when choosing a health insurance policy. It refers to the percentage of claims that an insurance company successfully settles out of the total claims received. A high claim settlement ratio indicates that the insurance company has a good track record of settling claims and is more likely to honor your claim when you need it.

When selecting a health insurance policy, it is essential to know about the claim settlement ratio of the insurance company. This ratio provides valuable information about the company’s ability to settle claims promptly and efficiently. A higher claim settlement ratio indicates that the company has a strong financial standing and is more likely to settle claims in a timely manner.

Another important factor to consider is the time taken for claim settlement. While a high claim settlement ratio is desirable, it is equally important to know how long it takes for the insurance company to process and settle claims. A company with a high claim settlement ratio but a long time taken for settlement may not be the ideal choice as it could cause delays and inconvenience when you need to make a claim.

Therefore, it is crucial to strike a balance between a high claim settlement ratio and a reasonable time taken for settlement. This can be determined by researching and comparing the claim settlement ratios and average time taken for settlement of different insurance companies. Reading customer reviews and seeking recommendations from trusted sources can also provide valuable insights into the claim settlement process of different insurance companies.

In conclusion, the claim settlement ratio and time taken for settlement are important factors to consider when choosing a health insurance policy. A high claim settlement ratio indicates the insurer’s ability to settle claims, while a reasonable time taken for settlement ensures timely and efficient processing of claims. By considering both factors, you can make an informed decision and select a health insurance policy that best meets your needs.

Question-answer:

What is claim settlement ratio in health insurance?

Claim settlement ratio in health insurance is the ratio of the number of claims settled by an insurance company to the total number of claims received in a given period of time. It is an important factor to consider when choosing a health insurance policy, as it indicates the company’s ability to settle claims effectively.

How is claim settlement ratio calculated?

Claim settlement ratio is calculated by dividing the total number of claims settled by the insurance company by the total number of claims received, and then multiplying the result by 100. The formula is: (Number of claims settled / Number of claims received) * 100.

Why is claim settlement ratio important in health insurance?

Claim settlement ratio is important in health insurance because it gives an indication of how likely an insurance company is to settle claims. A high claim settlement ratio indicates that the company is reliable and has a good track record of settling claims, while a low ratio may indicate that the company has a history of denying or delaying claims.

What is a good claim settlement ratio?

A good claim settlement ratio is typically considered to be above 90%. This means that the insurance company settles more than 90% of the claims it receives. However, it is important to note that the claim settlement ratio should not be the only factor to consider when choosing a health insurance policy. Other factors such as coverage, premium, and customer service should also be taken into account.