Individual Health Insurance vs Group Health Insurance

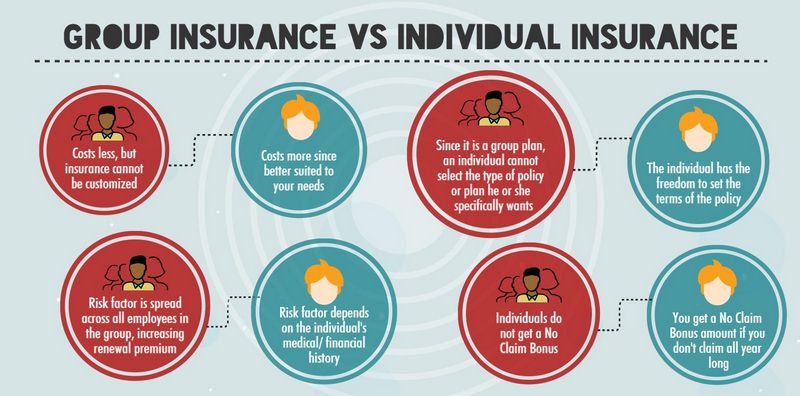

When it comes to health insurance, there are two main options to consider: individual health insurance and group health insurance. Each option has its own benefits and considerations, so it’s important to understand the differences and make an informed decision about which one is best for you.

Individual Health Insurance:

Individual health insurance is coverage that you purchase directly from an insurance provider. This type of insurance is typically tailored to meet your specific needs and offers a range of benefits. With individual health insurance, you have the flexibility to choose your own coverage options, such as deductibles, co-pays, and prescription drug coverage.

Group Health Insurance:

Group health insurance is coverage that is provided by an employer or organization to a group of individuals. This type of insurance is typically more affordable than individual health insurance because the risk is spread across a larger pool of people. Group health insurance often offers comprehensive coverage, including preventative care, hospitalization, and prescription drugs.

Comparison:

When comparing individual health insurance and group health insurance, there are several factors to consider. Individual health insurance offers more flexibility and customization options, allowing you to choose the coverage that best fits your needs. Group health insurance, on the other hand, is often more affordable and may provide more comprehensive coverage.

Coverage:

Individual health insurance provides coverage for you and your immediate family members. This coverage is typically portable, meaning you can take it with you if you change jobs or move to a different state. Group health insurance provides coverage for a group of individuals, such as employees or members of an organization. This coverage is typically tied to your employment or membership in the organization.

Conclusion:

Ultimately, the best option for you depends on your individual needs and circumstances. If you value flexibility and customization, individual health insurance may be the best choice. If affordability and comprehensive coverage are your top priorities, group health insurance may be the better option. Consider your budget, healthcare needs, and personal preferences when making your decision.

Remember, it’s important to have health insurance to protect yourself and your loved ones from unexpected medical expenses. Whether you choose individual health insurance or group health insurance, make sure you understand the terms and coverage options before making a decision.

Understanding Individual Health Insurance

Individual health insurance is a type of health insurance coverage that is purchased by an individual or a family, rather than being provided by an employer or a group. It offers a range of benefits and coverage options that can be tailored to meet the specific needs of the individual or family.

One of the key advantages of individual health insurance is the flexibility it provides. Unlike group health insurance, which is typically provided by an employer and offers limited options, individual health insurance allows individuals to choose their own coverage and benefits. This means that individuals can select a plan that best suits their needs and budget.

Another important aspect of individual health insurance is the control it gives individuals over their healthcare. With individual health insurance, individuals have the freedom to choose their own healthcare providers and hospitals. They can also decide which treatments and medications they want to receive, without having to rely on a group plan that may have restrictions or limitations.

Individual health insurance also offers the advantage of lower premiums compared to group health insurance. Since individual plans are tailored to the specific needs of the individual or family, premiums can be more affordable. Additionally, individuals have the option to choose a high-deductible plan, which can further reduce their monthly premiums.

In summary, individual health insurance offers greater flexibility, control, and affordability compared to group health insurance. It allows individuals to customize their coverage and benefits, choose their own healthcare providers, and save money on premiums. Whether you are self-employed, in-between jobs, or simply prefer the freedom and control of individual health insurance, it is important to carefully consider your options and choose the plan that best meets your needs.

Understanding Group Health Insurance

Group health insurance is a type of insurance that provides coverage to a group of people, such as employees of a company or members of an organization. Unlike individual health insurance, which is purchased by individuals for themselves and their families, group health insurance is obtained through an employer or a group administrator.

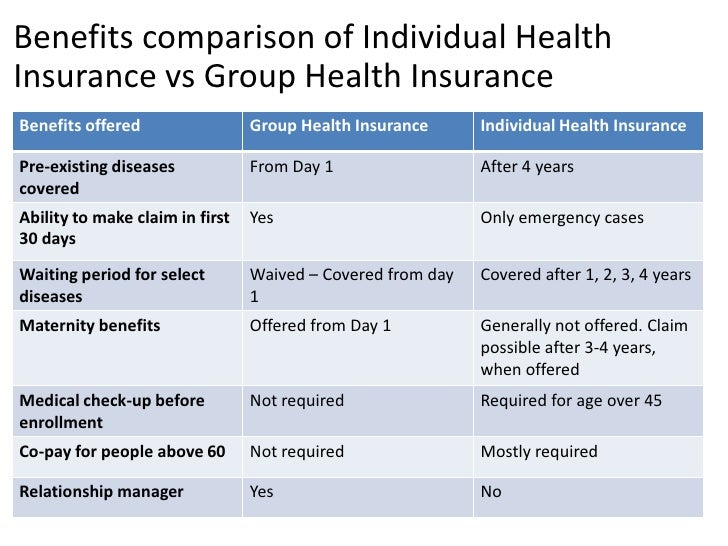

One of the main benefits of group health insurance is that it often offers more comprehensive coverage than individual health insurance. Group plans typically include a wider range of benefits, such as prescription drug coverage, preventive care, and mental health services. This can be especially beneficial for individuals who have pre-existing conditions or require ongoing medical treatment.

Another advantage of group health insurance is that the premiums are often lower compared to individual health insurance. This is because the risk is spread across a larger pool of individuals, which helps to reduce the overall cost. Additionally, employers may contribute towards the cost of the premiums, making it more affordable for employees.

When comparing individual and group health insurance, it’s important to consider the level of coverage and the cost. Individual health insurance may offer more flexibility in terms of choosing your own coverage and providers, but it may come with higher premiums. Group health insurance, on the other hand, may have more limited choices but can offer more affordable coverage.

In summary, group health insurance provides coverage to a group of individuals and offers comprehensive benefits at a lower cost. It is an attractive option for individuals who are part of a group or organization, as it provides access to quality healthcare without the high premiums associated with individual health insurance.

Coverage Options for Individual Health Insurance

When it comes to choosing health insurance, you have two main options: individual health insurance and group health insurance. While group health insurance is provided through an employer or organization, individual health insurance is purchased directly by an individual. Both options have their own benefits and premiums, so it’s important to understand the coverage and compare them before making a decision.

Individual health insurance offers coverage for an individual or their family, providing protection against unexpected medical expenses. Unlike group health insurance, individual plans can be customized to meet specific needs and preferences. This flexibility allows individuals to choose the coverage that best suits their unique circumstances.

One of the advantages of individual health insurance is the ability to choose from a wide range of insurance providers. This allows individuals to compare different plans and select the one that offers the best coverage and premiums. Additionally, individual health insurance plans often provide a broader network of healthcare providers, giving individuals more options for their medical care.

When considering individual health insurance, it’s important to understand the coverage options available. This includes understanding the types of services and treatments covered, as well as any limitations or exclusions. Some individual health insurance plans may offer coverage for preventive care, prescription drugs, and hospital stays, while others may have more limited coverage.

Overall, individual health insurance provides individuals with a greater level of control and flexibility over their healthcare coverage. By comparing the benefits, premiums, and coverage options of individual health insurance plans, individuals can make an informed decision that meets their specific healthcare needs.

Coverage Options for Group Health Insurance

Group health insurance offers a range of benefits and coverage options for individuals seeking health insurance. Unlike individual health insurance, which is purchased by an individual, group health insurance is typically provided by an employer or organization to a group of individuals. This type of insurance offers several advantages over individual health insurance.

One of the main advantages of group health insurance is that it often provides more comprehensive coverage than individual health insurance. Group plans typically include a wider range of services and treatments, such as preventive care, prescription drugs, and mental health services. This can be especially beneficial for individuals with chronic conditions or those who require ongoing medical care.

Another advantage of group health insurance is that it often has lower premiums compared to individual health insurance. Group plans are typically purchased in bulk, which allows for cost savings that can be passed on to the individuals covered under the plan. This can make group health insurance a more affordable option for individuals who may not be able to afford the higher premiums associated with individual health insurance.

Additionally, group health insurance often offers more flexibility in terms of coverage options. Group plans may allow individuals to choose from different levels of coverage, such as basic, standard, or premium plans. This allows individuals to select a plan that best suits their needs and budget. Group plans may also offer additional benefits, such as dental or vision coverage, which may not be available with individual health insurance.

In conclusion, group health insurance provides individuals with a range of coverage options and benefits that may not be available with individual health insurance. From comprehensive coverage to lower premiums and more flexibility, group health insurance offers a compelling alternative for individuals seeking health insurance coverage.

Cost Factors for Individual Health Insurance

When it comes to individual health insurance, there are several cost factors to consider. One of the main factors is the level of coverage you choose. Individual health insurance allows you to customize your coverage based on your specific health needs. This means you can choose a plan that provides the benefits you need most, whether that’s prescription drug coverage, maternity benefits, or mental health services.

Another cost factor to consider is your health status. Individual health insurance takes into account your individual health risks and may adjust your premium accordingly. If you have pre-existing conditions or a history of health problems, you may pay a higher premium compared to someone who is in good health.

Additionally, individual health insurance plans often have higher deductibles and out-of-pocket costs compared to group health insurance. This means that while your monthly premium may be lower, you may have to pay more out-of-pocket when you receive medical care. It’s important to carefully consider your budget and health needs when choosing an individual health insurance plan.

Finally, it’s worth noting that individual health insurance plans can be more flexible compared to group health insurance. With individual coverage, you have the freedom to choose your own doctors and specialists, whereas group health insurance may have restrictions on which providers you can see. This flexibility can be a significant benefit for individuals who have specific healthcare preferences or ongoing relationships with certain healthcare providers.

In conclusion, when comparing individual health insurance vs group health insurance, it’s important to consider the cost factors associated with individual coverage. These factors include the level of coverage, your health status, out-of-pocket costs, and the flexibility of the plan. By carefully evaluating these factors, you can make an informed decision about which type of health insurance is the best option for you.

Cost Factors for Group Health Insurance

When comparing individual health insurance vs group health insurance, one of the key factors to consider is the cost. Group health insurance typically offers lower premiums compared to individual health insurance. This is because the risk is spread across a larger pool of people in a group, which helps to lower the overall cost of coverage.

Another cost factor to consider is the level of coverage provided by group health insurance. Group plans often offer more comprehensive coverage compared to individual plans, which can result in lower out-of-pocket expenses for employees. This can include benefits such as prescription drug coverage, preventive care, and mental health services.

Additionally, employers may contribute towards the cost of group health insurance premiums, further reducing the financial burden on employees. This can make group health insurance a more affordable option for individuals compared to purchasing individual coverage on their own.

It’s important to note that the cost of group health insurance can vary depending on factors such as the size of the group, the location of the business, and the age and health of the employees. Employers should carefully consider these cost factors when choosing a group health insurance plan for their employees.

Benefits of Individual Health Insurance

Individual health insurance offers a range of benefits that can provide you with comprehensive coverage for your health needs. Unlike group health insurance, which is typically provided by an employer, individual health insurance allows you to choose a plan that meets your specific needs and preferences.

One of the main advantages of individual health insurance is the flexibility it offers. With individual coverage, you have the freedom to select the level of coverage that suits your budget and health requirements. You can choose from a variety of plans and customize your coverage options, such as deductibles, copayments, and prescription drug coverage.

Another benefit of individual health insurance is that you have the ability to shop around and compare different insurance providers. This allows you to find the best premiums and coverage options that fit your unique circumstances. You can also take advantage of online tools and resources to easily compare plans and make an informed decision.

Individual health insurance also offers the advantage of portability. Unlike group health insurance, which you may lose if you change jobs or leave a company, individual coverage stays with you regardless of your employment status. This provides you with continuous coverage and peace of mind knowing that you are protected no matter what.

In summary, individual health insurance offers flexibility, customization, and portability, allowing you to tailor your coverage to your specific needs and preferences. With individual health insurance, you have the ability to choose the best plan for you and ensure that you have comprehensive coverage for your health needs.

Benefits of Group Health Insurance

Group health insurance offers a range of benefits that make it an attractive option for individuals looking for comprehensive health coverage. Here are some of the key advantages of choosing group health insurance over individual health insurance:

- Lower Premiums: One of the main advantages of group health insurance is that it typically comes with lower premiums compared to individual health insurance. This is because the risk is spread across a larger pool of individuals, which helps to reduce costs.

- Greater Coverage: Group health insurance plans often offer more extensive coverage than individual plans. This means that you and your family members can access a wider range of medical services and treatments, including preventive care, specialist consultations, and prescription medications.

- Employer Contribution: Many employers offer group health insurance as part of their employee benefits package. This often includes a contribution towards the cost of the insurance premiums, making it more affordable for employees.

- More Flexibility: Group health insurance plans often provide more flexibility in terms of choosing healthcare providers. You may have access to a larger network of doctors, hospitals, and specialists, giving you more options for your healthcare needs.

- Additional Benefits: Group health insurance plans may include additional benefits such as dental and vision coverage, wellness programs, and access to employee assistance programs. These extra perks can help you and your family maintain good overall health and well-being.

- Easy Enrollment: Enrolling in group health insurance is often a straightforward process. You can typically sign up during the open enrollment period or when you first become eligible for coverage through your employer. This saves you time and effort compared to navigating the individual health insurance market.

Overall, group health insurance provides individuals with a range of benefits, including lower premiums, greater coverage, employer contributions, flexibility, additional benefits, and easy enrollment. It is a cost-effective and comprehensive option for those seeking reliable health insurance coverage.

Limitations of Individual Health Insurance

When it comes to health insurance, there are two main options to choose from: individual health insurance and group health insurance. While individual health insurance offers certain benefits, it also has its limitations in comparison to group health insurance.

One of the main limitations of individual health insurance is the coverage it provides. Unlike group health insurance, which typically offers comprehensive coverage for a wide range of medical services and treatments, individual health insurance plans may have limited coverage options. This means that individuals may have to pay out-of-pocket for certain medical expenses that are not covered by their insurance.

Another limitation of individual health insurance is the cost. Premiums for individual health insurance plans are generally higher than those for group health insurance. This is because individual health insurance plans are based on the individual’s age, health status, and other factors, whereas group health insurance plans spread the risk among a larger pool of people, resulting in lower premiums for each individual.

Furthermore, individual health insurance plans may not offer the same benefits and discounts that are available with group health insurance. Group health insurance plans often provide additional benefits such as dental and vision coverage, wellness programs, and prescription drug discounts. These benefits may not be available or may be limited in individual health insurance plans.

In conclusion, while individual health insurance can provide coverage for individuals who do not have access to group health insurance, it has its limitations. Limited coverage options, higher premiums, and fewer benefits are some of the drawbacks of individual health insurance. Therefore, it is important for individuals to carefully consider their options and choose the insurance plan that best suits their needs and budget.

Limitations of Group Health Insurance

While group health insurance can provide coverage for a large number of individuals, it also has its limitations. One of the main limitations is the lack of flexibility for individual needs. Group health insurance plans are designed to provide coverage for a group of people, which means that the coverage may not be tailored to each individual’s specific health needs.

Another limitation of group health insurance is the lack of control over premiums. In a group health insurance plan, the premiums are typically determined by the insurance company based on the overall health of the group. This means that individuals with pre-existing health conditions may end up paying higher premiums compared to those who are healthy.

Additionally, group health insurance plans may not offer the same level of coverage as individual health insurance plans. While group plans may provide basic coverage for essential medical services, they may not cover certain specialized treatments or procedures that an individual may require.

Furthermore, group health insurance plans may limit the choice of healthcare providers. Individuals may be restricted to a network of doctors and hospitals that are part of the insurance company’s preferred provider organization (PPO) or health maintenance organization (HMO). This can limit the options for individuals who prefer to see specific healthcare providers.

In comparison, individual health insurance plans offer more flexibility and control over coverage and premiums. Individuals can choose a plan that best suits their specific health needs and budget. They can also have the freedom to choose their preferred healthcare providers without restrictions.

Considerations for Choosing Individual Health Insurance

When it comes to health insurance, individuals have the option to choose between individual health insurance and group health insurance. It is important to carefully consider the benefits and drawbacks of each option before making a decision.

One of the main considerations when choosing individual health insurance is the comparison of premiums. Premiums for individual health insurance are typically higher compared to group health insurance. However, individual health insurance offers more flexibility in terms of coverage options and benefits.

Another important factor to consider is the level of coverage provided by individual health insurance. Individual health insurance plans often offer more comprehensive coverage compared to group health insurance. This means that individuals can have access to a wider range of medical services and treatments.

Individual health insurance also provides individuals with the freedom to choose their own healthcare providers. This means that individuals can select doctors and specialists that they trust and feel comfortable with. Group health insurance, on the other hand, may limit individuals to a specific network of healthcare providers.

Additionally, individual health insurance allows individuals to tailor their coverage to their specific needs. They can choose the level of coverage they need and add on additional benefits if desired. This level of customization is not typically available with group health insurance.

In conclusion, choosing individual health insurance requires careful consideration of various factors. While premiums may be higher, individuals can benefit from more comprehensive coverage, the freedom to choose their own healthcare providers, and the ability to tailor their coverage to their specific needs.

Considerations for Choosing Group Health Insurance

When it comes to choosing health insurance, there are several factors to consider. One important consideration is whether to opt for individual health insurance or group health insurance. While individual health insurance offers certain benefits, group health insurance has its own advantages.

1. Premiums: One of the main benefits of group health insurance is that the premiums are often lower compared to individual health insurance. This is because the risk is spread among a larger group of people, which helps to reduce the cost for each individual.

2. Coverage: Group health insurance typically offers more comprehensive coverage compared to individual health insurance. This means that you and your employees will have access to a wider range of medical services and treatments.

3. Comparison: Group health insurance allows for easier comparison between different plans. Employers can choose from a variety of options and select the one that best fits the needs of their employees. This can help save time and ensure that everyone is getting the coverage they need.

4. Insurance vs Health: Group health insurance focuses on the health and well-being of a group of individuals. This means that the insurance provider may offer additional wellness programs or resources to help promote a healthy lifestyle among employees.

In conclusion, group health insurance offers several advantages such as lower premiums, comprehensive coverage, easier comparison, and a focus on health and wellness. These considerations make it a viable option for employers looking to provide their employees with quality healthcare coverage.

Case Studies: Individual Health Insurance vs Group Health Insurance

When it comes to choosing health insurance, there are two main options to consider: individual health insurance and group health insurance. While both options provide coverage for medical expenses, there are significant differences in terms of premiums, benefits, and overall cost. To help you make an informed decision, we have conducted case studies comparing individual health insurance and group health insurance.

Individual health insurance is purchased by individuals directly from insurance companies. The premiums for individual health insurance are typically higher compared to group health insurance. However, individual health insurance offers more flexibility in terms of coverage options and benefits. It allows individuals to choose a plan that best suits their needs and budget.

On the other hand, group health insurance is provided by employers to their employees. The premiums for group health insurance are generally lower compared to individual health insurance. This is because the risk is spread across a larger group of people. Group health insurance also offers a wider range of benefits, including preventive care, maternity coverage, and mental health services.

In our case studies, we found that individual health insurance is a better option for individuals who are self-employed or do not have access to group health insurance through their employer. It provides more control over coverage and allows individuals to tailor their plan to fit their specific needs. However, if you have access to group health insurance through your employer, it may be more cost-effective and provide comprehensive coverage for you and your family.

Ultimately, the decision between individual health insurance and group health insurance depends on your personal circumstances and priorities. It is important to carefully consider the premiums, coverage options, and benefits of each option before making a decision. Consulting with an insurance agent or financial advisor can also help you make an informed choice.

Question-answer:

What is individual health insurance?

Individual health insurance is a type of insurance that covers an individual’s medical expenses. It is purchased by individuals and families directly from an insurance company or through the Health Insurance Marketplace.

What is group health insurance?

Group health insurance is a type of insurance that covers a group of people, such as employees of a company or members of an organization. It is usually purchased by an employer or organization and offers coverage to all eligible members of the group.

What are the advantages of individual health insurance?

Individual health insurance offers several advantages. Firstly, it provides you with the flexibility to choose a plan that suits your specific needs and budget. Secondly, it allows you to maintain coverage even if you change jobs or leave a group plan. Lastly, individual health insurance can be customized to your individual health needs, providing coverage for specific medical conditions or treatments.

What are the advantages of group health insurance?

Group health insurance offers several advantages. Firstly, it often provides more comprehensive coverage at a lower cost compared to individual health insurance. Secondly, it is typically easier to qualify for group health insurance, as there are no medical underwriting requirements for individual members. Lastly, group health insurance often includes additional benefits such as dental and vision coverage.

What factors should I consider when deciding between individual and group health insurance?

When deciding between individual and group health insurance, you should consider factors such as cost, coverage options, flexibility, and your specific health needs. Individual health insurance may be a better option if you value flexibility and customization, while group health insurance may be more cost-effective and provide more comprehensive coverage.