What Is Sum Insured in Health Insurance?

Health insurance is a type of insurance that provides coverage for medical and surgical expenses incurred by the insured. It is an agreement between the insured and the insurance company, where the insured pays a premium in exchange for financial protection in case of medical emergencies or illnesses. One of the most important aspects of health insurance is the sum insured, which determines the maximum amount that the insurance company will pay for the insured’s medical expenses.

The sum insured is the maximum limit of coverage provided by the insurance policy. It is important for the insured to choose an appropriate sum insured based on their healthcare needs and financial capabilities. The sum insured can vary depending on factors such as age, pre-existing conditions, and the type of medical treatment required. It is crucial for the insured to carefully consider these factors and select a sum insured that adequately covers their potential medical expenses.

In health insurance, the sum insured can be divided into two categories: individual sum insured and family floater sum insured. The individual sum insured provides coverage for a single person, while the family floater sum insured provides coverage for the entire family. The family floater sum insured is shared among all the members of the family, which means that the total coverage amount can be utilized by any family member in case of medical emergencies.

In conclusion, understanding the sum insured is essential for making informed decisions when it comes to health insurance. It is important to carefully assess one’s healthcare needs and financial capabilities in order to choose an appropriate sum insured. By doing so, the insured can ensure that they have adequate coverage and financial protection in case of medical emergencies or illnesses.

What is Sum Insured?

In the context of health insurance, sum insured refers to the maximum amount of coverage that an insurance policy provides. It is the total amount that an insurance company will pay out to cover medical expenses for the insured individual or family.

The sum insured is a crucial component of a health insurance policy as it determines the extent of financial protection that an individual or family has in case of medical emergencies or treatment. It is important to carefully consider the sum insured when choosing a health insurance policy to ensure that it adequately covers the potential healthcare expenses.

The sum insured can vary depending on the type of health insurance policy and the coverage options selected. It is typically chosen by the insured individual or family at the time of purchasing the policy. Higher sum insured amounts generally result in higher premiums, but they also provide greater financial protection in case of expensive medical treatments or hospitalizations.

When selecting a sum insured, it is important to consider factors such as the individual’s or family’s medical history, lifestyle, and potential healthcare needs. It is also advisable to review and update the sum insured periodically to account for inflation and changes in healthcare costs.

In summary, sum insured is the maximum amount of coverage provided by a health insurance policy. It is an important factor to consider when choosing a policy and determines the financial protection available for medical expenses. Careful consideration and periodic review of the sum insured can help ensure adequate coverage for healthcare needs.

Understanding the concept of Sum Insured in Health Insurance

Health insurance is a type of insurance that provides coverage for medical expenses incurred by an individual. It is designed to protect individuals from the financial burden of unexpected healthcare costs.

Sum insured is a key concept in health insurance. It refers to the maximum amount of money that an insurance company will pay for medical expenses in a given policy period. This amount is agreed upon at the time of policy purchase and is stated in the insurance policy.

The sum insured in health insurance is important because it determines the level of coverage an individual has. If the sum insured is low, the individual may have to bear a significant portion of the medical expenses out of pocket. On the other hand, if the sum insured is high, the individual will have a greater level of financial protection.

It is important for individuals to carefully consider the sum insured when purchasing health insurance. Factors such as age, health condition, and lifestyle should be taken into account when determining the appropriate sum insured. It is also advisable to review and update the sum insured periodically to ensure that it remains adequate to cover potential medical expenses.

In conclusion, understanding the concept of sum insured is crucial in health insurance. It helps individuals make informed decisions about the level of coverage they need and ensures that they are protected from unexpected healthcare costs.

Importance of Sum Insured in Health Insurance

Sum insured is a crucial factor in health insurance. It refers to the maximum amount of money that an insurance company will pay for medical expenses incurred by the insured individual. In other words, it is the financial coverage provided by the insurance policy.

Understanding the sum insured in health insurance is important because it determines the level of protection and financial assistance you will receive in case of any medical emergency. It is essential to choose a sum insured that adequately covers your healthcare needs and expenses.

When selecting a sum insured, it is important to consider various factors such as your age, health condition, lifestyle, and the cost of healthcare services in your area. It is recommended to opt for a sum insured that provides comprehensive coverage and ensures that you are adequately protected.

Having a sufficient sum insured in health insurance is crucial as it helps you avoid financial burden and stress during medical emergencies. It provides you with the peace of mind that you will receive the necessary medical treatment without worrying about the expenses.

In addition, having a higher sum insured also allows you to avail better healthcare facilities and services, as you can afford more expensive treatments and procedures. It ensures that you have access to quality healthcare without compromising on the level of care you receive.

In conclusion, the sum insured in health insurance is an important aspect that should not be overlooked. It determines the level of financial protection and assistance you will receive in case of any medical emergency. It is essential to carefully consider your healthcare needs and expenses to select a sum insured that provides adequate coverage and ensures peace of mind.

Factors that determine the Sum Insured

When it comes to health insurance, the sum insured plays a crucial role in determining the coverage and benefits you will receive. The sum insured is the maximum amount that the insurance company will pay for medical expenses in a given policy period. It is important to understand the factors that determine the sum insured in order to make an informed decision about your health insurance policy.

1. Age: Age is a significant factor that affects the sum insured. Generally, younger individuals have lower sum insured compared to older individuals. This is because the risk of developing health issues increases with age, and older individuals may require higher coverage.

2. Medical History: Your medical history also plays a role in determining the sum insured. If you have a pre-existing medical condition or a history of hospitalization, the insurance company may offer a higher sum insured to cover potential future medical expenses.

3. Lifestyle Factors: Certain lifestyle factors such as smoking, alcohol consumption, and obesity can impact the sum insured. Insurance companies may offer a lower sum insured for individuals with unhealthy lifestyles, as they are at a higher risk of developing health issues.

4. Geographic Location: The geographic location where you live can also influence the sum insured. Medical expenses vary across different regions, and insurance companies take this into account when determining the sum insured. Individuals living in areas with higher healthcare costs may be offered a higher sum insured.

5. Income and Affordability: Your income and affordability also play a role in determining the sum insured. Insurance companies consider your financial capability to pay premiums and may offer a sum insured that is affordable for you.

It is important to carefully consider these factors when selecting a health insurance policy. Assess your specific needs and requirements, and choose a sum insured that provides adequate coverage for you and your family’s healthcare needs.

How to choose the right Sum Insured for your Health Insurance

When it comes to health insurance, one of the most important factors to consider is the sum insured. The sum insured is the maximum amount that the insurance company will pay for your medical expenses in case of hospitalization or other covered medical treatments. It is crucial to choose the right sum insured to ensure that you are adequately covered for any potential healthcare costs.

So, what is the right sum insured for your health insurance? The answer to this question depends on several factors, including your age, medical history, and lifestyle. Younger individuals may opt for a lower sum insured, as they are generally less prone to serious health issues. On the other hand, older individuals or those with pre-existing conditions may require a higher sum insured to cover potential medical expenses.

It is also important to consider the rising healthcare costs when choosing the sum insured. Medical treatments and hospitalization expenses can be quite expensive, especially for specialized procedures or in major cities. Therefore, it is advisable to opt for a sum insured that can adequately cover these costs.

Additionally, consider your lifestyle and risk factors when determining the sum insured. If you have a sedentary lifestyle or engage in activities that may increase the risk of accidents or illnesses, such as smoking or extreme sports, it is wise to choose a higher sum insured to account for these potential risks.

Finally, it is recommended to review and reassess your sum insured periodically. As your health and circumstances change over time, your insurance needs may also change. It is important to ensure that your sum insured remains sufficient to cover any potential medical expenses that may arise.

In conclusion, choosing the right sum insured for your health insurance is a crucial decision. Consider factors such as your age, medical history, lifestyle, and rising healthcare costs to determine the appropriate sum insured. Regularly review and reassess your sum insured to ensure that you are adequately covered for any potential healthcare expenses.

Common mistakes to avoid while deciding the Sum Insured

Deciding the sum insured for health insurance is an important step in protecting yourself and your loved ones. However, there are some common mistakes that people often make when choosing the sum insured, which can lead to inadequate coverage and financial difficulties in case of a medical emergency.

1. Underestimating the cost of healthcare: One of the biggest mistakes people make is underestimating the cost of healthcare. They may choose a sum insured that seems sufficient at the time, but fail to consider the rising cost of medical treatments and hospitalization expenses. It is important to factor in inflation and the potential for unexpected medical expenses when deciding the sum insured.

2. Focusing solely on the premium: Many people make the mistake of choosing a lower sum insured to reduce the premium amount. While it may seem like a cost-saving measure in the short term, it can prove to be a costly mistake in the long run. Inadequate coverage can leave you with a huge financial burden in case of a medical emergency. It is important to strike a balance between affordability and adequate coverage.

3. Ignoring personal and family medical history: Another common mistake is ignoring personal and family medical history when deciding the sum insured. Certain medical conditions may require expensive treatments or long-term care, and it is important to take these factors into account. Consulting with a healthcare professional or insurance advisor can help you make an informed decision based on your specific medical needs.

4. Not considering lifestyle factors: Lifestyle factors such as smoking, alcohol consumption, and occupation can also affect your health and the likelihood of needing medical treatment. Ignoring these factors when deciding the sum insured can lead to inadequate coverage. It is important to disclose all relevant information to the insurance provider and consider these factors when choosing the sum insured.

5. Failing to review and update the sum insured: Lastly, many people make the mistake of not reviewing and updating their sum insured regularly. As your healthcare needs and financial situation change over time, it is important to reassess your coverage and make adjustments accordingly. Failure to do so can leave you underinsured or overpaying for coverage you don’t need.

Avoiding these common mistakes and taking the time to carefully evaluate your healthcare needs can help you choose the right sum insured for your health insurance policy. Remember, the sum insured should provide adequate coverage for potential medical expenses and give you peace of mind during uncertain times.

Types of Sum Insured options available in Health Insurance

When it comes to health insurance, understanding the different types of sum insured options is crucial. The sum insured refers to the maximum amount that an insurance company will pay out in the event of a claim. It is important to select the right sum insured to ensure that you are adequately covered for any medical expenses that may arise.

There are several types of sum insured options available in health insurance. The most common types include:

- Individual sum insured: This type of sum insured provides coverage for a single individual. The insurance company will pay out up to the specified sum insured amount for any medical expenses incurred by that individual.

- Family floater sum insured: This type of sum insured provides coverage for the entire family. The sum insured amount can be used by any family member in case of a medical emergency or illness.

- Top-up sum insured: A top-up sum insured is an additional coverage that can be added to an existing health insurance policy. It provides coverage for expenses that exceed the sum insured limit of the base policy.

- Super top-up sum insured: Similar to a top-up sum insured, a super top-up sum insured provides coverage for expenses that exceed the sum insured limit of the base policy. However, it applies to multiple claims in a policy year.

It is important to carefully consider the sum insured options available and choose the one that best suits your needs. Factors such as your age, health condition, and lifestyle should be taken into account when deciding on the sum insured amount. It is also advisable to review your sum insured periodically and make adjustments as necessary to ensure that you are adequately covered.

Benefits of having a higher Sum Insured

Having a higher sum insured is important when it comes to health insurance. It determines the maximum amount that an insured person can claim from their insurance policy. Here are some benefits of having a higher sum insured:

- Comprehensive coverage: A higher sum insured provides a wider coverage for various medical expenses. It ensures that you are financially protected in case of any unforeseen medical emergencies or hospitalization.

- Access to better healthcare facilities: With a higher sum insured, you can opt for better healthcare facilities and choose from a wider network of hospitals. This gives you the freedom to receive treatment from renowned doctors and hospitals, ensuring quality healthcare.

- Peace of mind: A higher sum insured gives you peace of mind, knowing that you are adequately covered for any medical expenses that may arise. It eliminates the worry of having to bear the financial burden of expensive treatments or surgeries.

- Protection against rising medical costs: Medical costs are constantly rising, and having a higher sum insured protects you against these increasing expenses. It ensures that you are not left with a hefty bill to pay out of your own pocket.

- Flexibility in choosing add-ons: With a higher sum insured, you have the flexibility to choose additional coverage options or add-ons to enhance your health insurance policy. This allows you to customize your coverage according to your specific needs and requirements.

Overall, having a higher sum insured in your health insurance policy provides you with the necessary financial protection and peace of mind in case of any medical emergencies. It ensures that you can avail quality healthcare without worrying about the financial burden.

Limitations of a lower Sum Insured

When it comes to health insurance, the sum insured plays a crucial role in determining the coverage and benefits you receive. A lower sum insured can have several limitations and drawbacks that can impact your financial security and access to quality healthcare.

One limitation of a lower sum insured is that it may not provide sufficient coverage for expensive medical treatments and procedures. In case of a major illness or injury, the cost of hospitalization, surgeries, and other medical expenses can quickly add up, leaving you with a significant financial burden.

Another limitation is that a lower sum insured may not cover certain types of treatments or services. For example, some health insurance policies have exclusions for cosmetic procedures, fertility treatments, or alternative therapies. If you require any of these treatments, you may have to bear the expenses out of your own pocket.

Furthermore, a lower sum insured may limit your choice of hospitals and doctors. Some health insurance plans have a network of preferred providers, and if you choose to go to a non-network hospital or doctor, your coverage may be significantly reduced. This can restrict your access to specialized or preferred healthcare providers.

In addition, a lower sum insured may also have limitations on pre-existing conditions. Pre-existing conditions are medical conditions that you had before purchasing the insurance policy. Some health insurance plans may have waiting periods or exclusions for pre-existing conditions, which means that you may not be able to get coverage for treatments related to these conditions for a certain period of time.

To ensure comprehensive coverage and financial security, it is important to carefully consider the sum insured when purchasing health insurance. It is recommended to opt for a higher sum insured that provides adequate coverage for your healthcare needs and safeguards you against unexpected medical expenses.

How to increase the Sum Insured in your Health Insurance policy

If you want to increase the sum insured in your health insurance policy, there are a few options you can consider. First, you can contact your insurance provider and inquire about the possibility of increasing the sum insured. They will be able to provide you with information on the process and any additional premiums that may be required.

Another option is to compare different health insurance policies and providers. By doing this, you can find a policy that offers a higher sum insured at a competitive premium. It’s important to carefully review the terms and conditions of each policy to ensure that it meets your specific needs and requirements.

You may also consider opting for a top-up or super top-up health insurance plan. These plans provide additional coverage on top of your existing health insurance policy. By opting for a top-up plan, you can increase the sum insured without having to purchase an entirely new policy.

Additionally, you can explore the option of adding a rider or add-on to your existing health insurance policy. Riders are additional benefits that can be added to your policy, such as critical illness cover or maternity cover. By adding a rider, you can increase the sum insured and enhance the coverage provided by your health insurance policy.

Finally, it’s important to regularly review and reassess your health insurance needs. As your circumstances change, you may require a higher sum insured to adequately cover your medical expenses. By staying informed and proactive, you can ensure that your health insurance policy provides the necessary coverage for you and your family.

Claim settlement process based on the Sum Insured

When it comes to health insurance, understanding the sum insured is crucial. The sum insured refers to the maximum amount that an insured individual can claim from their insurance policy. It is important to know what is covered under the sum insured and how the claim settlement process works based on this amount.

The claim settlement process in health insurance is based on the sum insured. If the medical expenses incurred by the insured individual are within the sum insured, the insurance company will cover the costs up to that amount. However, if the expenses exceed the sum insured, the insured individual will be responsible for paying the remaining amount.

It is important for individuals to carefully select the sum insured when purchasing health insurance. A higher sum insured provides greater coverage and ensures that the insured individual is protected against high medical expenses. On the other hand, a lower sum insured may not be sufficient to cover all medical costs, leaving the insured individual with out-of-pocket expenses.

When filing a claim, it is important to provide all the necessary documents and information to the insurance company. This includes medical bills, prescriptions, diagnostic reports, and any other relevant documents. The insurance company will review the claim and verify the expenses incurred by the insured individual.

Based on the sum insured, the insurance company will settle the claim accordingly. If the expenses are within the sum insured, the insurance company will reimburse the insured individual for the covered amount. If the expenses exceed the sum insured, the insurance company will reimburse up to the maximum amount allowed under the policy, and the insured individual will be responsible for the remaining balance.

In conclusion, the claim settlement process in health insurance is based on the sum insured. It is important for individuals to understand what is covered under the sum insured and select an appropriate amount when purchasing health insurance. By providing all the necessary documents and information, individuals can ensure a smooth and hassle-free claim settlement process.

Understanding the concept of No Claim Bonus in Health Insurance

Health insurance is a type of insurance that provides coverage for medical expenses incurred by the insured individual. It is important for individuals to understand the various components of health insurance, including the concept of No Claim Bonus.

No Claim Bonus (NCB) is a benefit provided by health insurance companies to policyholders who do not make any claims during a specific policy period. It is a reward for maintaining good health and not utilizing the insurance coverage. The NCB is usually offered as a discount on the premium for the subsequent policy period.

What makes the concept of No Claim Bonus unique is that it encourages individuals to take care of their health and avoid unnecessary medical expenses. By not making any claims, policyholders can enjoy the financial benefits in terms of reduced premium rates for their health insurance.

It is important to note that the No Claim Bonus is not applicable to all types of health insurance policies. Some policies may have specific terms and conditions regarding the eligibility and calculation of the NCB. It is advisable for individuals to carefully read and understand the policy documents to know if they are eligible for the No Claim Bonus.

In some cases, the No Claim Bonus can accumulate over the years if the policyholder continues to not make any claims. This can result in significant savings on the premium amount. However, it is important to review the policy terms and conditions to know the maximum limit of the NCB accumulation.

In conclusion, the concept of No Claim Bonus in health insurance is a beneficial feature that rewards individuals for maintaining good health and not utilizing the insurance coverage. It encourages policyholders to take preventive measures and avoid unnecessary medical expenses. Understanding the terms and conditions of the NCB is crucial to fully benefit from this feature of health insurance policies.

Impact of Sum Insured on the premium of Health Insurance

When it comes to health insurance, the sum insured plays a crucial role in determining the premium. The sum insured is the maximum amount that an insured individual is eligible to claim from the insurance company in case of a medical emergency or hospitalization. It is important to understand that the higher the sum insured, the higher the premium will be.

Insurance companies take into consideration the sum insured while calculating the premium as it directly affects the risk they are taking on. A higher sum insured means that the insurance company will have to pay a larger amount in case of a claim, which increases the risk for them. As a result, they charge a higher premium to compensate for this increased risk.

What is also important to note is that the sum insured should be adequate to cover the medical expenses in case of a serious illness or injury. If the sum insured is too low, the insured individual may end up paying a significant portion of the medical bills out of pocket. On the other hand, if the sum insured is too high, the insured individual may end up paying a higher premium unnecessarily.

It is advisable to carefully assess one’s healthcare needs and choose a sum insured that strikes a balance between adequate coverage and affordable premium. Insurance companies often offer different sum insured options, allowing individuals to select the one that best suits their requirements. Comparing different health insurance plans and their premiums can also help in making an informed decision.

Sum Insured vs. Deductible: Key differences and similarities

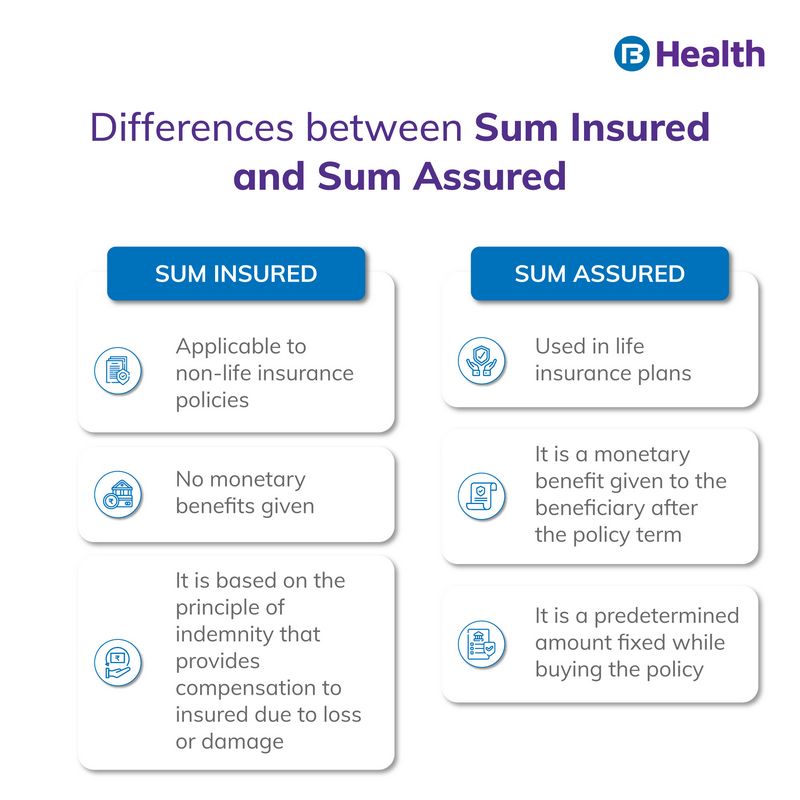

When it comes to health insurance, two important terms that often come up are “sum insured” and “deductible”. While they both relate to the coverage provided by the insurance policy, they have distinct differences and similarities.

The sum insured is the maximum amount that the insurance company is liable to pay for medical expenses incurred by the insured individual. It represents the total coverage available under the policy and is usually specified at the time of purchasing the insurance. The sum insured can vary depending on the type of policy and the premium paid by the insured.

On the other hand, a deductible is the amount that the insured individual needs to pay out of pocket before the insurance company starts covering the medical expenses. It is a fixed amount or a percentage of the sum insured that the insured needs to bear. The deductible is usually set by the insurance company and can vary depending on the policy and the insured’s preferences.

One key difference between the sum insured and the deductible is that the sum insured represents the maximum coverage available, while the deductible is the initial amount that the insured needs to pay. The sum insured is the total limit that the insurance company will pay, while the deductible is the amount that the insured needs to contribute.

However, there is also a similarity between the two. Both the sum insured and the deductible are important factors to consider when choosing a health insurance policy. The sum insured determines the maximum coverage available, while the deductible affects the out-of-pocket expenses that the insured needs to bear.

In conclusion, the sum insured and the deductible are key components of a health insurance policy. While the sum insured represents the maximum coverage available, the deductible is the amount that the insured needs to pay before the insurance company starts covering the expenses. Both factors should be carefully considered when selecting a health insurance policy to ensure adequate coverage and manageable out-of-pocket expenses.

Is it possible to change the Sum Insured after purchasing Health Insurance?

When it comes to health insurance, understanding the terms and conditions is crucial. One important aspect to consider is the Sum Insured, which is the maximum amount that an insured person can claim for medical expenses. But what happens if you want to change the Sum Insured after purchasing a health insurance policy?

Well, the answer to this question depends on the terms and conditions set by the insurance company. In some cases, it may be possible to change the Sum Insured, but it is not always guaranteed. It is important to carefully read the policy documents and contact the insurance company to inquire about any possible changes.

If the insurance company allows changes to the Sum Insured, there may be certain conditions that need to be met. For example, there might be a waiting period before the change can be made, or there may be additional charges or fees involved. It is important to thoroughly understand these conditions before making any decisions.

Changing the Sum Insured in a health insurance policy can be beneficial in certain situations. For example, if you anticipate a change in your health condition or if you want to increase your coverage due to rising medical costs. However, it is important to weigh the pros and cons and consult with the insurance company to make an informed decision.

In conclusion, while it is possible to change the Sum Insured in a health insurance policy, it is not always guaranteed. It is important to carefully read the policy documents, understand the terms and conditions, and consult with the insurance company to make any changes. Making an informed decision can help ensure that you have the right coverage to meet your healthcare needs.

Importance of reviewing and updating the Sum Insured regularly

Understanding what Sum Insured is in health insurance is crucial for every policyholder. It refers to the maximum amount that an insurance company will pay for covered medical expenses. However, it is important to note that the Sum Insured is not a fixed amount and should be regularly reviewed and updated.

One of the main reasons for reviewing and updating the Sum Insured regularly is to ensure that it adequately covers the healthcare needs of the policyholder. Over time, medical costs can increase significantly, and the initial Sum Insured may not be sufficient to cover these expenses. By reviewing and updating the Sum Insured, policyholders can ensure that they are adequately protected.

Regularly reviewing and updating the Sum Insured also allows policyholders to take into account any changes in their health condition or life