Health Insurance Claims Process: Cashless & Reimbursement

When it comes to managing your health and ensuring your well-being, having a comprehensive health insurance policy is essential. However, understanding the claims process can often be confusing and overwhelming. In this article, we will break down the different aspects of the health insurance claims process, including cashless and reimbursement options, so you can make informed decisions about your coverage.

First and foremost, it is important to understand the role of your insurance provider in the claims process. Your insurance provider is the company that you pay a premium to in exchange for coverage. They are responsible for processing and paying claims based on the terms outlined in your policy.

The claims process begins when you receive medical services from a healthcare provider. This could be a doctor, hospital, or any other healthcare professional. After you receive the services, you or your healthcare provider will submit a claim to the insurance company.

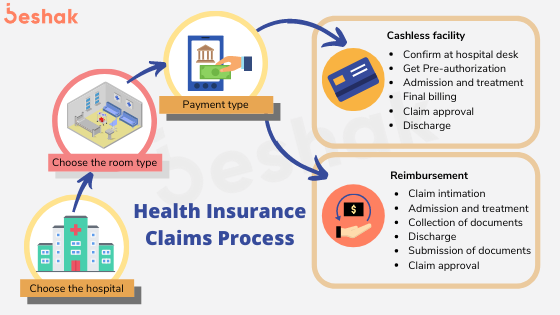

There are two main types of claims: cashless and reimbursement. Cashless claims refer to when you receive treatment at a network provider, and the insurance company settles the bill directly with the provider. This means you don’t have to pay anything out of pocket, as long as the treatment is covered by your policy.

On the other hand, reimbursement claims occur when you receive treatment from a non-network provider or when you pay for the treatment out of pocket. In this case, you will need to submit the necessary documents and receipts to the insurance company, and they will reimburse you for the eligible expenses based on your policy coverage.

It is important to note that the reimbursement process may require some paperwork and documentation, such as medical records, bills, and receipts. It is advisable to keep track of all your medical expenses and maintain proper records to ensure a smooth reimbursement process.

Understanding the health insurance claims process is crucial for maximizing your coverage and minimizing out-of-pocket expenses. By familiarizing yourself with the different options available, such as cashless and reimbursement claims, you can make informed decisions about your healthcare and ensure that you receive the benefits you are entitled to under your policy.

Remember, your health insurance policy is designed to protect you and provide financial support during times of medical need. By understanding the claims process, you can navigate the system more effectively and focus on what matters most – your health and well-being.

What is Health Insurance

Health insurance is a type of insurance policy that provides coverage for medical expenses incurred by an individual or a family. It is designed to protect individuals and their families from the financial burden of unexpected medical costs.

Health insurance works by paying a premium, which is a fixed amount that an individual or a family pays to the insurance provider on a regular basis. In return, the insurance provider agrees to cover a portion or all of the medical expenses incurred by the insured individual or family.

There are different types of health insurance policies available, including cashless and reimbursement policies. In a cashless policy, the insured individual can avail medical services from a network of healthcare providers without having to pay any cash upfront. The insurance provider directly settles the medical bills with the healthcare provider.

In a reimbursement policy, the insured individual pays the medical bills upfront and then submits a claim to the insurance provider for reimbursement. The insurance provider reviews the claim and reimburses the insured individual for the eligible medical expenses.

Health insurance claims are the requests made by the insured individuals to the insurance provider for reimbursement of medical expenses. The claims process involves submitting the necessary documents and supporting evidence to the insurance provider for review and processing.

Overall, health insurance is an essential tool for managing and mitigating the financial risks associated with healthcare expenses. It provides individuals and families with peace of mind, knowing that they have coverage for medical costs and can access quality healthcare services when needed.

Importance of Health Insurance

Health insurance is an essential financial tool that provides coverage for medical expenses. It plays a crucial role in safeguarding your financial well-being and ensuring access to quality healthcare.

One of the key benefits of health insurance is that it helps you manage the high costs of medical treatments. With the rising healthcare expenses, having a health insurance policy can provide financial protection and peace of mind.

When you have health insurance, you can choose from a network of healthcare providers who have a tie-up with your insurance company. This cashless process allows you to receive medical treatment without paying upfront. The insurance provider settles the bill directly with the healthcare facility, making it convenient and hassle-free.

In case you choose to receive treatment from a non-network provider, you can still avail the benefits of health insurance through the reimbursement process. You can submit the necessary documents and bills to your insurance company, and they will reimburse you for the expenses incurred.

Health insurance also provides coverage for various types of medical claims, including hospitalization, surgeries, diagnostic tests, medications, and emergency treatments. This comprehensive coverage ensures that you are protected against unexpected medical expenses.

Having health insurance is not only important for individuals but also for families. It provides financial security and enables you to provide the best healthcare for your loved ones. It also encourages regular health check-ups and preventive measures, promoting overall well-being.

In conclusion, health insurance is a crucial investment in your well-being. It protects you from the financial burden of medical expenses and ensures access to quality healthcare. Whether it’s through the cashless process or reimbursement, health insurance provides peace of mind and security for you and your family.

Health Insurance Claims

Understanding the health insurance claims process is crucial for every policyholder. It involves the reimbursement of medical expenses incurred by the insured individual. When you have a health insurance policy, you pay a premium to the insurance provider. In return, the insurance provider agrees to cover your medical expenses as per the terms and conditions of your policy.

The claims process starts when you receive medical treatment and incur expenses. You need to submit the necessary documents, such as medical bills, prescriptions, and diagnostic reports, to the insurance provider. These documents serve as evidence for your claim. The insurance provider then reviews the submitted documents and assesses the claim.

If the claim is approved, the insurance provider will reimburse the eligible expenses as per the policy terms. Reimbursement can be done directly to the insured individual or to the healthcare provider, depending on the policy and the agreement with the insurance provider. It is important to keep track of the reimbursement process and follow up with the insurance provider if there are any delays or issues.

Health insurance claims play a vital role in ensuring that individuals can access the necessary medical care without financial burden. It is essential to understand the claims process and be aware of the coverage and benefits provided by your health insurance policy. By staying informed and proactive, you can make the most of your health insurance coverage and receive the reimbursement you are entitled to.

Cashless Claims

When it comes to your health, you want to ensure that you have access to the best medical care without worrying about the financial burden. That’s where cashless claims come in. With cashless claims, you can avail of medical services without having to pay the full amount upfront. Instead, your health insurance provider will directly settle the payment with the healthcare provider.

One of the major advantages of cashless claims is that it saves you from the hassle of reimbursement. You don’t have to go through the lengthy process of submitting your medical bills and waiting for the insurance company to reimburse you. This not only saves you time but also ensures that you have immediate access to the medical care you need.

To avail of cashless claims, you need to ensure that you visit a network provider. These are healthcare providers that have a tie-up with your insurance company. When you visit a network provider, you simply need to show your health insurance card and the provider will take care of the rest. This makes the entire claims process seamless and convenient.

It’s important to note that cashless claims are subject to certain conditions and limits. Your health insurance policy will outline the specific terms and conditions for cashless claims. It’s advisable to thoroughly understand these conditions and limits to avoid any surprises when it comes to settling the payment for your medical services.

So, if you want a hassle-free claims process and immediate access to medical care, consider opting for cashless claims. It’s a convenient and efficient way to ensure that your health insurance premium is put to good use and that you receive the medical care you need without any financial worries.

Reimbursement Claims

When it comes to health insurance claims, the reimbursement process allows you to receive payment for medical expenses directly from your insurance provider. This means that you can choose any healthcare provider or hospital that you prefer, and then submit the claims for reimbursement.

With a reimbursement policy, you pay the medical bills out of your own pocket and then submit the required documents to your insurance company for reimbursement. These documents typically include invoices, receipts, and medical reports, which provide proof of the expenses incurred.

One of the advantages of reimbursement claims is that you have the freedom to choose any healthcare provider or hospital. This allows you to receive treatment from the provider of your choice, without being limited to a network of cashless hospitals.

However, it’s important to note that reimbursement claims require you to have sufficient funds to pay for the medical expenses upfront. You will need to keep track of all the bills and documents, and submit them to your insurance provider within the specified time frame. Once the claims are processed, you will receive the reimbursement amount as per the terms and conditions of your policy.

Before opting for a reimbursement policy, it’s important to understand the terms and conditions, including the deductible, co-payment, and maximum reimbursement limits. This will help you make an informed decision and choose a policy that suits your healthcare needs and budget.

Understanding the Claims Process

When it comes to managing your health, having a reliable insurance provider is essential. With the rising costs of medical treatments, having health insurance coverage can provide peace of mind and financial security. However, understanding the claims process is crucial to ensure that you receive the benefits you’re entitled to.

Insurance premiums are the regular payments you make to your insurance provider to maintain your coverage. These premiums may vary depending on factors such as your age, health condition, and the coverage plan you choose. By paying your premiums on time, you can ensure that your health insurance remains active and ready to support you in case of any medical emergencies.

There are two main types of claims processes: cashless and reimbursement. In the cashless process, you can avail medical services at network hospitals without making any upfront payments. Your insurance provider settles the bill directly with the hospital, making it convenient and hassle-free for you. On the other hand, the reimbursement process requires you to pay the medical bills upfront and then submit the necessary documents to your insurance provider for reimbursement.

Understanding the claims process is essential to ensure a smooth experience. In case of any medical treatments or emergencies, it’s crucial to inform your insurance provider as soon as possible. They will guide you through the necessary steps and documentation required for the claims process. It’s important to keep all the relevant documents such as medical reports, bills, and prescriptions handy to facilitate a quick and efficient claims process.

By familiarizing yourself with the claims process, you can make the most of your health insurance coverage. Whether it’s the cashless process or reimbursement, understanding the steps involved and maintaining clear communication with your insurance provider is key to receiving timely and accurate reimbursements for your medical expenses.

Cashless Claims Process

When it comes to health insurance claims, the cashless process is a convenient and hassle-free way to get reimbursed for medical expenses. With a cashless claims policy, you don’t have to worry about paying upfront and then waiting for reimbursement. Instead, you can simply visit a network provider and avail of the cashless facility.

The cashless claims process starts with choosing a health insurance provider that offers cashless facilities. Once you have chosen a provider, you can select a policy that suits your needs and pay the premium. This premium will cover your medical expenses in case of any claims.

When you need medical treatment, you can visit any network provider listed by your insurance company. Simply present your insurance card and provide your policy details to the healthcare provider. They will verify your details and initiate the cashless claims process.

During the cashless claims process, the healthcare provider will send the claim request to your insurance company. The insurance company will review the claim and decide on the reimbursement amount based on the terms and conditions of your policy. Once the claim is approved, the insurance company will directly settle the payment with the healthcare provider.

By opting for the cashless claims process, you can avoid the hassle of paying upfront and waiting for reimbursement. It provides a convenient and efficient way to get your medical expenses covered. So, choose a health insurance provider that offers cashless facilities and enjoy a hassle-free claims process.

Reimbursement Claims Process

When it comes to health insurance, understanding the reimbursement claims process is crucial. Reimbursement is a key feature of any insurance policy, allowing policyholders to be reimbursed for the medical expenses they have incurred. So, how does the reimbursement claims process work?

Firstly, it is important to note that reimbursement claims are different from cashless claims. In a cashless claim, the insurance provider settles the bill directly with the healthcare provider. However, in a reimbursement claim, the policyholder pays the medical expenses out of pocket and then seeks reimbursement from the insurance provider.

To start the reimbursement claims process, the policyholder needs to gather all the necessary documents, including the medical bills, prescriptions, and any other relevant documents. These documents serve as proof of the expenses incurred and are required for the reimbursement claim.

Once the documents are ready, the policyholder can submit the reimbursement claim to the insurance provider. It is important to fill out the claim form accurately and provide all the necessary information to avoid any delays in the reimbursement process.

After the reimbursement claim is submitted, the insurance provider will review the claim and verify the documents provided. This process may take some time, depending on the complexity of the claim and the insurance provider’s policies.

Once the claim is approved, the policyholder will receive the reimbursement amount as per the terms and conditions of the insurance policy. It is important to note that the reimbursement amount may be subject to deductibles, co-pays, or other limitations mentioned in the policy.

In conclusion, the reimbursement claims process is an essential part of health insurance. It allows policyholders to be reimbursed for the medical expenses they have paid out of pocket. By understanding the process and following the necessary steps, policyholders can ensure a smooth reimbursement experience.

Documents Required for Claims

When filing an insurance claim, it is important to provide the necessary documents to ensure a smooth process. These documents are required to verify your claim and determine the eligibility for reimbursement or cashless treatment.

1. Insurance Policy: You will need to provide a copy of your insurance policy, which contains important details such as the policy number, coverage details, and terms and conditions.

2. Claim Form: Fill out the claim form provided by your insurance provider. This form includes important information about the insured person, details of the claim, and any supporting documents.

3. Medical Bills and Receipts: Collect all original medical bills and receipts related to the treatment or procedure for which you are making a claim. These bills should include details such as the name of the provider, date of service, description of the service, and the amount charged.

4. Discharge Summary: Obtain a copy of the discharge summary from the hospital or healthcare provider. This document provides an overview of the treatment received, duration of stay, and any post-treatment instructions.

5. Diagnostic Reports: Include any relevant diagnostic reports such as X-rays, MRI scans, or laboratory test results that support your claim for reimbursement or cashless treatment.

6. Prescription and Pharmacy Bills: If you have purchased medication, provide the prescription and pharmacy bills as proof of the expenses incurred.

7. Other Supporting Documents: Depending on the nature of your claim, you may need to provide additional supporting documents. This could include referral letters, pre-authorization forms, or any other relevant paperwork.

By ensuring that you have all the necessary documents in order, you can expedite the claims process and increase the chances of a successful reimbursement or cashless treatment. Remember to keep copies of all submitted documents for your records.

Cashless Claims Documents

When it comes to health insurance, understanding the claims process is essential. Whether you have a cashless or reimbursement policy, knowing the required documents can make the process smoother.

For cashless claims, you need to provide certain documents to ensure a hassle-free experience. These documents typically include your insurance policy details, such as the policy number and the name of the insurance provider. Additionally, you may be required to present your health insurance card and any relevant identification documents.

It is important to note that the documents required for cashless claims may vary depending on the insurance provider and the specific policy you have. Therefore, it is advisable to check with your insurance company beforehand to ensure you have all the necessary documents.

Submitting the required documents promptly is crucial for a smooth cashless claims process. This ensures that the insurance provider can verify your policy details and approve the claim in a timely manner. Failing to provide the necessary documents may result in delays or even denial of the claim.

By understanding the cashless claims process and having the required documents ready, you can make the most of your health insurance policy. This allows you to receive the necessary medical treatment without worrying about the financial burden.

Reimbursement Claims Documents

When it comes to health insurance, understanding the reimbursement claims process is essential. Reimbursement claims allow policyholders to receive cashless payments for medical expenses incurred. To initiate the reimbursement process, certain documents need to be submitted to the insurance provider.

1. Claim Form: The first document required for reimbursement claims is the claim form. This form includes details such as the policyholder’s name, policy number, and the nature of the expenses incurred. It is important to fill out this form accurately and provide all the necessary information.

2. Medical Bills: Along with the claim form, all original medical bills need to be submitted. These bills should clearly mention the services or treatments received, along with the corresponding costs. It is advisable to keep a copy of these bills for personal records.

3. Prescription and Diagnostic Reports: If any prescribed medications or diagnostic tests were part of the treatment, the original prescriptions and diagnostic reports should be included in the reimbursement claim. These documents help validate the necessity of the expenses incurred.

4. Discharge Summary: In case of hospitalization or any major medical procedure, a discharge summary should be obtained from the healthcare provider. This summary provides an overview of the treatment received, duration of hospital stay, and any follow-up instructions. It is an important document to include in the reimbursement claim.

5. Other Supporting Documents: Depending on the nature of the expenses, additional supporting documents may be required. This could include referral letters, laboratory reports, or any other relevant paperwork. It is important to check with the insurance provider to ensure all necessary documents are included.

Submitting complete and accurate reimbursement claims documents is crucial for a smooth and hassle-free reimbursement process. It is recommended to maintain a record of all documents submitted and follow up with the insurance provider to track the progress of the claim.

Common Issues in Claims Process

When it comes to the health insurance claims process, there are several common issues that policyholders may encounter. These issues can cause delays or denials in the reimbursement or cashless settlement of claims.

One common issue is the incorrect submission of documents. Insurance providers require certain documents, such as medical bills, prescriptions, and diagnostic reports, to process claims. If these documents are not submitted correctly or are missing, it can lead to delays or rejection of the claim.

Another issue is the lack of understanding of the policy terms and conditions. Policyholders may not be aware of the specific coverage and limitations of their insurance policy. This can result in claims being rejected if the treatment or procedure is not covered or exceeds the policy limits.

Network restrictions can also pose challenges in the claims process. Some insurance policies have a limited network of healthcare providers, and if the policyholder seeks treatment from a non-network provider, it may not be covered or may require additional documentation for reimbursement.

Furthermore, errors in the billing and coding of medical procedures can also lead to issues in the claims process. If the medical provider submits incorrect billing codes or fails to provide necessary information, it can result in delays or denials of the claim.

To avoid these common issues, it is important for policyholders to carefully review their insurance policy, understand the coverage and limitations, and ensure that all required documents are submitted accurately and on time. It is also advisable to seek treatment from network providers whenever possible and to double-check the accuracy of billing and coding information before submitting a claim.

Denial of Cashless Claims

When it comes to health insurance, the policyholder expects a smooth and hassle-free claims process. However, there are instances when cashless claims get denied by the insurance provider, leaving the policyholder in a difficult situation.

There are several reasons why cashless claims may be denied. One common reason is when the treatment or procedure is not covered under the insurance policy. It is important for policyholders to carefully review their policy documents and understand the coverage details before seeking cashless claims.

Another reason for denial of cashless claims is when the policyholder fails to provide the necessary documents or information to the insurance provider. It is crucial to submit all the required documents, such as medical reports, bills, and prescriptions, in a timely manner to avoid claim rejection.

In some cases, the insurance provider may deny cashless claims if the policyholder has not paid the premium on time. It is essential to keep up with the premium payments to ensure the smooth processing of cashless claims.

If a cashless claim is denied, the policyholder still has the option to file for reimbursement. In this process, the policyholder pays for the treatment upfront and then submits the necessary documents to the insurance provider for reimbursement. While this may involve some out-of-pocket expenses, it ensures that the policyholder receives the rightful insurance coverage.

Understanding the reasons for denial of cashless claims and the alternative reimbursement process is crucial for every health insurance policyholder. It helps them navigate the claims process effectively and ensures that they receive the maximum benefits from their insurance policy.

Delay in Reimbursement Claims

If you have a health insurance policy, you may be familiar with the cashless claims process, where you can avail medical services without having to pay upfront. However, there are times when you may need to opt for reimbursement claims. This is when you pay for the medical treatment yourself and then submit the bills to your insurance provider for reimbursement.

While reimbursement claims can be convenient, there can be delays in the process. This can be frustrating, especially when you are in need of financial assistance. It is important to understand the reasons behind these delays and how you can avoid them.

One of the main reasons for delays in reimbursement claims is incomplete or incorrect documentation. It is crucial to provide all the necessary documents, such as medical bills, prescriptions, and diagnostic reports, in the right format and with accurate information. Any missing or incorrect information can lead to delays in processing your claim.

Another reason for delays can be the verification process. Insurance providers need to verify the authenticity of the documents and the treatment received. This can take time, especially if there are any discrepancies or if the provider needs to contact the hospital or healthcare professional for further information.

To avoid delays in reimbursement claims, it is important to thoroughly review the claim form and ensure all the required documents are attached. Double-check the accuracy of the information provided and make sure it matches the bills and reports. It is also helpful to maintain open communication with your insurance provider and promptly respond to any queries or requests for additional information.

Remember, delays in reimbursement claims can be frustrating, but by being proactive and ensuring all the necessary steps are taken, you can expedite the process and receive the reimbursement you are entitled to.

Tips for Smooth Claims Process

Understanding the health insurance claims process is crucial for policyholders to ensure a smooth and hassle-free experience. Whether you opt for a cashless or reimbursement claim, following these tips can help you navigate the process efficiently:

- Know your policy: Familiarize yourself with the details of your health insurance policy, including coverage limits, deductibles, and exclusions. This will help you understand what expenses are eligible for reimbursement and what services are covered under the cashless facility.

- Keep documentation: Maintain a record of all medical bills, prescriptions, and diagnostic reports. These documents are essential for filing claims and can serve as evidence of the services rendered.

- Submit claims promptly: It’s important to submit your claims as soon as possible to avoid any delays or complications. Be sure to fill out the necessary forms accurately and attach all required documents.

- Communicate with your provider: Stay in touch with your insurance provider throughout the claims process. If you have any questions or need assistance, reach out to their customer service team for guidance.

- Follow up: After submitting your claim, regularly follow up with your insurance provider to track its progress. This will help you stay informed about the status of your claim and address any potential issues promptly.

- Understand the reimbursement process: If you opt for reimbursement, familiarize yourself with the specific requirements and timelines for reimbursement. This will ensure that you provide all necessary documentation and receive timely reimbursement for eligible expenses.

- Be proactive: Take proactive steps to prevent claim denials or delays. This includes verifying the network status of healthcare providers, seeking pre-authorization when required, and adhering to the terms and conditions of your policy.

By following these tips, you can streamline the health insurance claims process and maximize your benefits. Remember to stay informed, organized, and proactive to make the most of your health insurance coverage.

Question-answer:

What is the Health Insurance Claims Process?

The health insurance claims process is the procedure through which a policyholder can get reimbursed for medical expenses covered by their health insurance policy.

What are cashless claims?

Cashless claims are a facility provided by health insurance companies where the policyholder can get medical treatment without having to pay for it upfront. The insurance company settles the payment directly with the hospital or healthcare provider.